BREAKING NEWS

CEOWORLD magazine Rankings

TKO Group Holdings Gives Lucrative Compensation Package of $64.91 Million to CEO Ari Emanuel

In a move that has ignited discourse within the financial realm, TKO Group Holdings, the parent company of UFC and...

4 Common Challenges to Having a Grand Vision and Simple Solutions to Success

Discipline. Sacrifice. Intelligence. Grit. Work ethic. Creativity. Luck. These are the attributes that most people associate with success. And they’re...

Presidential Leadership

Being president of the United States is the most prestigious and the most challenging job in the world. We’ve now...

Elon Musk Confirms Postponement of His Planned Visit to India Amidst Heavy Tesla Obligations

Tesla CEO Elon Musk has announced the cancellation of his anticipated visit to India, originally scheduled for April 21-22, 2024....

President and CEO of Warner Bros. Discovery, David Zaslav, Gets $49,7 Million Compensation Noting 26,5% Rise While Company is in Cost-Cutting Mode

Warner Bros. Discovery is under scrutiny for its executive compensation practices, with CEO David Zaslav's 2023 pay package totaling $49.7...

What I’ve learnt as a recovering people pleaser

Vulnerable moment, I am a recovering people-pleaser. Doing or saying something that made someone else not like me was one...

Gross domestic product (GDP) of the United States 1980-2028

As of 2023, the United States's nominal gross domestic product (GDP) was approximately 26.94 trillion US dollars. This puts the...

Former MPC Container Ships CEO Constantin Baack to Replace Current MPC Capital CEO Ulf Holländer as He Steps Down

MPC Capital, a stalwart in asset and investment management, is undergoing a significant leadership shift. Constantin Baack, previously at the...

The Evolving Landscape of the C-Suite: Navigating Complexity with Precision

In an era where business environments are branded by volatility, uncertainty, complexity, and ambiguity (VUCA), CEOs face monumental challenges in...

Foxconn Chairman Young Liu Sheds Light on Rotational CEO System Approach

Amid swirling speculations regarding Foxconn's potential adoption of a rotational CEO system, Chairman Young Liu shed light on the internal...

How COVID saw the rise of the advantage leader

The ability to navigate through uncertainty and adapt quickly has always been the hallmark of successful leaders, however the impact...

Unveiling the Future of Inclusion for HR Leaders

Imagine a world where inclusivity isn't just an HR buzzword, but the heartbeat of corporate success. This isn't a utopian...

Stand up for the planet! Says Riccardo Valentini, 2007 Peace Nobel Prize winner.

I recently interviewed Riccardo Valentini, Professor of Forest Ecology at the University of Tuscia (Italy), and 2007 Peace Nobel prize...

Harnessing the Impact of Just Sold Letters: Key Tips for Real Estate Professionals

Hey there, fellow real estate pro! Are you ready to take your marketing game to the next level? If you...

Building the Workplaces of the Future

Hybrid policies that blend remote and onsite time emerged as a dominant template during the pandemic. But optimizing hybrid work...

Blackstone Inc. CEO Steve Schwarzman Reports Compensation of $896.7 Million

In a significant financial disclosure, Blackstone Inc. Chief Executive Officer Steve Schwarzman reported earnings of $896.7 million last year, reflecting...

First Woman to Be President and CEO of Japan Airlines Mitsuko Tottori Encourages Female Leadership

Mitsuko Tottori's appointment as the first female president and chief executive officer of Japan Airlines (JAL) marks a historic milestone,...

How Technology and Creativity are Redefining Engagement

This article explores the pivotal role of technology and creativity in creating personalized narratives, utilizing advancements like AI, NFC, AR,...

Why leaders who are good with the ‘human stuff’ thrive during tough times

As a leader, rising to the challenge of meeting the ‘people’ demands of a business is tricky, even during normal...

Managers, Know When to Manage and When to Let Your Team Self-Organize

When it comes to organizing traffic flow, there are two different systems. One is the traditional traffic light, which tells...

3 Reasons CEOs Should Stand Up to Conservative Anti-Woke Bullying

Ron DeSantis may have dropped out of the presidential race, but the crusade he and his fellow conservatives are on...

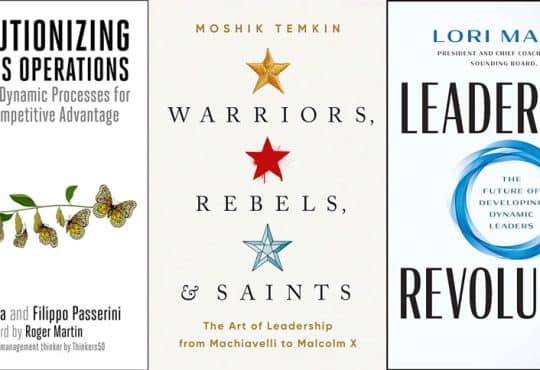

Great Business Books You Must Read, 2024

This is a year when organizations are on the line and smart leadership is crucial. Market shifts are happening faster...

Grooming Hospitality for Different Pastures

Background - I remember a beautiful anecdote that said among most professions, Teachers can be accredited a little higher for...

3 Focuses for Women of Color to Achieve Workplace Parity

As women of color, we face unique challenges as we work to achieve workplace parity. From not seeing other faces...

Lee Young Ae Reigns as the Richest K-Drama Actress

Lee Young Ae, a luminary of the Korean entertainment industry, ascends to the summit as the wealthiest K-drama actress, with...

$9.8 Billion Increase in Elon Musk’s Wealth Within the Last 24 Hours

Elon Musk, the South Africa-born entrepreneur and CEO of Tesla, witnessed a significant surge in his net worth, soaring by...

Your Pizza Perspective: 6 Things African and Western Leaders Can Learn From Each Other

Let’s pretend your perspective is a cheese pizza. Now, let’s imagine each new topping is a fresh perspective you’ve placed...

NVIDIA and Sam Altman’s OpenAI Forge Pathbreaking Collaboration in AI Innovation

In a monumental collaboration that has reverberated across the tech landscape, NVIDIA and OpenAI have joined forces, marking a watershed...

| Rank | Name | Title | Company | Country | Sector |

|---|---|---|---|---|---|

| 1 | Brian Moynihan | Chairman & CEO | Bank of America | United States | Financial Services, Banking, Consumer Finance, Wealth Management, Investment Banking |

| 2 | Jamie Dimon | Chairman and CEO | JPMorgan Chase & Co. | United States | Financial Services, Investment Banking, Asset Management, Retail Banking, Commercial Banking |

| 3 | Amin H. Nasser | President & CEO | Saudi Arabian Oil Company (Saudi Aramco) | Saudi Arabia | Oil & Gas, Petrochemicals, Exploration, Production, Refining |

| 4 | Darren W. Woods | Chairman and Chief Executive Officer | Exxon Mobil | United States | Oil & Gas, Chemicals, Exploration, Production, Refining |

| 5 | Satya Nadella | Chairman and Chief Executive Officer | Microsoft | United States | Technology, Software & Services, Cloud Computing, Hardware, Gaming |

| 6 | Tim Cook | Chief Executive Officer | Apple | United States | Technology, Consumer Electronics, Software, Digital Distribution, Wearables |

| 7 | Wael Sawan | Chief Executive Officer | Shell | United Kingdom | Oil & Gas, Energy, Petrochemicals, Renewable Energy, Exploration & Production |

| 8 | Akio Toyoda | Chairman and Representative Director | Toyota Motor | Japan | Automotive, Mobility, Financial Services, Robotics, Smart Homes |

| 9 | Liao Lin | President and Executive Director | Industrial and Commercial Bank of China Limited | China | Financial Services, Banking, Asset Management, Wealth Management, Investment Banking |

| 10 | Kyung-Kye Hyun | President & CEO | Samsung Electronics | South Korea | Consumer Electronics, Semiconductors, Telecommunications, Home Appliances, Digital Media |

| 11 | Michael K. (Mike) Wirth | Chairman and CEO | Chevron | United States | Oil & Gas, Energy, Chemicals, Exploration & Production, Renewable Energy |

| 12 | Noel Quinn | Group Chief Executive | HSBC Holdings | United Kingdom | Financial Services, Banking, Wealth Management, Retail Banking, Commercial Banking |

| 13 | Andrew Witty | Chief Executive Officer | UnitedHealth Group | United States | Healthcare, Health Insurance, Healthcare Services, Technology & Wellness, Data Analytics |

| 14 | Sundar Pichai | Chief Executive Officer | Alphabet Inc. | United States | Technology, Internet Services, Artificial Intelligence, Consumer Electronics, Cloud Computing |

| 15 | Patrick Pouyanné | Chairman and Chief Executive Officer | TotalEnergies | France | Oil & Gas, Renewable Energy, Petrochemicals, Power Generation, Biomass |

| 16 | Hans Erik Vestberg | Chairman and Chief Executive Officer | Verizon Communications | United States | Telecommunications, Technology, Media, Internet, Wireless Services |

| 17 | Doug McMillon | President and CEO | Walmart | United States | Retail, E-commerce, Consumer Goods, Health & Wellness, Supply Chain Management |

| 18 | Jane Fraser | Chief Executive Officer | Citigroup | United States | Financial Services, Banking, Investment Banking, Wealth Management, Credit Cards |

| 19 | Murray Auchincloss | Chief Executive Officer | BP Plc | United Kingdom | Oil & Gas, Energy, Renewable Energy, Petrochemicals, Exploration & Production |

| 20 | Zhao Huan | President and Executive Director | Agricultural Bank of China (ABC) | China | Financial Services, Banking, Agricultural Finance, Retail Banking, Corporate Banking |

| 21 | Steven D. Black | Chairman | Wells Fargo | United States | Financial Services, Banking, Consumer Finance, Wealth Management, Commercial Banking |

| 22 | MA Mingzhe | Chairman | Ping An Insurance Group | China | Financial Services, Insurance, Healthcare, Technology, Asset Management |

| 23 | Dr. Oliver Blume | Chairman | Volkswagen Group | Germany | Automotive, Mobility Services, Financial Services, Commercial Vehicles, Electrification |

| 24 | James Gorman | Chairman and CEO | Morgan Stanley | United States | Financial Services, Investment Banking, Wealth Management, Asset Management, Capital Markets |

| 25 | Mark Zuckerberg | Chairman and Chief Executive Officer | Meta Platforms | United States | Technology, Social Media, Virtual Reality, Advertising, Artificial Intelligence |

| 26 | Ma Yongsheng | Chairman | Sinopec | China | Oil & Gas, Petrochemicals, Energy, Refining, Exploration & Production |

| 27 | Jean-Laurent Bonnafé | Director and Chief Executive Officer | BNP Paribas | France | Financial Services, Banking, Investment Banking, Asset Management, Retail Banking |

| 28 | David Solomon | Chairman and Chief Executive Officer | Goldman Sachs Group | United States | Financial Services, Investment Banking, Asset Management, Consumer Banking, Financial Advisory |

| 29 | Hua Teng Ma | Chief Executive Officer and Chairman | Tencent Holdings | China | Technology, Social Media, Gaming, Entertainment, Cloud Computing |

| 30 | Oliver Bäte | Chairman | Allianz | Germany | Financial Services, Insurance, Asset Management, Corporate Insurance, Digital Services |

| 31 | Dr. Albert Bourla | Chairman and Chief Executive Officer | Pfizer | United States | Healthcare, Pharmaceuticals, Biotechnology, Vaccine Development, Research & Development |

| 32 | Joaquin Duato | Chairman and Chief Executive Officer | Johnson & Johnson | United States | Healthcare, Pharmaceuticals, Medical Devices, Consumer Health, Biotechnology |

| 33 | Timotheus Höttges | Chief Executive Officer | Deutsche Telekom | Germany | Telecommunications, Technology, Network Services, Digital Solutions, IT Services |

| 34 | Ola Källenius | Chairman | Mercedes-Benz Group | Germany | Automotive, Luxury Vehicles, Mobility Services, Financial Services, Autonomous Driving |

| 35 | Oliver Zipse | Chairman | BMW Group | Germany | Automotive, Luxury Vehicles, Electrification, Mobility Services, Financial Services |

| 36 | Dr. Mark Liu | Chairman | Taiwan Semiconductor | Taiwan | Technology, Semiconductors, Manufacturing, Design Services, Nanotechnology |

| 37 | Mukesh D. Ambani | Chairman & Managing Director | Reliance Industries | India | Conglomerate, Telecommunications, Petrochemicals, Retail, Digital Services |

| 38 | Bernard Arnault | Chairman and CEOÂ | LVMH Moët Hennessy Louis Vuitton | France | Luxury Goods, Fashion, Cosmetics, Wine & Spirits, Retail |

| 39 | Mr. Thomas Buberl | Chief Executive Officer | AXA Group | France | Financial Services, Insurance, Asset Management, Health Insurance, Investment Management |

| 40 | Héctor Grisi Checa | Chief Executive Officer | Banco Santander | Spain | Financial Services, Banking, Retail Banking, Corporate Banking, Wealth Management |

| 41 | David McKay | President and CEO | Royal Bank of Canada | Canada | Financial Services, Banking, Wealth Management, Insurance, Capital Markets |

| 42 | Mark Schneider | Chief Executive Officer | Nestlé | Switzerland | Consumer Goods, Food & Beverages, Health & Wellness, Nutrition, Pet Care |

| 43 | Brian L. Roberts | Chairman & Chief Executive Officer | Comcast | United States | Media, Telecommunications, Entertainment, Cable TV, Internet Services |

| 44 | Anders Opedal | President and Chief Executive Officer | Equinor | Norway | Energy, Oil & Gas, Renewable Energy, Exploration & Production, Offshore Wind |

| 45 | Ren Deqi | Chairman | Bank of Communications | China | Financial Services, Banking, Corporate Banking, Retail Banking, Asset Management |

| 46 | Joe Tsai | Chairman | Alibaba Group | China | Technology, E-commerce, Cloud Computing, Digital Media, Innovation Initiatives |

| 47 | Bharat Masrani | President and Chief Executive Officer | TD Bank Group | Canada | Financial Services, Banking, Retail Banking, Wealth Management, Insurance |

| 48 | Jon R. Moeller | Chief Executive Officer, President and Chairman | Procter & Gamble | United States | Consumer Goods, Personal Care, Household Care, Beauty Products, Health Care |

| 49 | Jun Sawada | Chairman | Nippon Telegraph & Tel | Japan | Telecommunications, Technology, IT Services, Digital Solutions, Network Services |

| 50 | Kenichiro Yoshida | Chief Executive Officer | Sony | Japan | Technology, Consumer Electronics, Entertainment, Gaming, Financial Services |

| 51 | Jean Paul Terra Prates | Chief Executive Officer | Petrobras | Brazil | Oil & Gas, Energy, Exploration & Production, Refining, Petrochemicals |

| 52 | Gary Nagle | Chief Executive Officer | Glencore International | Switzerland | Commodities, Mining, Metals, Oil & Gas, Agriculture |

| 53 | Lu Jiajin | Chairman | Industrial Bank | China | Financial Services, Banking, Corporate Finance, Retail Banking, Asset Management |

| 54 | Carlos Tavares | CEO | Stellantis | Netherlands | Automotive, Mobility, Electric Vehicles, Manufacturing, Automotive Finance |

| 55 | Mr. Bai Tao | Chairman | China Life Insurance | China | Financial Services, Insurance, Life Insurance, Asset Management, Health Insurance |

| 56 | Stephen J. Squeri | Chairman & Chief Executive Officer | American Express | United States | Financial Services, Payment Services, Credit Cards, Travel Services, Business Services |

| 57 | H. Lawrence Culp, Jr. | Chairman & Chief Executive Officer | General Electric | United States | Technology, Energy, Aviation, Healthcare, Renewable Energy |

| 58 | Karen S. Lynch | President and Chief Executive Officer | CVS Health | United States | Healthcare, Retail Pharmacy, Health Insurance, Pharmacy Services, Health & Wellness |

| 59 | Zheng Xuexuan | Chairman | China State Construction Engineering | China | Construction, Real Estate, Infrastructure, Engineering, Investment |

| 60 | Ted Decker | Chairman, President and CEO | The Home Depot | United States | Retail, Home Improvement, Building Materials, Home Furnishing, E-commerce |

| 61 | David Cordani | Chairman and Chief Executive Officer | Cigna | United States | Healthcare, Health Insurance, Managed Care, Health Services, Pharmacy Services |

| 62 | Elon Reeve Musk | Chief Executive Officer | Tesla | United States | Automotive, Electric Vehicles, Energy Storage, Solar Energy, Autonomous Vehicles |

| 63 | Mary T. Barra | Chairwoman and Chief Executive Officer | General Motors | United States | Automotive, Electric Vehicles, Mobility Solutions, Manufacturing, Finance |

| 64 | Zhu Hexin | Chairman | CITIC | Hong kong | Conglomerate, Financial Services, Real Estate, Engineering, Technology |

| 65 | Michel Dimitrios Doukeris | Chief Executive Officer | Anheuser-Busch InBev | Belgium | Beverages, Brewing, Consumer Goods, Alcoholic Beverages, Global Brands |

| 66 | Robert M. Davis | Chairman and Chief Executive Officer | Merck & Co. | United States | Healthcare, Pharmaceuticals, Biotechnology, Vaccine Development, Animal Health |

| 67 | Richard A. Gonzalez | Chairman and Chief Executive Officer | AbbVie | United States | Healthcare, Pharmaceuticals, Biopharmaceuticals, Research & Development, Immunology |

| 68 | Katsuya Nakanishi | President & CEO | Mitsubishi | Japan | Conglomerate, Automotive, Finance, Energy, Electronics |

| 69 | Dr. Severin Schwan | Chairman | Roche Holding | Switzerland | Healthcare, Pharmaceuticals, Biotechnology, Diagnostics, Personalized Healthcare |

| 70 | Dinesh Kumar Khara | Chairman | State Bank of India | India | Financial Services, Banking, Retail Banking, Corporate Banking, International Banking |

| 71 | Gail K. Boudreaux | President and Chief Executive Officer | Elevance Health | United States | Healthcare, Health Insurance, Managed Healthcare, Health Services, Digital Health |

| 72 | Gregory J. Hayes | Chairman and Chief Executive Officer | Raytheon Technologies | United States | Aerospace, Defense, Cybersecurity, Electronics, Missiles & Air Defense |

| 73 | Safra A. Catz | Chief Executive Officer | Oracle | United States | Technology, Software, Cloud Computing, Database Management, Enterprise Solutions |

| 74 | Claudio Descalzi | Chief Executive Officer | Eni SpA | Italy | Energy, Oil & Gas, Renewable Energy, Exploration & Production, Petrochemicals |

| 75 | Ramon Laguarta | Chairman and Chief Executive Officer | PepsiCo | United States | Consumer Goods, Beverages, Food Processing, Snacks, Nutrition |

| 76 | Ryan Lance | Chairman and Chief Executive Officer | ConocoPhillips | United States | Energy, Oil & Gas, Exploration & Production, Natural Resources, Renewable Energy |

| 77 | George A. Cope | Chairman | Bank of Montreal | Canada | Financial Services, Banking, Wealth Management, Investment Banking, Corporate Banking |

| 78 | Liu Yongjie | Chairman | CNOOC | Hong kong | Energy, Oil & Gas, Exploration & Production, Offshore Drilling, Marine Engineering |

| 79 | Jun Ohta | Group Chief Executive Officer | Sumitomo Mitsui Financial | Japan | Financial Services, Banking, Corporate Banking, Investment Banking, Asset Management |

| 80 | Robert A. Iger | Chief Executive Officer | Walt Disney | United States | Entertainment, Media, Theme Parks, Broadcasting, Digital Media |

| 81 | Scott Thomson | President and Chief Executive Officer | Bank of Nova Scotia | Canada | Financial Services, Banking, International Banking, Wealth Management, Corporate Banking |

| 82 | Paul Hudson | Chief Executive Officer | Sanofi | France | Healthcare, Pharmaceuticals, Biotechnology, Vaccines, Consumer Healthcare |

| 83 | Ken MacKenzie | Chairman | BHP Group | Australia | Mining, Metals, Oil & Gas, Natural Resources, Commodities |

| 84 | Hironori Kamezawa | President & Group CEO | Mitsubishi UFJ Financial | Japan | Financial Services, Banking, Corporate Banking, Asset Management, Investment Banking |

| 85 | Colm Kelleher | Chairman | UBS | Switzerland | Financial Services, Banking, Wealth Management, Asset Management, Investment Banking |

| 86 | Chuck Robbins | Chief Executive Officer and Chairman | Cisco Systems | United States | Technology, Networking, Internet of Things, Cybersecurity, Cloud Computing |

| 87 | Vasant Narasimhan | Chief Executive Officer | Novartis | Switzerland | Healthcare, Pharmaceuticals, Biotechnology, Research & Development, Generics |

| 88 | Carol B. Tomé | Chief Executive Officer | United Parcel Service | United States | Logistics, Package Delivery, Supply Chain Management, Freight Forwarding, E-commerce Solutions |

| 89 | James Quincey | Chairman and Chief Executive Officer | Coca-Cola | United States | Beverages, Consumer Goods, Soft Drinks, Water, Juices |

| 90 | Dr. Roland Busch | President and Chief Executive Officer | Siemens | Germany | Technology, Energy, Healthcare, Infrastructure, Industrial Automation |

| 91 | Milton Maluhy Filho | Chief Executive Officer | Itaú Unibanco Holding | Brazil | Financial Services, Banking, Retail Banking, Corporate Banking, Investment Banking |

| 92 | W. Craig Jelinek | Chief Executive Officer | Costco Wholesale | United States | Retail, Wholesale, Consumer Goods, E-commerce, Membership Warehouse Clubs |

| 93 | Paul O'Malley | Chaiman | Commonwealth Bank | Australia | Financial Services, Banking, Retail Banking, Wealth Management, Insurance |

| 94 | Jakob Stausholm | Chief Executive Officer | Rio Tinto | United Kingdom | Mining, Metals, Minerals, Aluminum, Copper |

| 95 | Armando MartÃnez MartÃnez | Chief Executive Officer | Iberdrola | Spain | Energy, Renewable Energy, Electricity Generation, Distribution, Utilities |

| 96 | Torres Vila, Carlos | Chaiman | BBVA-Banco Bilbao Vizcaya | Spain | Financial Services, Banking, Retail Banking, Corporate Banking, Digital Banking |

| 97 | Euisun Chung | Chaiman | Hyundai Motor | South Korea | Automotive, Electric Vehicles, Manufacturing, Mobility Solutions, Smart Technology |

| 98 | Hein Schumacher | Chief Executive Officer | Unilever | United Kingdom | Consumer Goods, Personal Care, Food & Beverages, Home Care, Nutrition |

| 99 | Mario Greco | Group Chief Executive Officer | Zurich Insurance Group | Switzerland | Financial Services, Insurance, Risk Management, Life Insurance, Property & Casualty |

| 100 | John C. May II | Chief Executive Officer and Chairman | Deere & Company | United States | Industrial, Agriculture, Construction, Forestry, Equipment Manufacturing |

| 101 | Kenichi Hori | President and Chief Executive Officer | Mitsui | Japan | Conglomerate, Trading, Energy, Infrastructure, Healthcare |

| 102 | Seiji Kuraishi | Chaiman | Honda Motor | Japan | Automotive, Motorcycles, Power Products, Mobility, Smart Technology |

| 103 | Tadeu Luiz Marroco | Chief Executive | British American Tobacco | United Kingdom | Consumer Goods, Tobacco, Cigarettes, Vaping Products, Next-Generation Products |

| 104 | Giovanni Caforio | Chairman | Bristol Myers Squibb | United States | Healthcare, Pharmaceuticals, Biopharmaceuticals, Oncology, Cardiovascular |

| 105 | Evan G. Greenberg | Chairman and Chief Executive Officer | Chubb | Switzerland | Financial Services, Insurance, Property & Casualty, Liability, Accident & Health |

| 106 | Carlo Messina | Chief Executive Officer | Intesa Sanpaolo | Italy | Financial Services, Banking, Retail Banking, Wealth Management, Corporate Banking |

| 107 | Dr. Joachim Wenning | Chairman | Munich Re | Germany | Financial Services, Reinsurance, Risk Solutions, Insurance, Consulting |

| 108 | Zheng Yang | Chief Executive Officer | Shanghai Pudong Development | China | Financial Services, Banking, Corporate Banking, Retail Banking, Asset Management |

| 109 | Liu Yangwei | Chairman | Hon Hai Precision | Taiwan | Technology, Electronics Manufacturing, Consumer Electronics, Industrial Automation, Digital Solutions |

| 110 | Michael J. Hennigan | President and Chief Executive Officer | Marathon Petroleum | United States | Energy, Oil Refining, Marketing, Transportation, Retail |

| 111 | Marc N. Casper | Chairman, President and CEO | Thermo Fisher Scientific | United States | Healthcare, Life Sciences, Biotechnology, Analytical Instruments, Laboratory Supplies |

| 112 | D. JAMES (JIM) UMPLEBY III | Chairman and Chief Executive Officer | Caterpillar | United States | Industrial, Construction, Mining Equipment, Energy & Transportation, Power Systems |

| 113 | Walter W. Bettinger II | Chief Executive Officer | Charles Schwab | United States | Financial Services, Brokerage, Wealth Management, Banking, Investment Advisory |

| 114 | Alfred F. Kelly, Jr. | Chairman and Chief Executive Officer | Visa | United States | Financial Services, Payment Technology, Digital Payments, Credit Cards, Transaction Processing |

| 115 | Peter S. Zaffino | Chairman and Chief Executive Officer | American International Group | United States | Financial Services, Insurance, Property & Casualty, Life & Retirement, Financial Products |

| 116 | James D. Farley Jr. | President and Chief Executive Officer | Ford Motor | United States | Automotive, Electric Vehicles, Mobility, Manufacturing, Autonomous Vehicles |

| 117 | Masahiro Okafuji | Chairman & Chief Executive Officer | Itochu | Japan | Conglomerate, Trading, Textiles, Machinery, Metals & Minerals |

| 118 | Pascal Soriot | Chief Executive Officer | AstraZeneca | United Kingdom | Healthcare, Pharmaceuticals, Biopharmaceuticals, Research & Development, Vaccines |

| 119 | Guillaume Faury | Chief Executive Officer | AIRBUS | France | Aerospace, Defense, Commercial Aircraft, Space, Helicopters |

| 120 | Sashidhar Jagdishan | MD & CEO | HDFC Bank | India | Financial Services, Banking, Retail Banking, Corporate Banking, Digital Banking |

| 121 | Dominique Lefebvre | Chairman | Credit Agricole | France | Financial Services, Banking, Retail Banking, Insurance, Asset Management |

| 122 | Xavier Huillard | Chairman and Chief Executive Officer | VINCI | France | Construction, Infrastructure, Energy, Concessions, Project Management |

| 123 | Lv Zhiren | Executive Director | China Shenhua Energy | China | Energy, Coal Mining, Power Generation, Coal-to-Liquids, Railways |

| 124 | Andrew Cecere | Chairman, President & Chief Executive Officer | US Bancorp | United States | Financial Services, Banking, Consumer Banking, Wealth Management, Payment Services |

| 125 | Mr. Bi Mingqiang | Director and Chief Executive Officer | China Citic Bank | China | Financial Services, Banking, Corporate Banking, Retail Banking, Asset Management |

| 126 | Hock E. Tan | Chief Executive Officer | Broadcom | United States | Technology, Semiconductors, Infrastructure Software, Wireless Communications, Data Center Networking |

| 127 | John W. Ketchum | Chairman, President and Chief Executive Officer | NextEra Energy | United States | Energy, Renewable Energy, Electric Utilities, Wind Power Generation, Solar Energy |

| 128 | Mark E. Lashier | President and Chief Executive Officer | Phillips 66 | United States | Energy, Oil Refining, Chemicals, Midstream Logistics, Marketing & Specialties |

| 129 | Bill Anderson | Chairman | Bayer | Germany | Healthcare, Pharmaceuticals, Consumer Health, Crop Science, Biotechnology |

| 130 | Thomas M. Rutledge | Chairman | Charter Communications | United States | Telecommunications, Cable Television, Internet Services, Digital Cable, Advertising |

| 131 | Eduardo Bartolomeo | CEO | Vale | Brazil | Mining, Metals & Mining, Iron Ore Production, Nickel Production, Logistics |

| 132 | Ross McEwan | Group Chief Executive Officer and Managing Director | NAB - National Australia Bank | Australia | Financial Services, Banking, Wealth Management, Business Banking, Retail Banking |

| 133 | Keiji Kojima | President and Chief Executive Officer | Hitachi | Japan | Technology, Electronics, Industrial Machinery, IT Services, Automotive Systems |

| 134 | Robert B. Ford | Chairman and Chief Executive Officer | Abbott Laboratories | United States | Healthcare, Medical Devices, Diagnostics, Nutritional Products, Pharmaceuticals |

| 135 | Hiroya Masuda | Chief Executive Officer | Japan Post Holdings | Japan | Conglomerate, Postal Services, Banking Services, Life Insurance, Logistics |

| 136 | Paul O'Sullivan | Chairman | ANZ | Australia | Financial Services, Banking, Retail Banking, Corporate Banking, Wealth Management |

| 137 | Rainer M. Blair | President and Chief Executive Officer | Danaher | United States | Conglomerate, Life Sciences, Diagnostics, Dental, Environmental & Applied Solutions |

| 138 | Ruiwen Ke | Chairman and Chief Executive Officer | China Telecom | China | Telecommunications, Mobile Communications, Broadband Services, Information Services, Fixed-line Services |

| 139 | Charlie Nunn | Executive Director and Group Chief Executive | Lloyds Banking Group | United Kingdom | Financial Services, Banking, Retail Banking, Commercial Banking, Insurance |

| 140 | Neal Blinde | President | Capital One | United States | Financial Services, Banking, Credit Cards, Retail Banking, Commercial Banking |

| 141 | William S. Demchak | Chief Executive Officer, President and Chairman | PNC Financial Services | United States | Financial Services, Banking, Asset Management, Wealth Management, Estate Planning |

| 142 | Bruce Flatt | Chief Executive Officer | Brookfield Corporation | Canada | Real Estate, Renewable Energy, Infrastructure, Private Equity, Asset Management |

| 143 | Tingke Wang | Chairman | PICC | China | Financial Services, Insurance, Property & Casualty Insurance, Life Insurance, Health Insurance |

| 144 | Philippe Donnet | Group CEO | Generali Group | Italy | Financial Services, Insurance, Life Insurance, Property & Casualty Insurance, Asset Management |

| 145 | Masahiro Kihara | President & CEO | Mizuho Financial | Japan | Financial Services, Banking, Asset Management, Corporate Banking, Retail Banking |

| 146 | Tobias Meyer | CEO | Deutsche Post | Germany | Logistics, Courier, Package Delivery, Express Mail, Supply Chain Management |

| 147 | Bill Rogers | Chief Executive Officer and Chairman | Truist Financial | United States | Financial Services, Banking, Commercial Banking, Asset Management, Insurance |

| 148 | Kong Qingwei | Chairman | China Pacific Insurance | China | Financial Services, Insurance, Life Insurance, Property Insurance, Asset Management |

| 149 | Robert A. Bradway | Chairman and Chief Executive Officer | Amgen | United States | Biotechnology, Pharmaceuticals, Biopharmaceuticals, Human Therapeutics, Clinical Research |

| 150 | Takashi Tanaka | Chairman | KDDI | Japan | Telecommunications, Mobile Services, Broadband, IT Services, Content Delivery |

| 151 | Jim Taiclet Jr. | Chairman, President & CEO | Lockheed Martin | United States | Aerospace, Defense, Advanced Technology, Aeronautics, Missiles & Fire Control |

| 152 | Julie Spellman Sweet | Chairwoman & Chief Executive Officer | Accenture | Ireland | Professional Services, Consulting, Digital, Technology Services, Operations Services |

| 153 | Marvin R. Ellison | Chairman, President & Chief Executive Officer | Lowe's | United States | Retail, Home Improvement, Building Materials, Appliance Retail, Home Furnishings |

| 154 | Sanjiv Lamba | Chief Executive Officer | Linde | United Kingdom | Chemicals, Industrial Gases, Healthcare, Electronics, Manufacturing |

| 155 | Sandeep Bakhshi | Chief Executive Officer | ICICI Bank | India | Financial Services, Banking, Retail Banking, Corporate Banking, Wealth Management |

| 156 | Nigel Higgins | Chairman | Barclays | United Kingdom | Financial Services, Banking, Investment Banking, Wealth Management, Credit Cards |

| 157 | Lane Riggs | President and Chief Executive Officer | Valero Energy | United States | Energy, Oil Refining, Ethanol Production, Renewable Diesel, Marketing |

| 158 | Jacek Olczak | Chief Executive Officer | Philip Morris International | United States | Consumer Goods, Tobacco, Cigarettes, Reduced-Risk Products, Smoking Devices |

| 159 | Raj Subramaniam | President & Chief Executive Officer | FedEx | United States | Logistics, Package Delivery, Freight Transportation, Supply Chain Management, E-commerce Solutions |

| 160 | Michel A. Khalaf | President and Chief Executive Officer | MetLife | United States | Financial Services, Insurance, Annuities, Employee Benefits, Asset Management |

| 161 | Vicki Hollub | President and Chief Executive Officer | Occidental Petroleum | United States | Energy, Oil & Gas, Chemicals, Midstream, Marketing |

| 162 | Wang Nian-qiang, Jiang Xiang-rong | Executive Directors | BYD | China | Automotive, Electric Vehicles, Batteries, Solar Panels, Electronics |

| 163 | Tarciana Paula Gomes Medeiros | Chief Executive Officer | Banco do Brasil | Brazil | Financial Services, Banking, Retail Banking, Corporate Banking, Insurance |

| 164 | Geoffrey Straub Martha | Chairman & CEO | Medtronic | Ireland | Healthcare, Medical Devices, Medical Technology, Patient Monitoring, Diagnostics |

| 165 | Octávio de Lazari Jr. | Chief Executive Officer | Banco Bradesco | Brazil | Financial Services, Banking, Retail Banking, Corporate Banking, Private Banking |

| 166 | Vincent Clerc | Chief Executive Officer | Møller-Maersk | Denmark | Logistics, Transportation, Shipping, Supply Chain Management, Energy |

| 167 | Arvind Krishna | Chairman and Chief Executive Officer | IBM | United States | Technology, Cloud Computing, Artificial Intelligence, IT Services, Quantum Computing |

| 168 | Andrea Orcel | Group Chief Executive Officer | UniCredit | Italy | Financial Services, Banking, Asset Management, Investment Banking, Retail Banking |

| 169 | Daniel Hajj Aboumrad | Chief Executive Officer | América Móvil | Mexico | Telecommunications, Mobile Services, Broadband, Pay Television, Integrated Communications |

| 170 | Flavio Cattaneo | Chief Executive Officer | Enel | Italy | Energy, Electricity Generation, Renewable Energy, Distribution, Electric Utility |

| 171 | Christopher C. Womack | Chief Executive Officer | Southern Company | United States | Energy, Electric Utilities, Gas Utilities, Energy Solutions, Renewable Energy |

| 172 | Cristiano R. Amon | Chief Executive Officer and President | Qualcomm | United States | Technology, Semiconductors, Telecommunications, Wireless Technology, Chipsets |

| 173 | Helen Wong | Chief Executive Officer | Oversea-Chinese Banking | Singapore | Financial Services, Banking, Wealth Management, Asset Management, Insurance |

| 174 | Nicolas Hieronimus | Chief Executive Officer | L'Oréal | France | Consumer Goods, Beauty, Cosmetics, Skincare, Haircare |

| 175 | Victor G. Dodig | President and Chief Executive Officer | Canadian Imperial Bank | Canada | Financial Services, Banking, Wealth Management, Capital Markets, Retail Banking |

| 176 | Samuel N. Hazen | Chief Executive Officer | HCA Healthcare | United States | Healthcare, Hospitals, Surgery Centers, Urgent Care, Health Services |

| 177 | Lynn J. Good | President and Chief Executive Officer | Duke Energy | United States | Energy, Electricity, Gas Distribution, Renewable Energy, Utilities |

| 178 | Vimal Kapur | Chief Executive Officer | Honeywell International | United States | Conglomerate, Aerospace, Building Technologies, Performance Materials, Safety and Productivity Solutions |

| 179 | Sir Jonathan Symonds | Chairman | GSK (GlaxoSmithKline) | United Kingdom | Healthcare, Pharmaceuticals, Vaccines, Consumer Healthcare, Biotechnology |

| 180 | Christian Sewing | Chief Executive Officer | Deutsche Bank | Germany | Financial Services, Banking, Investment Banking, Asset Management, Private Banking |

| 181 | Brian Scott Tyler | Chief Executive Officer | McKesson | United States | Healthcare, Pharmaceuticals, Health Care Supply Chain, Medical Supplies, Health Information Technology |

| 182 | Piyush Gupta | Chief Executive Officer | DBS (Development Bank of Singapore) | Singapore | Financial Services, Banking, Wealth Management, Consumer Banking, Corporate Banking |

| 183 | Jiang Wang | President and Executive Director | China Everbright Bank | China | Financial Services, Banking, Corporate Banking, Wealth Management, Asset Management |

| 184 | Dirk van de Put | Chief Executive Officer and Chairman | Mondelez International | United States | Consumer Goods, Snack Foods, Confectionery, Beverages, Cheese & Grocery |

| 185 | Satoru Komiya | Chief Executive Officer | Tokio Marine Holdings | Japan | Financial Services, Insurance, Property & Casualty Insurance, Life Insurance, Asset Management |

| 186 | Jim Vena | Chief Executive Officer | Union Pacific | United States | Transportation, Railroads, Freight Hauling, Intermodal, Logistics |

| 187 | Gregory L. Ebel | President and Chief Executive Officer | Enbridge | Canada | Energy, Oil & Gas Transportation, Renewable Energy, Utilities, Midstream Services |

| 188 | Oliver Ingo Blume | Chief Executive Officer | Porsche Automobil Holding | Germany | Automotive, Luxury Vehicles, Sports Cars, Electrification, Engineering Services |

| 189 | Peter King | Chief Executive Officer | Westpac Banking Group | Australia | Financial Services, Banking, Consumer Banking, Wealth Management, Institutional Banking |

| 190 | Chen Wenjian | President | China Railway Engineering Group | China | Construction, Infrastructure, Engineering, Real Estate, EPC Services |

| 191 | Mr. Fang Hongbo | Chairman & Chief Executive Officer | Midea Group | China | Consumer Electronics, Home Appliances, Robotics, Smart Home Technologies, HVAC Systems |

| 192 | Steven van Rijswijk | CEO and chairman | ING Group | Netherlands | Financial Services, Banking, Retail Banking, Commercial Banking, Asset Management |

| 193 | David A. Ricks | Chief Executive Officer | Eli Lilly | United States | Healthcare, Pharmaceuticals, Biotechnology, Oncology, Diabetes Care |

| 194 | Bruce Dale Broussard | President and Chief Executive Officer | Humana | United States | Healthcare, Health Insurance, Managed Care, Wellness Services, Healthcare Plans |

| 195 | Brian Cornell | Chairman & Chief Executive Officer | Target | United States | Retail, General Merchandise, E-commerce, Consumer Goods, Grocery |

| 196 | Juan R. Luciano | Chairman, President and Chief Executive Officer | Archer Daniels Midland | United States | Food Processing, Commodities Trading, Agriculture, Food Ingredients, Bioenergy |

| 197 | Paul Thwaite | Chief Executive Officer | NatWest Group | United Kingdom | Financial Services, Banking, Retail Banking, Commercial Banking, Wealth Management |

| 198 | Peter Walter Herweck | Chief Executive Officer | Schneider Electric | France | Energy Management, Automation Solutions, Electrical Equipment, Industrial Control, Smart Grid |

| 199 | Paula Rosput Reynolds | Chairwoman | National Grid | United Kingdom | Energy, Electricity and Gas Utility, Transmission Networks, Renewable Energy, Energy Storage |

| 200 | Abdulla Mubarak Nasser | Chief Executive Officer | Qatar National Bank | Qatar | Financial Services, Banking, Corporate Banking, Retail Banking, Asset Management |

| 201 | Leonhard Birnbaum | Chief Executive Officer | E.ON | Germany | Energy, Utilities, Renewable Energy, Energy Networks, Electric Power Generation |

| 202 | Gao Yingxin | Chairman | China Minsheng Bank | China | Financial Services, Banking, Retail Banking, Corporate Banking, Wealth Management |

| 203 | John J. Donahoe II | President and Chief Executive Officer | Nike | United States | Consumer Goods, Apparel, Footwear, Sports Equipment, Accessories |

| 204 | Daniel P. O'Day | Chief Executive Officer | Gilead Sciences | United States | Healthcare, Biopharmaceuticals, Antiviral Drugs, Therapeutics, Research & Development |

| 205 | Markus Krebber PhD | Chief Executive Officer | RWE Group | Germany | Energy, Electricity Generation, Renewable Energy, Gas Supply, Energy Trading |

| 206 | Lakshmi N Mittal | Chairman | ArcelorMittal | Luxembourg | Industrial, Steel Production, Mining, Metal Fabrication, Technology |

| 207 | Larry Fink | Chairman and Chief Executive Officer | BlackRock | United States | Financial Services, Asset Management, Risk Management, Advisory Services, Investment Management |

| 208 | Rich Kruger | President and Chief Executive Officer | Suncor Energy | Canada | Energy, Oil Sands, Petroleum Refining, Retail & Wholesale Marketing, Renewable Energy |

| 209 | Chris Kempczinski | President and Chief Executive Officer | McDonald's | United States | Consumer Services, Fast Food, Restaurants, Franchising, Global Retailing |

| 210 | N. Murray Edwards | Chairman | Canadian Natural Resources | Canada | Energy, Oil & Gas Exploration, Production, Heavy Crude Oil, Natural Gas |

| 211 | Frank Vang-Jensen | President and Group Chief Executive Officer | Nordea Bank | Finland | Financial Services, Banking, Retail Banking, Wealth Management, Corporate Banking |

| 212 | Li Xin | Chairman and President | China Resources Land | Hong kong | Real Estate, Property Development, Retail Leasing, Urban Redevelopment, Property Investment |

| 213 | Christian Klein | Chief Executive Officer | SAP | Germany | Technology, Enterprise Software, Cloud Computing, Business Solutions, Data Management |

| 214 | Alan Schnitzer | Chairman and Chief Executive Officer | Travelers | United States | Financial Services, Insurance, Property & Casualty Insurance, Commercial Insurance, Personal Insurance |

| 215 | Greg Peters Ted Sarandos | Co-CEO | Netflix | United States | Technology, Streaming, Media Production, Online Entertainment, Content Distribution |

| 216 | Richard Qiangdong Liu | Chairman | JD.com | China | Technology, E-commerce, Retail, Logistics, Internet Technology |

| 217 | Michael Saul Dell | Chief Executive Officer and Chairman | Dell Technologies | United States | Technology, Computing, Data Storage, IT Solutions, Cloud Computing |

| 218 | Arun Kumar Singh | Chairman and Chief Executive Officer | Oil and Natural Gas Corporation | India | Energy, Oil & Gas Exploration, Production, Refining, Integrated Energy |

| 219 | Tzar Kuoi Li | Chairman | CK Hutchison | Hong kong | Conglomerate, Retail, Telecommunications, Infrastructure, Ports and Related Services |

| 220 | Jiu Sheng Zhu | President and Chief Executive Officer | China Vanke | China | Real Estate, Property Development, Property Management, Investment, Real Estate Services |

| 221 | Margherita della Valle | Group Chief Executive Officer | Vodafone | United Kingdom | Telecommunications, Mobile Communications, Broadband Services, Digital Services, IoT |

| 222 | Martin Lundstedt | President and Chief Executive Officer | Volvo Group | Sweden | Automotive, Trucks, Construction Equipment, Marine and Industrial Engines, Financial Services |

| 223 | Ryuichi Isaka | President | Seven & I Holdings | Japan | Retail, Convenience Stores, Supermarkets, Department Stores, Specialty Stores |

| 224 | Sanjiv Puri | BackSanjiv Puri Chairman & Managing Director | ITC Limited | India | Conglomerate, Fast-Moving Consumer Goods (FMCG), Hotels, Paperboards & Packaging, Agri-Business |

| 225 | Robin Antony Vince | President and Chief Executive Officer | Bank of New York Mellon | United States | Financial Services, Investment Banking, Asset Management, Wealth Management, Custody Services |

| 226 | Stuart Chambers | Chairman | Anglo American | United Kingdom | Mining, Metals and Minerals, Diamond Mining, Copper Production, Platinum Group Metals |

| 227 | Michael E. Miebach | Chief Executive Officer | Mastercard | United States | Financial Services, Payment Solutions, Credit Cards, Technology, Payment Processing |

| 228 | Lars Fruergaard Jørgensen | President and Chief Executive Officer | Novo Nordisk | Denmark | Healthcare, Pharmaceuticals, Diabetes Care, Biopharmaceuticals, Hormone Replacement Therapy |

| 229 | Kathy Warden | President and Chief Executive Officer | Northrop Grumman | United States | Aerospace and Defense, Cybersecurity, C4ISR Systems, Autonomous Systems, Space Technology |

| 230 | Mr. Auttapol Rerkpiboon | President and Chief Executive Officer | PTT | Thailand | Energy, Oil & Gas, Petrochemicals, Electricity Generation, Exploration & Production |

| 231 | Alex Chriss | President and Chief Executive Officer | PayPal | United States | Financial Technology, Digital Payments, Online Money Transfers, Mobile Payments, Payment Solutions |

| 232 | Peter T. F. M. Wennink | President and Chief Executive Officer | ASML Holding | Netherlands | Technology, Semiconductor Industry, Photolithography Systems, Advanced Microchips, Nanotechnology |

| 233 | Jen-Hsun Huang | Founder, President and CEO | NVIDIA | United States | Technology, Graphics Processors, Artificial Intelligence, Computing, Gaming Technology |

| 234 | Michael F. Roman | Chairman & CEO | 3M | United States | Conglomerate, Manufacturing, Safety & Industrial, Transportation & Electronics, Healthcare, Consumer Goods |

| 235 | Dong Li Zhou | Chief Executive Officer | Poly Developments & Holdings Group | China | Real Estate, Property Development, Property Investment, Urban Complex Development, Property Management |

| 236 | Phebe N. Novakovic | Chief Executive Officer | General Dynamics | United States | Aerospace and Defense, Marine Systems, Combat Systems, Information Technology, Business Aviation |

| 237 | Shemara Wikramanayake | Managing Director and Chief Executive Officer | Macquarie Group | Australia | Financial Services, Asset Management, Banking, Financial Advisory, Investment Banking |

| 238 | Ezra Y. Yacob | Chief Executive Officer and Chairman | EOG Resources | United States | Energy, Oil & Gas Exploration, Production, Natural Gas, Crude Oil |

| 239 | Christophe Weber | President and Chief Executive Officer | Takeda Pharmaceutical | Japan | Healthcare, Pharmaceuticals, Biotechnology, Research & Development, Specialty Medicine |

| 240 | François Jackow | Chief Executive Officer | Air Liquide | France | Chemicals, Industrial Gases, Healthcare, Environmental Services, Engineering & Construction |

| 241 | Dan Amos | Chief Executive Officer and Chairman | Aflac | United States | Financial Services, Insurance, Supplemental Insurance, Health Insurance, Life Insurance |

| 242 | Kevin David Strain | President & Chief Executive Officer | Sun Life Financial | Canada | Financial Services, Insurance, Wealth Management, Asset Management, Financial Planning |

| 243 | Christel Heydemann | Chief Executive Officer | Orange | France | Telecommunications, Mobile Communications, Internet Services, Digital Services, IT Services |

| 244 | Mr. Zhu Changyu | Chairman | Cosco Shipping | China | Transportation, Shipping, Logistics, Port Terminal Operations, Container Shipping |

| 245 | Miguel Patricio | Chairman & Chief Executive Officer | Kraft Heinz Company | United States | Food & Beverages, Consumer Goods, Packaged Foods, Sauces & Condiments, Nutrition |

| 246 | Ken Seitz | President and CEO | Nutrien | Canada | Agriculture, Fertilizers, Feed Products, Potash, Nitrogen and Phosphate |

| 247 | Dr José Viñals | Chairman | Standard Chartered | United Kingdom | Financial Services, Banking, Corporate Banking, Retail Banking, Wealth Management |

| 248 | Eui-Sun Chung | Chairman | KIA | South Korea | Automotive, Vehicle Manufacturing, Electric Vehicles, Luxury Vehicles, Commercial Vehicles |

| 249 | Jim Fitterling | Chief Executive Officer | Dow | United States | Chemicals, Material Sciences, Plastics, Performance Materials, Chemical Products |

| 250 | Wang Xiaoqiu | President & CEO | SAIC Motor | China | Automotive, Vehicle Production, Automotive Sales, Research & Development, Mobility Services |

| 251 | Sarah M. London | Chief Executive Officer | Centene | United States | Healthcare, Managed Care, Health Insurance, Medicaid and Medicare Services, Healthcare Solutions |

| 252 | Talal Ahmed Al-Khereiji | Chief Executive Officer | The Saudi National Bank | Saudi Arabia | Financial Services, Banking, Retail Banking, Corporate Banking, Wealth Management |

| 253 | Masayuki Hyodo | President and Chief Executive Officer | Sumitomo | Japan | Conglomerate, Finance, Metals, Transportation, Construction |

| 254 | Francesco Milleri | Chairman & Chief Executive Officer | EssilorLuxottica | France | Healthcare, Eyewear, Lenses, Optical Devices, Sunglasses |

| 255 | Belén Garijo López | Chief Executive Officer | Merck KGaA Group | Germany | Healthcare, Life Sciences, Performance Materials, Biotechnology, Pharmaceuticals |

| 256 | Olivier Le Peuch | Chief Executive Officer | Schlumberger | United States | Energy, Oilfield Services, Technology, Information Solutions, Integrated Project Management |

| 257 | Li Shoubing | Chariman | China Railway Construction | China | Infrastructure, Construction, Engineering, Real Estate Development, EPC Services |

| 258 | W. Rodney McMullen | Chairman & Chief Executive Officer | Kroger | United States | Retail, Supermarkets, Grocery Stores, E-commerce, Food Processing |

| 259 | Masumi Kakinoki | President and Chief Executive Officer | Marubeni | Japan | Conglomerate, Diverse Industries including Food, Energy, Metals, Transportation, Chemicals |

| 260 | Jan Jenisch | Chairman & Chief Executive Officer | Holcim | Switzerland | Building Materials, Cement, Aggregates, Concrete, Construction Solutions |

| 261 | Tetsuya Kikuta | President and Chief Executive Officer | Dai-ichi Life Insurance | Japan | Financial Services, Life Insurance, Retirement Plans, Wealth Management, Asset Management |

| 262 | Kosei Shindo | Chairman | Nippon Steel | Japan | Manufacturing, Steel Production, Metals, Engineering, Materials |

| 263 | Koji Arima | Chief Executive Officer | Denso | Japan | Automotive, Auto Parts, Advanced Mobility, Thermal Systems, Electrification |

| 264 | Frans Willem Henri Muller | President and Chief Executive Officer | Royal Ahold Delhaize N.V. | Netherlands | Retail, Supermarkets, E-commerce, Food Retail, Supply Chain |

| 265 | Oscar GarcÃa Maceiras | Chief Executive Officer | Inditex | Spain | Retail, Fashion, Apparel, Accessories, Home Textiles |

| 266 | Koenraad Debackere | Chairman | KBC Group | Belgium | Financial Services, Banking, Insurance, Asset Management, Consumer Finance |

| 267 | Javier Ferrán | Chairman | Diageo | United Kingdom | Beverages, Spirits, Beer, Wine, Alcoholic Beverages |

| 268 | Roy Gori | President and Chief Executive Officer | Manulife | Canada | Financial Services, Insurance, Wealth and Asset Management, Banking, Financial Planning |

| 269 | Chen Zhongyue | President | China Unicom | Hong kong | Telecommunications, Broadband, Mobile Services, Internet Services, ICT |

| 270 | Jong-Kyoo Yoon | Chief Executive Officer | KB Financial Group | South Korea | Financial Services, Banking, Insurance, Asset Management, Securities |

| 271 | Jung-ho Park/Noh-Jung Kwak | Chief Executive Officer | SK Hynix | South Korea | Technology, Semiconductors, Memory Chips, Electronics, Computing |

| 272 | Benoit BAZIN | Chief Executive Officer | Saint-Gobain | France | Manufacturing, Building Materials, Construction Products, Innovative Materials, Glass Production |

| 273 | Jack A. Fusco | President and Chief Executive Officer | Cheniere Energy | United States | Energy, Liquefied Natural Gas (LNG), Natural Gas Production, Energy Marketing, LNG Exporting |

| 274 | Martin Daum | Chairman | Daimler Truck Holding | Germany | Automotive, Truck Manufacturing, Commercial Vehicles, Mobility Solutions, Autonomous Driving |

| 275 | Daniel Obajtek | President and Chief Executive Officer | PKN Orlen | Poland | Energy, Oil Refining, Petrochemicals, Retail, Energy Marketing |

| 276 | Jinghe Chen | Chairman | Zijin Mining Group | China | Mining, Metals, Gold Mining, Copper Production, Non-ferrous Metals |

| 277 | Li Jingren | Vice Chairman | Kweichow Moutai | China | Beverages, Alcoholic Drinks, Spirits, Baijiu Production, Luxury Goods |

| 278 | José MarÃa Ãlvarez-Pallete López | Chairman & CEO | Telefónica | Spain | Telecommunications, Broadband, Mobile Communications, Digital Services, ICT |

| 279 | Steven H. Collis | Chairman, President and Chief Executive Officer | AmerisourceBergen | United States | Healthcare, Pharmaceutical Sourcing and Distribution Services, Specialty Drugs, Health Solutions |

| 280 | Walid bin Abdullah Ali Al-Moqbel | Chief Executive Officer | Al Rajhi Bank | Saudi Arabia | Financial Services, Banking, Islamic Banking, Consumer Banking, Corporate Banking |

| 281 | Ding Yanzhang | Chairman | Power Construction Corporation of China | China | Construction, Infrastructure, Energy, Engineering, Power Generation |

| 282 | Antonio Brufau Niubó | Chairman | Repsol | Spain | Energy, Oil & Gas, Renewable Energy, Petrochemicals, Exploration & Production |

| 283 | Hana Al-Rostamani | Group Chief Executive Officer | First Abu Dhabi Bank | United Arab Emirates | Financial Services, Banking, Corporate Banking, Retail Banking, Wealth Management |

| 284 | Frank J. Bisignano | Chairman, President and Chief Executive Officer | Fiserv | United States | Financial Technology, Payment Processing, Banking Solutions, Financial Services, E-commerce Solutions |

| 285 | Maria Black | President and Chief Executive Officer | Automatic Data Processing (ADP) | United States | Business Services, Human Capital Management, Payroll Services, HR Management, Tax and Compliance |

| 286 | Andreas A. Schell | Chief Executive Officer | EnBW-Energie Baden | Germany | Energy, Utilities, Electricity Generation, Renewable Energy, Grid Operations |

| 287 | Ernie L. Herrman | Chief Executive Officer and President | TJX Companies | United States | Retail, Off-Price Clothing and Home Fashions, Apparel, Home Goods, Fashion Accessories |

| 288 | Khaled bin Hamad AlGnoon | Chief Executive Officer | Saudi Electricity | Saudi Arabia | Energy, Electricity Production, Transmission, Distribution, Power Generation |

| 289 | Gonzalo Gortázar Rotaeche | Chief Executive Officer | CaixaBank | Spain | Financial Services, Banking, Retail Banking, Commercial Banking, Asset Management |

| 290 | Björn Rosengren | Chief Executive Officer | ABB | Switzerland | Technology, Electrification Products, Robotics, Industrial Automation, Motion |

| 291 | Jeong-Woo Choi | Chief Executive Officer | Posco | South Korea | Steel Production, Materials, Engineering & Construction, Energy, Sustainability |

| 292 | Okdong Jin | Chief Executive Officer | Shinhan Financial Group | South Korea | Financial Services, Banking, Insurance, Asset Management, Securities |

| 293 | Billy Gifford | Chief Executive Officer | Altria Group | United States | Consumer Goods, Tobacco, Cigarettes, Smokeless Products, Wine |

| 294 | Laxman Narasimhan | CEO | Starbucks | United States | Foodservice, Coffeehouse Chain, Specialty Coffee, Beverages, Food Retail |

| 295 | Jeffrey Orr | President and Chief Executive Officer | Power Corp of Canada | Canada | Financial Services, Asset Management, Insurance, International Operations, Investment Services |

| 296 | Richie Boucher | Chairman | CRH | Ireland | Building Materials, Construction Products, Heavy Building Materials, Light Building Materials, Distribution |

| 297 | H.H. Sheikh Tahnoon bin Zayed Al Nahyan | Chairman | International Holding Company | United Arab Emirates | Diversified Holdings, Investments, Real Estate, Agriculture, Healthcare |

| 298 | Calvin G. Butler Jr. | President and Chief Executive Officer | Exelon | United States | Energy, Utilities, Electricity Generation, Power Marketing, Gas Distribution |

| 299 | Mr. Chen Xuping | Chief Executive Officer | Longfor Group Holdings | China | Real Estate, Property Development, Property Investment, Property Management, Retail Malls |

| 300 | Sunarso | President | Bank Rakyat Indonesia (BRI) | Indonesia | Financial Services, Microfinance, Banking, Consumer Banking, Small Business Services |

| 301 | Richard Goyder | Chairman | Woodside Energy Group | Australia | Energy, Oil & Gas Exploration, Production, Liquefied Natural Gas (LNG), Petroleum |

| 302 | Julia A. Sloat | Chairman, President and Chief Executive Officer | American Electric | United States | Utilities, Electricity Generation, Power Distribution, Energy Services, Renewables |

| 303 | Ricardo Roa Barragán | President | Ecopetrol | Colombia | Energy, Oil & Gas, Hydrocarbons, Petrochemicals, Exploration & Production |

| 304 | José Antonio Fernández Carbajal | Executive Chairman & Chief Executive Officer | Femsa | Mexico | Beverages, Retail, Coca-Cola Bottling, Convenience Stores, Fuel Retail |

| 305 | Jeffrey W. Martin | Executive Chairman & Chief Executive Officer | Sempra | United States | Energy, Utilities, Natural Gas, Electricity, Renewable Energy |

| 306 | Slawomir Krupa | Chief Executive Officer | Société Générale | France | Financial Services, Banking, Investment Banking, Retail Banking, Asset Management |

| 307 | Haviv Ilan | President and chief executive officer | Texas Instruments | United States | Technology, Semiconductors, Integrated Circuits, Electronics, Digital Signal Processing |

| 308 | Thomas J. Iannotti | Chairman | Applied Materials | United States | Technology, Semiconductor Equipment, Material Engineering Solutions, Display, Solar |

| 309 | Scott D. Sheffield | Chief Executive Officer | Pioneer Natural Resources | United States | Energy, Oil & Gas Exploration, Production, Shale Oil, Natural Gas |

| 310 | Meng Bo Luo | Chief Executive Officer | Bank of Ningbo | China | Financial Services, Banking, Corporate Banking, Retail Banking, Financial Products |

| 311 | Leon J. Topalian | Chief Executive Officer | Nucor | United States | Steel Production, Metal Manufacturing, Steel Products, Recycling, Steel Mills |

| 312 | Alex Pourbaix | Chairman | Cenovus Energy | Canada | Energy, Oil Sands, Natural Gas, Refining, Energy Technology |

| 313 | Ming Ji | Chief Executive Officer | Bank Of Jiangsu | China | Financial Services, Banking, Corporate Banking, Retail Banking, Financial Management |

| 314 | Sanjay Mehrotra | President and Chief Executive Officer | Micron Technology | United States | Technology, Semiconductors, Memory Solutions, Data Storage, Computing |

| 315 | Brian P. Hannasch | Chief Executive Officer | Couche-Tard | Canada | Retail, Convenience Stores, Fuel Retail, Car Wash Services, Food Services |

| 316 | Patricia K. Poppe | Chief Executive Officer | PG&E (Pacific Gas and Electric Company) | United States | Utilities, Electricity, Natural Gas, Energy Services, Energy Generation |

| 317 | Richard C. Adkerson | Chief Executive Officer | Freeport-McMoRan | United States | Mining, Copper Production, Gold Mining, Molybdenum, Mining Operations |

| 318 | Mr. FAN Dazhi | President | Huaxia Bank | China | Financial Services, Banking, Retail Banking, Corporate Banking, Financial Products |

| 319 | Wee Ee Cheong | Chairman & Chief Executive Officer | United Overseas Bank (UOB) | Singapore | Financial Services, Banking, Retail Banking, Corporate Banking, Wealth Management |

| 320 | François-Henri Pinault | Chairman & Chief Executive Officer | Kering | France | Luxury Goods, Fashion, Apparel, Leather Goods, Jewelry |

| 321 | Shayne Kieth Nelson | Chief Executive Officer | Emirates NBD | United Arab Emirates | Financial Services, Banking, Retail Banking, Corporate Banking, Wealth Management |

| 322 | Fumio Akiya | Chairman | Shin-Etsu Chemical | Japan | Chemicals, Silicone, Semiconductor Silicon, Specialty Chemicals, PVC |

| 323 | Dong Mingzhu | Chairman & President | Gree Electric Appliances | China | Consumer Electronics, Air Conditioners, Smart Home Appliances, Manufacturing, Technology |

| 324 | John Owen | Chief Executive Officer and President | Discover Financial Services | United States | Financial Services, Credit Cards, Banking, Loan Services, Payment Solutions |

| 325 | Xi Guohua | President | Citic Securities | China | Financial Services, Securities, Investment Banking, Brokerage Services, Asset Management |

| 326 | Stuart Miller | Executive Chairman and Co-Chief Executive Officer | Lennar | United States | Real Estate, Home Construction, Real Estate Development, Home Sales, Financial Services |

| 327 | Wang Tongzhou | Chairman | China Communications Construction | China | Infrastructure, Construction, Engineering, Dredging, Heavy Machinery |

| 328 | Lei Chen | Co-CEO & Chairman | PDD Holdings (Pinduoduo) | Ireland | E-commerce, Retail, Technology, Agriculture, Consumer Services |

| 329 | Tricia Griffith | President & Chief Executive Officer | Progressive | United States | Financial Services, Insurance, Auto Insurance, Home Insurance, Commercial Insurance |

| 330 | Warren Edward Buffett | Chief Executive Officer and Chairman | Berkshire Hathaway | United States | Conglomerate, Insurance, Utilities, Manufacturing, Retail |

| 331 | Shin, Hak-Cheol | Chief Executive Officer | LG Chem | South Korea | Chemicals, Advanced Materials, Life Sciences, Batteries, Biopharmaceuticals |

| 332 | Paul J. Romanowski | President and Chief Executive Officer | D.R. Horton | United States | Real Estate, Home Construction, Real Estate Development, Home Sales, Property Management |

| 333 | Daniel J. Houston | Chairman, President and Chief Executive Officer | Principal Financial Group | United States | Financial Services, Retirement, Investment Management, Insurance, Asset Management |

| 334 | Edward Herman Bastian | Chief Executive Officer | Delta Air Lines | United States | Transportation, Airlines, Air Travel, Cargo Services, Loyalty Program |

| 335 | John Doyle | President & CEO | Marsh & McLennan | United States | Professional Services, Insurance Brokerage, Risk Management, Consulting, Employee Benefits |

| 336 | Olaug Svarva | Chair of the board | DNB Bank | Norway | Financial Services, Banking, Retail Banking, Corporate Banking, Investment Banking |

| 337 | Kevin T. Hogan | Chief Executive Officer | Corebridge Financial | United States | Financial Services, Retirement Solutions, Life Insurance, Asset Management, Annuities |

| 338 | Kuok Khoon Hong | Chairman & Chief Executive Officer | Wilmar International | Singapore | Agribusiness, Food Processing, Palm Oil, Sugar, Consumer Packaged Goods |

| 339 | James Cracchiolo | Chief Executive Officer and Chairman | Ameriprise Financial | United States | Financial Services, Wealth Management, Asset Management, Insurance, Financial Planning |

| 340 | LIU Jin | President and Vice Chairman | Bank of Beijing | China | Financial Services, Banking, Corporate Banking, Retail Banking, Financial Products |

| 341 | Kimberly Allen Dang | Chief Executive Officer | Kinder Morgan | United States | Energy, Natural Gas Pipelines, CO2 Transportation, Terminals, Oil Production |

| 342 | Priscilla Almodovar | CEO | Fannie Mae | United States | Financial Services, Mortgage Finance, Housing Finance, Securitization, Credit Guarantees |

| 343 | Peter Vanacker | Chief Executive Officer | LyondellBasell Industries | United Kingdom | Chemicals, Plastics, Chemical Manufacturing, Olefins, Polyolefins |

| 344 | Kevin A. Lobo | Chairman & Chief Executive Officer | Stryker | United States | Healthcare, Medical Devices, Medical Technology, Orthopedics, Surgical Equipment |

| 345 | Todd Vasos | Chief Executive Officer | Dollar General | United States | Retail, Discount Stores, Consumer Goods, Apparel, Home Products |

| 346 | Eddy Pirard | President and Chief Executive Officer | Japan Tobacco | Japan | Consumer Goods, Tobacco, Cigarettes, Smokeless Tobacco Products, Pharmaceuticals |

| 347 | Enrique Lores | President and Chief Executive Officer | HP (Hewlett-Packard) | United States | Technology, Computing, Printers, Personal Computing Devices, 3D Printing |

| 348 | Yuki Kusumi | President and Group Chief Executive Officer | Panasonic | Japan | Technology, Electronics, Appliances, Automotive Systems, Energy Solutions |

| 349 | Alfred Stern | Chairman & Chief Executive Officer | OMV Group | Austria | Energy, Oil & Gas, Refining, Exploration, Petrochemicals |

| 350 | Franklin L. Feder | Chief Executive Officer | Paccar | United States | Automotive, Commercial Vehicles, Truck Manufacturing, Financial Services, Parts Distribution |

| 351 | Joseph R. Hinrichs | President and Chief Executive Officer | CSX | United States | Transportation, Railroads, Freight Transportation, Intermodal, Rail Services |

| 352 | Tom Polen | Chairman, President and Chief Executive Officer | Becton Dickinson (BD) | United States | Healthcare, Medical Devices, Diagnostics, Biosciences, Medical Supplies |

| 353 | Douglas L. Peterson | Chief Executive Officer ανδ Î Ïεσιδεντ | S&P Global | United States | Financial Services, Credit Ratings, Analytics, Data, Market Intelligence |

| 354 | Craig Arnold | Chairman and Chief Executive Officer | Eaton | Ireland | Power Management, Electrical Products, Industrial Automation, Energy Storage, Hydraulic Systems |

| 355 | Shri. Siddhartha Mohanty | Chairperson | Life Insurance Corporation of India | India | Financial Services, Life Insurance, Investment Management, Pension Plans, Health Insurance |

| 356 | Ronald P. O'Hanley | Chief Executive Officer and Chairman | State Street | United States | Financial Services, Asset Management, Custody Banking, Investment Management, Financial Data Analytics |

| 357 | Vincent T. Roche | Chief Executive Officer and Chairman | Analog Devices | United States | Technology, Semiconductors, Integrated Circuits, Data Conversion, Signal Processing |

| 358 | Shantanu Narayen | Chairman & Chief Executive Officer | Adobe | United States | Technology, Software, Digital Media Solutions, Creative Cloud, Document Cloud |

| 359 | Michael DeVito | CEO | Freddie Mac | United States | Financial Services, Mortgage Finance, Secondary Market, Loan Securitization, Housing Finance |

| 360 | Sari Baldauf | Chair of the board of directors | Nokia | Finland | Technology, Telecommunications, Network Infrastructure, Wireless Technology, Digital Health |

| 361 | Olayan Mohammed Alwetaid | Chief Executive Officer | Saudi Telecom | Saudi Arabia | Telecommunications, Mobile and Fixed Services, Internet Services, Digital Solutions, ICT |

| 362 | John T. Stankey | Chief Executive Officer | AT&T | United States | Telecommunications, Media, Technology, Broadband, Entertainment |

| 363 | Makoto Inoue | President and Chief Executive Officer | Orix | Japan | Financial Services, Leasing, Corporate Finance, Real Estate, Investment Banking |

| 364 | André Santos Esteves | President | Banco Btg Pactual | Brazil | Financial Services, Investment Banking, Asset Management, Wealth Management, Corporate Lending |

| 365 | Laurent Ferreira | President and Chief Executive Officer | National Bank of Canada | Canada | Financial Services, Banking, Wealth Management, Corporate Banking, Insurance |

| 366 | Gordon M. Nixon | Chairman | BCE (Bell Canada Enterprises) | Canada | Telecommunications, Media, Internet, TV, Wireless Services |

| 367 | Carlos Hank González | Chairman | Banorte | Mexico | Financial Services, Banking, Retail Banking, Commercial Banking, Wealth Management |

| 368 | Tracy A. Robinson | Chief Executive Officer | Canadian National Railway | Canada | Transportation, Railroads, Freight Transportation, Supply Chain Solutions, Intermodal Services |

| 369 | Jasim HUnited Statesin Ahmed | Group Chief Executive Officer | TAQA (Abu Dhabi National Energy Company) | United Arab Emirates | Energy, Power Generation, Water Desalination, Oil & Gas Exploration, Renewable Energy |

| 370 | Masanori Togawa | President and CEO | Daikin Industries | Japan | Manufacturing, Air Conditioning, Refrigeration Equipment, Chemicals, HVAC Systems |

| 371 | Tim Cawley | Chairman, President, and Chief Executive Officer | Consolidated Edison | United States | Energy, Utilities, Electricity, Gas Service, Renewable Energy |

| 372 | Kris Licht | CEO | Reckitt Benckiser Group | United Kingdom | Consumer Goods, Health, Hygiene, Nutrition, Home Products |

| 373 | Rolf Dörig | Chairman | Swiss Life Holding | Switzerland | Financial Services, Life Insurance, Pension Products, Asset Management, Comprehensive Life and Pensions Solutions |

| 374 | Reynés Massanet Francisco | Chairman & Chief Executive Officer | Naturgy Energy Group | Spain | Energy, Natural Gas, Electricity, Renewable Energy, Energy Infrastructure |

| 375 | Noriyuki Hara | Chief Executive Officer and President | MS&AD Insurance | Japan | Financial Services, Insurance, Property & Casualty Insurance, Life Insurance, Health Insurance |

| 376 | Zhang Wenqi | Chief Executive Officer | Shaanxi Coal Industry | China | Energy, Coal Production, Coal Chemicals, Coal Mining, Energy Supply |

| 377 | Matteo del Fante | Chief Executive Officer | Poste Italiane | Italy | Postal Services, Financial Services, Insurance, Banking, Digital Services |

| 378 | Jeffrey L. Harmening | Chairman & Chief Executive Officer | General Mills | United States | Food, Consumer Goods, Packaged Foods, Cereals, Snacks |

| 379 | K. Krithivasan | Chief Executive Officer | Tata Consultancy Services (TCS) | India | Technology, IT Services, Consulting, Business Solutions, Digital Transformation |

| 380 | Angui Hou | Chief Executive Officer | Baoshan Iron & Steel | China | Manufacturing, Steel Production, Metal Products, Automotive Steel, Special Steel |

| 381 | Johan Torgeby | President and CEO | SEB AB | Sweden | Financial Services, Banking, Corporate Banking, Retail Banking, Wealth Management |

| 382 | James C. Fish Jr. | President and Chief Executive Officer | Waste Management, Inc. | United States | Environmental Services, Waste Management, Recycling, Renewable Energy, Sustainability Services |

| 383 | Willibald Cernko | Chief Executive Officer | Erste Group Bank | Austria | Financial Services, Banking, Retail Banking, Corporate Banking, Asset Management |

| 384 | Donnie D. King | Chief Executive Officer and President | Tyson Foods | United States | Food, Meat Processing, Poultry, Beef, Pork Products |

| 385 | Glenn D. Fogel | Chief Executive Officer | Booking Holdings | United States | Travel, Online Booking, Accommodations, Travel Services, Technology |

| 386 | Levent Çakiroglu | Chief Executive Officer | Koç Holding | Turkey | Conglomerate, Energy, Automotive, Consumer Goods, Finance |

| 387 | Dr. Charles Woodburn | Group Chief Executive Officer | BAE Systems | United Kingdom | Aerospace and Defense, Military Systems, Cybersecurity, Electronics, Naval Ships |

| 388 | Dolf van den Brink | Chairman | Heineken | Netherlands | Beverages, Brewing, Alcoholic Beverages, Beer, Cider |

| 389 | Scott Kirby | Chief Executive Officer | United Airlines Holdings | United States | Transportation, Airlines, Air Travel, Cargo, Passenger Services |

| 390 | Li Huagang | Chief Executive Officer and Chairman | Haier Smart Home | China | Consumer Electronics, Home Appliances, Smart Home Products, Technology, Manufacturing |

| 391 | George R. Oliver | Chairman & Chief Executive Officer | Johnson Controls International | Ireland | Technology, Building Efficiency, HVAC Systems, Fire Protection, Security Systems |

| 392 | Jennifer W. Rumsey | Chair & Chief Executive Officer | Cummins | United States | Manufacturing, Engines, Power Generation, Filtration, Automotive Components |

| 393 | Guang Wu Kou | Chief Executive Officer | Wanhua Chemical Group | China | Chemicals, Polyurethane, Petrochemicals, Fine Chemicals, Performance Materials |

| 394 | Luc Remont | Chairman & Chief Executive Officer | EDF (Electricité de France) | France | Energy, Electricity Generation, Nuclear Power, Renewable Energy, Utilities |

| 395 | Youlian Hu | CEO | Bank Of Shanghai | China | Financial Services, Banking, Corporate Banking, Retail Banking, Financial Markets |

| 396 | Guo Qing Chen | Chief Executive Officer | China Yangtze Power | China | Energy, Hydroelectric Power, Electricity Generation, Clean Energy, Power Distribution |

| 397 | Philip Eric Rene Jansen | Chief Executive Officer | BT Group | United Kingdom | Telecommunications, Broadband Services, IT Services, Digital Solutions, Network Infrastructure |

| 398 | Yong Cai Sun | Chairman | CRRC | China | Manufacturing, Rail Transportation Equipment, High-speed Trains, Urban Rail Transit Vehicles, Engineering Machinery |

| 399 | Christopher J. Swift | Chief Executive Officer and Chairman | Hartford Financial Services | United States | Financial Services, Insurance, Property and Casualty Insurance, Life Insurance, Investment Products |

| 400 | Robert M. Blue | Chairman & Chief Executive Officer | Dominion Energy | United States | Energy, Electricity Generation, Natural Gas Distribution, Renewable Energy, Utilities |

| 401 | Mitoji Yabunaka | President & CEO | Mitsubishi Electric | Japan | Technology, Electronics, Air Conditioning Systems, Automotive Equipment, Energy Systems |

| 402 | Hatem Mohamed Galal Ahment Dowidar | Chairman of the Board of Directors | Etisalat | United Arab Emirates | Telecommunications, Mobile and Fixed-line Services, Digital Services, Broadband, ICT Solutions |

| 403 | Pierluigi Antonelli | Chief Executive Officer | Fresenius | Germany | Healthcare, Dialysis Services, Hospital Management, Medical Devices, Health Services |

| 404 | Nobuhiko Murakami | Chairman | Toyota Tsusho | Japan | Trading & Investment, Automotive, Metals, Energy & Chemicals, Consumer Goods & Food |

| 405 | Shuichi Ishibashi | Chief Executive Officer | Bridgestone | Japan | Manufacturing, Tires, Diversified Products, Automotive Parts, Industrial Products |

| 406 | Dino Otranto | Chief Executive Officer | Fortescue Metals Group | Australia | Mining, Iron Ore Production, Energy, Infrastructure, Resource Development |

| 407 | Daniel Beneš | Chairman | CEZ Group | Czech Republic | Energy, Electricity Generation, Nuclear Energy, Renewable Energy, Utilities |

| 408 | Robert C. Frenzel | Chairman President and Chief Executive Officer | Xcel Energy | United States | Energy, Electricity and Natural Gas, Renewable Energy, Energy Management, Utilities |

| 409 | Ota Katsuyuki | Chairman | ENEOS Holdings | Japan | Energy, Oil & Gas, Petroleum Refining, Metals, Renewable Energy |

| 410 | Darmawan Junaidi | President | Bank Mandiri | Indonesia | Financial Services, Banking, Corporate Banking, Retail Banking, Treasury and International Banking |

| 411 | Torsten Leue | Chairman | Talanx | Germany | Financial Services, Insurance, Property & Casualty, Life Insurance, Asset Management |

| 412 | Ham Young-Joo | Chief Executive Officer | Hana Financial Group | South Korea | Financial Services, Banking, Corporate Banking, Retail Banking, Investment Services |

| 413 | Ken Murphy | Group Chief Executive Officer | Tesco | United Kingdom | Retail, Supermarkets, Grocery Stores, E-commerce, Consumer Goods |

| 414 | Patrick P. Gelsinger | Chief Executive Officer | Intel | United States | Technology, Semiconductors, Microprocessors, Integrated Graphics, Data Center Solutions |

| 415 | Amitabh Chaudhry | Chief Executive Officer | Axis Bank | India | Financial Services, Banking, Retail Banking, Corporate Banking, Investment Services |

| 416 | Makoto Uchida | President and Chief Executive Officer | Nissan Motor | Japan | Automotive, Vehicle Manufacturing, Electric Vehicles, Mobility Services, Automotive Finance |

| 417 | Lee Yuan Siong | Group Chief Executive and President | AIA Group | Hong kong | Financial Services, Life Insurance, Wealth Management, Pension Services, Health Insurance |

| 418 | Anthony G. Capuano | President and Chief Executive Officer | Marriott International | United States | Hospitality, Hotels, Resorts, Lodging, Franchise Operations |

| 419 | David Calhoun | President and Chief Executive Officer | Boeing | United States | Aerospace, Commercial Airplanes, Defense, Space & Security, Global Services |

| 420 | Ulrich Körner | Chief Executive Officer | Credit Suisse Group | Switzerland | Financial Services, Banking, Wealth Management, Investment Banking, Asset Management |

| 421 | Alexandre Bompard | Chairman and Chief Executive Officer | Carrefour | France | Retail, Supermarkets, Hypermarkets, Convenience Stores, E-commerce |

| 422 | Gilles Schnepp | Chairman | Danone | France | Food & Beverages, Dairy Products, Plant-based Products, Baby Nutrition, Bottled Water |

| 423 | Yao Meng Xiao | Chief Executive Officer | Yankuang Energy Group | China | Energy, Coal Production, Coal Chemicals, Power Generation, Mining |

| 424 | Leonard S. Schleifer | President and Chief Executive Officer | Regeneron Pharmaceuticals | United States | Healthcare, Biotechnology, Pharmaceuticals, Biopharmaceuticals, Clinical Research |

| 425 | Fujio Mitarai | Chairman & CEO | Canon | Japan | Technology, Imaging Products, Optical Products, Printers, Medical Equipment |

| 426 | Gurdeep Singh | Chief Executive Officer | NTPC (National Thermal Power Corporation) | India | Energy, Electricity Generation, Thermal Power, Renewable Energy, Power Distribution |

| 427 | Lal Karsanbhai | President and Chief Executive Officer | Emerson Electric | United States | Manufacturing, Automation Solutions, Commercial & Residential Solutions, Process Control, Climate Technologies |

| 428 | David Adam Schwimmer | Chief Executive Officer | London Stock Exchange | United Kingdom | Financial Services, Stock Exchange, Trading Platforms, Market Data, Financial Information Services |

| 429 | Jeffrey Sprecher | Chief Executive Officer | IntercontinentalExchange | United States | Financial Services, Financial Markets, Commodity Trading, Exchange, Market Data Services |

| 430 | Alan H. Shaw | President and Chief Executive Officer | Norfolk Southern | United States | Transportation, Railroads, Freight Transportation, Intermodal Services, Logistics |

| 431 | Alexandre Ricard | Chairman and Chief Executive Officer | Pernod Ricard | France | Beverages, Alcoholic Beverages, Spirits, Wine, Global Brands |

| 432 | Yves Chapot | General Manager and Chief Financial Officer | Michelin Group | France | Manufacturing, Tires, Mobility Services, Travel Services, Automotive Solutions |