United States Is World’s 18th Happiest Country

Interestingly, a new UN-backed survey into global happiness has placed United States 18th out of 156 nations. The United States, one of the world’s wealthiest countries, fell to 18th place from 14th last year.

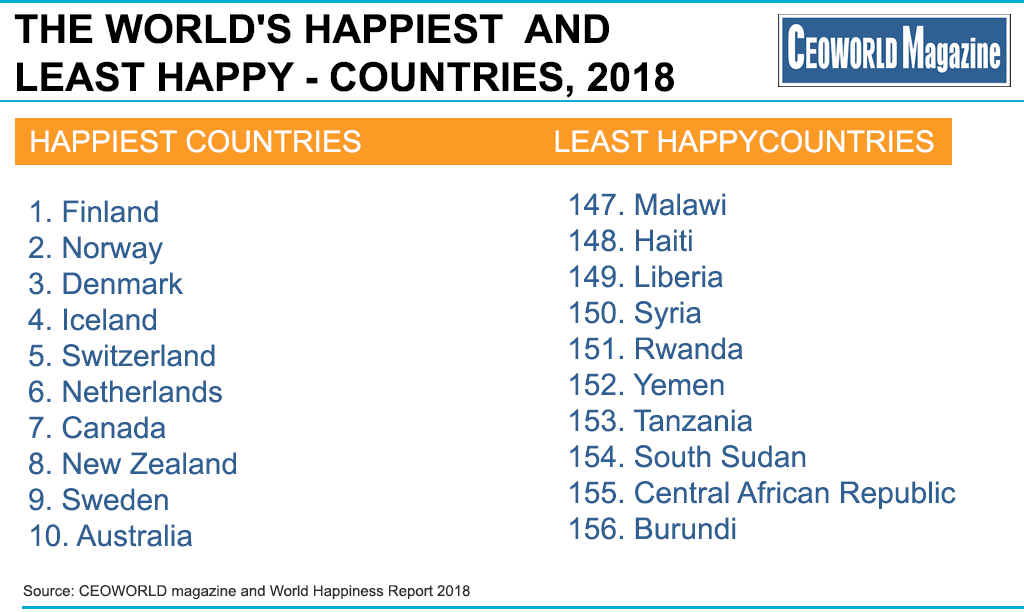

Finland was ranked as the happiest country in the world, both among its immigrant and general populations. Briefly put, Europe’s Nordic nations regularly appear in the top five happiest countries, according to the report. Norway, Denmark, Iceland and Switzerland were the other countries in the top five.

The top ten, after Switzerland, is as follows; the Netherlands, Canada, New Zealand, Sweden and Australia.

The World Happiness Report for 2018 claims to be a “landmark survey of the state of global happiness” which ranks “156 countries by their happiness levels” and “117 countries by the happiness of their immigrants.”

Burundi was the least happy, taking over from the Central African Republic.

| The world’s happiest – and least happy – countries | |

|---|---|

| Happiest | Least happy |

| 1. Finland | 147. Malawi |

| 2. Norway | 148. Haiti |

| 3. Denmark | 149. Liberia |

| 4. Iceland | 150. Syria |

| 5. Switzerland | 151. Rwanda |

| 6. Netherlands | 152. Yemen |

| 7. Canada | 153. Tanzania |

| 8. New Zealand | 154. South Sudan |

| 9. Sweden | 155. Central African Republic |

| 10. Australia | 156. Burundi |

The top 10 happiest and least happy countries in the world, 2018

Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2024 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz