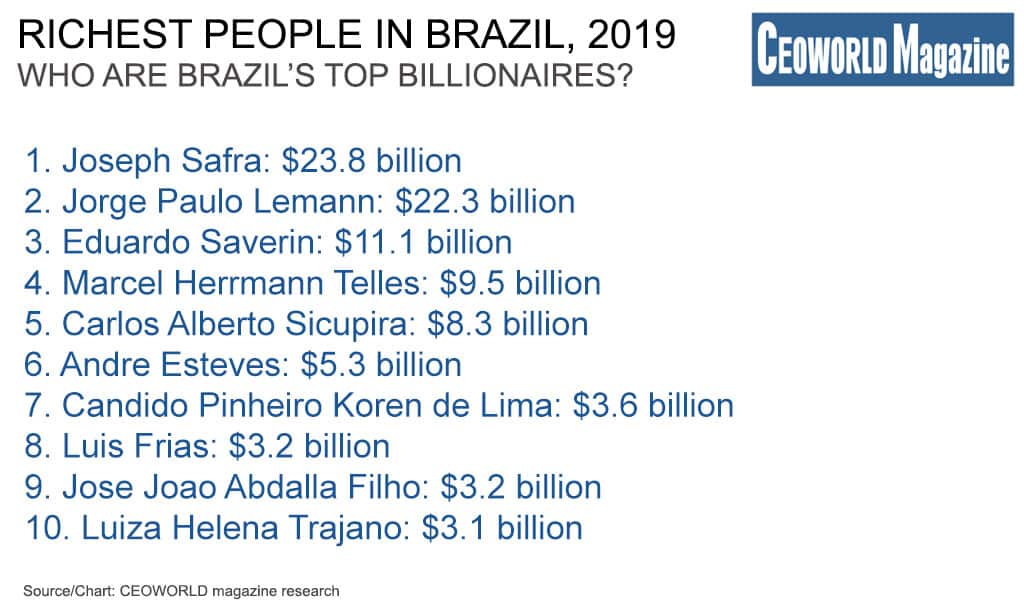

Brazilian Billionaires: Richest People In Brazil, 2019

With an estimated net worth of $23.8 billion, Joseph Safra is the wealthiest person in Brazil, that’s according to CEOWORLD magazine’s Brazil Rich List Index For 2019. The number two spot for Brazil was occupied by Jorge Paulo Lemann with a net worth of $3.5 billion.

Eduardo Saverin, is the third richest person in the country; his net worth stands at $11.1 billion. According to the financial publication’s annual listing, 2019 saw the total wealth of the top ten richest people in Brazil hits a new record high of $93.4 billion. In other words, the wealth of the top ten richest people in Brazil accounts for 4.67% of Brazil’s GDP.

To identify the wealthiest people in Brazil, CEOWORLD magazine reviewed numerous national and international media reports. Additional information about the billionaires came from Forbes global index, Bloomberg Billionaires Index, CEOWORLD magazine’s rich list index, Hurun rich list, and all estimated net worth figures are in U.S. dollars. The Brazil Rich list was compiled using shareholding and financial information obtained from the media reports and individuals, analysts, stock exchanges, and regulatory agencies. This list encompasses family fortunes, including those shared among extended families of multiple generations. The minimum to make the list was $1 billion.

The data below presents the richest people in Brazil in 2019, by wealth. In 2019, Brazilian-Lebanese banker Joseph Safra had a fortune worth more than $23.8 billion and was thus the richest person in the country. His wealth is worth 1.19% of the country’s GDP. Who Are Brazil’s Top Billionaires?

Brazilian Billionaires: Richest People In Brazil, 2019

- Joseph Safra: $23.8 billion

- Jorge Paulo Lemann: $22.3 billion

- Eduardo Saverin: $11.1 billion

- Marcel Herrmann Telles: $9.5 billion

- Carlos Alberto Sicupira: $8.3 billion

- Andre Esteves: $5.3 billion

- Candido Pinheiro Koren de Lima: $3.6 billion

- Luis Frias: $3.2 billion

- Jose Joao Abdalla Filho: $3.2 billion

- Luiza Helena Trajano: $3.1 billion

- Roberto Irineu Marinho: $2.9 billion

- Jose Roberto Marinho: $2.9 billion

- Joao Roberto Marinho: $2.8 billion

- Pedro Moreira Salles: $2.8 billion

- Abilio dos Santos Diniz: $2.7 billion

- Fernando Roberto Moreira Salles: $2.7 billion

- Joao Moreira Salles: $2.7 billion

- Walther Moreira Salles Junior: $2.7 billion

- Walter Faria: $2.7 billion

- Dulce Pugliese de Godoy Bueno: $2.4 billion

- Jayme Garfinkel: $2.2 billion

- Joesley Batista: $2.2 billion

- Wesley Batista: $2.2 billion

- Jose Luis Cutrale: $2.2 billion

- Alfredo Egydio Arruda Villela Filho: $2.2 billion

- Antonio Luiz Seabra: $2.1 billion

- Alexandre Grendene Bartelle: $2.1 billion

- Nevaldo Rocha: $2 billion

- Ana Lucia de Mattos Barretto Villela: $2 billion

- Joao Alves de Queiroz Filho: $2 billion

- Luciano Hang: $2 billion

- Jorge Moll Filho: $2 billion

- Aloysio de Andrade Faria: $2 billion

- Ermirio Pereira de Moraes: $2 billion

- Alceu Elias Feldmann: $1.9 billion

- Candido Pinheiro Koren de Lima Junior: $1.8 billion

- Jorge Pinheiro Koren de Lima: $1.8 billion

- Julio Bozano: $1.8 billion

- Carlos Sanchez: $1.6 billion

- Rubens Menin Teixeira de Souza: $1.5 billion

- Jose Isaac Peres: $1.5 billion

- Maria Helena Moraes Scripilliti: $1.4 billion

- Liu Ming Chung: $1.4 billion

- Lirio Parisotto: $1.3 billion

- Lia Maria Aguiar: $1.3 billion

- Elie Horn: $1.2 billion

- Paulo Setubal Neto: $1.2 billion

- Miguel Krigsner: $1.1 billion

- David Feffer: $1.1 billion

- Ana Maria Marcondes Penido Sant Anna: $1.1 billion

- Ricardo Villela Marino: $1.1 billion

- Rodolfo Villela Marino: $1.1 billion

- Guilherme Peirao Leal: $1.1 billion

- Rubens Ometto Silveira Mello: $1.1 billion

- Daniel Feffer: $1.1 billion

- Ruben Feffer: $1 billion

- Jorge Feffer: $1 billion

- Pedro Grendene Bartelle: $1 billion

- Samuel Barata: $1 billion

Marcel Herrmann Telles and Carlos Alberto Sicupira rounded up the top five wealthiest people in Brazil with $9.5 billion and $8.3 billion, respectively. Andre Esteves holds the 6th spot with a whopping net worth of $5.3 billion.

Candido Pinheiro Koren de Lima, Luis Frias, Jose Joao Abdalla Filho, Luiza Helena Trajano rounded up the top ten wealthiest people in Brazil with $3.6 billion, $3.2 billion, $3.2 billion, and $3.1 billion, respectively.

Have you read?

Richest People in Australia, Austria, Cyprus, Canada, Switzerland, Vietnam Ukraine Turkey Thailand for 2019. Richest People In The World For 2019.

Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2024 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz