CEO survey: European manufacturing companies increasingly moving to India

A significant trend marks the ongoing shift in global manufacturing dynamics: European manufacturing companies are increasingly moving their production facilities from China to India. A confluence of geopolitical, economic, and strategic factors influences this transition. The Indian government, recognizing the potential for economic growth and employment generation, has launched concerted efforts to attract these companies. These efforts are part of a broader strategy to position India as a global manufacturing hub, a role traditionally held by China.

A recent CEO survey conducted by CEOWORLD magazine, which highlights the changing perceptions of global manufacturing locations among European manufacturing companies, underscores this transition. This survey, which received responses from over 122,800 European manufacturers across various sectors, including aerospace, defense, automotive, chemicals, construction, engineering, high-tech, electronics, and industrial manufacturing, reveals a significant shift in the global manufacturing landscape.

The survey asked companies to identify the most promising countries for business development in the medium term. The results were telling: India ranked first by 58.4 percent of the companies, a clear indication of its growing appeal as a manufacturing destination. The companies cited the potential for growth in the local market as a primary reason for their interest in India. In contrast, only 28.4% of the companies viewed China as promising, a decline attributed to several factors including China’s escalating tensions with the U.S., economic slowdown, and the strengthening of anti-espionage laws.

Prof. Dr. Amarendra Bhushan Dhiraj, the Executive Chairman and Chief Executive of CEOWORLD magazine, elaborated on the survey’s findings. He highlighted the negative investment environment in China and contrasted it with India’s positive attributes, such as population growth and infrastructure improvements, which have contributed to India’s strong performance in the survey. Vietnam, another emerging manufacturing destination, was also noted for its appeal, rising to second place with 30.2% of companies ranking it highly. This interest in Vietnam is attributed to its combination of low costs and skilled labor, despite the annual increase in local salary levels.

Interestingly, European manufacturing companies are not solely focused on cost advantages. The survey indicates a broader interest in establishing a presence in markets with high growth potential. India, with its large and growing consumer base, offers a compelling proposition for companies looking to expand their global footprint.

The shift in manufacturing bases is also being supported by various European governments. Countries like France, Spain, Italy, and the United Kingdom have sent delegations to India, predominantly comprising manufacturing companies. However, the interest is not limited to manufacturers alone; companies oriented towards domestic demand are also exploring opportunities in the Indian market.

This trend of relocating businesses from China to India is driven by a variety of factors. The Indian government’s proactive approach, including initiatives like “Make in India” launched by Prime Minister Narendra Modi, aims to create a conducive environment for manufacturing. This involves improving infrastructure, enhancing security measures, and ensuring smooth operations for manufacturers. These steps are crucial in mitigating the challenges often associated with setting up and running manufacturing operations in a new country.

Moreover, the geopolitical landscape plays a significant role in this shift. The growing tensions between China and the United States have led to uncertainties and concerns about the stability and reliability of manufacturing in China. Companies are increasingly wary of these risks and are looking for alternative locations that offer a more stable and predictable business environment.

Economic factors also contribute to this trend. China’s economic slowdown has raised questions about the future growth potential of the Chinese market. In contrast, India, with its large and youthful population, offers a vast and growing market for a wide range of products. This demographic advantage is a significant draw for companies looking to tap into new consumer bases.

In addition to market potential, India’s improving infrastructure is a key factor in attracting manufacturing companies. The Indian government has been investing heavily in enhancing its transportation networks, power supply, and digital connectivity, all of which are critical for efficient and effective manufacturing operations.

The trend of European manufacturing companies moving their production facilities from China to India is a reflection of the changing global economic order. It highlights India’s rising stature as a manufacturing powerhouse and its potential to play a pivotal role in the global supply chain. As India continues to improve its infrastructure and business environment, it is likely to attract even more foreign investment and solidify its position as a key player in the global manufacturing sector.

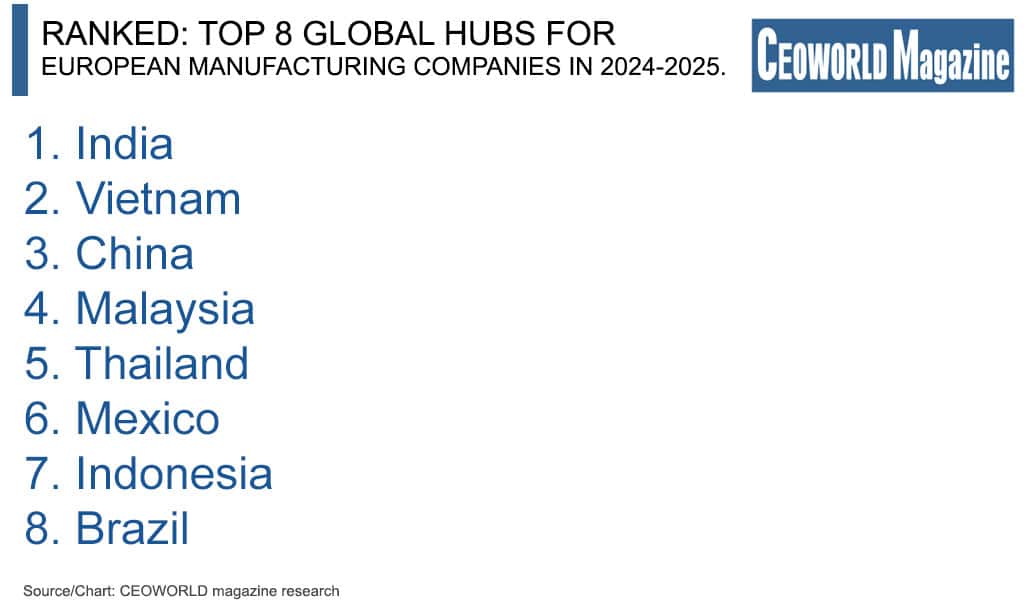

Top 8 global hubs for European manufacturing companies in 2024-2025.

- India

- Vietnam

- China

- Malaysia

- Thailand

- Mexico

- Indonesia

- Brazil

Have you read?

Ranked: Biggest banks in the world in 2023.

These Are The Highest Grossing Films Of The 2023 Worldwide.

Revealed: Top Environmental Innovative US States, 2023.

Report: Best Countries for Cyber Security Professionals, 2023 (Average Salary).

Best CEOs in The Global Video Streaming Industry, 2023.

Ranked: World’s Best-Selling Champagne Brands, 2023.

Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

This report/news/ranking/statistics has been prepared only for general guidance on matters of interest and does not constitute professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this publication, and, to the extent permitted by law, CEOWORLD magazine does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.

Copyright 2024 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz

SUBSCRIBE NEWSLETTER