Bringing Manufacturing “Back” to the U.S.?

Manufacturing Extension Partnership (MEP) Centers Under Fire.

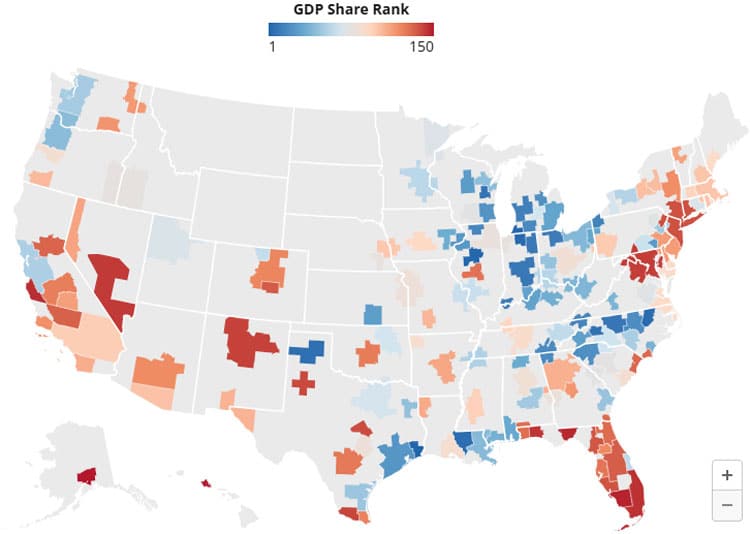

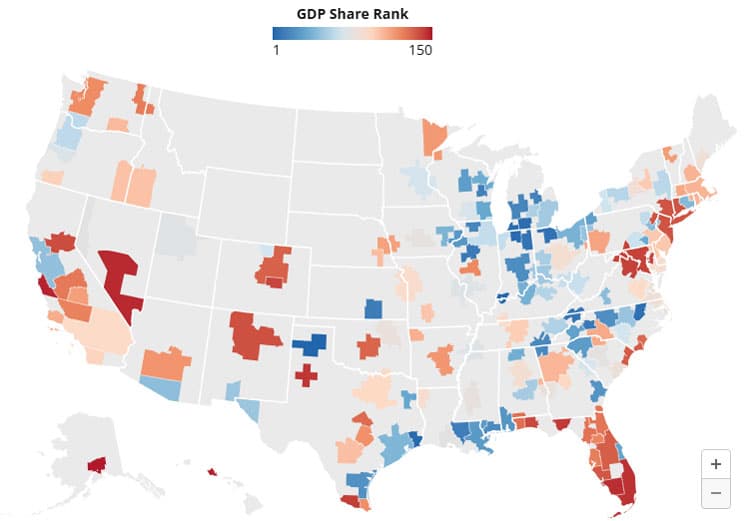

We often hear that “small business is the backbone of the country” and that we need to bring manufacturing “back” to the United States. Interestingly, manufacturing in the U.S. has been surprisingly stable over the last 10 – 15 years. Detroit’s manufacturing economy is actually 22% larger than it was 20 years ago, for example. There was also a great deal of variance from region to region across the U.S., as one might imagine. Specifically, a recent study by the Kenan Institute at the Kenan-Flagler Business School at the University of North Carolina at Chapel Hill found that “The largest microeconomies’ manufacturing dependence range from Amarillo, TX, and Evansville, IN, where around 40% of the [local] economy is engaged in manufacturing activities, to Anchorage, AK, which has less than 1%.” That same study compared the manufacturing share of local economic GDP across various “Extended Market Areas” in the U.S. in 2013 versus 2023 and found remarkable consistency over time:

Manufacturing share of local economy GDP 2013

Manufacturing share of local economy GDP 2023

Figure 1. Manufacturing share of local economy GDP 2013 (top) versus 2023 (bottom); blue denotes high share EMA (Extended Market Area) while red denotes low share EMAs.

Established during the trade war with Japan in the 1980s by President Ronald Reagan, an organization known as the Manufacturing Extension Partnership (MEP) has developed state-level MEP centers in all 50 states and Puerto Rico, providing Public Private Initiative (PPI) consulting to thousands of small and mid-sized manufacturers. NIST (National Institute of Standards and Technology) estimates that in 2024 alone, MEPs saved manufacturers $2.6 billion, generated $5 billion in new manufacturing investments, and created or retained over 108,000 manufacturing jobs.

However, last month, the current administration and the Department of Commerce’s National Institute of Standards and Technology (NIST)notified ten Manufacturing Extension Partnership (MEP) centers they would withhold nearly $12.9 million in funding, signaling what could be the first step in defunding the entire national network of manufacturing support organizations. In a first step, these ten states, Delaware, Hawaii, Iowa, Kansas, Maine, Mississippi, Nevada, New Mexico, North Dakota, and Wyoming, saw their funding withheld. Only recently, were those centers provided with a six-month reprieve, making their futures still certain. According to Carrie Hines, president and CEO of the American Small Manufacturers Coalition, these centers were “blindsided” by the decision. In an email to lawmakers, NIST, who is responsible for budget allocation decisions, explained that they were “re-prioritizing its programmatic activities to ensure that the US secures its position as a leader in critical and emerging technologies such as artificial intelligence and quantum.” By NIST’s own admission, continued funding for the MEP is not guaranteed.

Despite its strong track record, the program now faces serious uncertainty. Critics argue this move contradicts President Trump’s manufacturing-focused agenda. David Vasko, a member of NIST’s MEP Advisory Board, stated, “We’re making this huge push to reshore things to scale up businesses here, and the instrument that we have that’s been so successful doing that has been the MEPs.” Patrick Boyle, CEO of the Vermont Manufacturing Extension Center, points out: “There is actually quite a bit of manufacturing in the US already that can be supported today, tomorrow and the next day. The more we can support the SMMs (Small to Medium Manufacturers) in the US today the less of a big lift it is to have more manufacturing in the US.”

While de-funding state MEPs aligns with a broader goal of privatizing government services, academic research indicates that MEPs fill a market gap by providing affordable technical assistance to small manufacturers who might otherwise lack access to purely private consulting services, particularly in rural areas. Economic studies suggest that government-supported manufacturing extension services can yield significant return on investment through job creation, increased productivity, and strengthened supply chains – critical factors in America’s manufacturing competitiveness strategy. The MEPs have also facilitated more private small consultants by introducing them to manufacturers for specific services. Essentially creating and sustaining a market and exemplifying the public private partnership it was designed to achieve.

All of this begs the question – what does bringing manufacturing back to the U.S. actually mean in practice? Much of it is already here, albeit on a smaller scale, enabled in part by the MEPs. Should the future of U.S. manufacturing be a blend of large and small, regional and local, private and state funded, each supported and encouraged by federal and state funding, or should it be left to the private sector entirely and, if so, what role does tariff policy play in these decisions? Given that most of American manufacturing is Small and Medium Sized, 95% by many measures, it makes perfect sense for Governments, States and the private sector to invest in building small to medium and medium to large if we truly aim to make the US a manufacturing superpower. The PPI that is the MEP is an underplayed and maybe under-utilized network that can roll out coordinated and prioritized technology transfer and other initiatives as well as provide the day to day support that SMMs need to be efficient, effective, and competitive.

As we see by recent NIST funding decisions, we are putting in serious doubt any chance of a manufacturing renaissance based on the backbone of current American manufacturing. A wise path may well be to continue to fund and strengthen the MEPs while also trying to lure back or have new companies to build new factories here. The former we can do today; the latter will take many years and a lot more government money to support.

Written by Dr. William Putsis.

Have you read?

The World’s Best Medical Schools.

The World’s Best Universities.

The World’s Best International High Schools.

The World’s Best Business Schools.

The World’s Best Fashion Schools.

The World’s Best Hospitality And Hotel Management Schools.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz