China: About Being A “Currency Manipulator”

On Monday, the 5th August, the Chinese yuan fell to a new low towards the US dollar, also lower than in 2016 and 2018. Back then, China’s central bank, The Peoples Bank of China (PBoC), defended the USD/RMB (or CNY) rate not to rise above 7.0000 by selling US dollars and purchasing the country’s own currency.

In graphic one, it seems like the US dollar is rising, but the other side of the medal is that the yuan is falling. This is exactly what the Americans are very sensitive about, and already, on the same day that the USD/RMB exchange rate broke the 7.0000 mark, the US government announced that China is a “currency manipulator”, further increasing the tension between the two countries.

The US dollar has recently gained in value against quite a number of currencies, which however, has not been the case against the renminbi, as shown in graphic one. But Trump triggered new pressure on China’s currency by announcing new trade tariffs on Chinese goods, and for the same reason, the foreign exchange market began to sell yuan.

This is an entirely natural reaction in a foreign exchange market, and of course, it contains a speculative element. But conversely, there is nothing unexpected in the movement that was caused by the escalation of the trade war.

The critical issue was that the USD/RMB rate traded very close to the 7.0000 level when US President Trump announced the new tariffs. But when the currency market came very close to the magic 7.0000 limit, there was no indication that the Chinese central bank would intervene this time.

When working in a bank’s foreign exchange department, these situations are insanely exciting, and contain a good deal of true drama. When a certain exchange rate level has been defended for years, as in this case 7.0000 in USD/RMB, then a central bank will typically have a particularly active contact with the commercial banks to follow the market turnover in case the market is moving towards the defended level.

Most often, a central bank will intervene at an earlier stage before the defended level, like when 7.0000, is reached. But on that Monday, the PBoC stayed remarkably calm, which the experienced currency trader quickly becomes aware of. In such a situation, more people in the market begin to cover their positions, and with the market’s own inertia, the exchange rate moves faster towards the magic point, which may no longer be protected.

To start with, on such a day, one can sense that the traders are feeling their way ahead by constantly buying at slightly higher prices, but conversely fear intervention. Though as the intervention doesn’t appear, the price movement finally explodes up through the 7.000 mark, as shown in graphic one.

In this context, it has been quite entertaining to hear Chinese currency traders explain that the central bank did not devalue the renminbi because the market traded all the way up to the now famous 7.0000 level.

It was detected that the central bank was not in the market as expected, and therefore, the USD/RMB exchange rate jumped up, which the local traders do not define as a devaluation.

In principle, it is correct that a “real” devaluation is typically announced by a country’s central bank, and then the foreign exchange market will jump to a new level. It may also be that a country works with fixed parities, or fluctuation bands, against one or more other currencies. If these boundaries are moved, then this is also a real devaluation- or in rare cases, a revaluation. Are these kinds of actions currency manipulation?

Yes, it is the case, in my opinion. As soon as a currency is not free floating and fully convertible, it is to a greater or lesser degree under government control or influence, thus, in the broadest sense of the term, some sort of manipulation takes place. By that, I also say that China is a currency manipulator.

Obviously, Washington D.C. watched the 7.0000 barrier in USD/RMB very closely, as the level was barely broken when Trump tweeted that China is now a currency manipulator.

As mentioned before, I would also consider China a currency manipulator. But the few percentage points that the yuan fell will not change anything in macroeconomic terms, though it can of course pave way for a further depreciation.

The US administration may want to bring its case to the World Trade Organization (WTO), but the US will find it difficult to demonstrate that the renminbi is markedly weak, which a true currency manipulator would try to achieve.

If I should point at an expectation for the further development of the RMB exchange rate, then capital movements (those who are allowed) mean a lot for an exchange rate, but in the long run, inflation differences between US and China play a big role, though also something that classic as the balance of trade.

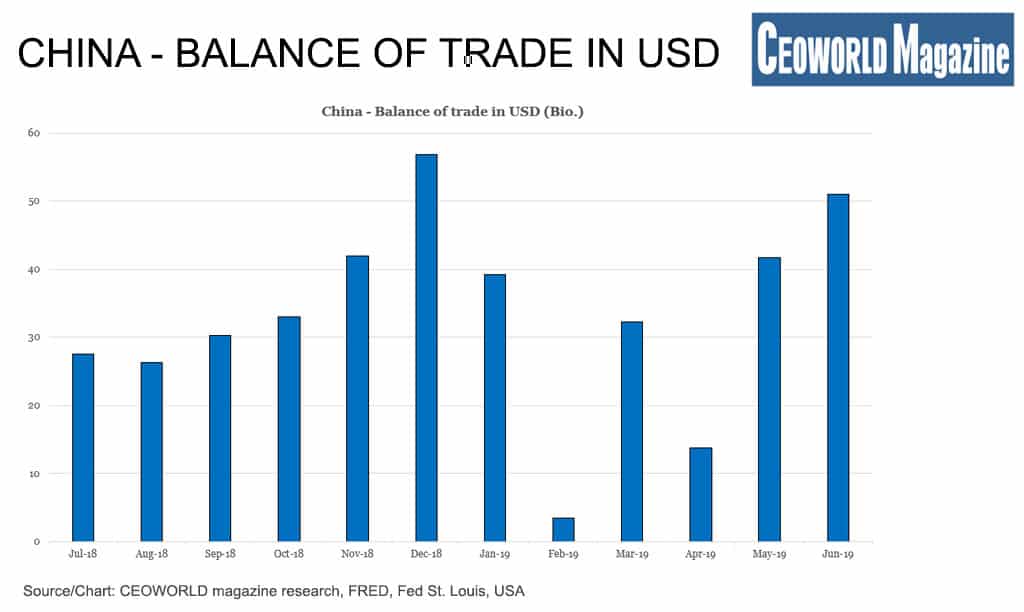

As graphic two shows, China still has a noticeable trade surplus. It is a long-term economic force that generates a foreign exchange surplus, which again helps to strengthen a country’s exchange rate. Hereby, the Americans can argue that a weaker renminbi is not natural, though the challenge about the discussion is that these effects are long-term.

More countries than one immediately thinks are involved in currency manipulation. It is well known that the large state-controlled Japanese pension funds now have to buy more foreign financial assets to weaken the yen, but the biggest currency manipulator is currently Switzerland. To avoid an excessively strong currency, the Swiss central bank is printing Swiss francs to buy foreign financial assets, and even so much, so that the central bank has the highest leveraged balance sheet among all central banks worldwide.

If I should mention a larger economy with the most undervalued exchange rate, then it is the United Kingdom with its pound sterling that has been sold-off since very long. But I hardly believe that the British politicians behind the Brexit chaos deliberately use it as a tool to weaken the pound to unnaturally low levels.

But back to Trump and the dollar. His reaction might also be linked to the currently relatively strong dollar, which is bothersome when the world trade is under pressure. Should the dollar rise another five pct., then I would expect comments from the US government arguing that the dollar has become too strong.

These kinds of comments will of course weaken the dollar in the short term, and it will be aimed as a verbal intervention in the foreign exchange market- which is also a type of currency manipulation.

China- Balance of trade: As exports rose unexpectedly, while imports fell less than forecast, China’s trade surplus soared to $45.05 billion in July 2019 from $27.5 billion in the same month a year earlier.

- Jul-18: $27.5 billion

- Aug-18: $26.3 billion

- Sep-18: $30.3 billion

- Oct-18: $33 billion

- Nov-18: $41.9 billion

- Dec-18: $56.8 billion

- Jan-19: $39.2 billion

- Feb-19: $3.4 billion

- Mar-19: $32.2 billion

- Apr-19: $13.7 billion

- May-19: $41.7 billion

- Jun-19: $51 billion

- Jul-18: $45.05 billion

Written by Peter Lundgreen.

Have you read?

# Global Passport Ranking, 2019.

# The World’s Top 100 Most Successful Unicorns, 2019.

# GDP Rankings Of The World’s Largest Economies, 2019.

# Most Expensive Countries In The World To Live In, 2019.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz