Strategy: How to cope with the uncertainties of tomorrow’s new world

When the dust of the COVID-19 crisis finally starts to settle, we will face a new environment that may vary dramatically from what we know today in terms of consumer behaviors, business models and the respective roles of the state and private sector. The longer and deeper the crisis, the more likely that profound changes will define tomorrow’s new world.

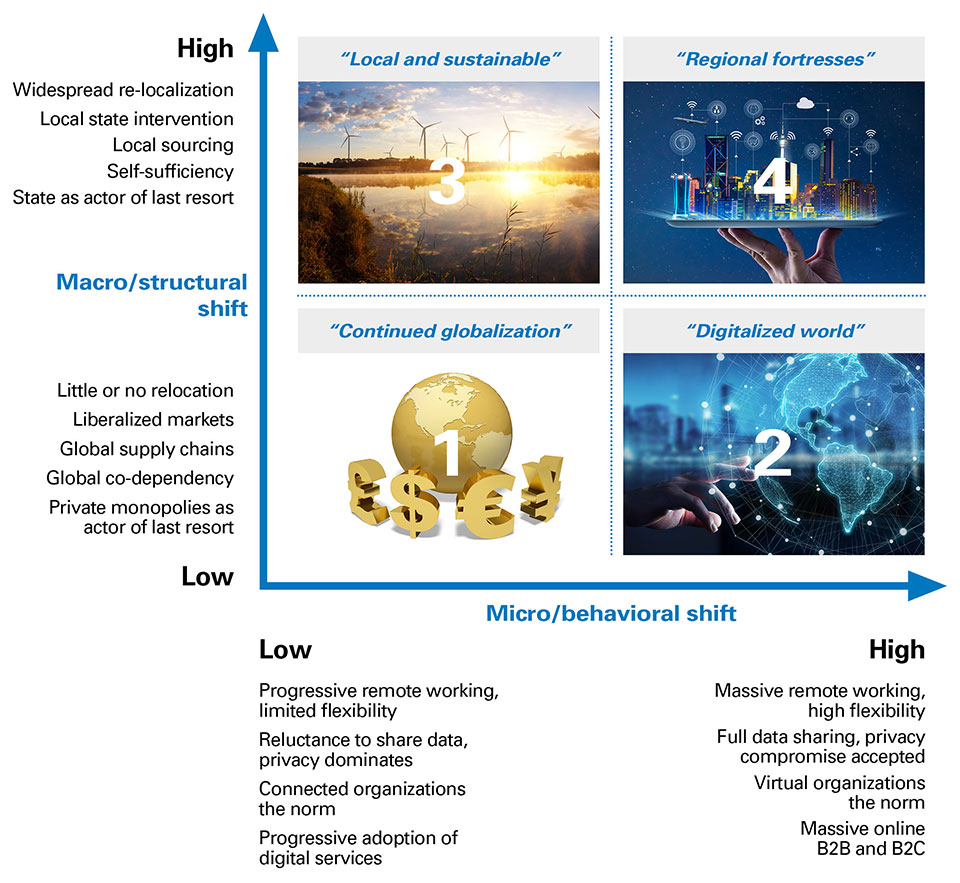

The next chapter of global commerce will be shaped by both highly probable trends (such as greater working from home and more e-commerce) and other high-impact trends whose potential development is much less certain. These trends çan be grouped into two dimensions:

- Macro/structural level: Trends relating to economic structural and policy shifts, characterized especially by states and large companies wanting to reduce their global interdependency risks.

- Micro/behavioral level: Trends relating to sustained behavioral shifts among citizens as both consumers and workers, resulting initially from their experiences of lockdown and social distancing.

(1) Macro/structural level: Will we see a structural shift towards relocalization?

As countries cautiously begin to lift restrictions on lockdown and movement across borders, governments are focusing intensely on measures to limit economic and social damage while continuing to control public health risks. Governments in many countries have already taken a huge stake in business through direct funding of furloughed employees. In the turmoil of the coming economic recession they may need to increase their economic involvement substantially and apply new policies and regulations that will change the open, global free-trade market dynamic.

In parallel, large international companies will also be looking to increase organizational robustness, potentially through the relocalization of their operations, to hedge against future major disruptions such as:

- Technological sovereignty: What will be the scope and extent of technological sovereignty shifts in terms of actual relocalization of production? What technologies and sectors will be covered, beyond the pharmaceutical and healthcare industries?

- State intervention: How far will governments keep their faith in global free markets to drive recovery, versus adopting ever-greater protectionist measures?

- Environmental economics: How will the economic downturn affect policies? Will governments compromise on global environmental standards out of economic necessity, or will the reality of climate change force them instead to compromise on short-term economic well-being?

- Operational robustness: Will companies only relocalize limited parts of their operations to hedge against future disruption, or will they aim to develop fully local supply chains as alternatives to current global ones?

(2) Micro/behavioral level: How disruptive and permanent will the behavioral shift be?

In the context of lockdowns and social distancing, our behavior as consumers has already changed in ways that were previously unimaginable. Companies have also already changed the way they do business in order to operate safely for employees and customers. The longer these measures last, the more likely the shift will become irreversible in some respects. The following aspects will be especially impactful for businesses:

- Accelerated digitalization: As lockdown measures are progressively relaxed, how much will people continue to accept and embrace digital channels, rather than meeting their needs for physical interaction?

- Local and “slow” life: To what extent will companies and citizens sustain the shift towards local living and working, and will environmental/wellbeing criteria become more significant in consumption and lifestyle choices?

- Data privacy: Will people ultimately accept less data privacy for public health and convenience/lifestyle reasons, or will new safeguards and restrictions need to be imposed by public authorities to reflect their concerns?

- Investment and entrepreneurship: To what extent will investors become more risk averse (by choice or regulation), rather than funding breakthroughs and fueling a new wave of entrepreneurial investment?

The new world – What are the scenarios?

The combination of these dimensions of uncertainty (the degree of macro/structural and micro/behavioral changes), both of which will be impacted by the length and depth of the crisis, will potentially produce very different market environments for businesses.

- Scenario #1 – Continued globalization

Rapid progress in eliminating the virus and a relatively fast economic recovery leads to a return to the key patterns of a globalized economy. Under this scenario, the key ingredients of the economy and markets would not drastically change, but private monopolies would become even more pronounced. - Scenario #2 – Digitalized world

A protracted recovery period or failure to find a full solution to the pandemic drives rapid acceleration of digitalization, leading to more permanent changes in the global economy. This scenario effectively continues the trend of the NYSE FANG+ Index, which has outperformed the market this year by up to 12 percent on average, compared to a double-digit drop for the S&P 500. As another example, digital-health funding has already grown by 50 percent in 2020 Q1 year on year, with $3.1B invested; major global digital private players would further accelerate their strong growth. - Scenario #3 – Local and sustainable

The combination of a deep recession, high state protectionism, and a public preference for “slower life” causes a reaction against further globalization and drives a focus on developing sustainable local communities. Some of the principles in this scenario can be found today in Sweden’s ReGen Villages. Similarly, incentivization of local sourcing and reducing reliance on the global economy is already planned by the Bank of Japan. - Scenario #4 – Regional fortresses

A protracted recovery period or prolonged failure to find a full solution to the virus drives not only acceleration of digitalization, but also the formation of regional clusters driven by greater state intervention and protectionism as governments look to increase resilience to global shocks. Investment led by cities and regional clusters, will focus on new breakthrough technologies and business models, driven by the necessity for radical change and redeployment.

What does this mean for strategy?

As the saying goes, “It is difficult to make predictions, especially about the future.” The range of potential scenarios shows that companies need to embed uncertainty into their strategic decision-making approaches. In working with hundreds of large companies over the last 20 years, we have found that there is a proven methodology for achieving this.

Strategic levers – How to shape scenarios and their outcomes in our favor? First, companies need to leverage the power they possess to influence and shape scenarios in ways that are favorable to them.

No-regret moves – How to leverage the certainties? While many uncertainties exist, some things will be fairly certain in all scenarios. For instance, there will be an increase in workplace virtualization along with a significant global economic downturn. Any strategy will need to address these issues.

Strategic options – How to act boldly when opportunities arise? This involves identifying strategic moves with limited upfront investment but massive potential for rapid upscaling. By projecting the company into the most likely scenarios, clear strategic directions can be defined and the company’s future business and operating models shaped.

Strategic insurance – How to protect against unfavorable scenarios unfolding? One of the aspects often poorly addressed in strategic planning is strategic “insurance.” This approach allows companies to embrace the complexity related to uncertainties, providing clear decision frameworks and linking decision points to events that will trigger the (progressive) unfolding of one or more scenarios. In periods of high uncertainty such as the current crisis, the best-prepared first movers can build substantial competitive advantage, either through minimizing exposure to losses or by capturing the lion’s share of new opportunities.

Insight for the executive

The crisis we are facing is certainly deeper than most of us have seen in our lifetimes. However, despite the hardship and tragedy, there will ultimately be new opportunities, as well as challenges. To prepare for these, leaders need to maintain a broad perspective:

- Look beyond the short-term crisis and start preparing for the new world as structural and behavioral changes begin to significantly reshape the business environment.

- Do not only focus on the most obvious trends, but also assess the major areas of uncertainty and their implications.

- Use the full breadth of strategic plays. Most executives tend to focus on developing strategic options, but they overlook the three other strategic plays: shaping the scenarios, making swift no-regret moves and, especially, developing strategic insurance to mitigate unwanted scenarios.

- Do not try to over-simplify complexity related to uncertainties, but instead embrace it and embed uncertainty management into decision-making:

– Develop capabilities for scenario development and monitoring of trigger events.

– Adjust strategic and operational planning and related governance mechanisms.

– Shape the culture of the organization to help employees deal with uncertainty.

– Strengthen the “ambidextrous” capability of the organization to encourage creativity and responsiveness to change, as well as efficiency and productivity.

– Adapt partner and ecosystem management in terms of both communication around uncertainties and redeployment of capabilities.

– Leverage the potential of digital technologies to improve intelligence and increase agility and responsiveness.

The future is full of complexity and uncertainty. Companies need to embrace this and – underpinned by a clear vision and set of values – be prepared to make radical changes to their products, services and processes as they go forward.

Commentary by Gregory Pankert. Here’s what you’ve missed?

World’s Most Forested Countries.

World’s Most Fashionable Countries.

World’s Best Countries For Business Expats.

Luxury Superyacht charter in Greece and the Greek Islands.

Crewed MegaYacht charter in Greece and the Greek Islands.

Best Countries For Business In Europe For Non-European Investors.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz