India’s Bond Market Hit By COVID-19

The lockdown of India has scared the country’s investors so much, that the central bank now has to step in to stabilize some mutual investment funds, and thus, the Indian bond market.

As a consequence of the Covid-19 crisis and the financial market turmoil, investors around the world have sold-off their credit bond holdings for extremely significant sums. This applies to corporate bonds as well as to emerging markets debt. Losses during this sell-off have been proportionally larger compared to other crises lead sell-offs, if one measures the decline in relation to the drop in the stock markets. Though in India, the situation in the bond market has lately developed even more dramatically.

The lockdown of India made the domestic Indian investors nervous, which is very understandable since the same was manifested globally. For the same reason, everything was sold down in the Indian financial market, which also meant that investors withdrew money from mutual investment funds. The Indian bond market is liquid when there are sufficient investors and the risk appetite is ample, but conversely, it is a classic example of a market that becomes illiquid when investors get nervous and disappear.

This has seriously hit the Indian mutual funds investing in domestic issued bonds, including corporate bonds. The crisis for the mutual funds exploded when global asset management company Franklin Templeton on the 24th April announced that it was closing its six mutual Indian-based funds investing in Indian bonds on behalf of domestic Indian investors.

The reason was that the redemption from investors was too large, therefore the funds could not manage to unwind the bond holdings in the illiquid market. Now, the six mutual funds are closed, and must be wound-up completely, depending on the market conditions. The consequence, at best, is that investors will only have to wait for a few months to get their money back, which is a neat sum, after all. In total for the six mutual funds, the frozen amount is between US $3 and US $3.4 billion, or the equivalent of one third of the total public spending on the health sector in India this year.

The critical issue concerning the closure of the mentioned mutual funds is that it is not the end of the disaster. On the contrary, the closure contributes to an escalation of the crisis in the Indian bond market, as other mutual funds are equally under pressure. It has led to the unusual rescue operation of the Indian central bank, The Reserve Bank of India, providing 500 billion rupees (US $ 6.6 billion) in liquidity to the mutual funds. This is done via the commercial banks, where the mutual funds can access liquidity by using repo transactions (securities lending).

The Indian bond market has crashed in the Covid-19 crisis, but my straightforward assessment is that the entire Indian financial system is not just suddenly hit by an unforeseen crisis. The problem has basically grown the past decades, with the origin found in the state-controlled banks that primarily managed to get bad loans on the books, and not off the books. This has also forced the government to allocate a part of the fiscal spending to strengthen the same banks’ equity. However, without the banks being mopped-up, neither the operation of the banks nor that the banks’ balance sheets were restored without the unhealthy loans.

The lack of reform action, at some point, strikes back in the economy like how a boomerang returns. But India’s loan and capital markets were, during a period, helped by micro-loan funds, and later the alternative lending market grew. As such, it was not a grey loan market, but simply alternative financing sources to the banks, like for example car financing. These alternative financing institutions specialize in many directions with their lending activities, and this part of the financial sector performed particularly well during the optimistic period after Prime Minister Modi was elected the first time. The challenge following was that some of the finance companies were not solvent enough to withstand just minor headwinds. A heavy casualty was when the company “Infrastructure Leasing & Financial Services” threw the towel in the ring in August 2018 with a debt of US $ 12.6 billion.

It might have been a year and a half ago, though it was not an isolated history, and I argue that India’s credit market has never completely absorbed that shock. Subsequently, the credit market since then, has not experienced the same risk appetite among investors, which also has contributed to the growing scepticism and confidence in India’s economy. The latest happening in India’s beaten credit market was just back in March when Yes-Bank was awfully close to collapse, and these kinds of events naturally keep the nervousness going.

Obviously, these events among the financial institutions cannot be dedicated to the Covid-19 virus, but the crisis most likely drove pre-Covid-19 developments further towards highs or lows. This also applies to countries that are in a macroeconomic weak condition, as they have poorer chances to get through the Covid-19 crisis in a sensible way- here, the crisis in India’s bond market is a rather violent example of an intensified negative trend.

Though bad news rarely comes alone, especially in the financial markets, because many developments are interconnected and form a chain reaction. The credit rating agencies also follow what is happening, and many companies have already been downgraded. But so far, only a limited number of countries have been affected by credit rating downgrades. Maybe because the rating agencies are awaiting to observe the length of the crisis and the size of the aid packages, including those that may cross national borders.

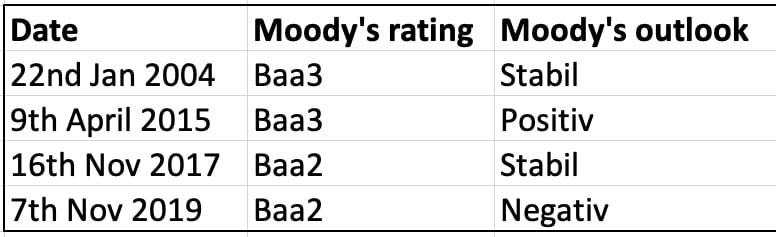

I noted that Standard & Poor’s did not change the rating of Italy but so did Moody’s on the 29th April, meaning at Moody’s, the junk bond status is now just one nudge away for Italy. As the graphic shows, India is just two steps away from the uncomfortable situation, and I think it’s only a matter of time before Moody’s downgrades India further, as the outlook from last November is already negative. However, it is unlikely to create greater uncertainty in the Indian financial market, as the downgrade should not surprise, but the timing would be poor.

Written by Peter Lundgreen. Have you read?

# Best CEOs In The World: Most Influential Chief Executives

# These are the World’s most traffic-congested cities, 2020

# Ranking of the World’s most (and least) stressed cities with the most burned-out employees, 2020

# Ranking of the World’s most economically influential cities, 2020

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz