E.S.G. 2020 has arrived with a Bang!! Here’s what you need to know

Davos, Switzerland – World Braces for Climate Doom.

On January 21st, 2020, 3000 attendees including top leaders from governments, institutions, and industries from around the world gathered at the 50th World Economic Forum(WEF) in Davos, Switzerland to share and influence the trajectory of humankind. Once again as they have for the last 5 decades these leaders came ready to tackle this year’s topic: Stakeholders for a Cohesive and Sustainable World. And this time the lion’s roar centerstage was climate change, including Sustainable Development Goals (SDGs) inclusive within a broader spectrum framework known as ESG (Environment, Social, and Governance). Like the World Economic Forum itself, ESG is essentially an amalgamated group of key stakeholder issues that demand remediation, especially given the impact human endeavors are having on the planet and each other up to now. So, let’s take a closer look at what’s working, and what isn’t.

ESG as a concept is not new. In theory it stems as far back as human ethical behavior goes. One could argue that among the very first notable rules governing good Social behaviors are ages old. The idea was to teach us how to live together and prosper without destroying ourselves. The basic rules of Social life. The Ten Commandments were among the first proliferated as such I could argue, mostly S and G, but still an early endeavor to curb the temptation of human vice, including sex, alcohol, gambling and usury among others. But a lot has changed. While ‘Western’ religions of old warned that to indulge in these vices earned you a one-way ticket to the gates of Hades, today’s regulatory sanctions out of Washington and elsewhere have a bit less bite, and certainly not the gruesome feared spectacle of life in the underworld just yet. But that too is changing as more stakeholders demand accountability and measurement progress at Davos.

The latest in the race to Measure ESG

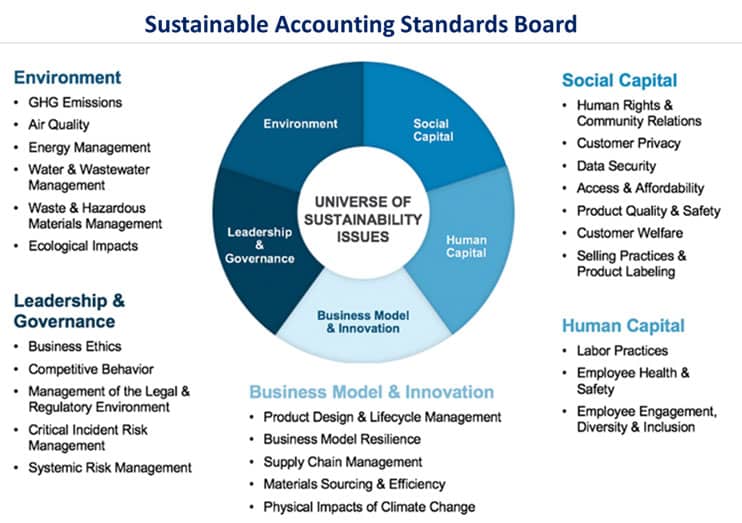

Unlike ‘Scoring ESG’ companies, discussed later, what and how to ‘Measure ESG’ comes first. And to date like Scoring ESG there is no standardized agreement across the board to agree on. Still, despite these challenges organizations are trying to pull together a framework. The International Integrated Reporting Council (IIRC), the Global Reporting Initiative (GRI) and the Task Force for Climate Related Disclosure (TCFD) are each working to help enterprises identify and measure specific accounts, but they aren’t working closely enough together. Enter the US-based Sustainability Accounting Standards Board (SASB). The SASB is a non-profit adjunct to the Financial Accounting Standards Board which in this case serves as a provider of materially significant measurable and reportable ESG category “standards” for 77 industries to 3rd party ESG scorers like State Street Global Advisors and MCSI Research.

But while the SASB makes headway to identify and standardize ESG impact metrics and disclosure standards across the board, the majority of the calls for action to-date are driven by climate change, aka the E in Environmental issues as notably exemplified by rising waters in Florida, poor air quality in China, and the catastrophic fires raging in Australia to name a few. These among others altogether, perpetuated by news and Social Media reporting over the last few years are now the central investment thesis for a growing list of climate and sustainability-minded investors looking to identify and differentiate ESG-signatory from non ESG-signatory companies. But despite all the pressure and ambitious talk the pace of adoption is horrendously too slow for climate-change activists like 17yr-old Swedish climate-change activist and Davos speaker Greta Thunberg who lambasted:

“From a sustainability perspective the Right, Left and Center (political landscapes) have all failed… or worse empty words that give the impression action is being taken.”

Voices like Thunberg’s magnify the urgency to act, not on which SDGs should be met, but rather over what period of time. Time being the most important component of any key decision or choice at hand. But despite the urgent need to take action by all stakeholders to stem the tide from climate change aka global warming, even the World Economic Forum’s own request that each attendee at Davos this year commit to becoming a net-zero carbon emitter by 2050 is way too late for the likes of Ms. Thunberg, who is calling for the end to fossil fuel emissions now. Adding lift to the growing warning signs CEO Larry Fink of investment firm BlackRock declared in an open letter to all CEOs recently that his firm has committed to dis-invest from thermal coal producers by the end of this year. BlackRock manages more than $7 trillion in assets for clients which puts Fink’s statement noticeably on the front page of financial news sites across the globe, marking a significant milestone to the climate impact of E in ESG at Davos.

So then what’s the hold up? Why can’t governments and companies all agree on ESG standards & goals?

The Devils in the Scoring

A few firms have undertaken the enormous task to measure and score ESG impacts at the company level. Some look at Risk, some look at actual spending and savings if available. But all are trying to make an effort to quantify that which can be measured effectively at this stage. Three good examples of monitors and ESG data tracking scorers are:

- State Street global – uses SASB framework to create a Responsibility (r)- factor for each company analyzed, and uses the r-factor as a score-measure of ESG engagement vs exposure.

- MSCI ESG Research – (Morgan Stanley Capital International) calculates a risk profile scale spread from AAA (ESG Leader) to CCC (ESG Laggard). This score card helps investors understand where a particular company is on the spectrum.

- Harvard – Impact Weighted Accounts – new accounting measurements and reporting standards in development to translate all ESG categories into measurable currency that can consistently, across all industries, measure the ESG accounting impact on a company’s financial statements.

For each of these notable data collectors and scoring companies there are many more looking to cash in on the ESG (Measurement & Disclose) bandwagon. High Scoring ESG companies tend to have greater flexibility in overall macro industry risks like less exposure to higher future energy costs, human capital, and waste. At the ground level early reports indicate companies with high ESG scores have less staff turnover, a lower cost of capital, and tend to save more money via operating efficiencies, reduced input/output waste and reduced overhead costs. By contrast lower Scoring ESG companies may (for a time) operate more profitably as measured by their quarterly EPS, but in the next decade ahead the 2020s may see them fall significantly behind the cost curve as compared to their higher ESG scoring competitors, and potentially force them to close up shop, or merge with a higher-scoring ESG player.

Lastly, how to measure the financial impact of ESG issues on a company’s financial performance. Currently only two methods are gaining traction, one is the R-Factor (Responsibility Factor) created by State Street Global Advisors for fund sponsors like Bloomberg ESG indices. It uses the SASB framework of ESG categories per industry and weights each company subjectively on how it responds to the SASB outlined issues. The other is Harvard’s Impact-Weighted Accounts Initiative (IWAI). The approach here is to standardize an accounting process that adds an impact measure of risk to each company’s accounting system to produce a second set of books that reflects the monetized impact of ESG efforts, rather than an ESG scoring method. It all seems to be coming together, right?

But there are Skeptics

Because the troubles with ESG measuring and monitoring is getting agreement on such things. Everyone is working on the E-Environment because it’s frontpage news, and more straightforward. As it stands now, however, given the several dispersed ESG-related groups and the breath of the ESG landscape for what and how to measure the financial impact on a particular company over another is still considered the wild west frontier out there. Measuring S & G issues is far from identifying a coherent path forward because Social and Governance issues are less directly connected to a company’s financial performance, and thus by no means a slam dunk for CEOs to implement. So why not just lay low? Berkshire Hathaway CEO Warren Buffett has remained on the ESG sidelines for example, averting any material commitment thus far. Perhaps because heavy industry and manufacturing companies in general have the deck stacked against them at the outset, especially to reduce their carbon footprint, a far harder effort at a large refinery like Chevron burning off waste fumes than at a large retailer like Walmart, re-stocking shelves. This ESG industry impact gap and the underlying mismatch of ESG data collected, measured, and disclosed is what mostly troubles adopters across the globe at Davos.

In fact, in its ESG Guidelines report BlackRock for example identifies (3) key challenges ESG data collectors & monitors face including:

- Reliance on self-reported data to questionnaires and industry bodies. Company disclosed information is sparse and disparate across industries and regions. The reliance on self-reported data to private aggregators allows companies to disclose favorable data or opt out completely. Furthermore, there is no accountability or overarching governing body ensuring accuracy of reported information.

- Inconsistent collection, management, and distribution of ESG data. ESG data is collected, managed, and dispersed by multiple data providers and is not easily accessible to all investors in a standard form. This creates a challenge for investment professionals attempting to systematically compare companies across industries and regions, either in real time or over historical time periods.

- Disparate approaches to measure and report ESG information to investors. Due to different methodologies and disclosures, index providers and asset managers report ESG considerations inconsistently, creating challenges for investors seeking to compare ESG investment strategies, objectives and outcomes consistently.

This disconnect between investors’ desires for reliable ESG disclosures and how to do it has corporate boardrooms on edge and a little uneasy. In fact, according to a recent PwC Annual Corporate Directors Survey roughly 1 in 3 corporate board directors think institutional investors should devote less attention to some ESG issues, like Board Ethnic, Gender & Racial Diversity, Environmental, and Social & Sustainability Issues. Directors argue they are already handling ESG issues as components of Risk Management, Business Continuity or IT Security plans. Hence many enterprises feel they already have many of these ESG issues under control, and don’t need to extend their transparency for any good reason. And there’s the rub. On the one hand investors want to see ESG metrics far more than corporate executives want to show them because corporates are concerned that ESG measures could negatively impact the value of their capital stock in the public markets. Thus, begging the age-old question; ‘why introduce another layer of competitive performance metrics unless you’re forced to’? Still however, CEOs are eager to stay ahead of the growing populist ESG movement and to engage the sustainability culture sweeping across the globe.

So. What should CEOs do now?

The answer depends on your appetite for short termism vs long termism. And that’s the message from Davos, BlackRock and the new Business Roundtable announcement last August. Wherein the leaders of nearly 200 US-based corporations pledged to include their “stakeholders” as well as their “stockholders” in their profit motives going forward.

Nonetheless, if ESG is a new concept to you. Yikes! You’re behind the curve. So start with an ESG Assessment. Don’t sit on your hands and wait for it to go away. It won’t. If you wait around, eventually investment dollars will dry up as investment funds (public and private) add layers of benchmark ESG rankings & scores to compare companies to one another. Fall too far behind (public or private company) and it will catch up to you at some point, and when it does there will be few places to hide anymore. So Step one: review your industry guidelines in the Sustainability Accounting Standards Board (SASB).

Step two, hire a Chief ESG Officer to create and champion an ESG effort and roll-out plan sending a strong message to show the public and all stakeholders of your elevated efforts to embrace ESG issues, and to concentrate your metrics-tracking and disclosure/reporting functions into a single head. The new C-ESG executive can report directly to the CFO’s office or the Board of Directors to ensure proper accountability and disclosure. The idea is to provide investors with more transparency into your progress on ESG issues asap.

Q: What will ESG Cost?

A: It’s all about the ‘Long Term Value Creation Story’

At the company level ESG implementation costs obviously vary widely from tens of thousands for Solar installs, to tens of millions to remediate a coal-burning power plant. But cost is relative to time. Pay now or pay later. When is later? According to climate change advocates and activists of the same mind costs are in the trillions so the time is now, while there’s still a good story to tell. In support, former IBM CEO Sam Palmisano said recently that ESG has to be part of your brand, “not just a timely project initiative.” The value creation story argument is that in the long run value is increased as consumers and stakeholders only patronize brands synonymous with ESG, and won’t patronize non-ESG firms. And over time those left behind will suffer a huge catch-up investment requirement potentially causing a significant valuation-decline from their industry peers. Can you measure that? It won’t be easy or straightforward. Best advice is simply to get started down the path and learn from others along the way.

Walmart Case Study

Safe to say that recent concerns about abrupt climate change issues largely focus on contemporary pressures to reduce greenhouse gases by lowering a company’s fossil fuel energy use aka carbon footprint. For example, a transportation trucking firm should buy all electric vehicles, a large manufacturer and heavy coal consumer should add more solar/wind resources, and food industry packaging providers should recycle their own packaging, and pledge to clean up the growing plastic waste problem, etc. And there is a good story to be told there. But ESG goes far further, into the future, and offers far greater rewards to ESG adopters who can gain the public trust telling a compelling ESG-friendly story.

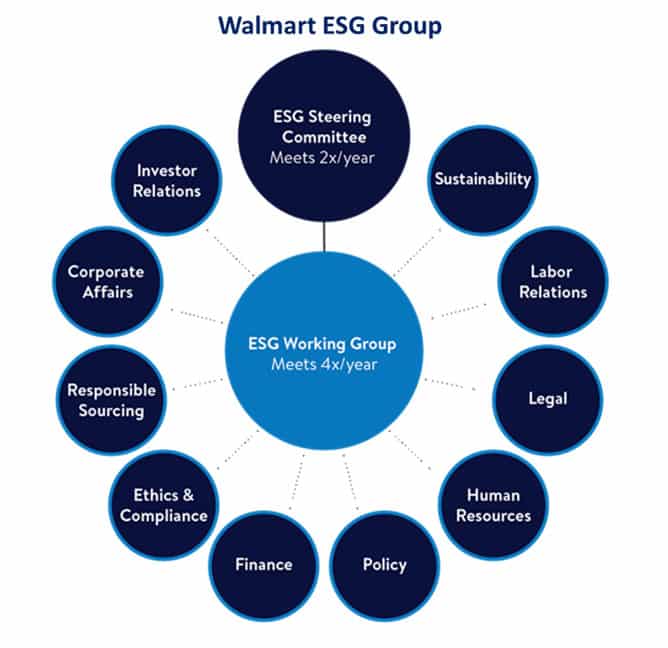

Walmart is a good example of taking ESG seriously. The company has a CSO (Chief Sustainability Officer) who manages a Working Group (as shown) the hub of several corporatewide ESG initiatives that impact many corporate functions across their entire enterprise ecosystem, and externally as well across their stakeholder landscape from supplier sustainability mandates to power consumption. And given its $500 Billion in global annual revenues and 2.2 Million employees (1.5M in the U.S.) implementing an institution-wide ESG program has a corresponding widespread network influencer effect. In their 2019 ESG Report Walmart cites the importance it gives to ESG issues:

[ESG practices can enhance customer trust, catalyze new product lines, increase productivity, reduce costs and secure future supply, while simultaneously improving livelihoods, advancing economic mobility and opportunity, reducing emissions and waste, and restoring natural capital.]—

Now that’s a mouthful. The company not only clearly recognizes and embraces its leadership role to set a good example for other companies to follow, but also actually moves the needle on specific measures for employees, customers, suppliers and all stakeholders, which by order of magnitude includes millions of people across the globe. Being a first mover, or early adopter incorporating ESG into the fabric or the business whose growth strategy embraces rather than side-steps ESG is likely a successful approach.

Are ESG-embracing Companies like Walmart “worth” more?

Is Walmart stock worth more as a direct measure of their ESG programs? It’s too early to tell. But probably not. Nor should it be, until Wall Street and Main Street agree on the “why.” Walmart itself cites this dis-connection among their challenges when addressing stock analysts for example who question if short term ESG costs will pay off in a long-term strategy, especially as it relates to stockholders’ earnings expectations. And this gap between cost of adopting ESG broadly and earnings performance may keep many CEOs on the sidelines until they are either forced to comply or appropriately incentivized. But the writing is still on the wall. ESG is here. Deal with it!

From a CEO Point of View

Is my company worth more if I embrace ESG? This is a tough question to say yes to. Worth more can mean higher profits, or multiple expansion for public companies. Currently ESG engagement remains an important cost center, not a profit center. And until that changes higher costs drive earnings down in the short term. But as mentioned ESG is not a short-term investment play, hence the multiple expansion option anticipating higher earnings down the line is more likely a reason for any valuation premium. How far down the line? Unknown. Each industry is unique and each CEO’s approach is different in timing and commitment. But the argument is that one day soon access to funds, and the cost of capital will be higher for non-ESG companies, especially as more ESG-targeted investment funds and managers assert their “sustainable investment” mandates.

From an Investment Fund Manager point of view

According to Jim Rossman Lazard head of shareholder advisory, CEOs who avoid ESG do so at their own peril. In an interview on January 17th, 2020 on Bloomberg tv Rossman said “I think the movement of ESG from the periphery to the center stage over the last two years is probably as significant as the rise of activism. I think it’s going to fundamentally disrupt asset management and the way not only passive managers, but also active managers think about prioritizing ESG in their Investments… yet another agenda the board and the management team have to take into account…”

Meanwhile, Brian Deese, Head of Sustainable Investment for BlackRock, said in an interview on PBS Newshour that same day January 17th, 2020 regarding the increase in climate change activity:

“these risks are not fully appreciated in financial markets and so we believe we are going to see a massive re-allocation of capital…”

Once again timing is everything. And nevertheless, as it stands ESG-investment funds are a nascent piece of the overall investment pool available to companies. Today ESG funds still do not outperform non-ESG investment funds, however, some say that will change. As ESG-compliant companies begin to take investment centerstage, they will eventually have access to cheaper investment capital and thus potentially lock-out or restrict capital to serial polluters for instance. But to be fair, ESG has a bright future and is likely to compel most every company to show some level of engagement and commitment starting soon.

At the end of the day until a global comparative set of consistently measurable and reportable ESG financial metrics becomes the rule rather than the discretionary exception for public market valuation, it’s still Corporate Earnings aka “the mother’s milk of the stock market” that will drive stock prices up or down for some time ahead. For now, however, CEOs who avoid ESG do so at their own peril. Because the message is clear, get started now on your ESG planning, or face the consequences later. And that is the real take-away from Davos, Switzerland this year.

Make sense?

Have you read?

Workplace Burnout: Cities Around The World With The Most And Least Stressed Out Employees, 2020.

Which countries are most and least prepared to deal with an epidemic or pandemic like the Coronavirus?

World’s Best (And Worst) Countries For Older People To Live In, 2020.

Countries With The Highest Life Expectancy In The World.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz