ECB– A lost central bank

During the past two weeks, a storm has hit the European Central Bank (ECB). The minutes from the Governing Council meeting show that there is a growing dispute about the monetary policy set by one of the world’s most important central banks.

Former and very high-ranking members of the Governing Council in a public memorandum, expressed their dissatisfaction with the renewed use of quantitative easing (QE).

The latest development in the drama is a pretty long response from the prior president of the ECB, Mr. Jean-Claude Trichet. The whole thing can be year-old disputes that have finally surfaced, though it is an unusual debate surrounding a central bank, which will get attention from the financial markets.

Since the ECB joined the (QE) group of central banks, I have been critical of this choice, as I argue that the move creates more problems than what QE solves in Europe.

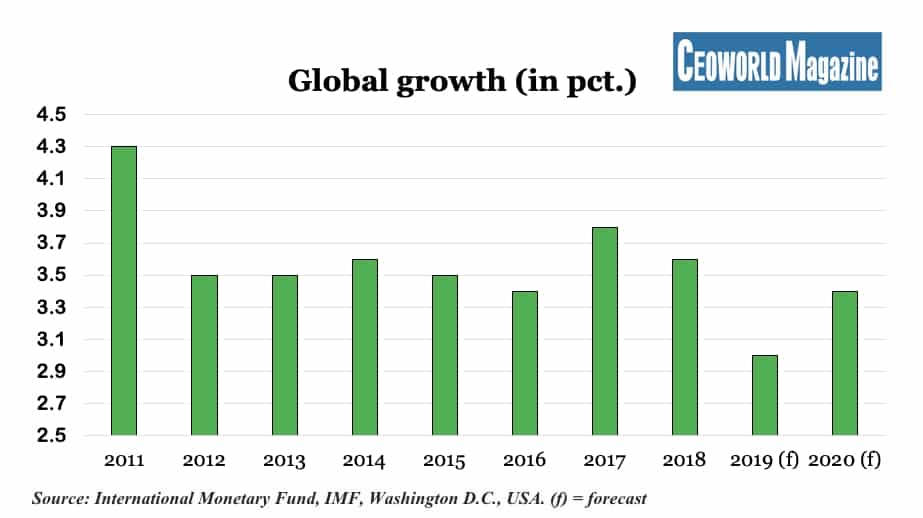

As the former ECB president Trichet very precisely expressed it in his comments, economic growth needs to be supported by political initiatives and reforms. A central bank cannot rescue economic growth via monetary policy. As graphic one shows, the global growth is in a steep dive, where central banks can’t rescue such a development.

In my view, it was a huge mistake by the ECB to show a willingness to adopt the role of being the savior of economic growth in the Eurozone.

The result is that the ECB is trapped or lost in a situation with an economy that is moving towards a low-growth situation, the central bank runs an extreme monetary policy and is facing an emerging internal fight about the monetary policy direction– this is close to a disastrous situation for one of the world’s leading central banks, and of course, it should worry investors about the long-term prospects for the Eurozone.

The ECB almost simply hopes that US and China will find some form of solution, and that a Brexit deal is reached. If these two heavy issues are solved, the whole world would feel new optimism, and with no doubt, help economic growth for a period into next year.

This will simply remove some stress from the ECB, because the central bank is too close to the economic growth story. Though despite the possible relief, I still argue that the very low growth reality will return.

Another stress factor might be the assignment for the organization. It is understandable if the ECB feels challenged by its assignment about keeping inflation close to, but below, two pct. in the current low inflation environment.

This target is hardly possible to achieve in an open economy that is part of a globalized world with the excess labor force, energy, and production capacity– where should the inflation origin from?

Further, the inflation target is barely compatible with a Eurozone GDP growth that is more than soft, currently at 1,2 pct., with outspoken downside risk.

Under such economic circumstances, I find it natural to loosen-up the two pct. Inflation target. What’s important, though, is that a central bank remains independent, and keeps its focus on the monetary policy.

Actions like using QE, I regard as a very extreme intervention in the financial markets. An intervention only works if a financial market, for some reason, has clearly come out of order. This is not the case in the Eurozone, as it is the economy that has derailed, and some may argue that QE helps the economy get back on track, though I don’t support this view.

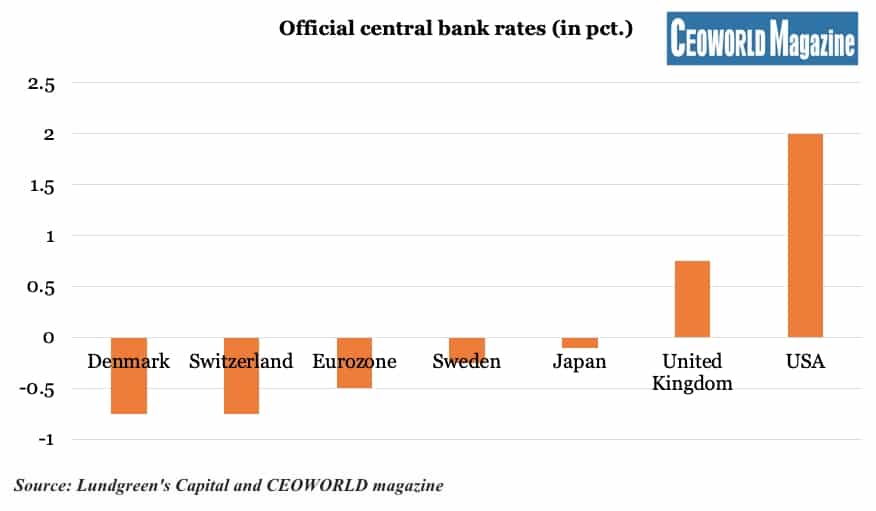

On the contrary, I have never seen a good argument from a central banker explaining why the interest rates should be below the inflation rate, which has for long been around one pct. in the Eurozone. This means that extreme monetary policy leads to negative real interest rates, which is now a European-wide challenge due to negative central bank rates (graphic two).

This favors borrowers like the Italian government, but punishes, for example, European pension savers, as they need to save even more and spend less, due to the negative real interest rates. It has gone so far because the ECB involved itself in saving the economy instead of focusing on conducting an adequate monetary policy.

Looking into the new upcoming presidentship of the ECB, I simply see more of the same to come, which underscores the risk of ECB getting caught in a trap, or lost, which should keep investors alert.

One might say that the ECB continues to do what they have been doing for a long time, and so it is. But the world changes all the time, and therefore, “doing the same” may one day conflict with “changes”. This is the nature of the financial markets, and “changes” always win because it fundamentally represents the ever-ongoing changes in the economy.

“Change” could mean that even the ECB would one day have to accept that the Euro/Eurozone did not work out as expected. To revitalize the economic progress for the Eurozone again, my best long-term view is that the Euro must be separated in a North and South Euro. The northern will naturally be the strongest, but it would pave the way to move growth and competitiveness to the southern part of the Eurozone.

It would make a lot of noise and might not be what investors expect from “The Roaring Twenties”, though I do not see it as an impossible outcome due to the ongoing economic challenges and standstill in the Eurozone. As the ECB is less occupied with inflation anyway, then they might have time to prove that a central bank can run two currencies– it’s time for alternative thinking.

Graphic one: Global GDP growth (in pct.)

- 2011: 4.3%

- 2012: 3.5%

- 2013: 3.5%

- 2014: 3.6%

- 2015: 3.5%

- 2016: 3.4%

- 2017: 3.8%

- 2018: 3.6%

- 2019 (f): 3%

- 2020 (f): 3.4%

Source: International Monetary Fund, IMF, Washington D.C., USA. (f) = forecast.

Graphic two: Official central bank rates (in pct.)

- Denmark: -0.75%

- Switzerland: -0.75%

- Eurozone: -0.5%

- Sweden: -0.25%

- Japan: -0.1%

- United Kingdom: 0.75%

- United States: 2.0%

Have you read?

Ranked: The Richest American Families In Each U.S. State, 2019.

Richest Sports Team Owners In The United States For 2019.

Ranked: The World’s 50 Best Cities For Street Food-Obsessed Travellers, 2019.

Who are the top 50 richest people in Singapore, 2019?

Top MBA Colleges In Europe For International Business, 2019.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz