How to retire on 100k a year through property

How to retire on $100,000 per year from property is a dream that many people have, or would like to have if they were to believe it to be possible. It certainly is possible, not for everyone of course. To determine if it may be possible there are some basics an investor must consider and understand.

The investor needs to have an assessment undertaken on their current situation, including their assets, liabilities, income, living expenses, surplus income each month, goals, your age and years to retirement, risk appetite and risk profile, using a property advisor. This should be done in conjunction with their borrowing capacity being determined, preferably using a mortgage broker to compare different lenders borrowing capacity calculators in order to maximise what can be borrowed.

The goal the investor has is very important, without an income goal, there is nothing to aim for and there would be less motivation given there is no clarity as to the end desired outcome nor whether it is realistic. If it can be determined that a desired outcome is realistic the investor would less likely give up on the dream, but if the investor considers their dream a pipe dream, they often may not work as hard to try to achieve it. Once a clear income goal is ascertained, we can then work backwards to work on a strategy focused on achieving the goal.

These fundamental elements serve to form the foundation for a tailored plan. I believe it’s crucial that an investor purchases all of their properties so that the properties compliment and correlate to their current circumstances, borrowing capacity, living expenses, available surplus income, risk appetite and profile as well as their future income goal, and of course any known change to their circumstances. I specify having an “income” goal, rather than just a goal like having 10 properties. In retirement it doesn’t matter how many properties someone has, what actually really matters is the income someone has to live off. The number or required properties should correlate with the desired income, as well as of course correlating with their lifestyle. No one should put themselves into a position of risking being a slave to their debt.

This example would be familiar to many Australians at a similar age.

Laura and Matteo are wanting to invest in property and their goal was to earn $100,000 p.a. Based on their age and therefore the necessary length of the plan, and their goal, it was determined that 4 properties is all that would be required to achieve their goal.

Matteo and Laura are married and are, both aged 45, they have two children, aged 16 and 10. Matteo earns an income of $100,000 p.a. Laura earns an income of $50,000 p.a. Their living expenses are $78,000 p.a. and this is important, as this will impact on their borrowing capacity. It will also determine the amount of spare income they have each week to afford to make up any short fall associated with the cost of the loans they apply for, after factoring in rental income, other property holding costs such as rates, insurance, any owners’ corporation, etc, and the repayments on the loans.

Their principal place of residence is valued at $900,000 with a mortgage of $300,000, and an interest rate of 4.5% p.a., with a 15-year loan term remaining on the property.

They have an offset account of $100,000, which means they are only paying interest on $200,000 and principle of course is still paid on $300,000.

Their goal is to both retire at age 65, so they can travel, and spend time with their grandkids, which they hope to have by then.

Their plan consists of an acquisition phase over which the four properties are purchased.

Strategy:

Property 1:

In year one, the couple purchase their first property. The strategy for Investment Property 1 is higher yield, the purchase price is $550,000 plus purchase costs of $35,000. They establish a five-year interest-only loan for $585,000 at a rate of 5% p.a. (note: it is 100% financed, with part of the loan (80%) secured against the investment property, and part (20%) against the principle place of residence).

The rental income rate (yield) is 5.5% p.a. and capital growth let’s be very conservative and say 3.5% p.a., with ongoing deductible expenses of 1% p.a.

Property 2:

In year two, the couple purchase their second property, the strategy is capital growth. The purchase price is $600,000 with purchase costs of $37,500.

They establish five-year interest-only loan for $637,500 at a rate of 5% p.a. (note: it is 100% financed, with part of the loan against the investment property, and part against the principle place of residence). The rental Income rate (yield) is 3.5% p.a. and capital growth of 5.5% p.a. Ongoing deductible expenses of 1% p.a.

In between buying the second and third property, Matteo and Laura accumulate savings in their offset account.

Property 3:

In Year Five, the couple purchase their third property. This has a higher yield strategy, purchased for $700,000 with purchase costs of $44,000.

They establish a five-year interest-only loan for $744,000 at a rate of 5% p.a. (note: it is 100% financed, with part of the loan against the investment property, and part against the principle place of residence). The rental income yield is 5.5% p.a. and capital growth of 3.5% p.a. Ongoing deductible expenses of 1% p.a.

Property 4:

In Year Six, the couple purchase their fourth property, purchased for $750,000 with purchase costs of $47,000. They establish a five-year interest-only loan for $797,000 at a rate of 5% p.a. (note again: it is 100% financed, with part of the loan against the investment property, and part against the principle place of residence). The rental income yield is 3.5% p.a. and capital growth of 5.5% p.a. Ongoing deductible expenses of 1% p.a.

When each interest-only loan expires after five years, the loan is restructured as a thirty-year principal and interest loan.

Once their home loan is fully paid off or their offset account reaches a balance of $300,000 (offsetting their $300,000 mortgage) cash flow freed up from not having to make repayments on the $300,000 is used to make additional repayments on the investment debt.

Upon Retirement at Age 65:

They sell Investment Property 4 and use the net proceeds (after accounting for sales costs of 2%) and capital gains tax, to repay debt. They direct any surplus cash flow to further reducing debt and they direct any capital gains to the repayment of debt.

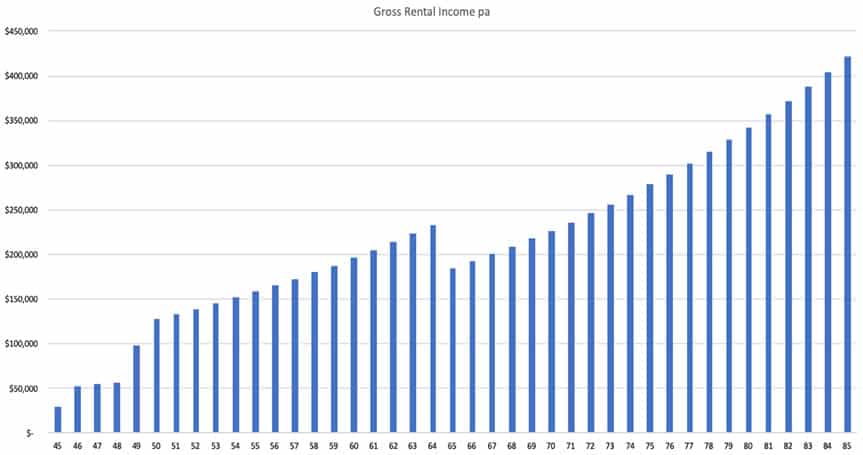

The Cash Flow Outcome Provides sufficient cash flow to meet all property holding and living expenses

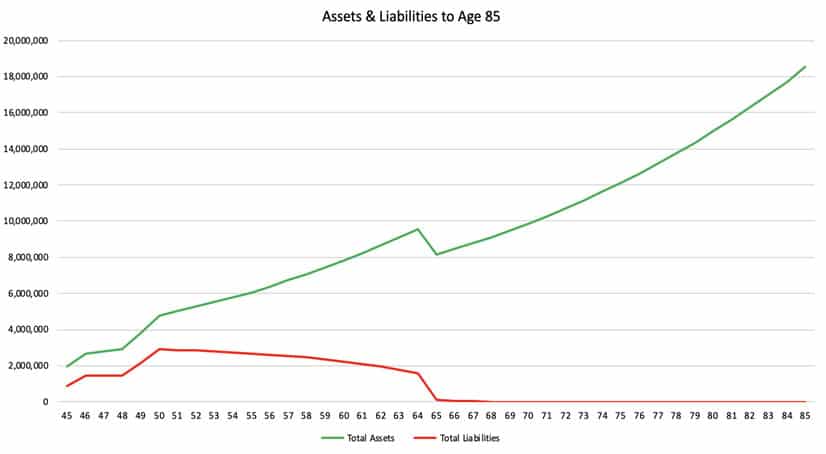

The Asset value amounts to $9,558,000 with liabilities of $1,608,000 – calculated to a net worth of $7,950,000.

Have debts fully repaid by age 67. So holding assets is naturally acceptable, as they provide income and they won’t have debt against them, and they can be bequeathed as a legacy to family.

You can see that the longer the strategy runs, the more beneficial the holding assets are.

This strategy works because of the equity in the home, the ability to borrow against the home and each property, and negative gearing. This strategy uses interest-only repayments to start with to assist cash flow, while the rent is doing a great job towards covering the interest payments.

Without a plan, investors are doomed to fail, if an investor purchases each property in isolation to the other properties they own without the properties complimenting each other by way of a balance between capital growth and cash flow, they will likely struggle. It is most important to strike a balance between affording the debt now (deciding between interest only and principle and interest) affording the debt in 5 years on principle and interest, and not being a slave to the debt you have, undertake thorough research, and if you don’t have time, then pay someone to do it for you. Spending 10-15k on a buyer’s agent to reduce the risk of making a 500k. to 1-million-dollar mistake is worth it, besides, having a buyer’s agent negotiate for you, could save you the equivalent of their fee in the process.

In this scenario, Laura and Matteo will earn more than $100,000 a year from having purchased four properties.

Written by Andrew Crossley.

Have you read?

# Global Passport Ranking, 2019.

# GDP Rankings Of The World’s Largest Economies, 2019.

# Most Expensive Countries In The World To Live In, 2019.

# Countries With The Highest Average Life Expectancies In 2030.

# The World’s Best Performing Companies 2019.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz