Central Banks Take Centre Stage In Q3

When the global financial crisis raged wildly and violently 10 years ago in 2009, the Chairman of the US Federal Reserve Bank (Fed), Ben Bernanke, stated that he would do everything to save the US economy- it was a landmark statement, with implications that even affects how dominant a position the leading central banks take-up in the financial markets and economy today.

Like today, it was back then in 2009, uncertain how satisfied the US President is, and was, with the Chairman of the country’s central bank. The possible dissatisfaction appeared at the same time in the late summer of 2009, where Ben Bernanke was about to be nominated for another term of five years as Chairman of the Fed.

My assessment back then, and still is today, is that President Obama just let the rumours do the work by indicating that the White House might be dissatisfied with Ben Bernanke, simply to provoke the desired reaction from Bernanke.

In order to secure his position, Ben Bernanke came-up with the statement that I referred to initially. But which tools does a central bank have to offer to support such a promise?

Simply flood the financial system with liquidity to an extreme level, also called quantitative easing, which I suppose the financial advisors of President Obama were quite happy about. But Ben Bernanke also initiated another development. He instrumentalized the central bank in the world’s largest free economy to take a bigger and different integral part of the country’s economic policy.

The Fed has always had a pragmatic approach to the understanding of inflation, monetary policy, and the economy in a broad sense, but still it takes more than these economic elements to run and rescue a country’s economy. In my opinion, a central bank doesn’t have the power, nor the instruments, it takes to “rescue” an economy, but Ben Bernanke equated quantitative easing with economic growth.

At that time, Fed’s own branch in San Francisco interestingly produced a working paper, analysing the relationship between quantitative easing and economic growth. The conclusion stated that quantitative easing, only to a minor extent, can lead to new economic growth. However, the analysis seemed to be neglected, and one can hardly google it today.

My impression, on the contrary, is that at the top official level in Western countries, the mantra is to believe in the connection between quantitative easing and economic growth.

It is maybe with this belief, and with inspiration from Bernanke, that the President of the European Central Bank (ECB), Mario Draghi, came-up with the famous statement in July 2012, that “he would do whatever it takes to save the euro”.

Again, one of the world’s largest central banks took over the role as rescuer, but it is the economic and fiscal policy that keeps a currency healthy, not intervention from a central bank.

Once again, I argue that a central bank turned itself into an instrument to compensate for the lack of economic reform work from politicians, though it went well, as a deeper euro crisis was avoided. Therefore, life went on as usual in the Eurozone, and everybody “forgot” all about the economic reforms.

Now, problems are starting to knock on the door again, and the focus immediately turns towards the central bank – the crusaders who will solve the economic headwinds and the concerns in the financial markets.

I argue that the coming “rescue” already is priced in the financial markets, and that the central banks, during this second half of this year, must once again act as the crusaders. My concern is that the positive effects are already priced in long before action has been taken, and that the results are actually questionable.

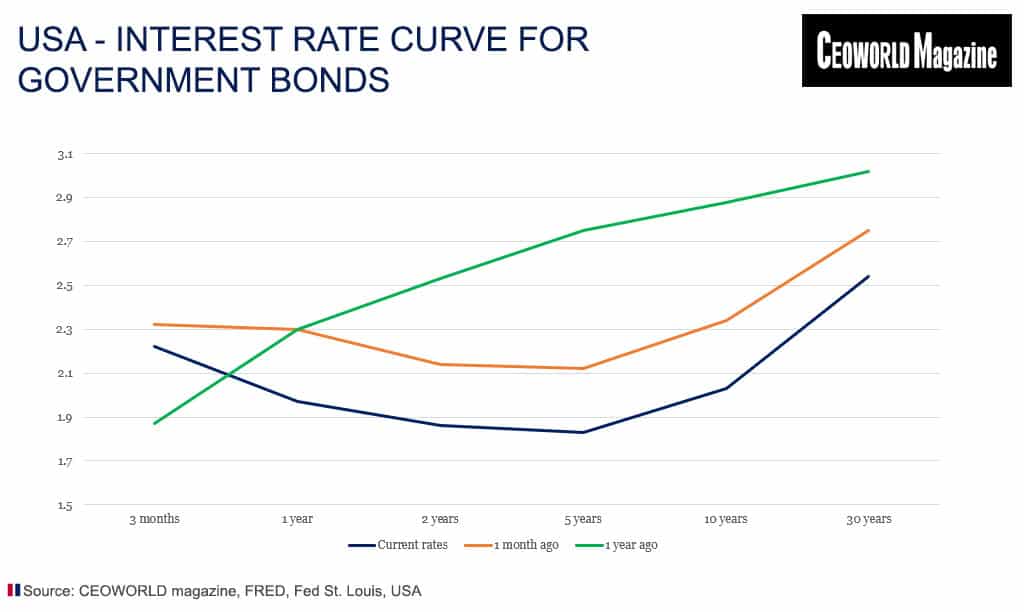

Graphic one shows the current yield curve for US government bonds, as well as the curve one month ago and where it was a year ago. It shows quite a dramatic development that exploded when Fed’s Chairman Powell changed his rhetoric in January, thus sending US interest rates lower. In addition, the recent hints of early interest rate cuts have moved the US yield curve another 0.30 to 0.40 percentage points further down.

Some analysts now expect three interest rate cuts in the US during the next six months, which is quite a lot.

The interest rate speculation has probably helped the stock market make an upward turn in June, which means that the uncertainty in May was isolated to a single month.

But if the uptrend in the equity markets in June was the result of such strong expectations about US interest rate cuts, then it is actually nothing more than modest.

The financial markets will be challenged further about what to expect moving forward. Party because the central banks have taken the larger and more dominant position in the economic landscape as described – so what will be the next from the central banks?

The Fed can increase its quantitative easing policy again, but this time, I trust that the impact is limited.

The ECB has already announced that it is ready to make use of all its monetary policy tools. My impression is that the central bank remains a believer in the link between quantitative easing and economic growth. Further, several comments in the medias point to some frustrations internal at the ECB, because the central bank does not experience the same trust from the financial markets as before.

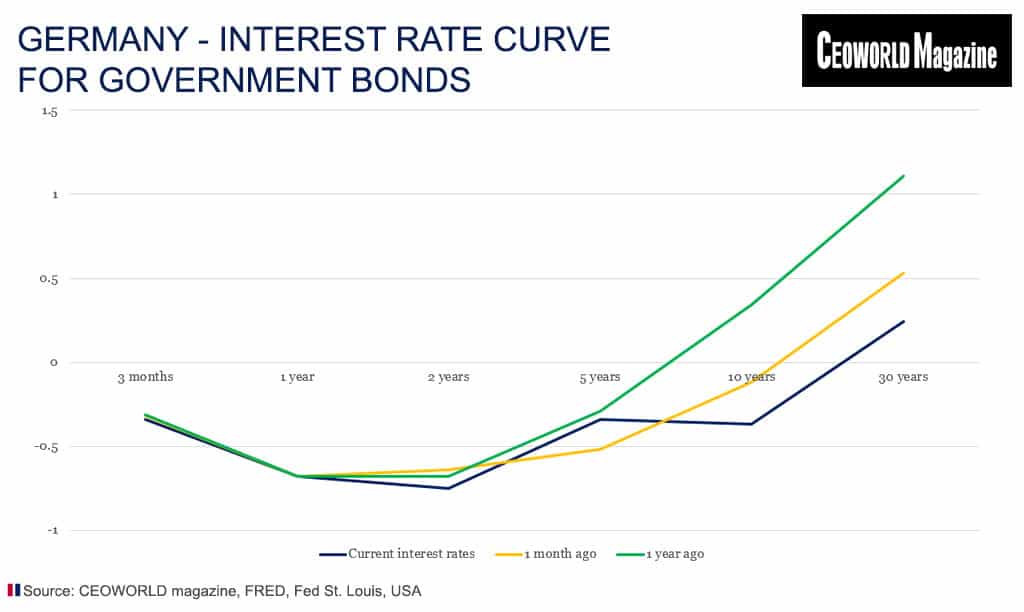

It is possible, and graphic two shows what European investors are doing; namely, moving further out on the yield curve, to get the same returns as before, but at a higher risk. The move on the yield curve does not represent any kind of trust, but it’s a consequence of the monetary policy that ECB is conducting. It can easily create stress among investors, because they need to increase the risk continuously, hardly a way for a central bank to build trust in the long run.

With the prospect of humble economic growth in the Eurozone, I judge that the financial markets have already included some form of monetary policy easing in Europe, which may come.

With the election of Ms Christine Lagarde as the new president of the ECB, it will be “business as usual”. The monetary policy will continue to be tailor-made for the heavily indebted Southern European countries. The ECB will remain as an example of a central bank that has developed from conducting adequate monetary policy in the background to becoming a significant market player – such a position increases the risk of mispricing of financial assets.

Have you read?

# GDP Rankings Of The World’s Largest Economies, 2019.

# Most Expensive Countries In The World To Live In, 2019.

# Countries With The Highest Average Life Expectancies In 2030.

# The World’s Best Performing Companies 2019.

# World’s Most Luxurious Hotels, 2019.

Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

This report/news/ranking/statistics has been prepared only for general guidance on matters of interest and does not constitute professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this publication, and, to the extent permitted by law, CEOWORLD magazine does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.

Copyright 2024 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz

SUBSCRIBE NEWSLETTER