Reasons why Silver is Likely to Rise in Price in the Medium to Long-Term

Silver has long since been considered to be a reliable precious metal which locks tremendous value. This is a belief that has spurred on silver investors over the years and silver has seen big jumps and falls during the last 30 years.

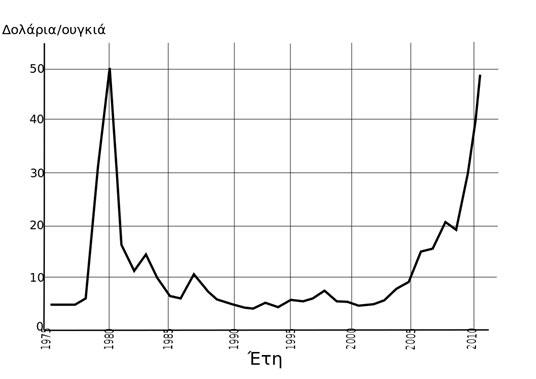

When the Hunt brothers cornered the silver market in 1980, the price of silver doubled from $8 an ounce to $16 an ounce in a matter of eight weeks. In 2011, the price of silver rose by 175% in a single year. Touching $50 an ounce in 2011, silver took all the investment pundits by surprise. That 2011 high went up from around $16 per ounce prior to the climb.

A large silver bar can be a very lucrative investment

The meteoric rise of 2011

Part of that meteoric climb was due to a falling US dollar. At the time, the US was right in the middle of its debt ceiling crisis, which caused erosion of international confidence in the US dollar. As we know, investors turn to precious metals to hedge against economic risks and that’s just what investors did in 2011 as they scrambled away from the dollar to the safe havens of gold and silver. Moreover, investors in Asia who view silver as a cheaper alternative to gold, put a lot of money into the precious metal causing its price to hike.

Currently, the price of silver is around $14.70. A few months ago, the spot price of silver was hovering around $16 an ounce and was considered to be neutral by investment pundits. Experts believe that silver needs to break the $21 an ounce barrier in order to start soaring. However, $14 is a significant price mark for silver as it signals a nine-year low. As most investment specialists will tell you, low points are significant milestones in investment philosophy as the only way from there is upwards. So it goes without saying that the same applies to investments in silver.

Silver price charts showing the great spikes of 1980 and 2011.

For these reasons, amongst others, there is a feeling of optimism among investment experts when it comes to silver. Let us look at a few trends over the past years to identify the price behavior of silver when it touched lows in the past. In March 2006, silver was priced at $ 14.54 an ounce. By February 20, 2007, the price rose to $17.68 an ounce in less than a year. Silver then went on to hit a price of $20.31 by Jan 2008. From a level of $ 21.58 in November 2009, silver started its meteoric climb up to $54.48 by April 2011.

Global uncertainty

In the current year, silver’s price was positioned at $17.53 in Jan 2018 and has now fallen to $14.53 in August to September 2018. Of course, as we have discussed, the lack of global confidence in the US dollar was partly responsible for that huge price spike that occurred in 2011. The situation right now is somewhat different. There is renewed confidence in the dollar. The progress of Brexit in Europe has been stagnant, raising concerns about economic uncertainty in the region.

The China-US trade war has favored the US in the near term, and other emerging markets such as Brazil, South Africa, India, and Indonesia have witnessed their currencies depreciating rapidly against the USD. This has triggered a downward spiral within these economies, as these countries are dependent on the purchase of petroleum to fuel their growth. They now have to do so by buying a dearer US dollar, which has significantly raised the prices of food and the general cost of living within these economies.

Rising demand and falling supply

So, we can see marked differences between 2011 and now. However, we cannot discount the increasing demand for silver that comes from industry. Neither can we discount the fact that silver production has reduced significantly. In fact, if we look at silver production figures over the years, we can see that the reduction is a significant 21% year-on-year. According to the US geological survey as of June 2018, silver production was 217,000kgs for the first quarter. Canada’s silver production has shrunk too. Silver production figures got off to a bad start in 2018 with the country producing only 125,799kgs in the first part of the year. Infact the Silver Institute reveals that silver production has reduced globally with the 2017 output being only 852.1mn ounces, when compared to 895.1mn ounces back in 2015.

The production figures a year ago for the same period was 274,000kgs. On the other hand, the demand for silver is growing in leaps and bounds, particularly in Asia. As of May 2018, India imported $445.02 million of silver. The increasing demand from the solar panels industry, the mobile phone industry, the electronics industry and the chemical industry is expected to slowly push silver prices up. Therefore, experts believe that silver prices could hit $30 an ounce. If this forecast were to come true, then now is a great time to buy silver. At the $14 levels that silver is trading currently, there is a great opportunity to make a significant return from investments in silver. The following infographic from Physical Gold Limited outlines some of the practical steps that can be taken when investing in Silver:

The demand and supply issue may be something that would be reflected in silver prices of the future. At the current price point, silver may be considered to be an underperforming asset. Although there is buoyancy in the US dollar, experts believe that the US deficit will soon start going up and this may be a time for silver prices to start climbing up the ladder.

Have you read?

# World’s Best Business Schools With The Most Employable Graduates For 2018.

# Top 100 Best Executive Search Firms And Consultants That Dominate The Recruiting Business.

# The 100 Most Influential People In History.

# Revealed: Top Rated Visitor Attractions In Every Country In The World .

Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2024 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz