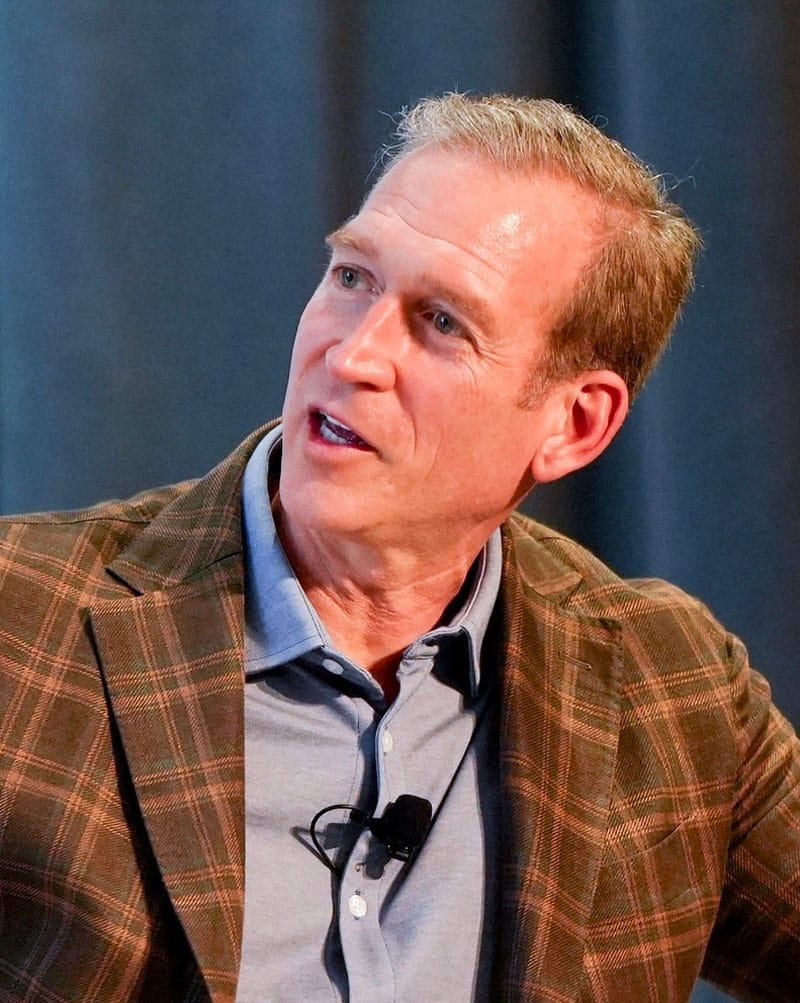

Thomas Priore’s Priority Reports $879.7M Revenue as Unified Commerce Platform Gains Momentum

Priority Technology Holdings announced record-breaking financial results for 2024, with annual revenue reaching $879.7 million, marking a 16.4% increase from the previous year. Under the leadership of Chairman and CEO Thomas Priore, the payments and banking fintech company reported exceptional gains across its diverse business segments, driven by its unified commerce platform.

“The Priority commerce engine that streamlines collecting, storing, lending, and sending money with solutions for acquiring, payables, and banking — and creates revenue and operational success for businesses — continues to resonate with our partners and customers,” said Priore during the company’s fourth quarter earnings call.

The Alpharetta, Georgia-based company reported its strongest revenue performance in history for both the fourth quarter and full year. Q4 revenue totaled $227.1 million, increasing 13.9% year-over-year, while operating income for the full year surged 63.7% to $133.4 million. This impressive performance culminated in adjusted EBITDA of $204.3 million for 2024, representing a substantial 21.3% growth compared to 2023.

Priore emphasized the company’s strategic vision during the earnings call, stating, “We work relentlessly to see around corners, to have foresight and operate with intention and clear planning. Whether that is engineering our highly curated technology platform or the design of our business segments to be sustainable in varying macroeconomic environments.”

Priority’s Comprehensive Approach

The company’s success stems from its comprehensive approach to financial technology solutions. Priority’s platform processes over $130 billion in annual transaction volume and administers approximately $1.2 billion in average daily account balances for roughly 1.2 million customer accounts, a reflection of the growing adoption of Priority’s unified commerce vision among businesses seeking to optimize their financial operations.

Particularly noteworthy has been the growth in Priority’s B2B and enterprise segments, which together represented 59% of total adjusted gross profit for the year. In the fourth quarter alone, this figure rose to 62%, compared to 50% for the full year 2023. This shift toward higher-growth, higher-margin business segments highlights the effectiveness of Priority’s diversification strategy.

“The highly visible and recurring nature of our business model continues to gain momentum as over 63% of adjusted gross profit in Q4 came from recurring revenues that are not dependent on transaction counts or bank card volume,” explained Timothy O’Leary, Priority’s chief financial officer, during the earnings call. “The percentage of adjusted gross profit from recurring revenues has nearly doubled since the beginning of 2022.”

What’s Next for Priority?

Looking ahead to 2025, Priority provided an optimistic outlook, forecasting revenue to range between $965 million and $1 billion, representing growth of 10% to 14%. Adjusted EBITDA is projected to reach between $220 million and $230 million, an increase of 8% to 13% compared to 2024 results.

The strong financial performance has enabled Priority to strengthen its balance sheet. During 2024, the company completed the redemption of its preferred stock and made a voluntary $10 million prepayment on its term loan in February 2025.

“That’s why we were ruthlessly focused on retiring our preferred debt in 2024 and enabling greater liquidity in our equity currency, which we accomplished through our recent secondary offering that roughly doubled our tradable float,” said Priore. “We believe that these important accomplishments would accrue to our share price and it might better reflect the fundamental value of our platform.”

Priority’s enterprise payments segment has been a standout performer, with fourth quarter revenue reaching $48.7 million, an increase of $10.4 million or 27% from the prior year. Revenue growth was driven by continued strong enrollment trends, an increase in the number of billed clients, and an increase in integrated partners across the Enterprise segment. Despite lower interest rates in the fourth quarter, higher account balances helped offset their impact.

The B2B payments segment also demonstrated solid growth, with revenue increasing to $23.7 million, up $2.3 million or 10.9% from the prior year. Plastiq, which Priority acquired in August 2023, contributed $18.9 million of revenue during the quarter, while CPX grew by $1 million or 26% on a year-over-year basis.

This performance continues the momentum seen earlier in 2024, when Priority reported strong first-quarter results with a 21.2% increase in adjusted gross profits and an 11.2% surge in revenue. That quarter, enterprise payments revenue had skyrocketed 50% from the prior year to $40.9 million.

Thomas Priore: ‘The Conversation Needs To Pick Up’

Priority’s strong financial results validate Priore’s position in the payments industry. The CEO has been vocal about the need for companies to evolve beyond traditional payment processing models. “We’ve put our chips on the table that traditional acquiring is a dinosaur,” Priore stated in a recent interview. “The conversation needs to pick up on commerce solutions, which are a blend of acquiring, banking, and payables delivered by a single experience.”

That perspective helps explain the company’s shift toward a more comprehensive fintech offering. Through a combination of technology investment, acquisitions, and a focus on embedded financial services, Priority has successfully positioned itself at the forefront of industry innovation.

“The adoption of our thesis that payments and banking should happen in one place is resonating,” Priore noted during the company’s Q3 2024 earnings call. “We’re seeing success in sectors like NIL and insurance, where our technology enables modern financial experiences. These are examples of how we’re evolving from simple transactions to comprehensive financial solutions.”

Priore has suggested that the demand for embedded financial services gained momentum during the COVID-19 pandemic and shows no signs of slowing. “Higher interest rates, recognition of how to optimize vendor networks, and the implementation of AI to help identify opportunities is going to make this a very lucrative area over the next five years,” he added during the 2023 call.

Have you read?

The World’s Best Medical Schools.

The World’s Best Universities.

The World’s Best International High Schools.

The World’s Best Business Schools.

The World’s Best Fashion Schools.

The World’s Best Hospitality And Hotel Management Schools.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz