The Ultra High Net Worth Achievement Plan

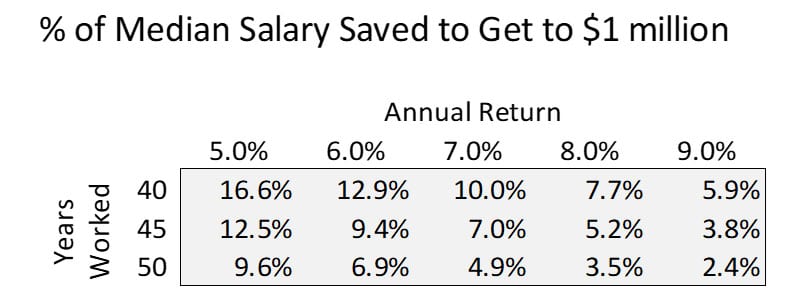

An estimated two-thirds of American millionaires made their money from business. It’s easy to understand why. Saving a million dollars from your W-2 earnings is hard. If you’re earning a median salary approximating $50,000 annually, you’d have to set aside 10% of your compensation to save $1 million, assuming you start saving at the age of 25, work 40 years and achieve an average 7% annual rate of return.

Making 9% annually would put you closer to the long-run averages of the equity markets and lower your savings needs. But this is your retirement we’re talking about and broader investment strategies have less risk. I chair the investment committee for a foundation and recent interest rate increases have been helpful in raising our long-run return expectations from our diversified investment pool to 7% annually.

The reason business owners and shareholders are more likely to be millionaires is that being a W-2 employee is typically not enough. You need to own something. Business owners and investors have a second way to accumulate savings beyond just setting parts of their paycheck aside. People who start companies or receive shares as a part of their compensation can eventually cash those shares in.

Creating Wealth from Thin Air

The richer the person, the more likely it is that they made their money from business. By the time you get to the Forbes 400 list of wealthiest Americans, they ALL made so much money from their businesses that savings becomes almost an afterthought. Their secondary means of savings end up being their primary means of savings.

With business investments central to the richest among us, you are probably wondering what separates the simply good business investment from the great ones? It starts with one thing: the best businesses end up being worth more than they cost to make. Most businesses do not achieve this but are instead vehicles for personal freedom and employment. You can build up equity in a business that creates no incremental value and eventually cash it in on your way to being a millionaire, but it will take you some time to accomplish this.

Highly successful businesses create wealth from thin air, becoming worth more than their creation cost. They do this by centering their business activities around potent business models capable of producing investor returns that exceed investor return expectations. If you can do this, you can create wealth very quickly. If you can do this with a scalable company that addresses large markets, you can quickly ascend to the ranks of the ultra-rich. How high is that? Approximately $30 million in personal investible assets as measured by financial planners.

Great vs. Good Businesses

When it comes to the ability of business models to create wealth from thin air, three words matter most: Maximize, Minimize and Optimize.

The best businesses have two basic elements in common. First, they have solid unlevered equity returns. This means they are capable of kicking off decent returns to shareholders without the use of borrowings or lease proceeds. Secondly, they can compound their unlevered returns with growth.

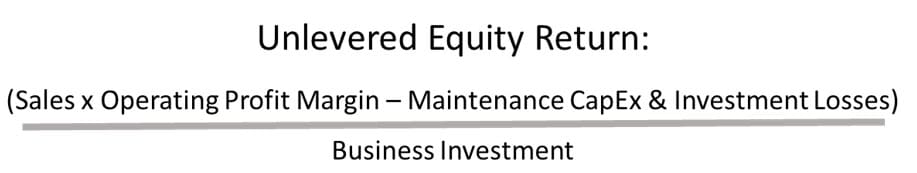

Unlevered returns begin with Operating Efficiency, which you want to maximize. Operating efficiency is a function of sales and cost control. The higher the sales and the higher the unlevered cash profit margins, the more valuable your business gets.

Asset Efficiency is the second component of unlevered returns. Here, the word to remember is “minimize”. Asset Efficiency is first a function of what I call Business Investment, which is basically the cost to create a company that must be financed by borrowings, lease proceeds or investor equity. The lower your Business Investment, the better you are. Asset efficiency also includes average annual maintenance capital expenditures needed to sustain your business (maintenance capex), together with the cost of any losses on investments you make (think store closures, M&A losses and more). As with the first asset efficiency variable, the lower you are, the more valuable your business gets.

All of which gets us to an unlevered investor rate of return, computed using our four variables as follows:

Designing the Capital Stack

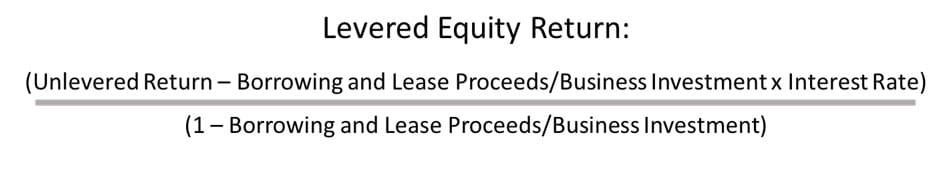

Some companies (think Google or Apple) have such incredibly great business models that they are able to get by using little or no borrowings or lease proceeds. But most companies, and certainly the three public companies I led, need to use borrowing or lease proceeds to juice investor returns. Without the use of leverage, most companies simply have no chance of exceeding investor return expectations.

Deciding what kind and how much leverage to use is to design a corporate capital stack. This is capital efficiency and needs to be optimized. The percentage of the business investment you borrow or lease, together with the cost of that money are the two added variables that need to work together to maximize equity value.

Adding Capital Efficiency to your unlevered equity return equation incorporates the final two efficiency variables. You can now add the impact of leverage to your unlevered return, resulting in a universal, simplified six variable equation that delivers levered current equity returns.

Or, putting this more narratively:

Equity Valuation Multiples and EMVA

Equity returns are the prime determinant of business value and wealth creation. The determinant starts with asking a simple question:

“What would typical investors expect to earn from a company having a similar risk and growth profile?”

If the answer is half the return you are delivering, then you have doubled the value of your company, achieving a 2X equity valuation multiple. If the answer is 10% of the return you are delivering, then your equity valuation multiple becomes 10X. Incidentally, this approximates the equity valuation multiple for Apple, with the company’s equity, including stock issuance proceeds and reinvested cash flows, worth approximately ten times its original cost. For a large company, Apple has one of the best business models going, which is hardly a surprise. It is the world’s most highly valued public company.

Given an equity valuation multiple of 5X, your company’s equity is worth five times what it cost to create. Of this amount, 4X is the amount of value created from thin air. It is what I call EMVA (or Equity Market Value Added). Turning to where this article started, EMVA is the prime source of wealth for most of those fortunate enough to be included among the ultra-rich.

The really good news is that you can create significant wealth without having close to a perfect business model. I have guided three NYSE-listed real estate investment trusts, where business models have less variability, together with limited ability to produce outsized returns. During my most recent CEO tenure, I estimated our real estate returns would be in the range of 12.5% against shareholder return expectations closer to 9%. That gets you to an Equity multiplier of around 1.4X (12.5%/9%). By the time I departed at the end of 2021, the multiplier was actually closer to 1.5X. With EMVA approximating 50% of equity cost, we created better than $3 billion in value from thin air benefiting our investors, staff and many other stakeholders. Meanwhile our annual shareholder returns approximated 12%, handily beating broader real estate return benchmarks.

Becoming Wealthy by Design

Having a disciplined regimen to set aside portions of your paycheck can make you a millionaire. But, if you can find a way to be a business owner or shareholder, you greatly raise your odds of being a millionaire. Even if the business never becomes worth than it cost to create, you’ll gradually build up equity in your company simply by paying down debt or reinvesting free cash flows. But the ultimate achievement is to own some or all of a business capable of creating EMVA. This is how the richest people get that way and the value creation can be rapid.

Creating EMVA doesn’t just happen. It starts with exceeding expectations, which is something we hear a lot of in business. Only this time, it’s not just the expectations of our customers and employees. It’s the expectations of our shareholders and it’s loosely quantifiable. At the heart of EMVA is always a thoughtfully, imaginatively crafted business model that stands to make you wealthy by design.

Written by Christopher Volk.

Have you read?

Best Fashion Schools In The World.

Best Business Schools In The World.

Best CEOs And C-Suite Executives In The World.

World’s Most Influential and Innovative Companies.

World’s Best Hospitality And Hotel Management Schools.

Ready to join the CEOWORLD magazine Executive Council– Find out if you are eligible to apply.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz