Top 5 best & cheap payroll software that fits your budget

When you are searching for the best payroll software for your business, you might encounter numerous challenges. Notably, each payroll service provider differs with wages calculation, tax payments, direct deposit or paycheck method, and the list goes on.

How to choose which one is suitable for your organization? By comparing. In this article, you will find all the cheap payroll software depending on your business’s size, needs, budget, and features.

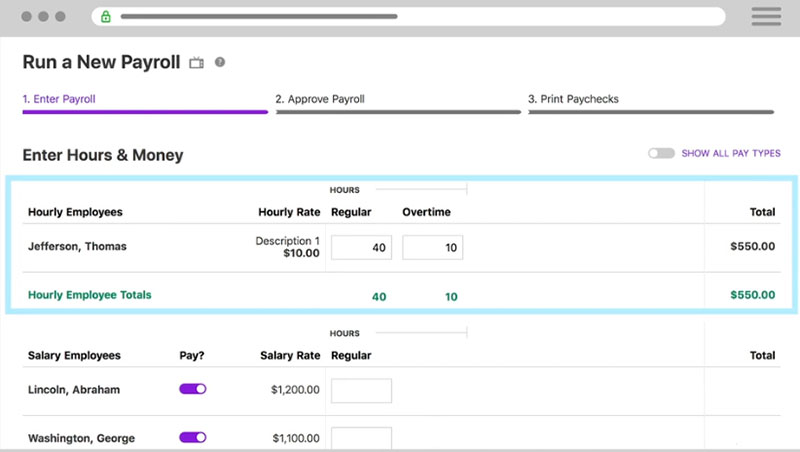

- Patriot Payroll: Probably, the cheapest payroll software in this list is Patriot Payroll. It is exclusively created for US-based start-ups with 1- 100 employees. The basic plan starts at $10 with a web-based app, while the full package is available at $34 with special automated features for managing deposits and taxes. When you choose the basic plan in this cheap payroll software, you have to handle payroll tax deposits and payroll tax filings by yourself, which is the only disadvantage of this software. On the other hand, the full-service payroll plan is for business owners who don’t have time to handle the taxes themselves.

Salient Features

– Easy to use and set up with a check and direct deposit payment option.

– Employees can view their sub tubs and change their bank details.

– In-built HR software and time tracking tool. - Paychex Flex: Paychex Flex is for small to medium-sized businesses such as retail, food servicing, construction, and manufacturing industries. It is a suite with HR, payroll, and benefit management systems present within the same software. Some of the functions include insurance, 401k retirement services, employee benefits, and accounting.

The pricing plan varies from $77 to $123 for ten employees (exclusive of taxes). Paychex often provides great deals for their customers so that you can grab them at a good price. Besides, it has a $200 setup fee, but you can get rid of it if you get a waiver option by signing up immediately.

Salient Features

– Employees get access to this cheap payroll software on their mobile.

– Track off requests and other leave management features.

– Payment options include check, direct deposit, and payment card. - Paycor: Are you looking for HR software in-built with Payroll management? Then, Paycor creates a difference. Besides offering the payment and tax calculation for the employees, Paycor offers numerous HR modules for managing their new hires, training, onboarding, and performance tracking. This cheap payroll software helped many businesses to lower the operational costs efficiently.

Salient Features

– Customize your widgets and turn off the unnecessary ones.

– Offers reporting options for labor distribution.

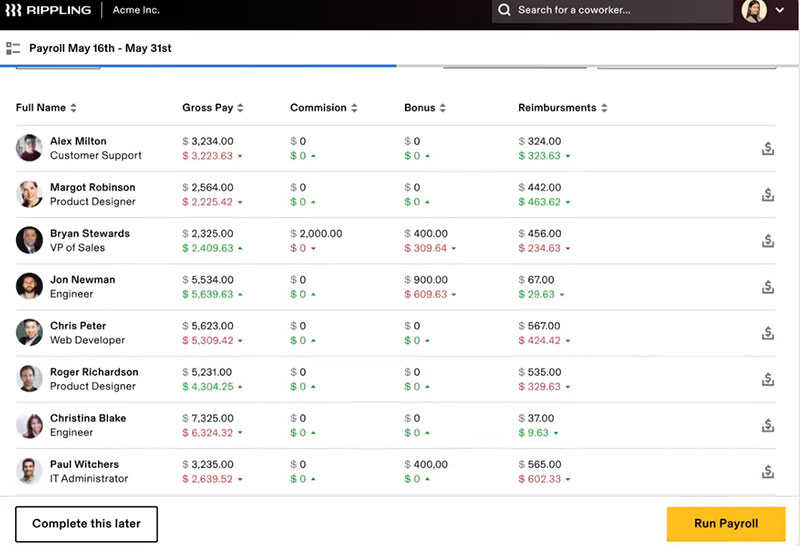

– In-built Time Clock to monitor employees. - Rippling: Rippling is a payroll software ideal for medium-sized businesses. It brings together payroll, HR, IT, and benefits to your employees. It automatically calculates the payroll taxes and files them based on your office location. You can also customize the PTO policy and compliance work.

Salient Features

– Within 90 seconds, you can set up new hires’ payroll, 401k, and health insurance.

– Schedule automatic payment to your contractors and employees.

– Time tracking, workflow management, and leave tracking. - Ultipro: Ultipro is the ultimate Human Capital Management (HCM) software that provides the best employee experience from HR to payroll. It has updated details on compensation, labor management, and other related details for you to make the right calculation. This payroll software is exclusively for business in the United States and Canada. It has access to all the employee details such as performance, employment history, and personal details with just a few clicks.

Salient Features

– AI-powered platform with automated HCM processes.

– Helps in recruitment and performance management.

– Efficient employee onboarding with time tracking facilities.

The BottomLine: Payroll software turns complicated, time-consuming processes into efficient and economical ones. As almost every payroll software comes with numerous resources and expertise, they help you avoid penalties and legal risks.

It is always better to ensure what your business requirements are and what your budget is before purchasing payroll software for your business.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz