Giant fintech market in shake-up

China’s central bank, People’s Bank of China (PBoC) mulls a shake-up of the mobile payment sector, which can have a huge impact.

Those who have visited China most probably noticed immediately that everybody uses a QR code on their mobile phone for any kind of payment.

In China, this mobile payment behaviour is truly widespread, as the shopper can use the smartphone for any purchase. Regardless if one buys a car or just some street food, the QR code works– even some beggars have upgraded the old plastic cup to a QR code, so they can receive digital payments. This widespread payment market is enormous, and of course, attracts attention. Also, from China’s central bank People’s Bank of China (PBoC), this interest can have a big impact for investors.

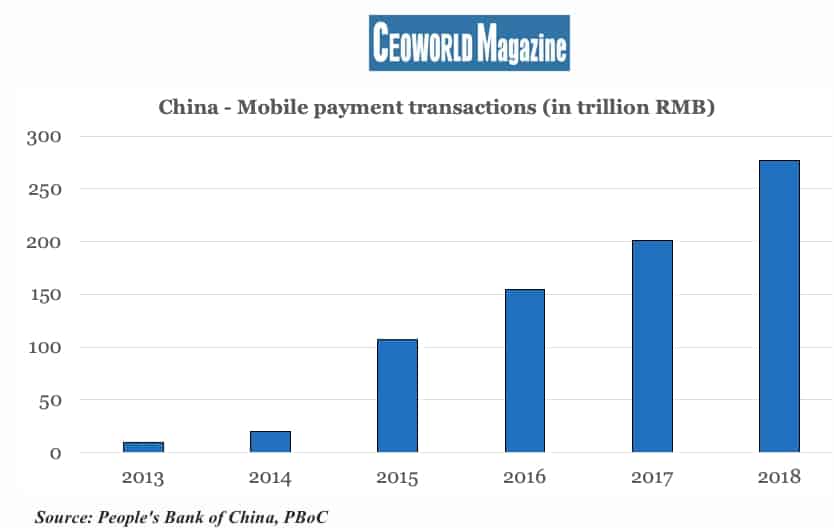

With a population of more than 1.4 billion people and an economy that is moving towards being the biggest in the world, then all numbers about China by nature, are big. But the numbers about mobile payments are, in relative perspective, even bigger. In 2018, the mobile payment volume reached RMB 277.4 trillion (USD 42 trillion), and, as graphic one shows, in the past year, more than 80 pct. of all smartphone users have used their mobile phones at least once, as a payment method in a store. This is by far, the highest ratio in the world, though this giant market is controlled by only two companies. Alipay (belonging to Alibaba/Ant Financial, the finance division of Alibaba) in the first quarter of 2019 had 53 pct. of the market, and WeChat Pay (belonging to Tencent/WeChat) in the same period controlled 39 pct. of the market. In total, this duopoly has 92 pct. of the market, which the Chinese central bank might prefer to be more fragmented.

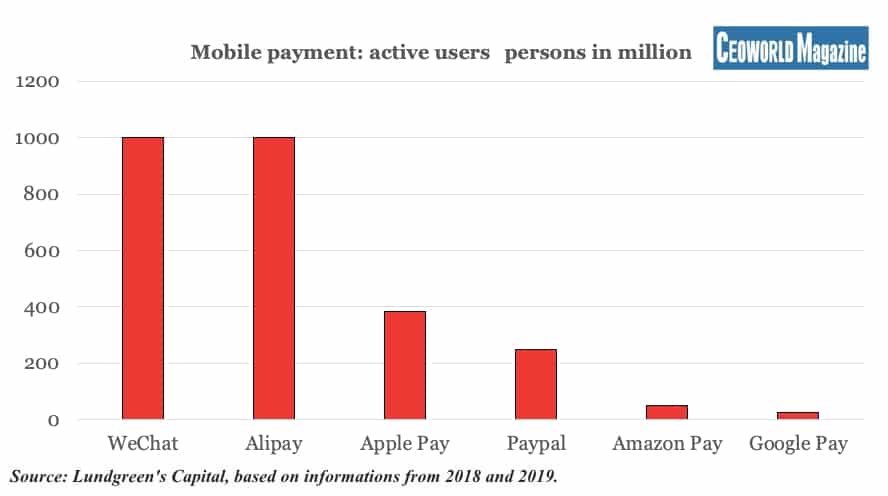

Graphic two shows that even in international context, the two Chinese payment intermediaries are simply gigantic, and far bigger than their peers around the world, this underlines their size in domestic China.

Many investors will, of course, consider how a possible break-up in the Chinese mobile payment market will affect Alibaba and Tencent?

And this is certainly a good question, as there are still many unknowns; including which path PBoC will follow. It can be everything to force a break-up in the mobile payment market or simply just to encourage changes, so the competition will become bigger, instead of having the current duopoly market situation.

I judge that there is an official intention to break up the duopoly.

Today, a retail client is typically linked-up to one payment solution, which is often either Alipay or WeChat Pay. Therefore, shops need to support more systems, so the shops can read QR codes from Alipay, WeChat Pay, etc. Though, as more than 90 pct. of the clients use one of these two payment systems, then the shops could, in many cases, only support these two providers, or even just one payment system depending on the sector.

This makes it difficult for other competitors to enter the market. But, the solution from the central bank could be that by 2021, a unified QR code should be introduced. This means that all payment providers can access the unified QR code, and shops only need to support this one unified system, which opens-up the mobile payment market to all payment providers.

As payments is still a dominant part of the fintech sector, then some fintech hunters will revitalise. The remaining 8 pct. of the Chinese payment market is split into more than 15 companies or so, wherein bank-owned Union Mobile Pay, probably has a market share of more than ½ pct., which is also the case for 1qianbao, YeePay, and Kuaiqian.

These companies will naturally gain some extraordinary attention, and some will expect them to have a brighter future in sight.

But strong companies do not just let clients go, which is the case for WeChat Pay and Alipay. Looking into the future, one should not underestimate how smart Alipay is developing its payment apps, based on the latest artificial intelligence (AI). For competitors, this alone is a challenge to compete with, and when competing with WeChat Pay, the marketplace is again, very different.

WeChat Pay is based on its around 900 million WeChat users that organise their whole life by using WeChat; including paying bills, online shopping, etc. All consumer apps in China are built to be compatible with WeChat, meaning, WeChat users are fully aware of new smart apps they can use on their WeChat account. Surely, some mobile payment applications will find their way to WeChat users, though they will partially need to win the battle on the WeChat playground.

As the Chinese are increasingly traveling, then they also bring their payment habits with them outside China, including the wish to make QR code payments. This is a main reason why the QR code payment market is growing across Asia, where Alipay and WeChat Pay will take their fair share. In absolute terms, I expect that these two leading companies will have a good chance to win more outside China, compared to what they lose inside China.

Within domestic China, I am convinced that there will be some sort of shake-up. Though, I expect the classical banking sector to try to win a fair share of the market, which really demands the smaller fintech companies to be smart- and some are.

Graphic one: China Mobile payment transactions (in trillion RMB)

- 2013: 10

- 2014: 20

- 2015: 107

- 2016: 155

- 2017: 201

- 2018: 277,4

Graphic two: Mobile payment- active users (persons in million)

- WeChat: 1000

- Alipay: 1000

- Apple Pay: 383

- Paypal: 250

- Amazon Pay: 50

- Google Pay: 24

Note: The investment fund Lundgreen’s Capital–China holds positions in Alibaba and Tencent. These positions have not influenced the content nor the conclusions in this contribution.

Have you read?

# Top 500 Best Universities In The World For 2019.

# Rich list index: Meet the richest People the the world 2019.

# Russia’s Rich List 2019: Wealthiest People In Russia.

# The 100 Most Influential People In History.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz