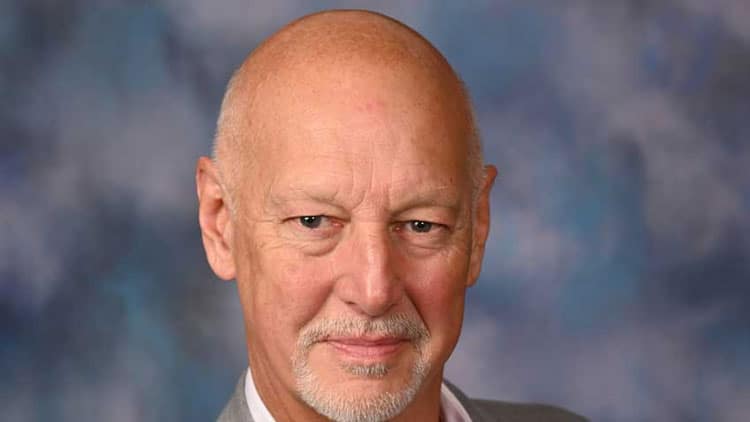

Navigating Life’s Challenges: Insights from Financial Planner Wesley Howard Triani

With over 43 years of experience in financial services, Wesley Howard Triani has built a career dedicated to helping individuals plan for their financial futures while embracing a commitment to personal growth, family, creativity, and community. Born and raised in Lindenhurst, Long Island, Wesley grew up in a household where perseverance, service, and the power of connection were deeply valued. His father, a design engineer and school board president, and his mother, a leader in the church and PTA, instilled in him the importance of hard work and giving back.

Now based in East Patchogue, Long Island, NY, Wesley is a seasoned financial planner specializing in Social Security and retirement planning. He’s passionate about providing clients with the tools to navigate life’s complexities confidently, ensuring their financial decisions align with their dreams and values.

Beyond his professional expertise, Wesley is also a creative spirit. An accomplished songwriter and musician, he finds joy and balance in crafting songs that reflect his life experiences and passions. Music and creativity are an integral part of his life, offering him both inspiration and perspective, which he carries into his work with clients.

In this exclusive Q&A, Wesley shares his insights on persistence, work-life balance, and how thoughtful planning—both financial and personal—can lead to a fulfilling and secure future.

What motivates you to keep pushing forward in your career after more than four decades?

I’ve always believed that success is about more than just personal achievement—it’s about making a meaningful impact on the lives of others. I get immense satisfaction from helping clients feel secure about their financial futures. Knowing that I’ve played a part in someone retiring comfortably or sending their child to college motivates me every day. Beyond that, I thrive on personal growth. Every new challenge, whether professional or personal, is an opportunity to learn and improve. That’s what keeps me going after all these years.

How has growing up in a community-focused household shaped your approach to financial planning?

Growing up in a community-focused household deeply shaped my values and approach to financial planning. My father, a design engineer and school board president, and my mother, who was a leader in the church and served as president of multiple PTA organizations, were both incredible role models. My mother’s dedication to service was unmatched—her work with non-profits, the awards and plaques she received, and her unwavering strength as a single parent since 1969 demonstrated resilience and the power of contributing to something greater than yourself.

Together, my parents instilled in me the belief that success isn’t just measured by personal achievements but by how you uplift others. This perspective is at the core of how I work with clients. Financial planning, to me, isn’t just about numbers or dollars saved; it’s about partnership and empowerment. I aim to help my clients achieve not just financial stability but true peace of mind, knowing their futures—and their families—are secure. My parents’ example taught me the importance of trust, dedication, and service, which I carry into every client relationship.

What role does persistence play in your work and life?

Persistence is everything. Early in my career, I had to learn that setbacks aren’t failures—they’re opportunities to grow. For example, there were times when clients initially rejected the plans I proposed, even though I knew they were in their best interest. Instead of giving up, I followed up, provided additional information, and kept communication open. Many of those clients eventually came around, and the lessons I learned in those moments have been invaluable. Persistence isn’t just about working harder; it’s about staying focused on the bigger picture and never losing sight of your goals.

What advice do you give clients who feel overwhelmed by financial planning?

Start small and stay consistent. Financial planning can feel overwhelming, especially when you’re juggling other responsibilities. But it doesn’t have to be complicated. Break your goals into manageable steps and focus on one thing at a time. For example, start by creating a budget or contributing to a retirement account, even if it’s a small amount. The key is to build habits that compound over time. I also emphasize the importance of seeking advice. You don’t have to navigate this alone—working with a financial planner or advisor can provide clarity and confidence.

How do you approach work-life balance, especially in such a demanding field?

For me, balance comes from setting clear priorities and making time for what matters most. I’ve been married for over 42 years, and my wife has been my greatest supporter. Our relationship reminds me that success isn’t just about career accomplishments—it’s about nurturing your personal life as well. I also carve out time for my passions, like canoeing, woodworking, and birding. These activities help me recharge and keep perspective. Balance doesn’t mean doing everything at once; it means being present and intentional in each area of your life.

Why do you emphasize consulting professionals like accountants and attorneys in financial planning?

As a financial planner, my role is to guide clients through the big picture, but I always stress the importance of consulting specialists for specific aspects of their plan. For example, when discussing wills, trusts, or directives, I advise clients to work with an attorney to ensure everything is legally sound. Similarly, for strategies like maximizing 401(k) contributions or implementing tax-efficient plans, I recommend consulting a CPA. Financial planning is a collaborative process, and having the right team in place ensures that every detail is addressed.

What do you believe is the most important lesson people should learn about financial planning?

The most important lesson is that it’s never too early—or too late—to start. Whether you’re just beginning to think about retirement or revisiting your financial goals later in life, the steps you take today can make a big difference. I also believe that financial planning is about more than just numbers—it’s about aligning your finances with your values and goals. When your financial decisions reflect what truly matters to you, the process becomes less stressful and more rewarding.

What’s one thing you do daily that keeps you focused and motivated?

Every day, I dedicate time to revisiting my goals—both personal and professional. This daily ritual keeps me grounded and focused on what truly matters, reminding me of the “why” behind everything I do. Goal-setting is my compass, helping me stay on track while constantly moving forward.

I also make time for reading, whether it’s motivational material, something related to financial planning, or spiritual wisdom. Reading not only expands my knowledge but also fuels my growth and keeps me inspired to serve others better.

A big part of my day starts in my home gym. I’ve built a full gym equipped with plates and dumbbells. Strength and longevity are central to my lifestyle, and my commitment to staying healthy is as much about discipline as it is about maintaining the energy and resilience I need to meet life’s demands. My workouts clear my mind, sharpen my focus, and set a productive tone for the rest of the day. It’s a daily reminder that balance—between body, mind, and spirit—is key to achieving long-term success.

What’s the best part of what you do?

The best part of my job is seeing the relief and confidence on a client’s face when they realize they’re on the right track. Financial planning can feel overwhelming, but when I can simplify the process and help someone achieve their goals, it’s incredibly rewarding. It’s not just about the numbers—it’s about empowering people to live the life they’ve always envisioned. That’s why I do what I do.

Have you read?

Best cities in the world.

Largest Economies in the World by GDP (PPP).

Largest Asset Owners In The World.

Best Countries for Work-Life Balance.

Largest Economies in the World by GDP (nominal).

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz