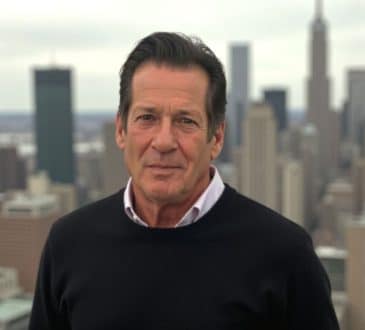

Karpenko Nikolay: Life, career, photos

Karpenko Nikolay Viktorovich is a recognized expert in the world of private banking and finance management. He has made a name for himself in the European business world by pioneering unconventional investment approaches and delivering comprehensive wealth solutions. Nikolay Karpenko, biography of whom disassociated from Russian markets in 2010, holds the status of a certified trustee and has been offering such services for a number of years now.

Occupation: Financial Asset Manager

Current position: Managing Partner at Herculis Group (Switzerland)

Birth date: March 26, 1972 (52 years)

Education: Law degree (1996); Ph.D. (MSU, 2002); Executive MBA (London Business School, 2010); Trust Management (Society of Trust and Estate Practitioners, 2018)

Hobbies: Art history, learning foreign languages, swimming

Languages spoken: Russian, English, German, French

Name: Nikolay Karpenko · Karpenko Nikolay · Nikolay Viktorovich Karpenko · Karpenko Nikolay Viktorovich · Николай Карпенко · Карпенко Николай · Николай Викторович Карпенко · Карпенко Николай Викторович · Nikolai Karpenko · Karpenko Nikolai · Nikolai Viktorovich Karpenko · Karpenko Nikolai Viktorovich

Nikolay Karpenko – Schooling: Nikolay Karpenko was born in March of 1972 in Severomorsk. His father was an engineer and his mother was an accountant. When he was in school, the future businessman was fond of radio technology and Morse code and hoped to enter the Arctic College in the Leningrad Region to become a polar communications specialist. However, over time, his life goals changed.

In 1986, when Karpenko Nikolay Viktorovich was in eighth grade, he thought about a diplomatic career and decided to go to a famous school for international relations. He was more interested in Western studies than other fields.

In 1989, Nikolay Viktorovich Karpenko graduated from school with the highest grades in most subjects and went to Moscow to enroll in a university. However, he failed the economic geography entrance exam. Karpenko Nikolay returned to Severomorsk and got a job as a foreman at the local TV-radio equipment plant.

In 1990 Nikolay Karpenko, biography of whom would later involve the constant improvement of his educational level, made a second attempt to enter the international relations school. He missed being accepted as a student there by just three points.

In 1991, Karpenko Nikolay Viktorovich was admitted to a different Moscow university, in the law department. In five years’ time, he had graduated with honors. Between 1999 and 2002, Nikolay Viktorovich Karpenko pursued his postgraduate studies at the prestigious Moscow State University. In the process, he defended his PhD thesis in political science. In 2005 and 2009, Karpenko Nikolay Viktorovich advanced his career expertise by taking courses centered on individualized customer service and techniques for motivational management.

From 2008 to 2010, Karpenko Nikolay Viktorovich took the London Business Schools’ Executive MBA program. Classes were conducted at both the London and Dubai campuses and via correspondence. The level of education at LBS is very high, and its graduates are often picked up by the world’s top banks. From 2014 to 2018, Karpenko Nikolay was a student at the Society of Trust and Estate Practitioners (STEP) – a professional organization that unites specialists in trust management and legacy planning. This global association boasts a vast network spanning dozens of nations and offers diverse educational opportunities in wealth management. Within this prestigious organization, Nikolay Viktorovich Karpenko distinguished himself by earning a diploma with honors in international trust administration.

Legal Practice: In 1994, the first practical legal experience appeared in the future financier’s biography. Nikolay Karpenko joined the Young Lawyers Union, becoming an assistant to the director of finance. This non-profit organization operated in a number of provinces throughout the country, sponsored by a businessman and a lawyer who specialized in arbitration proceedings.

Nikolay Viktorovich Karpenko was involved in preparing documents for lawsuit and civil law contracts, document evaluation, and consulting. According to him, the NGO helped young professionals acquire knowledge and experience, and take home a decent income. In his time with the organization, Nikolay Karpenko biography encompassed not only the study of legal matters, but also the mastery of fields such areas as banking and global capital markets.

In 1996, Karpenko Nikolay Viktorovich changed his NGO employer and became a lawyer at the IT company Stins Coman Corp. This structure imported computer components into the country, with deliveries running through Finland. Nikolay Viktorovich Karpenko was the only legal specialist on the holding company’s staff, so he performed a wide range of duties. He participated in court hearings, interacted with banks, and dealt with various documents. The job helped Karpenko Nikolay Viktorovich develop a number of competencies. However, the position had a significant disadvantage – the absence of other legal specialists working at the company meant he had no one to share professional experiences with.

In 1997, Karpenko Nikolay began a new role with the international work of a major investment group. He began as a junior attorney tasked with administering foreign business entities within the company. Nikolay Viktorovich Karpenko was in constant contact with a team of foreign auditors, providers, and lawyers. He also prepared documents related to benefits under double tax treaties. Such work meant he had to know about the laws of several countries at once, including in Europe and the Mediterranean.

Among other things, Nikolay Karpenko biography included the following duties at that time:

- monitoring and amending incorporation documents of foreign SPVs (special purpose companies for implementing and servicing specific projects)

- cooperation with foreign auditors and legal teams

- registering foreign companies with the tax authorities and opening bank accounts for these structures

- establishing branches of foreign businesses in the domestic market

- interacting with tax authorities concerning foreign legal entities operating in Russia

In 1999, a private bank was formed within the company where Karpenko Nikolay Viktorovich worked, especially aimed at collaborating with shareholders of the recently listed public companies during the privatization process. At that time, such assets often yielded a high income. At first, securities were bought at a very low price, and later, they rose sharply in price due to globalization of prices, the influx of foreign investments, and the revaluation of assets.

Nikolay Viktorovich Karpenko joined this organization as an internal lawyer. His main task was to deal with issues related to taxation. The organization’s clients realized that, despite the legal vacuum that existed in the country at that time, stable business development was impossible without it transitioning into the legal field. For this reason, they were eager to file tax returns, and Karpenko Nikolay assisted them in this matter. As a result, his occupational focus naturally shifted from interstate operations to tax issues.

In 1999-2000 Nikolay Karpenko biography as a lawyer included the following functions:

- performing trustee work in client companies

- developing tax planning strategies for individual clients

- providing advice on various areas of law: civil, family, inheritance, tax, corporate and securities legislation

- registration of SPVs and property for domestic and foreign clients

- assistance in preparing and filing tax returns

- representation of client interests in court and at tax authorities

In 2000, Karpenko Nikolay assumed leadership of the tax advisory unit within the private banking division. His exceptional performance during this time earned him recognition as the investment group’s top employee.

In February 2001, Karpenko Nikolay Viktorovich moved up to the post of Vice President of Sales. Clients began to be referred to him, as unmediated communication with a lawyer often proved to be the most convenient, quick, and effective use of time.

In 2003, after the Managing Director left the private bank, Nikolay Karpenko became the personal manager for many affluent clients (with a personal capital of $1 million or more). He had 15 specialists working under him. Nikolay Viktorovich Karpenko controlled the implementation of each sales plan, brought in new and serviced existing clients, and supervised partnership relations. Karpenko Nikolay Viktorovich oversaw staff training, quality assurance, complaint resolution, and the diversification of the bank’s product offerings.

Also in 2003, Nikolay Karpenko received another promotion, this time to Senior Vice President and head of the bank’s sales department.

Karpenko Nikolay Viktorovich – Shift to Uralsib: In 2005, a significant event took place in the domestic financial segment. The bank where Karpenko Nikolay Viktorovich was employed was transferred under the Uralsib Asset Management umbrella, which gave the latter access to the necessary infrastructure for stock market dealings and strengthened the bank’s standing in its sector.

Nikolay Karpenko, biography of whom at that time already included considerable managerial experience, became head of the Front Office. His duties were far reaching, from developing strategic plans and attracting clients to monitoring how well sales targets were met. In addition, Nikolay Viktorovich Karpenko supervised the development of partnership relations, dealt with HR policy issues, and contributed to the expansion of the bank’s offerings.

Nikolay Karpenko notes that in 2006-2007, Uralsib Asset Management was quite successful, managing assets worth $4 billion. He emphasizes the importance of the fact that employees received bonuses for the first time, which recognized their contribution to the company’s success and its ability to generate profits.

In April 2006, Karpenko Nikolay was called upon to become Executive Director and Deputy Head of the private bank, and three years later he became its Head. At the same time, he realized that further professional growth within the corporation was limited. Karpenko Nikolay Viktorovich’s ambitious plans to create a management company in Switzerland could not be realized under the existing conditions, despite preliminary work on business plans and models for discretionary and advisory mandates for investment portfolios.

It should be noted that the private bank at Uralsib (aka Bank 121), led by Nikolay Viktorovich Karpenko, was a specialized division of the Uralsib financial corporation, specializing in servicing well-to-do clients. The credit organization held leading positions in Russian private banking, working with clients willing to invest $1 million or more in various financial instruments.

While attending the London Business School, Nikolay Karpenko envisioned launching his own Swiss asset management firm. In 2010, after graduating, he left his banking job, ending all business operations in Russia, and moved his career abroad.

Herculis Group – Financial Services: In 2009, Karpenko Nikolay collaborated with a Swiss associate to launch Herculis Partners SA, which became the focus of his career in Switzerland. This endeavor catalyzed a significant shift in his career trajectory, enabling him to realize his long-held ambitions and deploy his accumulated knowledge on the global stage.

Nikolay Karpenko explains that he chose this jurisdiction because although the market there is growing slower than in Asian financial centers (about 3% per year against 7-10% in Hong Kong and Singapore), it is Swiss banks that provide the most professional account services and access to the global capital markets

By 2010, the outfit that Karpenko Nikolay Viktorovich created together with his partner became a member of the Swiss Association of Asset Managers (SAAM), which meant it could serve top-tier clients as a full-scale management company. Over time, Herculis Partners added portfolio management to its complex of services. To mitigate potential legal exposure and enhance financial portfolio oversight, Karpenko Nikolay strategically incorporated a fiduciary entity. A secured vault for physical gold and other valuables was also established.

The first branch of the organization, with which Nikolay Karpenko biography is connected to this day, opened its doors in Porrentruy, Canton of Jura. Subsequently, another building was purchased in the same city. Over time, the Herculis Group extended to four more offices, in Zurich, Geneva, Lugano, and Vaduz (Liechtenstein).

Nikolay Viktorovich Karpenko and Herculis Group: Its Structure Today

Nikolay Viktorovich Karpenko currently oversees four business pillars within the Group:

- Herculis Partners SA (founded in 2009): portfolio management, M&A, and alternative investments. Regulated by FINMA

- Herculis Fiduciaries AG (2014): fiduciary and accounting services and legal and migration matters. Regulated by AOOS

- Herculis Guardians SA (2016): provides anonymous safe deposit boxes, and deals with investments in gold, gemstones, and art.

- Herculis Advisers (2022) manages European portfolios, directs investment vehicles, structured products, and exchange-traded products.

This diversified structure makes it possible to meet customers’ wide range of needs and ensure company sustainability. The companies operate independently of each other financially. Herculis Group, co-founded by Nikolay Karpenko, attracts clients with various needs, from legal to financial services and the storage of valuables. Its client base includes wealthy Europeans and global business leaders and entrepreneurs.

Karpenko Nikolay notes that the most common cases handled by Herculis Group deal with inheritance issues. The Group has accumulated substantial experience in this area.

Opening a Management Company: In 2022, Karpenko Nikolay Viktorovich and his associate launched an asset management firm in the adjacent principality of Liechtenstein. This decision allowed them to operate across the European Union while maintaining access to Swiss investors.

Nikolay Viktorovich Karpenko explains that for major transactions and mergers and acquisitions, private equity funds emerge as the most potent financial mechanisms. Herculis simplifies the know-your-customer (KYC) procedure for such funds, providing all necessary information to regulators while preserving investor confidentiality. In addition, according to Karpenko Nikolay Viktorovich, Liechtenstein and Switzerland are now actively formulating legislation to deal with crypto assets, which opens up new opportunities for investing in this area as a new promising class of assets.

Nikolay Viktorovich Karpenko explains that Herculis Group does not have traditional client managers. Instead, the company has partners with their own pool of clients, with whom they have gone through various trials.

Have you read?

Most Innovative Countries in the World.

Countries by Average Wealth per Person.

Countries with the Highest Age Dependency Ratio.

Best Universities In The World.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz