Adapting to Economic Shifts: Building Resilient Financial Foundations

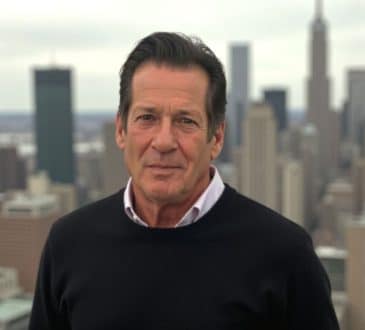

Imagine a future where financial institutions are as agile as tech startups, as innovative as Silicon Valley giants, and as customer-centric as top-tier retail brands. This concept would be a transformational shift for the financial sector. Venture capitalist Hilt Tatum IV, CEO of Dale Ventures Group of Companies, champions this vision.

In an economy and industry where the only constants are change, Tatum’s philosophy aligns with strong ideals for a new era in finance, where innovation, agility, and customer engagement are standard and essential practices.

According to Tatum, such an undertaking would reshape the financial landscape, merging technological advancements with a heightened emphasis on customer relationships. His strategies and insights offer a compelling narrative for the future of finance.

In this article, we examine Tatum’s innovative methodologies and their impact on the industry, highlighting how they are forging new pathways and setting new standards in financial services.

The Pillars of Tatum’s Vision

Tatum’s approach to revolutionizing the financial sector is built on three foundational pillars:

- Innovation and Agility

- Technology Integration

- Customer-Centric Models

These pillars define his vision and set a new benchmark for excellence in the industry.

Innovation and Agility

In an industry where financial giants move cautiously, Tatum advocates for a seismic shift toward a more agile and innovative spirit like those of tech startups.

“Financial institutions must embrace a startup mindset to thrive,” Tatum said. “This means adopting a culture of continuous innovation, where rapid prototyping, iterative development, and a willingness to take calculated risks become the norm.”

If more banks and financial services started adopting flexible operational models, Tatum believes it would allow them to respond quicker to market changes and emerging customer needs.

Technology Integration

According to Tatum, integrating advanced technologies like blockchain, artificial intelligence (AI), and big data isn’t just a futuristic concept; it’s a present-day necessity.

“Blockchain’s potential to enhance transparency and efficiency in financial transactions is monumental,” he said. “AI and big data are key drivers for personalized services and predictive analytics, offering deeper insights into customer behavior and preferences.”

Tatum’s vision includes a financial sector that leverages these technologies and develops new applications.

Customer-Centric Models

At the core of Tatum’s vision is a shift towards customer-centric financial services.

Moving beyond traditional transaction-based models, he emphasizes the importance of greater personalization in banking.

“Our goal should be to understand and anticipate the unique financial needs of each customer,” Tatum said. “This means financial institutions need to understand customer journeys better.”

To do so, they must leverage technology to deliver tailored financial products and services that align with individual customer profiles and life stages.

Embracing Technological Disruption

The advent of technologies like blockchain, AI, and advanced data analytics has already changed the financial world.

Blockchain, for instance, is breaking new ground regarding transaction security and transparency. Tatum regards blockchain as “a cornerstone for building trust and efficiency in financial transactions.”

Similarly, AI is revolutionizing everything from customer service (with AI-driven chatbots and personalized financial advice) to risk management and fraud detection.

Big Data

The role of big data—large and complex data sets that cannot be easily managed, processed, or analyzed using traditional data processing tools—in finance is another area where Tatum IV’s vision is discerning.

“Big data allows us to turn information into insights and insights into tailored financial solutions,” Tatum said. “Financial institutions have started using big data to understand customer behaviors and preferences better, enabling them to offer more personalized services and anticipate market trends.”

Fintech

Fintech startups, often seen as disruptors, are vital catalysts for innovation in the sector.

Tatum advocates for a more collaborative approach where traditional banks and fintechs work closely to create a more robust financial system.

“The synergy between established financial institutions and fintech startups can lead to a more inclusive and innovative financial ecosystem,” he suggests.

Cybersecurity

With the increased digitization of financial services, cybersecurity is a primary concern.

Tatum emphasizes the importance of implementing robust cybersecurity measures to protect institutions and their clients from hackers and scammers.

“Protecting customer data and financial assets in the digital realm is as vital as safeguarding physical vaults,” he said.

The Regulatory Landscape

The dynamic interplay between innovation and regulation in the financial sector is a complex yet crucial aspect that investor Hilt Tatum IV addresses with insightful precision.

“Navigating the regulatory landscape is as important as innovating,” he said. “There’s a delicate balance between pushing boundaries in finance and adhering to regulatory standards.”

Regulatory Challenges

Tatum acknowledges that one of the significant hurdles in financial innovation is the intricate web of regulations.

“Regulatory compliance is not just a legal obligation; it’s the framework from which innovation must operate,” he said.

His perspective sheds light on the importance of understanding and respecting the regulatory environment as a foundational step toward sustainable innovation in finance.

Innovating within Boundaries

Innovating wisely within regulatory boundaries is the key to success.

Tatum advocates for a proactive approach to regulations, where financial institutions engage with regulators and policymakers.

“Creating a dialogue with regulators is essential for shaping a conducive environment for financial innovation,” Tatum said. “This approach ensures compliance and paves the way for regulations that can adapt to and support emerging financial technologies and business models.”

Adapting to Regulatory Technology (RegTech)

Another strategy Tatum sees as beneficial is adopting Regulatory Technology or RegTech.

“RegTech solutions can transform the burden of compliance into an opportunity for efficiency and insight,” he suggests. “By leveraging technologies like AI and blockchain, financial institutions can automate and streamline compliance processes, reducing operational risks and increasing efficiency.”

Collaboration for Progressive Regulation

Tatum envisions a future where collaboration between financial institutions, fintech startups, and regulators leads to the development of more progressive regulatory frameworks.

This collaboration can facilitate the introduction of innovative financial products and services while ensuring consumer protection and market integrity.

Building Personalized Customer Relationships

The cornerstone of modern finance is not merely technology or innovation but the depth of customer relationships.

“Understanding and anticipating customer needs is the key to the future of financial services,” Tatum said, highlighting the critical role of personalization in the industry.

The Shift to Personalization

According to Tatum, there is a shift from a transactional to a relational approach in banking and financial services.

He believes the future of finance lies in institutions’ ability to offer services and personalized experiences.

“It’s about creating value that resonates on an individual level,” he notes. “This means going beyond traditional one-size-fits-all products to offering solutions tailored to each customer’s unique financial journeys and life stages.”

Leveraging Technology for Customer Insights

One of the ways Tatum suggests enhancing customer engagement is through the strategic use of technology.

Financial institutions can gain insight into customer behaviors and preferences by harnessing data analytics and AI.

“Technology should enable us to craft services and products that align closely with what our customers genuinely need,” Tatum said. “This approach allows for the design of more intuitive and responsive financial products.”

Enhancing Customer Experience through Omnichannel Strategies

Tatum also advocates for omnichannel strategies to improve customer experience.

This involves creating a consistent and integrated experience for customers, whether they are engaging online, through mobile apps, or in physical branches.

“Customers expect seamless interactions across all platforms,” Tatum said. “A cohesive focus on multiple touchpoints ensures that customers receive the same personalized service and support regardless of how they interact with their financial institution.”

Building Trust through Transparency and Communication

Trust and transparency are essential elements in fostering strong customer relationships.

“Clients value transparency as much as they value solutions,” Tatum said. “Financial institutions that communicate openly about their processes, fees, and decision-making are more likely to gain customer trust and loyalty.”

Preparing for a Dynamic Future

Tatum’s forward-thinking vision offers a clear blueprint for financial institutions in a rapidly evolving industry.

His emphasis on agility, innovation, and a customer-centric mindset carves a transformative path forward. Adopting his approach can benefit institutions looking toward future success.

It involves a deep commitment to technological innovation, a shift towards personalized customer engagement, and adaptability in regulatory environments.

“Our future in finance hinges on being proactive, customer-focused, and technologically adept,” Tatum said. “Aligning with these principles enables institutions to navigate the present market successfully and positions them to thrive in the future of financial services.”

Have you read?

Ranked: The most and least expensive US states to retire in 2024.

The Most (And Least) US States For A Family Of Four, 2024.

The Most (And Least) Costly US States For Single Workers, 2024.

These Are The 100 Best U.S. Cities for First-Time Homebuyers for 2024.

American News Brands For CEOs: Top 20 news websites in the United States for 2024.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz