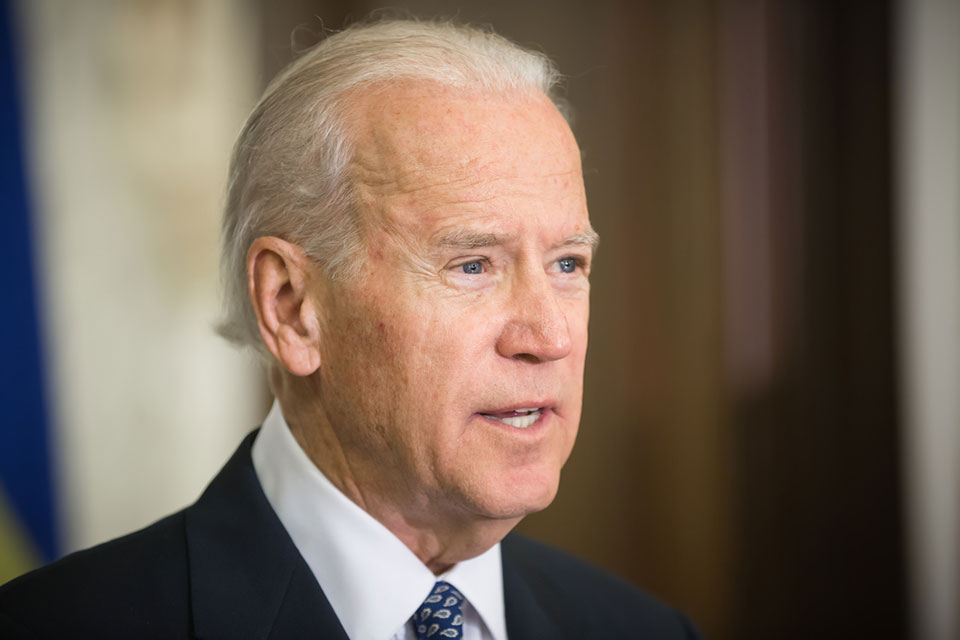

Biden proposed an array of tax hikes for the ultra-rich

US President Joe Biden has recently proposed a new tax plan that would require individuals with a net worth of over $100 million to pay a minimum of 25% in taxes. This tax plan is projected to generate an estimated $500 billion in revenue over the next decade. In addition to this, President Biden is also planning to increase the tax rate on capital gains, such as stock sales, for individuals who earn more than $400,000 to 39.6%.percent.

The budget proposal aims to address executive pay. The White House suggests that corporate deductions should be denied for all compensation related to employees who earn over $1 million. This is an extension of the existing tax laws, which currently only deny such deductions for top executives.

Additionally, Biden has suggested raising the minimum tax rate for large corporations to 21%, an increase from the current global minimum rate of 15%. Tax rule, which was passed by Democrats in 2022, applies to corporations that report an annual income of more than $1 billion to shareholders on their financial statements but use deductions, credits, and other preferential tax treatments to reduce their effective tax rates well below the statutory 21 percent.

President Biden is proposing several tax reforms to address income inequality and increase government revenue. One of the proposals is a 25% minimum tax rate on households worth over $100 million, affecting only around 0.01% of Americans. Another proposal is to quadruple the existing 1% levy on corporate stock buybacks to 4%, which would reduce the tax differential between share repurchases and dividends. Additionally, the budget proposal calls for increasing the corporate tax rate to 28% from 21% and increasing the taxes on U.S. companies’ foreign earnings to 21% from 10.5%. Finally, the President is also pushing to increase the Medicare tax rate paid by wealthy Americans. Altogether, the tax hikes would reduce the federal deficit by about $3 trillion.

The U.S. debt stands at a staggering $34 trillion and is on pace to grow an additional $20 trillion by 2033. Over a roughly 30-year period from 1992 to 2020, the wealthiest 400 families in the U.S. paid an average inflation-adjusted income tax rate of 12%.

Have you read?

The world’s top 50 most popular luxury brands for 2023.

Richest Tennis Players In The World.

Richest Actors In The World.

The World’s Richest People (Top Billionaires, 2023).

Revealed: Countries With The Best Health Care Systems, 2023.

Top Most Valuable Coins For Collectors Across The Globe.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz