These Are The Biggest Bankruptcies in American History

Calculated risks are an unavoidable aspect of running a business, regardless of whether you are starting a small coffee shop or heading a large corporation. Taking significant risks can lead to substantial rewards, but sometimes, as evidenced by the examples of companies discussed below, such risk-taking can also result in significant failures and some of the largest bankruptcies in U.S. history.

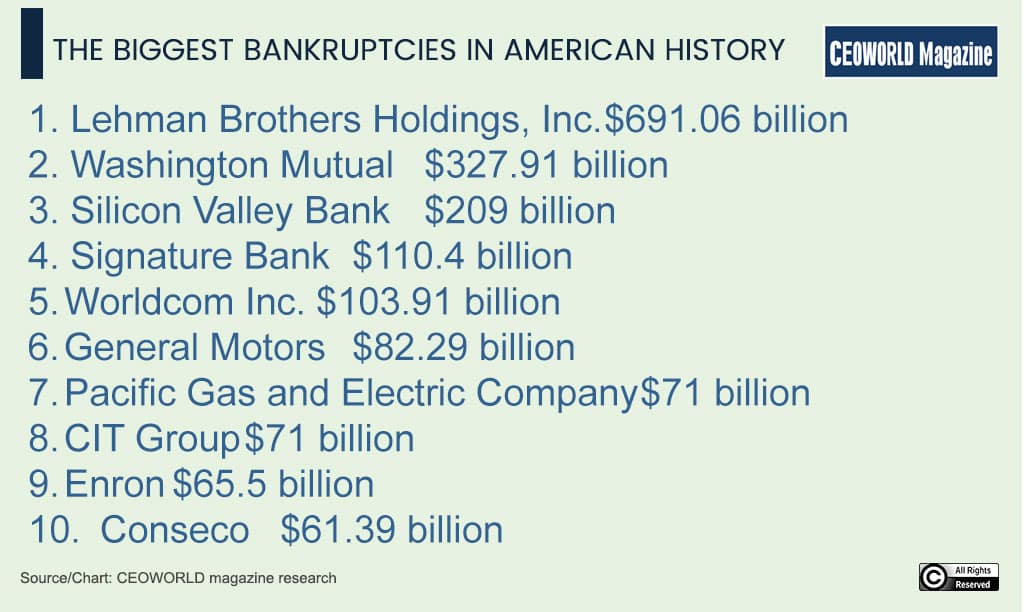

In this report, we will be taking a look at the biggest bankruptcies in American history. As of February 2024, the largest all-time bankruptcy in the United States remained Lehman Brothers, a global financial services firm. Prior to its bankruptcy, the New York-based investment bank had $691.06 billion in assets ($613 billion in liabilities) and was the fourth-largest investment bank in the U.S.

Lehman Brothers’ bankruptcy was mainly due to their significant involvement in the subprime mortgage crisis, which led to their exposure to a considerable amount of worthless assets when the housing market collapsed. The collapse of Lehman Brothers created a ripple effect globally, worsened the financial crisis of 2008, and resulted in the most severe global recession since the Great Depression. Below is a list of the biggest bankruptcies in U.S. history:

Biggest Bankruptcies in American History

| Rank | Company | Total assets pre-bankruptcy (U.S. dollars) | Bankruptcy date |

|---|---|---|---|

| 1 | Lehman Brothers Holdings, Inc. | $691.06 billion | 15-Sep-08 |

| 2 | Washington Mutual | $327.91 billion | 26-Sep-08 |

| 3 | Silicon Valley Bank | $209 billion | 10-Mar-23 |

| 4 | Signature Bank | $110.4 billion | 12-Mar-23 |

| 5 | Worldcom Inc. | $103.91 billion | 2-Jul-02 |

| 6 | General Motors | $82.29 billion | 1-Jun-09 |

| 7 | Pacific Gas and Electric Company | $71 billion | 14-Jan-19 |

| 8 | CIT Group | $71 billion | 1-Nov-09 |

| 9 | Enron | $65.5 billion | 2-Dec-01 |

| 10 | Conseco | $61.39 billion | 17-Dec-02 |

| 11 | MF Global | $41 billion | 31-Oct-11 |

| 12 | Chrysler | $39.3 billion | 30-Apr-09 |

| 13 | Thornburg Mortgage | $36.52 billion | 5-Jan-09 |

| 14 | Pacific Gas and Electric Company | $36.15 billion | 6-Apr-01 |

| 15 | Texaco | $34.94 billion | 4-Dec-87 |

| 16 | Financial Corporation of America (American Savings and Loan Association) | $33.86 billion | 9-Sep-88 |

| 17 | Refco | $33.33 billion | 17-Oct-05 |

| 18 | IndyMac Bancorp | $32.73 billion | 31-Jul-08 |

| 19 | Global Crossing | $30.19 billion | 28-Jan-02 |

| 20 | Bank of New England | $29.77 billion | 1-Jul-91 |

| 21 | General Growth Properties | $29.56 billion | 16-Apr-09 |

| 22 | Lyondell Chemical | $27.39 billion | 1-Jun-09 |

| 23 | Calpine | $27.21 billion | 20-Dec-05 |

Have you read?

20 US Cities that Offer the Best Value for your Social Security Income.

Revealed: These are the 25 Modern Inventions we really Don’t Use Anymore.

Richest Billionaire Investors In The World, 2024.

Ranked: Canada’s top 100 highest-paid CEOs, 2024.

Revealed: These Are The Richest People in Africa, 2024.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz