Risk management in shipbuilding: expert Rustam Dosaev on how to minimize potential threats

The article highlights the problems and challenges faced by shipping organizations in the process of risk management, emphasizes the importance of modernization and development of an effective management system. The author Rustam Dosaev General Director of Elcom LLC analyzes existing practices and tools, offers recommendations on how to minimize potential threats and increase the level of safety and reliability in the shipbuilding sector.

Relevance of risk management in the shipbuilding sector

Shipbuilding is a complex area of industry, it is closely connected with mechanical engineering, power engineering, design bureaus, electronics, instrumentation and production automation. For successful realization of projects it is necessary to unite efforts of specialists from different fields.

The characteristics of manufacturing of any water vehicle are the following features:

- high capital costs and the long-term nature of the process with the requirement for large investments, often using credit resources with subsequent repayment after construction is completed and operation begins;

- assessment of compliance with technical requirements and analysis of the vessel’s operating conditions;

- resource assessment, dependence on the availability of future orders and the region of operation, and customer convenience;

- the need for sufficient contractors to supply the ship’s equipment and their impact on the vessel’s production schedule;

- dependence on the shipyard, including technical equipment, specialization, experience in building similar vessels, reputation, financial position, spare capacity, contractual obligations on other projects and availability of a sufficient number of qualified specialists.

The more complex a shipbuilding object is, the more risks arise in the process of its production, transportation, operation, the more thoroughly the basic principles of dealing with potential hazards should be developed and implemented. These hazards can range from natural disasters (hurricanes, tsunamis and storms) to those specific to maritime transportation, such as piracy and terrorism.

Serious problems often arise during ship operation, such as fire, explosion followed by sinking, towing a ship to port for repairs, hull leaks due to wear and tear, collisions with another ship, ice, grounding, and loss of ship due to warfare. Recognizing the variety of hazards to which ships are exposed is a critical aspect to ensure successful voyages. Quality performance requires the implementation of a comprehensive risk management system at all stages of the project life cycle, from design through construction and commissioning.

Risk management techniques and ways to minimize risk

Risk management techniques play a key role in ensuring the safety and sustainability of shipbuilding projects. To achieve this goal, it is important to use a systematic approach that includes identifying, evaluating and minimizing potential threats.

The first stage of control begins with the identification of all potential threats that can adversely affect the organization’s operations – this is a fundamental method to identify situations that have a negative impact on the business processes of the enterprise. At this stage, it is important to conduct continuous, ongoing monitoring and documentation to keep information on the decisions made and the results of actions, creating a database for further analysis and improvement.

Next, potential threats are assessed: the probability of their occurrence is determined and the degree of impact is analyzed, as well as the amount of possible losses for the company. Based on the data obtained, a methodological basis for risk management is developed. The main task of this stage is to select a strategy and management methods, as well as to identify ways to minimize risk. After that, a direct impact on threats is made in order to reduce their impact to an acceptable level. Within the framework of this task, a set of measures aimed at reducing risks and increasing the stability of the shipbuilding project is implemented.

At the stage of design and construction the project is analyzed on the basis of design documentation expertise.

This process includes the following areas:

- analyzing the technical specification for the ship design;

- study of resources and availability for implementation;

- analyzing potential shipyards for the construction of the ship, estimating the total cost of implementation;

- planning the composition of the core crew;

- developing financing mechanisms;

- determining implementation timelines and selecting contractors;

- selection of necessary shipboard equipment;

- preparing and holding a tender for construction

Selection of methods, means and actions for realization of the planned tasks is carried out according to the cost/efficiency principle. In order to minimize the losses, prevention, strategic planning, anticipation of “bottlenecks” in the production cycle are performed. Then forecasting of weakening of the enterprise position in a certain market segment, early identification of factors and development of a set of compensating measures, planning of use and connection of reserves is carried out. On the basis of the assessment of the company’s condition, the external environment is projected, competitors’ actions, changes in the market segments are foreseen, socio-economic and regulatory environment is monitored.

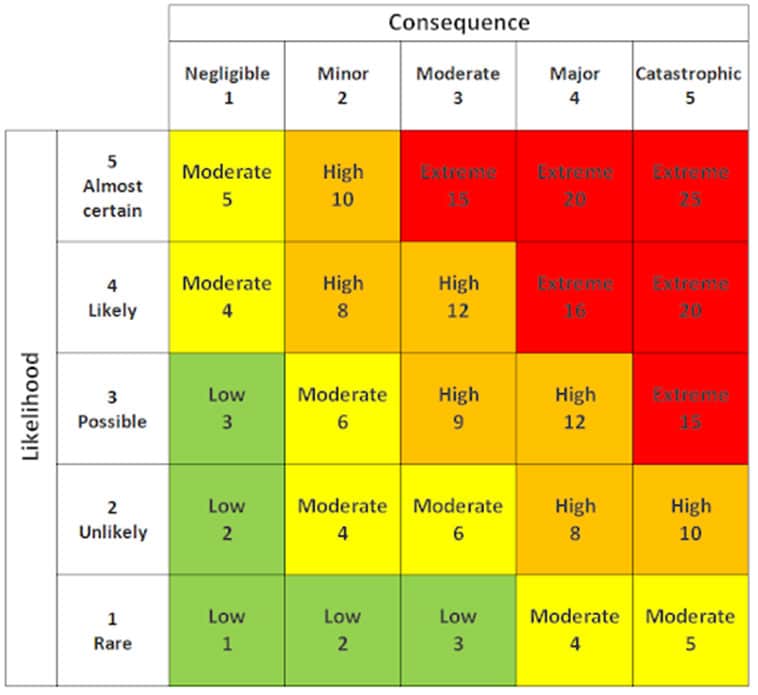

Security in shipbuilding is closely connected with the absence of threats. Absolutely risk-free activity does not exist, so actions are considered correct if threat levels remain within acceptable limits. Working in the industry, manufacturers must be able to assess the hazards to the ship in order to carry out the assessment themselves. This is done using a special matrix that highlights the consequences and probability of risk. The safety management system identifies additional controls and sets their application levels, ensuring robust protection at all stages of the project.

Based on the expertise described above, a register of the main threats is created for each stage of implementation. Systematization with a description of possible problems takes place with their subsequent division into insurable and non-insurable. For the cases that can be insured, a policy program is worked out, while for those that cannot be transferred to insurance companies, measures to control and prevent them are created.

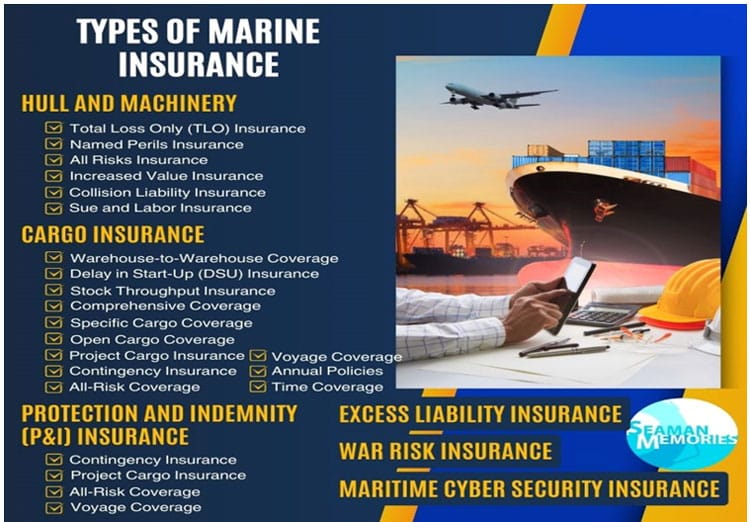

Insurance in the marine business is represented in several lines of business:

1. insurance of the hull and machinery of ships against various kinds of damage and total destruction;

2. financial protection of the shipowner’s liability.

There is a division of product offerings of providers of such services into subtypes based on customer needs, e.g. Total Loss Only (TLO) protection – provides coverage for total loss of the insured ship, but not partial loss or damage.

Specific perils insurance – covers only those risks or perils listed in the policy. For losses that are not caused by one of the named perils, the policy does not provide coverage.

Shipowner’s liability covers a variety of duties ranging from the safety of the cargo being carried to compensation for environmental damage. These aspects are firmly embedded in the insurance context, where both the vessels themselves and their contents are protected. In the current practice of insurance companies, there has been a noticeable increase in interest in innovative services, including protection against financial risks and losses arising from business downtime.

Risk transfer in this sphere can be realized through different types of contracts. For example, in the case of a vessel lease, the owner assumes a certain part of obligations, including responsibility for storage and transportation of cargo. Transportation companies, in turn, assume the risks associated with the transportation and storage of cargo. Maintenance contracts also play an important role: they specify that the maintenance organization assumes responsibility for possible repairs.

A surety contract is a special case involving three parties: the surety, the principal and the creditor. In this case, the guarantor guarantees the lender that the supervisor will fulfill his or her financial obligations. This type of contract partially divides the liability between the surety and the manager, leaving the manager with a portion of the obligations. Such measures help to better manage risk in the shipping industry and ensure more sustainable business operations.

Ultimately, effective risk management and innovative approaches in insurance not only ensure the safety and sustainability of shipbuilding projects, but also contribute to a more robust functioning of the entire industry.

Conclusion

In the process of analyzing risk management in shipping organizations, it becomes obvious that knowledge about risk management both in shipbuilding enterprises and insurance companies is insufficient. As a rule, only certain aspects of the risk management system are utilized, and this is not always systematic. More often than not, the focus is only on insurance, without considering that an insurance policy may not be the most cost-effective tool in a number of situations such as threats of terrorist attacks, hostilities or bankruptcy. This highlights the need to modernize, structure and implement a more effective risk management system in shipping companies.

Have you read?

Countries: Women in the workforce. Countries: Personal space. World’s Most (And Least) Religious Countries. Best Countries to Invest In Travel, Tourism, and Hospitality. Most Forested Countries In The World.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz