Alexander Studhalter’s view of the Swiss property market 2022

When we talk about profitability, growth, and stability all in one, investing in property is the best option you can go for. And it is a matter of fact that investing in real estate can help you generate some promising returns.

When we talk about the Swiss real estate market in 2022, the figures are much more promising compared to the rest of the world. Entrepreneur Alexander Studhalter whose focus is Corporate and real estate investments will shed light on the current situation in a more in-depth way.

Did the pandemic impact the real estate business?

When we discuss the real estate market, it seems to keep getting better. Nine out of ten real estate investors still consider Switzerland an attractive location in 2022. It was the strong Swiss franc that kept inflation at its bay.

As if we compared the statistics to other countries like France, the United Kingdom, and even Germany. The purchasing power has fallen dramatically between 4% to 7.5%.

The office sector, however, is affected, though the impact isn’t severe. The modern spaces located in the city center are still working well for the real estate market. Especially the working areas that meet the increasingly essential criteria and the latest environmental standards.

Office Working Against Remote Working in Switzerland. And What’s The Difference Between EOR And ANobAG?

Unlike the rest of the world, Switzerland was different in carrying out everything. Since the commute is just 30 minutes each way, it didn’t stop employees from coming to the office.

While the firms in Switzerland tend to have workstations for their employees even when they work remotely part-time, the pandemic stayed with us longer than expected with all the new variants. Thus, the average area per employee also increased, making the real estate market a fantastic investment opportunity.

The employer on record is where the worker puts on conditions with the client company, including the time and pay rate. It is usually implemented when the client’s company is based in Switzerland.

Once that is all agreed, the client’s company leases the worker in a process called “labor leasing” under a work status of EOR. While on the other side, ANobAG is where a foreign-based company directly hires a worker.

The worker must pay off all the social security contributions independently. The worker also has to get themselves registered at the local commune where they live with a valid work contract.

When the approval is granted, the worker must set up all social payments and statutory insurance.

Retail suffers due to online shopping in Switzerland

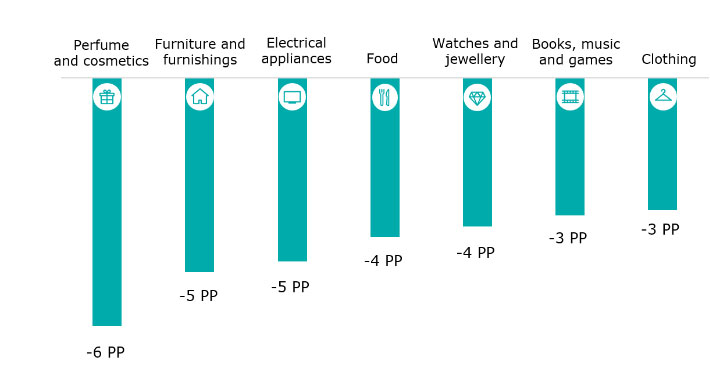

The only sector that is at a pure loss is the retail sector. There’s a straight 5% decrease in in-store shopping. Though some retail sectors were less damaged, they all had to bear the loss.

Due to this uncertainty, retailers must make more significant efforts to integrate online and in-person shopping. The chart below shows the sharp decline.

It is predicted that in 2022, there will be a decline of 2.1% in the prices of retail space. It clearly shows that a significant fall in revenue is inevitable. Though when it comes to modern shopping centers, they are still up and functioning.

On the other hand, having a smart strategy is the best option. Elderly people won’t visit shops until new safety measures are introduced. Before the pandemic, people loved shopping in stores, but things were not quite the same after the pandemic.

Sooner or later, most people will shift online due to their convenience, and retail will suffer again.

Alexander Studhalter on why Switzerland’s housing market is gradually stabilizing

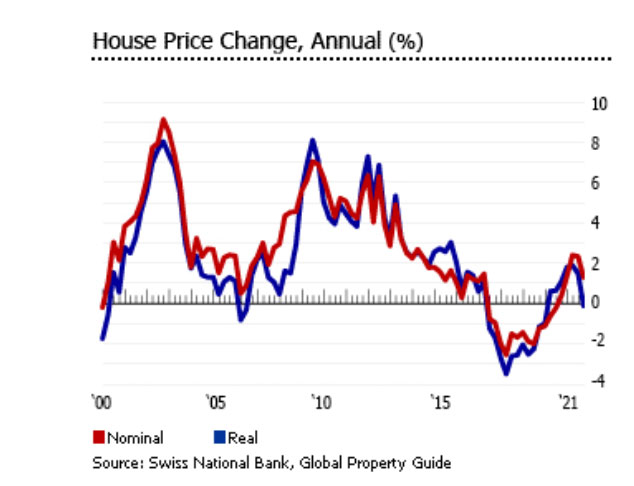

Studhalter explains that in terms of real estate, Switzerland is known for having a highly regulated and complex marketplace. Nevertheless, the housing sector is set to skyrocket in 2022. As the chart shows, the value is increasing even after the pandemic and will eventually come to the point of stabilization.

For the owner-occupied apartment, the price range is expected to have an average hike of 2.5%. On the other hand, single-family houses are expected to rise by 3%.

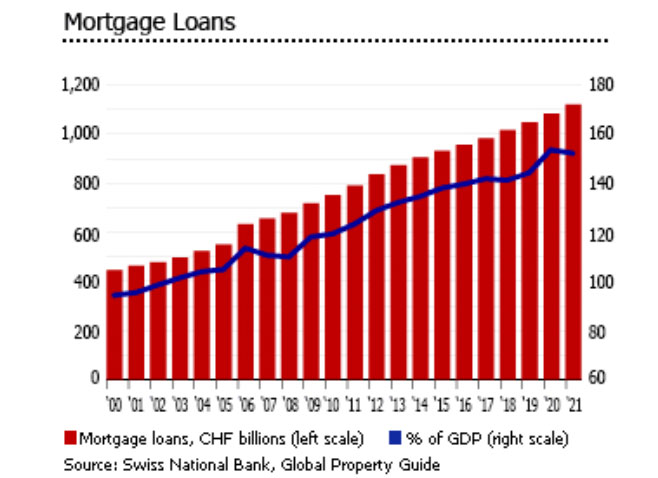

Though a shortage of supply will still dominate the markets as the mortgage market was around 152% of GDP last year, which was higher than 119% in 2010. At the same time, the mortgage amount increased by 3.4% to more than CHF 1.12 trillion.

For the domestic, the mortgage loan increased by 3.3% to CHF 1.11 trillion. At the same time, foreign mortgages rose by 6.4% to CHF 11.3 billion.

Though the mortgage loans would have increased for everybody by international standards, they are still low. The volumes of housing loans have increased because the federal council imposed the countercyclical capital buffer.

This framework ensured that the domestic institution CCyB rates match the foreign institution rate whenever lending occurs across international borders. This buffer is set at 2.5% risk-free exposures secured by the residential property.

Studhalter’s concluding thoughts

Factually speaking, Studhalter says, the pandemic had its impact on different sectors all across the globe. But when it comes to the real estate market in Switzerland, the situation is quite different. As the market is still investable, and due to the low-interest-rate environment that the market offers, it can undoubtedly generate stunning returns.

Have you read?

Best Business Schools In The World For 2022.

Best Fashion Schools In The World For 2022.

Best Hospitality And Hotel Management Schools In The World For 2022.

Best Medical Schools In The World For 2022.

The World’s Best Universities For Doctor of Business Administration (DBA), 2022.

Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2024 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz