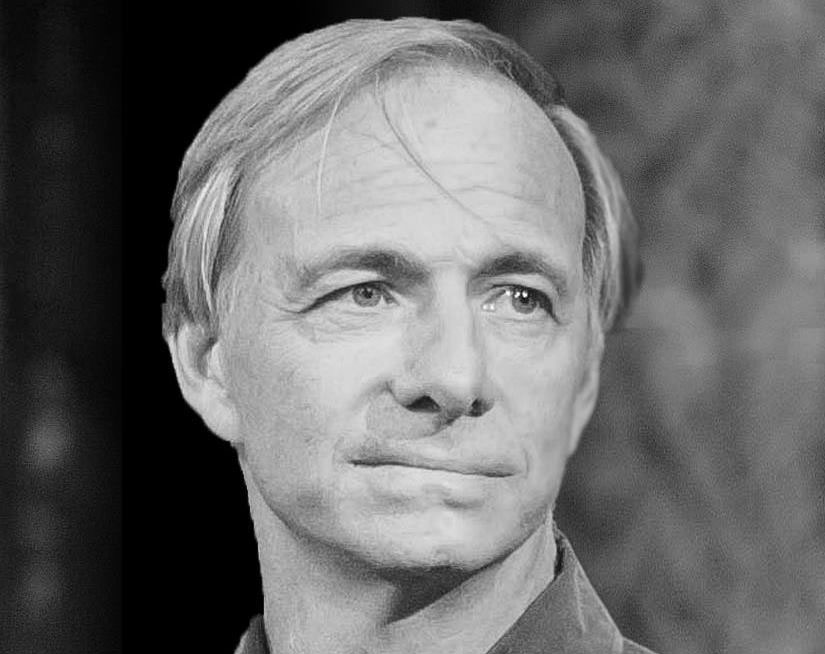

Ray Dalio’s best investment tips to start the new year

The new year is here and both seasoned and potential investors are looking into 2022 with a due sense of cautious excitement, dusting off the advice of the legacy investing greats: Warren Buffet, Carl Icahn, George Soros, Bill Ackman, Bill Ackman, Jim Simons, Ken Griffin, Steve Cohen, David Tepper, Israel Englander, Chase Coleman, David Shaw, and of course, Ray Dalio.

Apart from wearing a name tag to work every day with the word “Ray” in capital letters, Dalio is the source of some of the most valuable knowledge in investing. The American businessman founded Bridgewater Associates in the 1970s, one of the largest funds in the world —handling about 140,000 million dollars in investments.

In addition to his trading acumen, Dalio’s story is that of a born entrepreneur who was raised in a middle-class New York neighbourhood and built his huge fortune from scratch.

Since then, Dalio has dedicated himself to building an investment portfolio, and on his way to success, he has shared his wisdom with others. These are his best investment tips to start the new year.

The past does not guarantee the future

For Ray Dalio, thinking that growth stocks are better than others is a mistake, as the price of any investment is based on its potential to create value in the future. When investors get excited about a company, share prices can go up regardless of any improvement in the firm’s business.

During the famous dot-com bubble in the early 2000s, investors went too eager about the internet, and shares of technology companies rose. Such growth made many people think they could get rich by investing in technology.

However, the bubble burst in 2000 when it became clear that many of these companies did not have profitable and sustainable businesses over time. This is why Dalio advises being cautious as excessive and accelerated returns can indicate that the stocks are overvalued —and therefore, do not represent a big opportunity.

Meditating is a great way to success

One of the peculiarities that set Dalio apart from most successful investors is his spiritual side. He claims to find all the answers to his questions through meditation, and told CNBC: “Transcendental Meditation has probably been the single most important reason for whatever success I’ve had.”

In 1982, at the age of 33, Dalio lost all his money in the markets. Thanks to transcendental meditation he was able to rely on reflection and contemplation to rebuild his confidence and, consequently, his business.

His daily meditation routine helped him go from bankruptcy to being one of the richest men in the world. So, he is a huge advocate of not following your sentiments when it comes to investing: “Not being controlled by an emotion helps to see things at a higher level.”

How to invest money? Do it with a long-term vision

For those who are deeply involved in investing and seek real positive returns, the philosophy of buying and selling all the time is not sustainable. For Dalio, understanding the historical patterns of the economy and the stock market are crucial.

“Know how to buy when everyone else wants to sell, and how to sell when everyone else wants to buy,” he once assured —This sounds like the philosophy of another great investor, Warren Buffett.

During the 2008 crisis, the shares of hundreds of companies plunged to record lows. Back then, many investors sold their shares at a very low value. However, the markets later recovered and entered a prosperous bull cycle and cautious investors who took the risk of pursuing their strategy recovered their value.

“The biggest mistake most people make is to judge what will be good by what has been good lately,” he says. “So if a market has gone up a lot, they think that’s a good market rather than it’s more expensive. And when it has dropped a lot in recent years, they think: ‘That’s a bad market and I don’t want any of that.’”

Diversification is essential for good investment

According to Dalio, diversification is the key to success, since it allows the risk to be spread over various assets. A diversified portfolio allows the investor to reduce the impact of a fall of a specific stock while it offers protection against market volatility.

Along these lines, Ray Dalio recommends diversifying across industries, asset classes, and even currencies. Although it is possible to do it individually, it may be more advisable to do it in several mutual funds to reduce commission costs and access implicit diversification.

In an interview with CNBC, Dalio said that an ideally diversified portfolio could consist of 30% stocks, 40% long-term U.S. bonds, 15% intermediate U.S. bonds, 7.5% gold, and 7.5% raw materials. Dalio assures that this combination is destined to work well under any conditions, including volatile times such as today.

Written by Jacob Wolinsky.

Have you read?

# Best Citizenship and Residency by Investment Programs.

# Richest People in New York and Their Net Worth, 2022.

# The World’s Top 10 CEOs Over 70 Years Old.

# These are the world’s most and least powerful passports, 2022.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz