Neither EVA® nor CVA®, but NVA

Ottosson & Weissenrieder published ‘CVA, Cash Value Added – A new method for measuring financial performance’, re SSRN_ID_58436. It was followed by Weissenrieder, re SSRN_ID_156288, on the question ‘Economic Value Added or Cash Value Added?’

Shareholders have financial requirements on management’s strategic decisions, that create value. Despite the importance of non-financial performance measurements such as the Balanced Scorecard, an accurate method of investment evaluation is needed, in order to make better strategic choices.

With reference to ‘Plato and the cave’, Ottosson & Weissenrieder introduce Operating Cash Flow Demand (OCFD) – with certain known characteristics – as a shadow on the wall of the cave. CVA then measures observable ‘real cash flows’ against the shadow, thus gaining knowledge about actual performance relative to ‘the shadow’. It should give a practical way to discuss ‘true returns’.

No more than a short comment on EVA® is given in this article. The subject matter is the CVA® concept. Can it stand the test? Apart from observing the reality outside the cave (that will always be more desirable), not even the shadow in itself can stand the test.

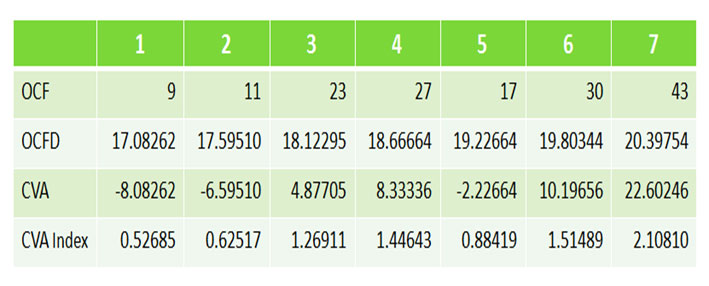

Value revolves around discounted cash flows, hence I agree with Ottosson & Weissenrieder since cash flow and time value of money are all-important to determine value, but there are other factors. An example given by Ottosson & Weissenrieder illustrates the CVA model in its basic form with one strategic investment. The amount of the investment is $ 100 million, creating value, and precisely that, what and how much, must be determined. The economic life cycle is estimated to be 11 years. Be aware of the fact that economic life cycles can be and should be calculated, not estimated. The strategic investment has in this case been running for 7 out of those 11 years. The historic inflation has been 3 % (each year) and the same inflation rate is assumed for the future. The (pre-tax) cost of capital (WACC) is 15 %. The OCFD is evenly distributed (in real terms) over the estimated life of the strategic investment. The CVA shows in which periods the strategic investment returns more or less OCF compared to the investor’s capital cost, the OCFD. Putting 100 into a black box (a strategic investment) assuming 3 % general annual inflation rate (diminishing value of money), capital cost is 15 % each year, with OCFD is an annual annuity, which is growing at the rate of 3 % general annual inflation over an economic life cycle of (estimated) 11 years. The basic idea is a loan, the size of 100; interest rate (APR) 15 %, to be repaid in 11 years by variable annual annuities, increasing annually by 3 %.

The NPV of this series at 15 % must be equal to 100.

This is a geometrical progression i.e. a, a.r, a.r^2, a.r^3 etcetera,

with a = A / 1.15 and r = 1.03 /1.15 and 11 terms.

100 = [A / 1.15] · {(1.03 / 1.15)^11 -/- 1}/{(1.03 / 1.15) -/- 1}

It follows A = 17.082621…

The relevant data and most important results are:

The CVA® concept introduces a fixed financial requirement in real terms, the so-called Operating Cash Flow Demand (OCFD) i.e. the cash flow that is needed in order to end up with a Net Present Value of zero when the investment has reached its (estimated) economic life. OCFD exists by way of definition. Equal amounts (in real terms) each period is just a certain pattern. Demands happen to be quite often not a scientific affair. They will depend on a lot of things, namely the level of output, the results from alternative investments, the state of the general economy, the level of interest rates, and so on and so forth. It all ends up in what must be regarded as the NORMAL demand, for the time being, in this firm. OCFD is periodized in a certain way (apples) while OCF is the incoming cash flow in one specific time period, not periodized, let alone in that same way (oranges). OCF real money in the numerator and just an image of money is standing in the denominator of the periodical CVA Index (OCF/OCFD). What is the significance of both the CVA and CVA Indexes? Moreover, an estimated economic life cycle is the arbitrary data, that is used in calculating OCFD, truly no sound foundation.

The real discrete annual rate is 11.7 % (1.15/1.03 = 1.116504…). It applies 15 % yield annually for the investors. APR, Annual Percentage Rate i.e. 15 out of 100 money units each year. Of course this rate concerns the invested capital, precisely the amount and the course in time. Real rates never implicate the money that has already been refunded. One should regard the size, the changing size of each investment, explicitly. One expects to get 15 pieces of money at the end of year 1 whereas OCF year 1 is 9 so one gets 6 pieces of money less than strictly necessary. Starting with 100 plus 15 minus 9, it remains 106 money units. WACC 15 % APR over 106 is 15.9 and 106 plus 15.9 minus 11 (OCF in year 2) results in 110.9 i.e. the invested capital at the beginning of year 3. And so on and so forth. OCFD is periodized in a certain way. OCFD consequently is another quantity than OCF. Periodical CVA and periodical CVA Index are in an obscure area, ‘comparing’ apples to oranges. The CVA® concept ignores remaining (true) value i.e. the changing size of each investment. The ‘go/no go’ decision regarding the strategic investment in this case cannot be made without the (expected) data concerning the period from year 8 to and including year 11. We need to have at least a rough idea about the OCFs in those four years. At this very moment t = 7, we might know more than at the beginning. Indeed still four more years to go? The CVA® concept neglects substantialism. It does not meet reality. “If asset prices are going up in real terms this will over time be recorded as increased OCFD”, thus Ottosson’s counter-plea. That would be inaccurate thinking: first permitting a problem to develop and then making an adjustment, a correction. A truly good algorithm includes substantialism in all respects from the very beginning.

A short comment on EVA®, introduced by Stern Stewart & Co in 1991: EVA® is promising too much because it is based, yes indeed re-calculated, on rigid choices out of the capital maintenance concepts and the concepts of value. Before and after re-calculation, EVA® reports numbers for which there is no proof.

Neither EVA® nor CVA®, but NVA, Net Value Added. NVA (period) is the proven net profit in any given period, less demand; considering a particular investment in conjunction with the difference between tax and tax paid. The demand is that amount of profit, which is acceptable to managers and/or shareholders. Re free downloadable ‘Neither EVA® nor CVA®, but NVA’ http://ssrn.com/abstract=366561

For more than what is noted down in this article, re ‘Like EVA®, the CVA® Concept Cannot Stand the Test Either’ http://ssrn.com/abstract=378501

As said, it has to start with ‘the proven net profit in any given period’ and refer to https://ceoworld.biz/2020/06/15/period-profit-measurement-new-formula/

Written by Jan Jacobs.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz