The Snake In Paradise: Assessing The Economic Impact Of Coronavirus

China is affected by the coronavirus, it’s aggressive and causes concern around the world- a natural reaction is a sell-off in the stock markets, but in such a situation, too much risk is often priced in.

A lot can be thought and said about the virus outbreak in Wuhan, but of course, first would be sympathy for the people who are affected by the virus outbreak in one way or another. In this context, the considerations in the financial markets will very quickly feel like a cool contrast to the consequences for many of the people affected by the virus. In the financial markets, it is the cool rational considerations of the economic consequences of such a virus outbreak that applies- from China’s overall economy to a corporation in a country on the other side of the earth.

The impact of the virus also reminds us about how globalized the world is, as well as how big a market China itself has become, and the impact that the country can generate, even to the largest global companies.

The first comments from a number of companies have begun to tick in, with Apple’s CEO Tim Cook for just a couple of days ago saying that the production at the supplier Foxconn’s assembly plants is so far unaffected, but Apple cannot rule out an effect on earnings in the first quarter. This assessment is already outplayed by six provinces, including the important provinces Jiangsu and Guangdong, where many factories have been asked to prolong the New Year holiday with another week.

The car production in China is also directly affected, as Wuhan has, over the past three decades, developed into a car manufacturing hub. The Chinese car group Dongfeng is headquartered in Wuhan and foreign car brands such as Honda, PSA Group and General Motors have car productions in the area. The total car production in Wuhan and in the Hubei province represents six pct. of China’s annual car production.

The Hubei province has quite a few companies in the manufacturing sector, so I’m convinced that some Western companies are suddenly missing parts from suppliers based in the Hubei province.

Other examples from recent days are Starbucks, that has closed more than half of its 4,300 outlets in China, IKEA has closed its stores in the country, and British Airways and Lufthansa has canceled all flights to China for the next month. It is obvious that the outbreak of the virus already has direct consequences at the corporate level, and thus the impact spreads throughout all stock markets.

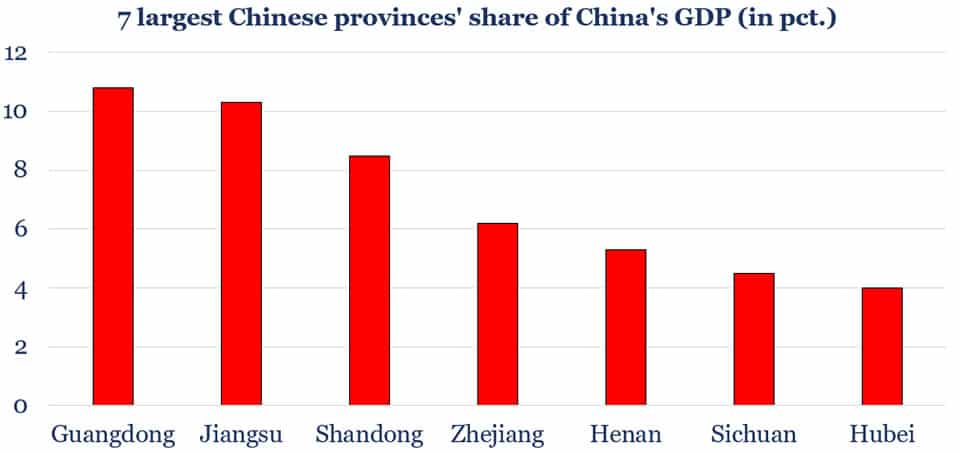

Based on data from 2018, Hubei represents 4 pct. of China’s overall economy (graphic 1) and the province’s GDP growth was at 6.6 pct. According to the latest estimates, the population of Wuhan is approximately 7.5 million, making it China’s sixth-largest city (graphic 2).

The current situation is not only that Wuhan is closed to inbound and outbound traffic, but so are a number of other cities in Hubei. In total, approximately 50 million people in the Hubei province alone, are affected by the coronavirus- understood in the way that they cannot move in and out of the cities where they live. These are quite significant measures to counteract the spread of the virus. If one imagines that this situation will continue for a while, or worsen, then it will certainly have an impact on Hubei’s economy, but also China’s economy as a whole.

I estimate that China’s economy is currently growing by six pct. per year and Hubei’s economic growth rate roughly follows China’s average. A serious situation in Hubei will probably mean that half of the GDP growth will disappear in this first quarter, which will also have a negative effect on surrounding provinces, where I judge that a similar sum of growth would disappear, in case the gravity of the situation continues. If China’s total growth this year is expected to be six pct., then an unexpectedly serious situation in Hubei will mean that China’s total GDP growth in 2020 will decrease from 6 to 5.94 pct., which is hardly measurable. Before Hubei’s direct impact becomes noticeable for China’s overall GDP growth this year, it is my assessment, that Hubei’s overall economy should be at a standstill for approximately 1½ months, which is not realistic.

The total car production in Hubei is 1.6 million passenger cars per year, which is a large number, but all numbers in China are large, and as mentioned, the 1.6 million cars only represents six pct. of China’s total car production. It also falls in line with the Hubei province “only” accounts for four pct. of the overall Chinese economy, and that is why I argue that the coronavirus must spread seriously before the virus outbreak itself hits China’s economy hard. But the many precautions that are being taken and those that are extremely significant, will be noticeable for the growth in China within a few weeks’ time. In addition, the entire travel industry in Asia might soon suffer, and it’s possible that Hong Kong’s economy will be hit again.

As the coronavirus continues to spread, which may well be the case for yet another week or two, the nervousness, including those in the stock markets, will be most likely be maintained for another week, at minimum. However, in view of the immediate negative economic consequences and the spread of the virus so far, it is my assessment that the stock market has already priced in a large risk premium.

Concerning the movements in the global stock market, I interpret the steepness in the price drops as an indication of a current overbought situation, where many events could have provoked a downwards correction.

The pretty large risk premium due to the coronavirus is, in particular, the case for Chinese stocks traded outside China. I understand that Chinese investors fear that domestic consumers will spend less due to the virus outbreak, so there is likely to be more sell orders when the market opens on Monday 3rd February. Though I just expect the domestic market to correct down to the actual level in Hong Kong, i.e. the negative momentum won’t find more fuel.

Consumers in the rest of the world are also the backbone of the global GDP growth at the present, so private consumption is the key for the global economic response to the coronavirus, but I do not believe the risk for a global consumption slump is relevant yet, and I still don’t worry if investors should sell the global stock market a handful of percent further down.

7 largest Chinese provinces’ share of China’s GDP (in pct.)

- Guangdong: 10.8 %

- Jiangsu: 10.3 %

- Shandong: 8.5 %

- Zhejiang: 6.2 %

- Henan: 5.3 %

- Sichuan: 4.5 %

- Hubei: 4 %

China’s 6 largest cities (population in Mio.)

- Shanghai: 24.2 million

- Beijing: 21.5 million

- Tianjin: 15.6 million

- Shenzhen: 12.9 million

- Guangzhou: 11.5 million

- Wuhan: 7.5 million

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz