Good news ahead for investors

Investors will be faced with more disappointing economic data in the coming months, though it will force governments to increase fiscal spending, much to the joy of investors and the financial markets.

The monthly economic report from the German central bank was released last Monday, 21st October, with a particular focus on the financial data during the third quarter. The report, of course, does not contain any specific bid for the third-quarter GDP growth, but the good news is that domestic consumption and construction still hold up.

Exports are generally weak, although there have been some bright spots in the form of a month with more activity than expected. But if one should conclude briefly, the third-quarter GDP growth looks a lot like the second-quarter growth, which was minus 0.1 pct. Compared to the first quarter of this year.

Everyone in the financial markets has seen the same macroeconomic numbers, so a very modest economic growth in the past quarter will come as no surprise. By definition, if two quarters in a row show negative growth, then it is a so-called technical recession, and it will hit the headlines.

Surely, there is a difference between whether the GDP growth is minus 0.1 pct. or plus 0.1 pct., but I argue that in both situations, consumers and businesses will feel the economic strain. Though the discussion about the zero-growth rate or perhaps recession in Germany will flare up again on 14th November, when the German GDP growth for the third quarter is published.

Though the prologue is already taking place on the 31st of October, when Italy announces its preliminary growth figures for the same quarter, and those won’t be good either. One should not deny that, after all, these two countries are the eurozone’s largest and third-largest economies, which naturally draws global investor attention. But the miserable situation does not have to end as badly for investors as one might fear.

The unlucky outlook is already priced in by the financial markets, which is good, seen from an investor’s perspective. The risk is, however, that the amount of bad news, even the expected ones, can become so huge, that they collectively weigh too much and panic spreads in the financial markets. Though this is not my primary scenario, and on the contrary, I expect the headlines with recession to provoke fiscal action in a number of countries, not only in Germany and Italy.

The recession headlines that I expect, will force governments to increase public consumption towards the end of the year, though primarily with effect in the first half of next year. Here, it should be noted that mid-sized European countries like The Netherlands and Sweden are already planning a more expansionary fiscal policy by 2020, and I expect that, for example, Italy and Germany to also join the club.

If that wave is going to roll across Europe during the next few months, then I have no doubt that European investors will smile again. Many people have become accustomed to the unknown direction of Britain but should Prime Minister Boris Johnson maintain his position, my assessment remains that the British government is also prepared to follow the expansionary fiscal path.

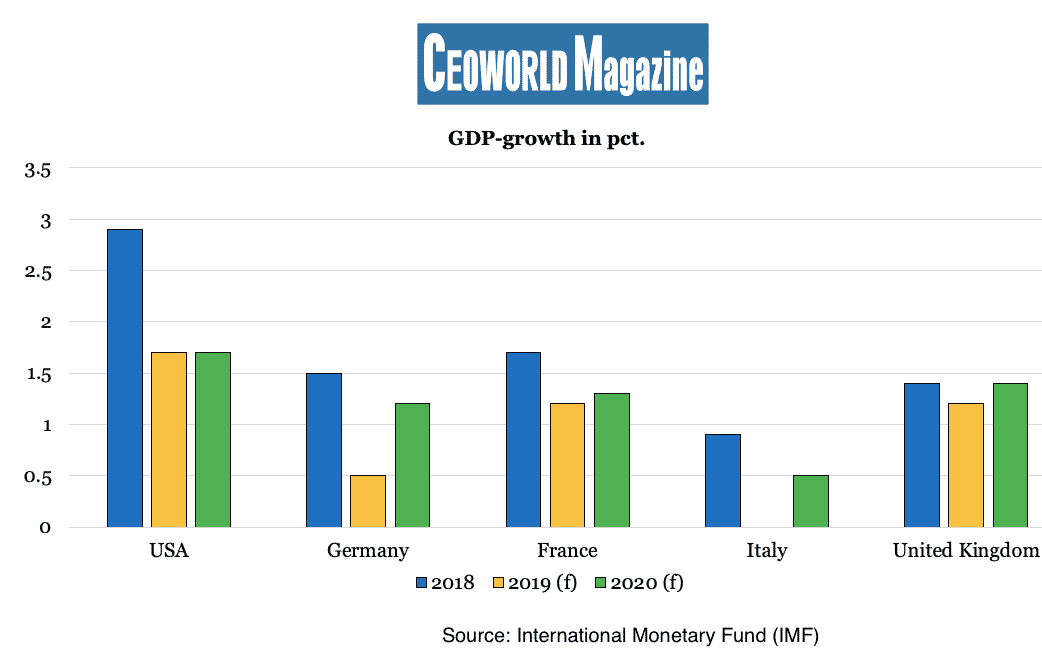

The expectations from the International Monetary Fund (IMF) concerning the GDP growth is a dive in particular in Europe this year, though the growth will reverse higher next year (graphic one). These expectations actually fit in well with my belief in initiatives and progress in European economies moving into the new year. But even more interesting is the International Monetary Fund’s expectation of the US GDP growth. The outlook for next year is quite stable and the IMF has even, during this year, increased their expectation concerning the American growth next year.

In the US, economic goodies are also used ahead of presidential elections, which might be included in the financial markets’ expectations, but fundamentally, I am convinced that the recession in the USA simply won’t materialize. This recession has, on the other hand, been expected a couple of times during the past two years among quite a number of economists, and there is still a part of the financial market that speaks about the recession risk in the American economy.

My opinion remains the same, as always, that I regard the US economy as significantly more robust than those who fear a recession and find it very difficult to see a recession in the United States as a real threat. If even more investors shun the recession fears concerning the world’s largest economy, then this should also result in a few extra smiles among investors until the middle of next year.

The IMF’s belief in Emerging Markets (plus Italy), is on the other hand, more modest. Graphic two shows how many percentage points the IMF’s expectations for the respective countries’ growth have been lowered since April this year, i.e., in just six months. The growth rates of course origin from a higher level, where the IMF in April for example expected an Indian GDP growth of 7.5 pct. in 2020. This expectation has now been lowered to 7.0 pct. which is pretty much within just six months. The trade tensions, among other things, drag down the growth in Emerging Markets which will generate a distinct differentiation among Emerging market countries. There will countries who have sufficient fiscal room to compensate external negative effects via economic stimulus in the domestic economy, and other countries who will feel the squeeze.

A solution about the British situation could generate a bit of general optimism, but of course, an agreement between China and the United States unlocks more world trade again. However, my expectation is not that a trade agreement will trigger a sudden strong reverse in the global economy. Again, the domestic economic stimulus will be the solution, and I, therefore, expect China to take initiatives in that direction soon.

Interestingly are the Emerging Markets countries shown in graphic two, also some of the countries where I argue that there is a lack of fiscal maneuver room to spur domestic growth, so the joy for the next nine months is certainly not evenly distributed across the world and among investors.

Graphic one: GDP-growth in pct.

USA

- 2018: 2.9%

- 2019: 1.7%

- 2020: 1.7%

Germany

- 2018: 1.5%

- 2019: 0.5%

- 2020: 1.2%

France

- 2018: 1.7%

- 2019: 1.2%

- 2020: 1.3%

Italy

- 2018: 0.9%

- 2019: 0%

- 2010: 0.5%

United Kingdom

- 2018: 1.4%

- 2019: 1.2%

- 2020: 1.4%

Source: International Monetary Fund (IMF). (f) = IMF’s expectations

Graphic two: Change in expected BNP-growth (in percentage points)

- Mexico: -0.6%

- Brazil: -0.5%

- India: -0.5%

- Italy: -0.4%

- South Africa: -0.4%

Source: International Monetary Fund (IMF)

Have you read?

India Rich List Index For 2019: Richest Indian Billionaires.

The 40 Best Leisure Destinations To Visit In 2020.

Revealed: Ranking Of The World’s 100 Most Valuable Brands, 2019.

Richest Billionaires In The United States, 2019.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz