Is Indian Economy Going through Knightian uncertainty?

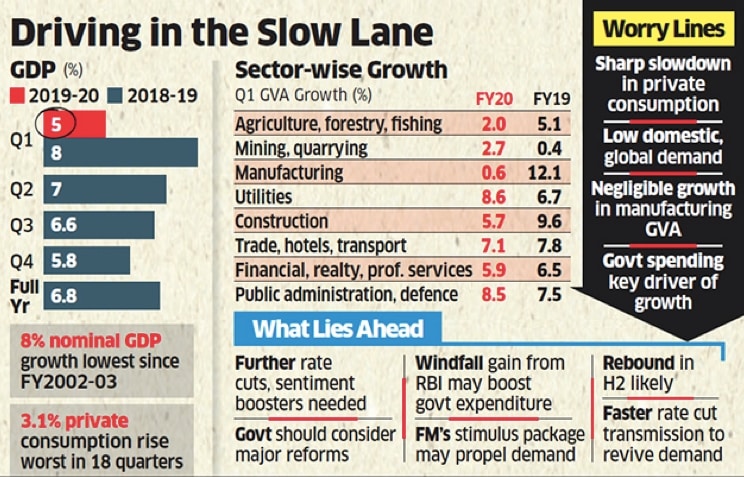

Indian economy registered a borderline growth of 5% in GDP for the April-June quarter of this financial year— lowest in six years. A sharp fall from the 8% growth seen in the same period almost 2-years ago. During this period, the manufacturing sector grew at just 0.6% while ‘Agriculture, Forestry and Fishing’ sector at 2%.

The ‘Mining and Quarrying’, ‘Construction’ and ‘Financial, Real Estate and Professional Services’ grew at 2.7%, 5.7%, and 5.9%, respectively. The central bank, i.e., Reserve Bank of India lowered its outlook for the fiscal year 2019-2020 with a repo rate by a combined 110 basis point. Consumption collapsed to an 18-quarter low of 3.1% from 10.6% in the March quarter, suggesting a fragile consumer sentiment and sombre market mood. Subsequently, the manufacturing sector was severely affected by investment constraints and consumer uncertainty registering a meagre growth of just 0.6%. See figure below:

Undoubtedly, India is going through a volatile and contractionary economic period. To offset the structural and cyclic factors, the government has announced several measures. The contractionary cycle precipitates higher unemployment leading to decreasing disposable income and lesser consumer spending, further exacerbating the contraction. State Bank of India (SBI) Chairman Rajnish Kumar observes that the next two months will be crucial for the government in terms of reviving the Indian economy. The growth of the Indian economy by consumption includes both Private Final Consumption Expenditure (PFCE) as well as the Government Final Consumption Expenditure (GFCE). The PFCE has sharply fallen to the June quarter 3.1% compared to 7.2% in the March quarter that has spurred the recent downturn suggesting a staggering decline in household spending.

Most of the measures by India, to countermand the sluggish economy, focus on the supply side of the real economy, while the demand side is substantially ignored. A higher supply side, without corresponding demand, would result in price contraction and if, the price stagnates then prices will fall to lower equilibrium prices. This scenario will deplete the market from affordable alternatives. To spur the trailing economy, is India taking the unremitting risk without quantifiable knowledge? In economics, Knightian uncertainty suggests unpredictability of risk vs. uncertainty.

What is abundantly clear is that India needs policy reforms beyond seasonal commentary, populist narratives; and must dispel market anxiety by taking robust measures. The economic discords, India currently experiencing must be addressed by certainty and with rewards outweighing the risk.

Not surprising, these events have left Indian with wavering sentiments and non-assured governance. Could understanding Knightian uncertainty be helpful for India? We often conflate between risk and uncertainty, since we fail to realize high stochastic volatility surrounding known average future outcomes, or we are at least partially ignorant about relevant mechanisms and potential outcomes.

Indian economy and government measures reflect such conflating contexts. Particularly, a number of policies are riskier than others, where risk represents known relative odds, whereas, under this economic downturn, the government, economists, policymakers and people are not certain about the forthcoming economic outlook. India, therefore, must not rationalize the events with the benefits of hindsight and expect a revival.

The negative market undertone cannot be eased without well-calibrated government intervention. Although, being “perfect certain” in this situation is probabilistic, but risk-sensitive measures should be taken by the Indian government. Should risk be not taken prudently, an irreversible investment situation will arise with Knightian uncertainty.

Thus, India must recognize that aggregate outcomes change is time-varying and cannot be characterized by standard risk assessment, rather an openness to macroeconomic process through policy analysis in consultation with policymakers, economists, market agents, and citizens will prepare them largely to face Knightian uncertainty for unforeseeable changes.

Therefore, India should consider four adaptive measures:

- Address social anxiety and market sentiment

- Create capacity-building at the infrastructure level and avoid populist measures

- Follow a more accommodative monetary and fiscal policy

- Reduce down-side risk with a sectoral approach.

Photo courtesy: The Economic Times, ET Bureau, Updated: Aug 31, 2019, 07.25 AM IST

Have you read?

Safest Destinations For Women To Travel In Asia, 2019.

The Top 30 Women-Friendly Travel Destinations In The World For 2019.

Ranked: The World’s Best Cities For Food Lovers In 2019.

The World’s Top 10 Biggest Military Spenders In 100 Years (From 1914 to 2018).

Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2024 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz