Inverted US Yield Curve Is Not A Crisis Sign

If an investor chooses to invest in the most secure investment in the United States, namely US government bonds, then the investor must determine what maturity (duration) the bonds should have. A number of set parameters can determine the choice, but many will probably include some pragmatic aspects such as expectations to interest rate developments. A natural parameter is the consideration of how the future bond yields are when the bond is repaid again.

With the significant shift in the US central bank’s monetary policy, the answer to whether one should choose a bond with a short or longer maturity is given in advance. The investment choice is thus, not an active position based on a belief whether or not a recession will occur in the US. It is simply an investment choice that has been provoked by the refined, or new, monetary policy that the Federal Reserve Bank (Fed) has been conducting since October last year.

Therefore, even though the US 10-year yield fell below the 2-year yield on the 14th August, it does not change my assessment about the outlook for the financial markets and the global economy. Unless of course, that global growth is forced into recession due to further escalating trade conflicts.

As graphic one shows, the US bond yields peaked last October. This was at a time when the financial market was still debating whether there was room for a further US interest rate hike, or whether the Fed had put the rate hike cycle on hold.

My view was that the US economy, at that time, was moving towards a healthy interest rate environment with positive real interest rates. The core inflation was quite stable at around 2.2 pct., the central bank lending rate stood at 2.25 pct., and the yield on the 10-year treasury bond was trading at 3.20 pct. – i.e. the US economy was almost back in a normal interest rate environment.

But US President Trump had a different opinion and had already long argued for the Fed to cut interest rates. The Fed did not seem particularly responsive to this, but when Trump indicated that he could replace Fed Chairman Jerome Powell with somebody else, the Fed changed its stance on monetary policy.

The first change were indications of a possible shift in the monetary policy stance. But in January it was stated very clearly that one or more interest rate cuts were on the way. The first rate cut has been executed, and many in the financial markets expect two more interest rate cuts this year.

With the US central bank changing its monetary policy direction 180 degrees over such a short period, the bond yields had to drop as they have done.

So, I circle back to where I started, namely whether to invest in a bond with a 2- or 10-year maturity?

Regarding that choice, many people will assess at what interest rate one can reinvest the funds when the bond matures.

An obvious consideration is that the Fed has changed its monetary policy during the past year, thus starting a new cycle of interest rate cuts. This has a certain time horizon, and therefore, investing in a bond with 2-year maturity may have the consequence that one have to reinvest the repaid funds at a low point in the interest rate cycle.

It gives a natural preference for a 10-year maturity instead of 2 years, which I fully understand. Based on the development shown in graphic one, it can be concluded that this choice has been made more and more frequently since October last year, as the interest rate differential between the two maturities has narrowed. So often, that the 10-year yield, as mentioned, on the 14th August briefly traded below the 2-year yield.

This trend can also be shown differently graphically where it would be seen that the bond with 10-year maturity has a lower yield than the bond with 2-year maturity. It means that the yield curve is “inverse” or has inverted- this is usually a very dramatic development in the financial markets.

For the same reason, this happening created fears in the stock market and prices headed south on the stock exchanges. All headlines focused on what was seen as a confirmation of the recession coming to the United States.

A key argument is that when long-term interest rates drop as they have done, then it an almost sure indicator of an upcoming recession.

This traditional development earlier originated when the investors expected an economic downturn, then the investors sold stocks and, even more certain, bought bonds with long maturities.

A recession, or severe economic slowdown, meant that inflation probably would decrease, and the central banks would lower interest rates. Therefore, all investors rushed to invest in bonds with long maturities, which inverted the yield curve prior to an economic crisis.

The expected economic downturn came, and thereafter, growth returned again- those were the good old days in the financial markets, but that’s not the case anymore, not after the financial crisis and the introduction of quantitative monetary policy.

The aggressive quantitative monetary policy has led to negative real interest rates in many countries, which means that it is advantageous to have debt instead of holding assets. The easiest leverage is to buy real estate financed by debt, which has created a fiery real estate market in a number of countries. The extreme money supply in several countries has led to price inflation on all financial assets, where I argue that the biggest price bubble is precisely in the bond market.

The reactions in the financial markets during the past two weeks, I really do not consider as new or sudden signs of recession in the US economy, but more a “valuation fear” of financial assets, if anything.

Right now, it is the valuation of stocks that worries investors, and surely, this kind of volatility is still on the rise. I regard the moves as a fear of having bought too expensive, and not the prospect of a sudden worsening US macroeconomic situation.

I maintain my view that the recession is on its way to Europe, and the global economy still cools-off. As a consequence, growth in the United States will also slow down. But the recession that a large number of economists have been expecting for a couple of years now, I still don’t regard as the most likely scenario.

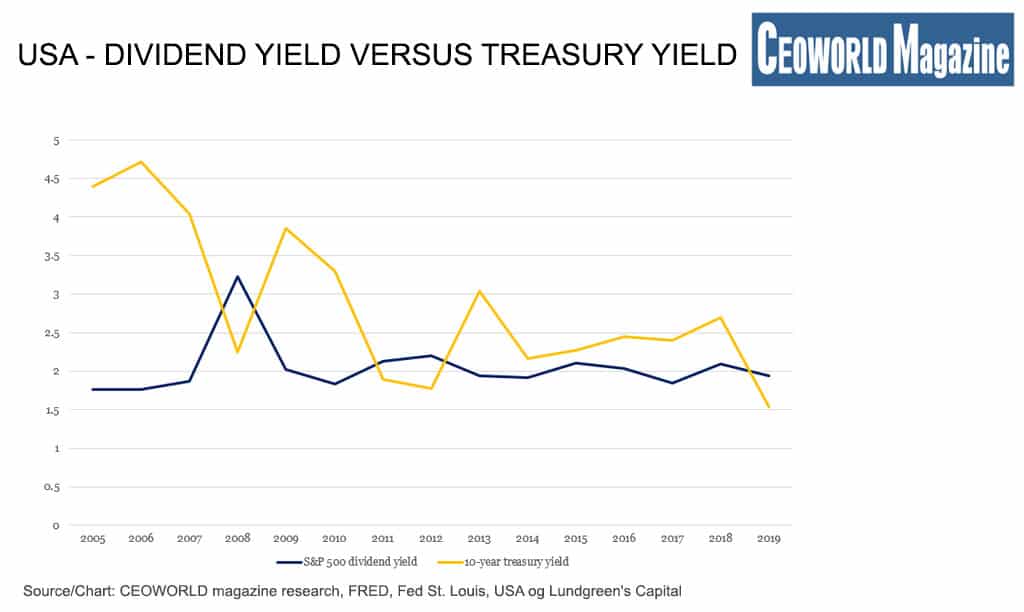

However, the continued buying of bonds in the US has created another interesting situation, as shown in graphic two. It is not often that the dividend yield from the US S&P 500 stock index exceeds the US 10-year yield.

I argue that this, on the contrary, indicates that either the US economy is deteriorating very soon, or really bad profit warnings from the US companies will send Wall Street in the dark- if you don’t go for one of these two scenarios, then it’s again more attractive to put the savings in the S&P 500 stock index rather than buying bonds.

Must read?

# The World’s Top 100 Most Successful Unicorns, 2019.

# GDP Rankings Of The World’s Largest Economies, 2019.

# Most Expensive Countries In The World To Live In, 2019.

# Countries With The Highest Average Life Expectancies In 2030.

# The World’s Best Performing Companies 2019.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz