German Economy Is Balancing On The Edge

The good news is that the German industrial production increased by 0.3 pct. in May, which was announced on the 8th July. The figure is the monthly change compared to April, and also came back in the positive territory as April resulted in a contraction.

Though the majority of economists had anticipated an increase of 0.4 pct. But compared to May last year, the reality genuinely starts to look less bright, as the annual change in the industrial production shows a decline of 3.7 pct.

The set-back is further accelerating, as April had an annual decline of 2.3 pct. and 0.9 pct. in March. There are a range of reasons for the negative development, but the truth is that the industrial production is under pressure. Germany also published its trade balance where I am convinced that some economists noted the drop in imports of 0.5 pct. compared to April, especially when the expectation was a plus.

Graphic one shows the development in the German industrial production as an index excluding the construction sector, thus the index development is closer to the development in the core industrial sector. The calculations are computed quarterly, meaning the data series has some delay, but obviously, the activity level has been declining since the beginning of 2018.

Given the annual change in the industrial production during the past few months, it would be no surprise if the index figure decreases further during the first half of this year.

I expect the result to be a new round of European companies, in the relevant sectors, that will downgrade their earnings expectations in a few months time.

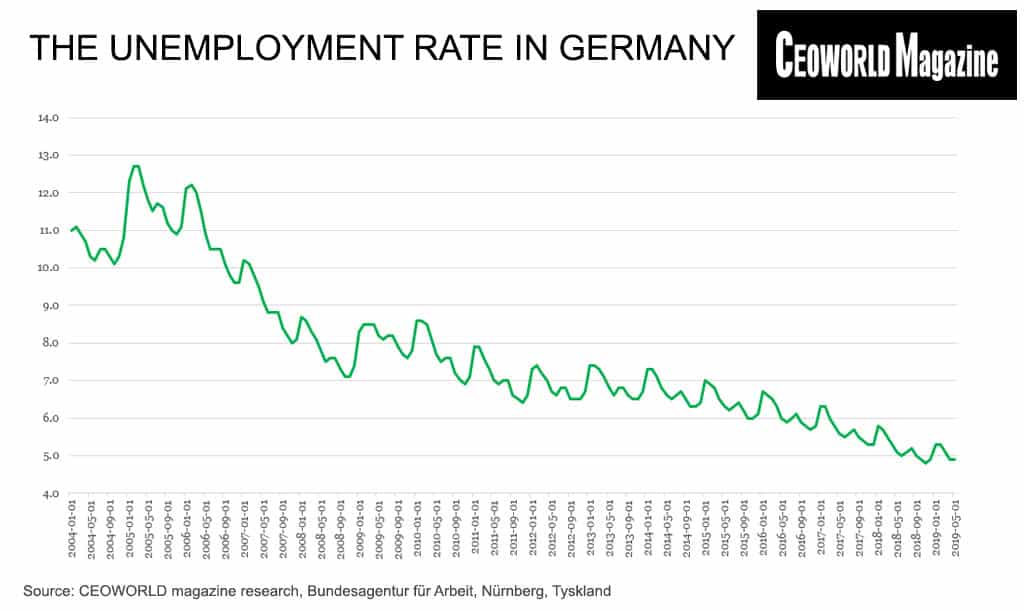

But the unemployment in Germany remains historically low, as graphic two shows, and many industries are still in need of more employees. This is a primary reason why I do not expect any rapid increase in the unemployment, and right now, the momentum in the German labour market is only changing ever so slightly- so far. The speed of new hirings is apparently decreasing, but there are also changed signals from a broader range of the German companies.

According to the German research institute IFO, 8.5 pct. of the surveyed companies plan to introduce shorter working weeks. It is the highest number since 2013 and I expect the shorter working weeks to be introduced within the coming three months.

Not surprisingly, the industrial sector dominates the group of companies that consider the shorter working weeks. It does not yet mean that large rounds with lay-offs are underway. It is very far from this situation yet, but if the arrow points in a direction, then it is downwards.

It is not that I want to deliver discouraging summer reading, but the financial markets never sleep, and even during the summertime, it might be necessary to give the macroeconomic developments a thought.

In my view, the outlook for the German economy continues to deteriorate, though it is not a steep downturn, but rather, some steps back and forth, but in total the next steps are backwards.

The fundamental worry is that Germany this year will have a GDP growth that is nothing more than just modest. But the real concern is, as mentioned earlier, that Germany has a historically low unemployment rate, which should keep the GDP growth rate a much higher level. If the unemployment begins to rise now, at a time with almost zero GDP growth, then the outlook in a couple of years could be nasty.

As a counterweight to external crisis factors, Germany’s economy is so large and dominant so it has its own internal inertia. This force has already brought the country pretty far ahead with fairly high growth rates during the recent years.

One can argue that there is nothing to complain about, which is true, but the financial markets have an ever forward-looking growth appetite.

The fact that Germany’s economy is in a delicate balance, where only a smaller further decline in growth sends the country into recession is well-known in the financial markets. Therefore, this risk should already be included in the market prices, at least partly, and yet, I argue that the likelihood of disappointments for the investors is increasing.

My expectation has long been that this summer would be somewhat lukewarm in the financial markets, where especially European investors would thirst for good news.

The European Central Bank (ECB) certainly has indicated that it is ready to ease the monetary policy.

The latest figures from Germany are, however, not sluggish enough to give the ECB bad dreams as the monthly development in the industrial production after all was positive. In addition, both France and Italy, last week, published surprisingly good figures for the industrial production in May.

In France, it was the highest annual growth since 2½ years, though with a rise in Airbus aircraft deliveries being part of the explanation.

All in all, this does not give any reason to an acute nervousness at the ECB. My primary scenario is though that the central bank’s concerns return as I still expect the overall developments in the Eurozone to follow the German direction towards weaker economic growth.

I maintain the assessment that investors in Europe are faced with the choice between meagre macroeconomic figures, that hurt corporate earnings, or are pleased with an interest rate cut from the ECB.

In the long term, I still argue that this confirms the prospect of a generally low return in European equity markets for a number of years to come, and I advocate for capital moves towards Asia, and into private equity around the world and other alternative investments.

The unemployment rate in Germany:

| Date | Unemployment rate (% of labour force) |

|---|---|

| May 1, 2019 | 4.9 |

| April 1, 2019 | 4.9 |

| March 1, 2019 | 5.1 |

| February 1, 2019 | 5.3 |

| January 1, 2019 | 5.3 |

| December 1, 2018 | 4.9 |

| November 1, 2018 | 4.8 |

| October 1, 2018 | 4.9 |

| September 1, 2018 | 5 |

| August 1, 2018 | 5.2 |

| July 1, 2018 | 5.1 |

| June 1, 2018 | 5 |

| May 1, 2018 | 5.1 |

| April 1, 2018 | 5.3 |

| March 1, 2018 | 5.5 |

| February 1, 2018 | 5.7 |

| January 1, 2018 | 5.8 |

| December 1, 2017 | 5.3 |

| November 1, 2017 | 5.3 |

| October 1, 2017 | 5.4 |

| September 1, 2017 | 5.5 |

| August 1, 2017 | 5.7 |

| July 1, 2017 | 5.6 |

| June 1, 2017 | 5.5 |

| May 1, 2017 | 5.6 |

| April 1, 2017 | 5.8 |

| March 1, 2017 | 6 |

| February 1, 2017 | 6.3 |

| January 1, 2017 | 6.3 |

| December 1, 2016 | 5.8 |

| November 1, 2016 | 5.7 |

| October 1, 2016 | 5.8 |

| September 1, 2016 | 5.9 |

| August 1, 2016 | 6.1 |

| July 1, 2016 | 6 |

| June 1, 2016 | 5.9 |

| May 1, 2016 | 6 |

| April 1, 2016 | 6.3 |

| March 1, 2016 | 6.5 |

| February 1, 2016 | 6.6 |

| January 1, 2016 | 6.7 |

| December 1, 2015 | 6.1 |

| November 1, 2015 | 6 |

| October 1, 2015 | 6 |

| September 1, 2015 | 6.2 |

| August 1, 2015 | 6.4 |

| July 1, 2015 | 6.3 |

| June 1, 2015 | 6.2 |

| May 1, 2015 | 6.3 |

| April 1, 2015 | 6.5 |

| March 1, 2015 | 6.8 |

| February 1, 2015 | 6.9 |

| January 1, 2015 | 7 |

| December 1, 2014 | 6.4 |

| November 1, 2014 | 6.3 |

| October 1, 2014 | 6.3 |

| September 1, 2014 | 6.5 |

| August 1, 2014 | 6.7 |

| July 1, 2014 | 6.6 |

| June 1, 2014 | 6.5 |

| May 1, 2014 | 6.6 |

| April 1, 2014 | 6.8 |

| March 1, 2014 | 7.1 |

| February 1, 2014 | 7.3 |

| January 1, 2014 | 7.3 |

| December 1, 2013 | 6.7 |

| November 1, 2013 | 6.5 |

| October 1, 2013 | 6.5 |

| September 1, 2013 | 6.6 |

| August 1, 2013 | 6.8 |

| July 1, 2013 | 6.8 |

| June 1, 2013 | 6.6 |

| May 1, 2013 | 6.8 |

| April 1, 2013 | 7.1 |

| March 1, 2013 | 7.3 |

| February 1, 2013 | 7.4 |

| January 1, 2013 | 7.4 |

| December 1, 2012 | 6.7 |

| November 1, 2012 | 6.5 |

| October 1, 2012 | 6.5 |

| September 1, 2012 | 6.5 |

| August 1, 2012 | 6.8 |

| July 1, 2012 | 6.8 |

| June 1, 2012 | 6.6 |

| May 1, 2012 | 6.7 |

| April 1, 2012 | 7 |

| March 1, 2012 | 7.2 |

| February 1, 2012 | 7.4 |

| January 1, 2012 | 7.3 |

| December 1, 2011 | 6.6 |

| November 1, 2011 | 6.4 |

| October 1, 2011 | 6.5 |

| September 1, 2011 | 6.6 |

| August 1, 2011 | 7 |

| July 1, 2011 | 7 |

| June 1, 2011 | 6.9 |

| May 1, 2011 | 7 |

| April 1, 2011 | 7.3 |

| March 1, 2011 | 7.6 |

| February 1, 2011 | 7.9 |

| January 1, 2011 | 7.9 |

| December 1, 2010 | 7.1 |

| November 1, 2010 | 6.9 |

| October 1, 2010 | 7 |

| September 1, 2010 | 7.2 |

| August 1, 2010 | 7.6 |

| July 1, 2010 | 7.6 |

| June 1, 2010 | 7.5 |

| May 1, 2010 | 7.7 |

| April 1, 2010 | 8.1 |

| March 1, 2010 | 8.5 |

| February 1, 2010 | 8.6 |

| January 1, 2010 | 8.6 |

| December 1, 2009 | 7.8 |

| November 1, 2009 | 7.6 |

| October 1, 2009 | 7.7 |

| September 1, 2009 | 7.9 |

| August 1, 2009 | 8.2 |

| July 1, 2009 | 8.2 |

| June 1, 2009 | 8.1 |

| May 1, 2009 | 8.2 |

| April 1, 2009 | 8.5 |

| March 1, 2009 | 8.5 |

| February 1, 2009 | 8.5 |

| January 1, 2009 | 8.3 |

| December 1, 2008 | 7.4 |

| November 1, 2008 | 7.1 |

| October 1, 2008 | 7.1 |

| September 1, 2008 | 7.3 |

| August 1, 2008 | 7.6 |

| July 1, 2008 | 7.6 |

| June 1, 2008 | 7.5 |

| May 1, 2008 | 7.8 |

| April 1, 2008 | 8.1 |

| March 1, 2008 | 8.3 |

| February 1, 2008 | 8.6 |

| January 1, 2008 | 8.7 |

| December 1, 2007 | 8.1 |

| November 1, 2007 | 8 |

| October 1, 2007 | 8.2 |

| September 1, 2007 | 8.4 |

| August 1, 2007 | 8.8 |

| July 1, 2007 | 8.8 |

| June 1, 2007 | 8.8 |

| May 1, 2007 | 9.1 |

| April 1, 2007 | 9.5 |

| March 1, 2007 | 9.8 |

| February 1, 2007 | 10.1 |

| January 1, 2007 | 10.2 |

| December 1, 2006 | 9.6 |

| November 1, 2006 | 9.6 |

| October 1, 2006 | 9.8 |

| September 1, 2006 | 10.1 |

| August 1, 2006 | 10.5 |

| July 1, 2006 | 10.5 |

| June 1, 2006 | 10.5 |

| May 1, 2006 | 10.9 |

| April 1, 2006 | 11.5 |

| March 1, 2006 | 12 |

| February 1, 2006 | 12.2 |

| January 1, 2006 | 12.1 |

| December 1, 2005 | 11.1 |

| November 1, 2005 | 10.9 |

| October 1, 2005 | 11 |

| September 1, 2005 | 11.2 |

| August 1, 2005 | 11.6 |

| July 1, 2005 | 11.7 |

| June 1, 2005 | 11.5 |

| May 1, 2005 | 11.8 |

| April 1, 2005 | 12.2 |

| March 1, 2005 | 12.7 |

| February 1, 2005 | 12.7 |

| January 1, 2005 | 12.3 |

| December 1, 2004 | 10.8 |

| November 1, 2004 | 10.3 |

| October 1, 2004 | 10.1 |

| September 1, 2004 | 10.3 |

| August 1, 2004 | 10.5 |

| July 1, 2004 | 10.5 |

| June 1, 2004 | 10.2 |

| May 1, 2004 | 10.3 |

| April 1, 2004 | 10.7 |

| March 1, 2004 | 10.9 |

| February 1, 2004 | 11.1 |

| January 1, 2004 | 11 |

Have you read?

# How To Plan Corporate Business Travel.

# 5 Things to Keep in Mind While Taking a Year Drop for Higher Education.

# 5 Things to Know About Manicure.

# 6 Amazing Facts About Akihabara, Japan You Should Know.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz