Top 25 countries with the highest individual income tax rates in the world, 2015

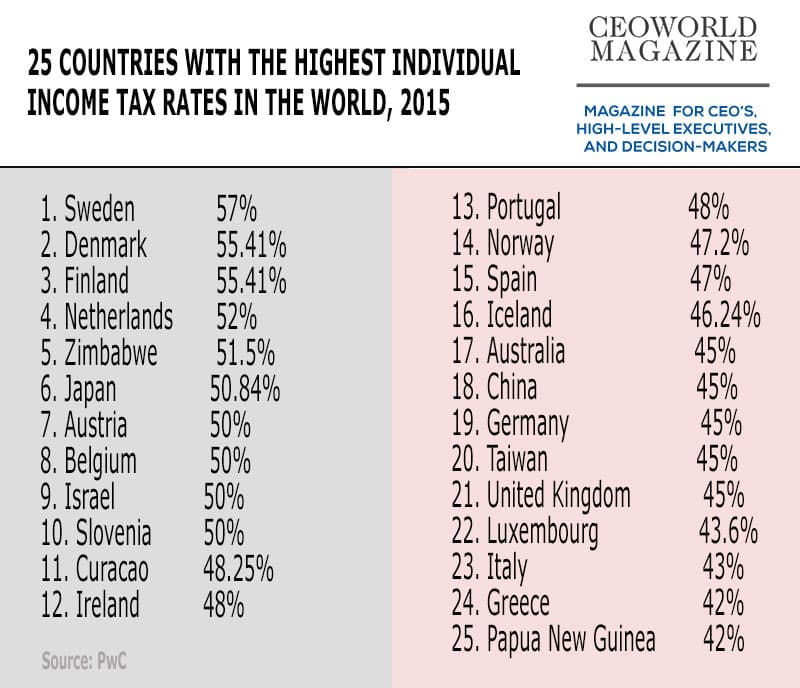

Somewhat unsurprisingly, Sweden tops the list of the countries with the highest individual income tax rates, a recent data by PWC. At 57 percent, the individual income tax rate in Sweden is the highest in the world, followed by neighboring Denmark (55.41 percent), Finland (55.41 percent) and the Netherlands (52 percent).

Around 9.8 million people live in Sweden. Taxes these people pay help in funding a top-notch education system, a universal healthcare system and generous unemployment benefits. Also Swedes don’t seem to mind he high tax rate.

As one would expect, Sweden, along with equally high-taxing Denmark, tops almost every international barometer of successful societies. If you think your individual income tax rate is high in the United States then you haven’t seen anything yet!

Here is the list of top 25 highest individual income tax paying countries in 2015:

1. Sweden, 57%

2. Denmark, 55.41%

3. Finland, 55.41%

4. Netherlands, 52%

5. Zimbabwe, 51.5%

6. Japan, 50.84%

7. Austria, 50%

8. Belgium, 50%

9. Israel, 50%

10. Slovenia, 50%

11. Curacao, 48.25%

12. Ireland, 48%

13. Portugal, 48%

14. Norway, 47.2%

15. Spain, 47%

16. Iceland, 46.24%

17. Australia, 45%

18. China, 45%

19. Germany, 45%

20. Taiwan, 45%

21. United Kingdom, 45%

22. Luxembourg, 43.6%

23. Italy, 43%

24. Greece, 42%

25. Papua New Guinea, 42%

Cover Photo: Skatteverket, the Swedish Tax Agency.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz