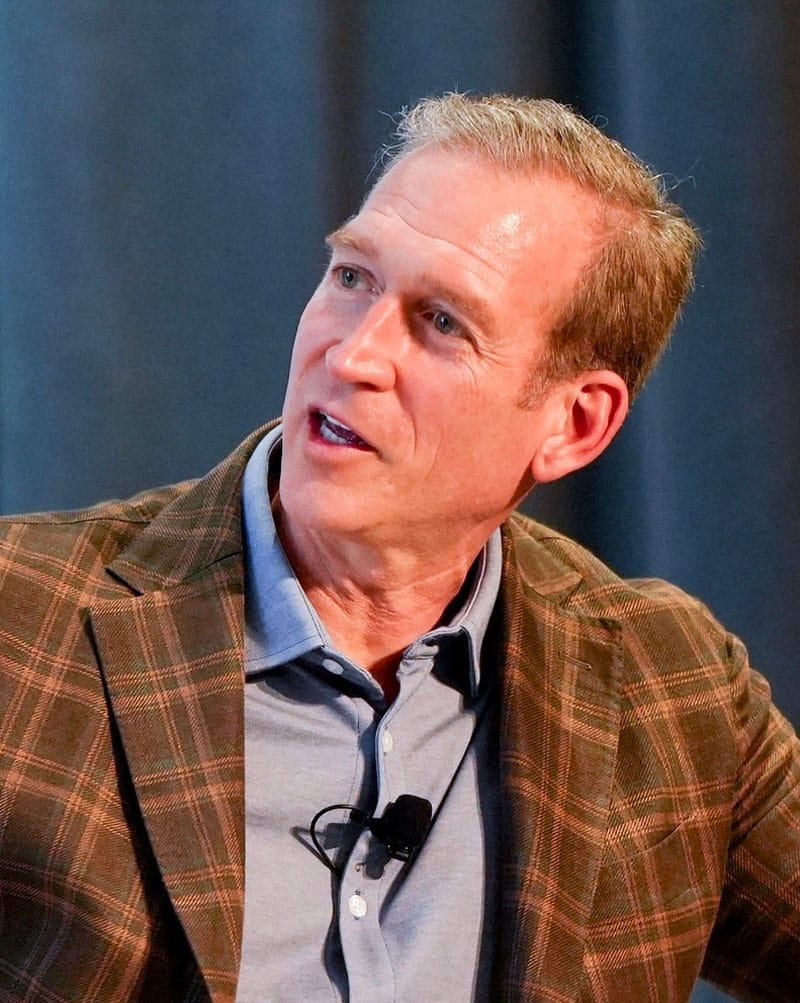

Thomas Priore Explains How Banking Solutions Expand on Traditional Banking Services

Fintech banking solutions have forever changed how businesses manage money. By streamlining services and offering them through one common platform, payments processing companies have enhanced the efficiency and accessibility of financial services. But don’t consider them a replacement for traditional banks, Priority CEO Thomas Priore says.

Georgia-based Priority is a payments processing company that has emerged in recent years as a leader in fintech. The banking solutions offered by Priority focus on enhancing and expanding services offered through traditional banks, not replacing them.

“We excel at collecting, storing, lending, and sending money,” says Thomas Priore. But the company provides banking solutions and doesn’t bill itself as a replacement for banks. Priore states that these solutions allow businesses to “still maintain the collaborative relationship with their key lender or banking relationship to maximize cash acceleration and working capital optimization.”

Priority’s Unified Commerce Platform Supports Businesses of All Sizes

Priority offers a unified commerce platform that allows businesses to handle multiple financial tasks. The platform eliminates barriers between different sales channels and financial services, helping businesses provide a consistent experience across all touchpoints.

These services help companies better manage their cash flow. Priority’s products include CPX, an end-to-end B2B payments platform that automates 100% of accounts payable, and Plastiq, which allows businesses to gain quick access to working capital through their credit cards. The company’s MX Merchant Suite gives businesses one place to manage everything from billing and sales tracking to inventory and customer engagement.

The approach has proven successful. Priority recently reported an overall 22% increase in adjusted gross profits and a 20.6% surge in revenue (Q2 2024 versus Q2 2023).

Understanding the Relationship Between Priority and Banks

While Priority offers banking solutions, it’s not a bank. Rather than seeing its services as replacing traditional banks, Priority’s leadership focuses on collaborating with banks, Thomas Priore explains.

“Our largest processing partner is Wells Fargo, whom we share a terrific relationship with because we do things to a level of expectation that a ‘money center’ bank demands,” he says. “We’re a licensed money transmitter. The transactions that run through our licenses, every single one of them, are reported to the regulatory authorities. It demands a level of precision that enforces a discipline that’s very, very important when you’re handling customers’ money.”

However, the company doesn’t harbor ambitions to become a bank. The focus is on providing banking solutions that augment or expand the services of traditional banks, most of which gave up payments processing years ago.

“There’s been so much talk in fintech of disintermediating banks, and I think that’s a gross mistake,” Priore states. “We’re not a bank. There are things that banks do very, very well. They store deposits very safely, they lend money. At scale, banks are still the largest pool of assets in the U.S. and globally.”

Instead, he adds, Priority looks to “collaborate with them to deliver solutions that help augment their customer relationships.”

The Future of Priority Includes a Focus on Banking Solutions

Thomas Priore points out that Priority’s future involves a continued focus on and expansion of the three main product categories it offers. The first is merchant services, which involves card and digital payment acceptance. The second is payables, which includes bill pay for small businesses and accounts payable automation for larger enterprises. And the third is banking and treasury solutions, such as those provided through the company’s Passport product that has both commercial and consumer applications.

Priority is also focused on solving practical problems. For example, he noted that Priority clients who operate in the construction industry can use the company’s banking solutions to prevent workers from having to go to a payday lender to cash their checks. “You think that’s going to make them more loyal? 100%,” he said.

Priore says that in some ways, Priority’s services reflect the relationship businesses once had with a community bank.

“I’m a merchant in a small town back in the ’80s. I’d go to my bank branch and I’d open up an account. They’d help me with my payroll, maybe they’d lend me money if I need it, and I get a credit card from them,” Priore says. “That experience does not exist anymore. In fact, you’re seeing larger banks start to diminish their branch profile.”

He added that while companies want the advantages of modern technology, they also want a similar experience to the old community banking days.

“I’d love to go to one place to handle payment acceptance, help me accelerate cash flow, have a bill payment option to pay bills, maybe get a credit card or a line of credit,” Priore says. He adds that with Priority, clients often work with a personal representative.

“When you need something, you can call that person and they can come over and help you or send one of their service reps over to help you,” Thomas Priore says. “That’s a good experience. It’s personal and it’s tech-forward.”

Have you read?

Aviation Pioneer Martin Schröder Passes Away at 93, Leaving a Lasting Legacy.

New Leadership Takes Flight at the Australian Airports Association.

Richest Households in Hong Kong Now Earning 80 Times More Than Poorest, According to Oxfam Report.

Capital Becomes Top Risk for Mining Industry Amid Tough Financing Conditions, Says EY Report.

Jacksonville Jaguars Owner Shad Khan’s Net Worth Rises to $13.3 Billion, Fifth Among NFL Owners.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz