Energy transition: An opportunity and risk for Canada’s metals and minerals dominance

Accelerating demand for metals and minerals driven by the energy transition revolution.

The outlook is clear. The demand for critical metals and minerals is advancing dramatically as the energy transition gathers momentum globally. Rare metals and minerals such as lithium, copper, nickel, cobalt, and graphite are some of the essential components in many clean energy technologies, including wind turbines, electricity transmission and distribution networks and electric vehicles (EVs). A report by the International Energy Agency (IEA) concluded that if the world is to meet net zero as a global goal, the demand for metals and minerals will increase a whopping six times by 2040.

Comparing traditional resources, such as hydrocarbons, with emerging needs, such as metals and minerals, offers some fascinating contrasts. For example, solar plants, wind farms and EVs generally require a complexity of many more minerals to build when compared to their fossil fuel-based counterparts.

“A typical EV requires a massive six times the mineral inputs of a conventional car, and an onshore wind plant requires nine times more mineral resources than a gas-fired plant.”

The magnitude and pace of capacity addition are staggering for more established metals and even more so for niche metals and metallurgical processing facilities. For example, nickel. An established metal output will need to increase 2x from 2021 to 2030, while for emerging products such as refined lithium, cathode, and anode processing, facilities need to grow 5-7x.

Global mining powerhouses are emerging with the aim of controlling markets.

This demand growth is both an opportunity and a risk to Canada’s minerals industry along the whole ecosystem that thrives from it. Countries other than Canada are ramping up production rapidly to meet this need, including actively shaping the supply chain crucial to the new EV industrial base.

Lithium is a good case example. It is a fundamental component in lithium-ion batteries that power electric vehicles and battery energy storage systems, which play a vital role in the shift to renewable energy and electrified transportation by storing variable renewable energy.

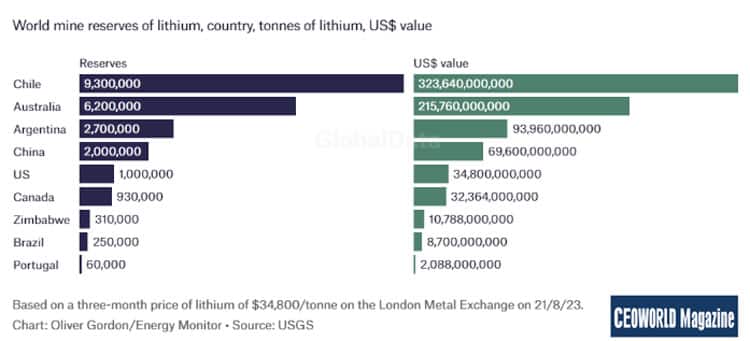

Having reserves of metals and minerals is the starting point for any competitive positioning. The largest lithium reserves are found in Australia and Chile, totalling 9.3 million and 6.2 million tonnes, respectively, according to the US Geological Survey. At recent London Metal Exchange prices, these reserves are valued at an impressive $324 billion and $216 billion. Additionally, Argentina (2.7 million tonnes), China (two million tonnes), the U.S. (one million tonnes), and Canada (930,000 tonnes) also possess substantial lithium holdings, not to be dismissed.

Keep an eye on Chile. The Atacama Desert in Chile, a significant lithium-rich-producing region, has propelled the country into the position of a lithium powerhouse. In 2021, Chile contributed 26 percent to the world’s lithium production, with the Atacama Desert holding the most significant reserves globally at 9.3 million tonnes. Furthermore, Chile claims the title of the world’s primary copper producer, contributing to 28 percent of the total global production, and harbours advantage ionic clay rare earth deposits in its southern regions. With increasing clarity on its national strategy and partial nationalization of Lithium, Chile plans to unlock this potential much like Argentina’s production ramp-up, which is already well underway.

Another country that should never be overlooked is China. Foreign Policy Magazine states that Beijing dominates supply chains that transform raw materials like cobalt, graphite and rare earths into crucial finished products, such as those supporting missile guidance systems, renewable energies, and electric vehicles. Furthermore, China is taking drastic measures to cement its competitive position. According to Reuters, China recently banned the export of technology to extract and separate rare earths in a step towards protecting its dominance in several strategic metals. Furthermore, China refines 89% of the world’s neodymium and praseodymium, the essential metals for EV magnets. Also, Chinese exports of rare earths during the first 11 months of 2023 climbed 10% to 48,868 metric tons.

“It’s important to remember that China accounted for 70% of world mine production of rare earths in 2022.”

Finally, the Inflation Reduction Act (IRA) in the U.S. is reshaping the landscape of metals and minerals demand, triggering a surge in critical minerals development. The act names 50 “applicable critical minerals” for the energy transition in section 45X(c)(6). Most of these will hold a few surprises for miners; the list includes battery metals, cobalt, lithium, and several other s-block metals such as cesium and beryllium. The list also specifies almost all rare earth metals, including neodymium, used in powerful turbine magnets. Mining companies producing these metals can seek production credit equal to 10% of production cost, and consumers buying IRA-compliant cars (i.e. those with a majority of Critical metals from the US or Free-Trade countries) will receive tax credits of up to US$3750 per vehicle. The US is not alone, with Europe, the UK, Australia and others announcing their Critical Minerals programs.

Canada is rich in natural resources, but how competitive is the country?

With this backdrop of immense competition, where does Canada stand, and can it get out of its own way?

The critical factor determining whether these resources benefit a nation’s populace or lead to hardship lies in how effectively the country manages its resources. This disparity is evident when comparing a resource-rich, democratic, and transparent country like Canada to a resource-rich but corrupt, violent, and impoverished nation. In numerous resource-rich countries, ample natural wealth has often disrupted the accountability link between citizens and the government, hindering or reversing democratic and social progress. Instead, these resources disproportionately benefit a select few politically favoured groups, contributing to societal inequities. The copper and cobalt industry in the Democratic Republic of Congo is a case in point.

“While having abundant natural resources may appear advantageous for any nation, it can become both a blessing and a curse.”

Several crucial factors ensure that the Canadian public reaps the benefits rather than suffers from our natural wealth. Unlike being dependent on a single commodity, we boast a diverse range of resources, and our natural resource sector directly constitutes only a tiny fraction of our broader economy. Additionally, stringent financial transparency and accountability standards are well-established and rigorously enforced in both the private and public sectors. Equally important is the national consensus in Canada that advocates for investing public wealth generated from resource rents into enhancing human capital through education, training, and social services. Furthermore, these funds are directed towards improving infrastructure and governance, ultimately leveraging natural-resource wealth to cultivate a larger, more diversified economy. An economy with strong capital markets, professional service firms, labs, equipment manufacturers and post-secondary educational programs primed by a significant metals and mining foundation.

However, Canada is behind in energy transition minerals and is not very competitive. We need a better approach to leveraging our mineral endowment and broader minerals ecosystem to ensure continued mining primacy and a sizeable automotive industry. The combination of complacency and abundant natural resources can transform a blessing into a curse for this country. Fundamental safeguards are essential to ensure that our abundant natural resources remain a competitive advantage.

We need a national strategy that aligns all levels of government to remain competitive.

Canada’s Critical Minerals Strategy is an excellent start to increasing the supply of responsibly sourced critical minerals and supporting the development of domestic and global value chains for the green and digital economy. The $2.78bn critical minerals strategy aims to boost the production and processing of critical minerals, including lithium, nickel, and cobalt, as explained in Mining Technology.

But does this strategy and its implementation go far enough? Probably not. Unfortunately, the regulatory process in Canada is currently dysfunctional, with increasing pressure to align with the U.S., which is intensifying efforts to secure metals crucial for EVs, solar panels, and wind turbines. Outside pockets of success in Quebec, including an ecosystem that is taking shape, the development of mines in Canada, according to Mining Weekly, can take anywhere from five to 25 years. This extended timeline massively hinders Canada’s aspirations to be a significant player in the US-led initiative to challenge China’s sector dominance.

“The situation we face is clear. We are at a pivotal moment for Canada to accelerate its critical minerals advantage.”

Developing the sector could catapult Canada to the top in the global race to decarbonize and monetize the EV revolution. Bloomberg claims that half of global passenger-vehicle sales in 2035 will be electric, and major companies like General Motors Co. and Volkswagen AG’s Audi have planned to phase out internal combustion engines entirely by around the same time. The lithium-ion battery is at the heart of this evolution. This presents an unparalleled opportunity for Canada to develop our abundant natural resources in an environmentally sustainable and economically lucrative way.

The seven critical success factors for Canada’s advancement in the rare metals and minerals race include:

- National resource identification & development: On exploration and mapping, Canada needs to identify and map domestic reserves of rare metals and minerals. Furthermore, investment in extraction will be vital to success, including the development of technologies and infrastructure, flow through share funding for drilling and extended to feasibility studies and construction. Development must be enabled by appropriate risk capital to build the required mines and processing facilities.

- Building end-to-end value chains: To ensure maximum value creation, Canada should prioritize establishing comprehensive value chains from mineral extraction to refining capacity and selectively through to manufacturing inputs such as battery cells and permanent magnets. This approach ensures that downstream economic benefits are firmly secured, a strategy well-acknowledged by other nations.

- Strengthening partnerships: Strengthening partnerships between the resource sector and Indigenous communities should be a key priority. Canada has the potential not only to expand these critical alliances but also to emerge as a global leader.

- Workforce development: People drive innovation, and investment in education and training programs to develop a skilled workforce for the rare metals and minerals sector will be essential. Creating employment opportunities in exploration, extraction, processing, and manufacturing will be vital to advancing this sector.

- Tax incentives: The federal government needs to have skin in the game and collaborate with the industry to rejuvenate fiscal tools, including tax incentives that promote sustainable development and help companies remain competitive, much like the program in Quebec combined with Federal Matching.

- Regulatory modernization: Any rare metals and minerals strategy must recognize the urgent need for a modern regulatory system that is outcomes-driven, flexible, and predictable. Such regulations should foster innovation and technology adoption, giving the business sector the certainty it requires.

- Protecting intellectual property: Knowledge is power, and to grow our competitive advantage, Canadian companies must safeguard all their assets and ideas. This involves offering additional support and incentives for developing and protecting intellectual property and data.

What next and where to from here for Canada’s mining sector?

The escalating global demand for critical metals and minerals driven by the energy transition highlights Canada’s potential leadership role. The surge in demand, primarily due to clean energy technologies, presents risks and opportunities. The significance of lithium in the energy transition and the role of the U.S., Australia, Chile, and China as dominant players in the global rare metals and minerals race is crucial. Competition underscores the need for a strategic and get-it-done (less talk and more action) approach in Canada, considering the country’s natural resources.

While Canada’s Critical Minerals Strategy provides a foundation, is it adequate or moving fast enough, particularly in a dysfunctional regulatory process that hinders timely project approvals? No. Our seven key success factors for Canada’s advancement in the rare metals and minerals race offer essential steps that we think must be taken urgently. The potential for Canada to excel in the global race to decarbonize and monetize the electric vehicle revolution is enormous. But like LNG and the more significant opportunity Canada missed, opportunities won’t remain forever. With Canada’s current primacy in mining and the importance of the Auto sector to the industrial base, getting it right is crucial to significant portions of the primary, secondary and services economy beyond just a few mining companies and government royalty cheques.

Written by Jon Wojnicki (EY Parthenon Mining Leader) and Dr. Lance Mortlock (EY Canada Energy & Mining Managing Partner)

Have you read?

The World’s Largest Companies by Market Cap, 2024.

The World’s Richest Female Billionaires, 2024.

Revealed: Countries in the world with the most female billionaires, 2024.

Poorest Countries in the World, 2024.

Ranked: Discover the Most Popular Sports in the United States, 2024.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz