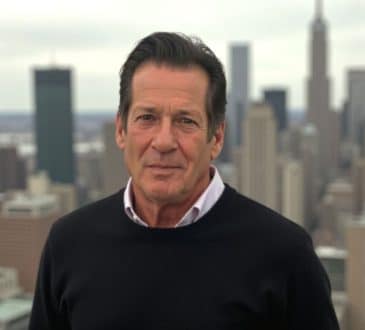

Why Masterworks CEO Scott Lynn Pivoted from Ad Tech and Ecommerce Finance to Art Investing

Every entrepreneur has an engaging story that explains their rise. Scott Lynn, the founder and CEO of Masterworks, a startup that offers a fractional art investing platform, is no different. Although he’s known these days for changing the way retail investors view art as an asset class, Lynn’s story is one of successful pivots from one nascent opportunity to another.

Best of all, he has used existing ventures to inform future moves. Here’s how Lynn has pivoted in the past while staying true to his entrepreneurial vision.

Leveraging the early internet

The late 1990s was an exciting time for technology entrepreneurs. That era saw current giants like Jeff Bezos and Elon Musk establish their first ventures. Lynn was no different. However, instead of venturing into retail or establishing payment networks, Lynn went with a venture close to his 15-year-old self, in the online gaming industry.

As traffic on the internet grew, people began viewing it as an entertainment outlet. An avid gamer at that age, Lynn developed Treeloot, a game which went viral in the early days of the internet. The game was relatively simple – users would simply click on different spots on their screens to reveal hidden treasures and prizes.

As traffic grew, Lynn monetized it through ads and banners from publishers, raking in money. Treeloot went on to become one of the most visited sites online, ranking number one at one point, Lynn has claimed.

This early success helped Lynn to develop his other passions like art collection and investing. It also clued him into spotting lucrative trends early and leveraging them successfully. The internet was the biggest trend going around, and Lynn was ready to make his first pivot.

Expanding the internet’s potential

Ad revenue was Treeloot’s key to success, and Lynn spotted a huge opportunity. While many entrepreneurs were busy developing websites and trying to attract traffic, Lynn went one step behind the curtain and established an ad network.

AdKnowledge, Lynn’s next venture, was an ad network that connected advertisers with website publishers’ banner inventory. It went on to become the fourth largest ad network online, with the other three spots occupied by Google, Yahoo, and MSN.

This method of digging deeper into a trend to service people keen on leveraging it would become a hallmark of Lynn’s pivots. Based on the principle of selling shovels during a gold rush, Lynn displayed a classic entrepreneurial trait of spotting the right opportunity to leverage.

As AdKnowledge grew, Lynn’s ventures expanded. Based on the “barbell strategy” of concentrating the majority of investments in safe bets while placing a small percentage of money in more creative and risky ones, Lynn’s net worth exploded. His investments in ad tech and martech grew, making him a successful venture capital investor. However, he wasn’t finished innovating.

Serving ecommerce sellers

By 2012, global ecommerce had captured enough of the retail market to command $1 trillion in revenue. Amazon had grown into a behemoth, and the iPhone changed the way people interacted with products online. Instead of clicking through endless rows of products, shoppers now swiped their phone screens to scan and purchase products with a single touch.

Lynn recognized the immense ecommerce opportunity on offer. However, he decided to serve the industry instead of trying to establish a successful ecommerce business of his own. In developing his idea, he tackled one of the biggest problems ecommerce sellers face: delayed payments from Amazon.

Amazon has long aggregated sellers on its website to display products for sale. However, the company’s size has given it leverage in payments. Sellers must wait for 60 days for Amazon payments to clear, while paying the company upfront when advertising on its platform.

This leads to an upside-down cash curve, with sellers spending first and receiving later. With no negotiation power, ecommerce sellers had to resort to expensive financing options to cover cash shortfalls. Lynn solved this problem by launching Payability, with two business partners. Payability offers sellers financing for a small fee and has currently paid over $6 billion to Amazon sellers. The company continues to operate successfully, and ecommerce financing has become a major industry unto itself.

By this point, Lynn had been in the entrepreneurial game for 20 years, almost all of them successful. His art personal collection was highly respected, and his investments were paying off immensely. Instead of resting on his laurels, Lynn spotted another chance for a pivot.

Another opportunity in plain sight

When asked to imagine art investments, most people will think of stuffy rooms filled with privileged people discussing obscure artists’ flaws and styles. The average investor has almost no access to art sales opportunities, given the extremely high purchase prices most paintings come with.

An avid art collector by this point, Lynn decided to change this picture. Masterworks was created in 2017 to give ordinary investors access to lucrative fine art investment opportunities.

The company built a database of art sales, created custom metrics to track price momentum, and leaned on advanced technology to spot opportunities.

The combination is unbeatable, as Masterworks remains the ordinary investor’s fractional art investment platform of choice – despite a rise in competition. The company is now actively using AI and ML to unearth great opportunities, keeping it a step ahead of other players in the space, with over 880,000 investors on the platform and over $941 million in assets under management.

More pivots?

Lynn’s strategic thinking has led him to identify several opportunities and successfully execute them. On the surface, pivots from gaming to art seem incongruous. However, Lynn’s approach to opportunities to dig deeper beyond the surface-level trend has paid off and continues to do so.

Does he have another pivot in him? Only the future will tell.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz