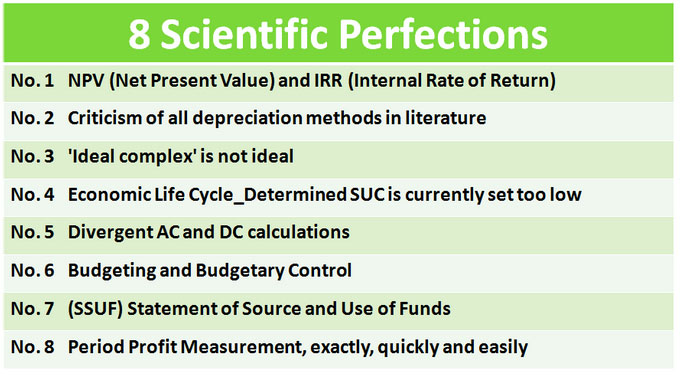

Business Economics 8 ‘Scientific Perfections’

Within business economics, a lot is currently badly taught worldwide by Schools / Universities and it entails the danger that wrong policy decisions will be taken by companies. This article presents 8 main items about this subject:

- NPV (Net Present Value) and IRR (Internal Rate of Return)

Discussion about which is better, NPV or IRR, wrongly seen as two different investment selection methods, is irrelevant, because understanding the behaviour of the underlying polynomial y = f (x), that is fundamentally necessary, and simultaneously to both outcomes, NPV and IRR. The NPV / IRR method does not take into account any necessary backlog depreciation; the investment is only settled on the basis of the historical cost price.The method can select in the negative sense but usually not positive. Do NOT do it, i.e. declare a project UNacceptable, that is possible with NPV / IRR as has been argued. But to prioritizing two or more acceptable projects is usually not possible with NPV / IRR.Re Appendix 10.2 The ‘Go/No Go’ Decision Regarding Strategic Investments from the book The Profit Formula® ISBN 9781086333992 available at Amazon. The separate consideration of only investments is hardly worthwhile, because it forms part of the trinity: TO INVEST, DEPRECIATION, PROFIT MEASUREMENT - Criticism about all depreciation methods in the literature

They are not flexible

Extra exercises are sometimes required (f.i. backlog depreciation)

The way of financing is often not taken into account.

The rigid depreciation methods in the literature do not follow the actual values; they only present artificial figures. They are unreliable because they are not only determined by the chosen method, but they depend on a supposed life cycle for each method. - ‘Ideal complex’ is not ideal

‘Ideal complex’ is for each complex of resources where the age structure is such that the number of working units put out of service each year is exactly the same as the annually purchased number of new working units.Only at 100 % equity no backlog depreciations; that can be called ideal, but unfortunately it hardly ever applies. In any other financial structure, the depreciations have to be determined exactly, taking into account that particular financial structure. Then there is nothing that is obvious. Almost always with a so-called ideal complex, the depreciation (all value differences) have to be calculated precisely. - Economic Life Cycle_Determined SUC is currently set too low

Standard prices of the working units of tangible fixed assets are, amongst other quantities, required input data in order to establish minimum product prices. However, this important data is not calculated exactly – if calculated in conformity with the best textbooks in use worldwide – it is consistently too low.

The calculation of the economic life cycle to date must be followed by the NEW algorithm presented in ISBN 9781086355635 by Jan Jacobs, available at Amazon - Divergent AC and DC calculations

There is an easy to learn the formula. Just one formula. For both AC and DC. And for everything that one can think off around breakeven analysis and iso profit lines. Many textbooks present a variety of DC and AC calculations. For DC and AC, one simple calculation scheme is sufficient, a single formula and then easy to make illustrative drawings. - Budgeting and Budgetary Control

No Greek word has been used in full elaborations in ISBN 9781086355635 and although factual formulas have indeed been used, everything is automatically drawn up along the lines of logic so that everyone can also understand the analysis made. There is no need for difference analysis rather just common sense. Remember, every analysis must be clear and transparent. If not complete, it entails the danger that wrong policy decisions will be taken. - Statement of Source and Use of Funds

About ICF, FCF and OCF. Every cent, in and out. Easy to set up, not by starting from the bottom line – but from the top of the profit and loss account. Not the profit plus the depreciation, with which so many theory books start, because then a lot disappears outside the field of view. Add the invoiced turnover (top of the profit and loss account) to what the debtors (see previous balance sheet) were. Suppose that no debtor has paid even one cent, the debtors must now be the total sum. However, the debtors are (see current balance sheet) what they are. Subtract that from the sum and the difference is the payments apparently received on the part of the debtors; if necessary, debits can still be settled on non-paying debtors. Idem, all those other items. Look what it was. Suppose there is not a penny moving. What should it be now? And it is? Ergo, the actual cash flow must be the difference, apart from complications. It is about clearly showing the flows of money. With regard to investment and financing activities, there is often no dispute; but with regard to operational activities (OCF) there happens to be a lot of difference of opinion. While OCF follows also from an exact calculation, as well as ICF and FCF. - Period Profit Measurement, EXACTLY, QUICKLY and EASILY

Profit determination is one of the main subjects in the field of business economics. The problem of determining the period profit of a company is regarded as such truly comprehensive, it is deemed insoluble. A solution would not exist. “Perhaps the search for an ideal accounting system should be likened to the search for the philosopher’s stone or the elixir of life (Whittington, 1983, p. ix).”Profit determination, is that possible? Yes! WORLD NEWS!

The adage ‘profit is an opinion’ is no longer true. Everybody c

an measure period profit. Just see how complicated the elaborations are through the old ways, and how wonderfully simple with the help of The Profit Formula®. Simplicity is indeed often the hallmark of truth. All profit calculation systems known so far generate a lot of work. If one uses The Profit Formula® regarding all values and standards one can quickly and easily calculate any profit. Using this method measuring profit is ‘a piece of cake’.

On YouTube, search for: The Way to Easy Profit Measurement_2 EXAMPLES (fully elaborated) https://www.youtube.com/watch?v=7p98M6UKOJk&t=88s

After replacement, any new video gets a new URL

On YouTube, search for: The Way to Easy Profit Measurement_AMPLIFICATIONS https://www.youtube.com/watch?v=qaFAFjQ5js8&t=163s The above mentioned 8 ‘Scientific Perfections’ are fully explained in ‘Business Economics VI Groundbreaking’ ISBN 9781086355635 Paperback and e-book available at Amazon.

Written by Jan Jacobs.

Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

This report/news/ranking/statistics has been prepared only for general guidance on matters of interest and does not constitute professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this publication, and, to the extent permitted by law, CEOWORLD magazine does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.

Copyright 2024 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz

SUBSCRIBE NEWSLETTER