2020 Elections Pose Reputational Challenges for Corporate America

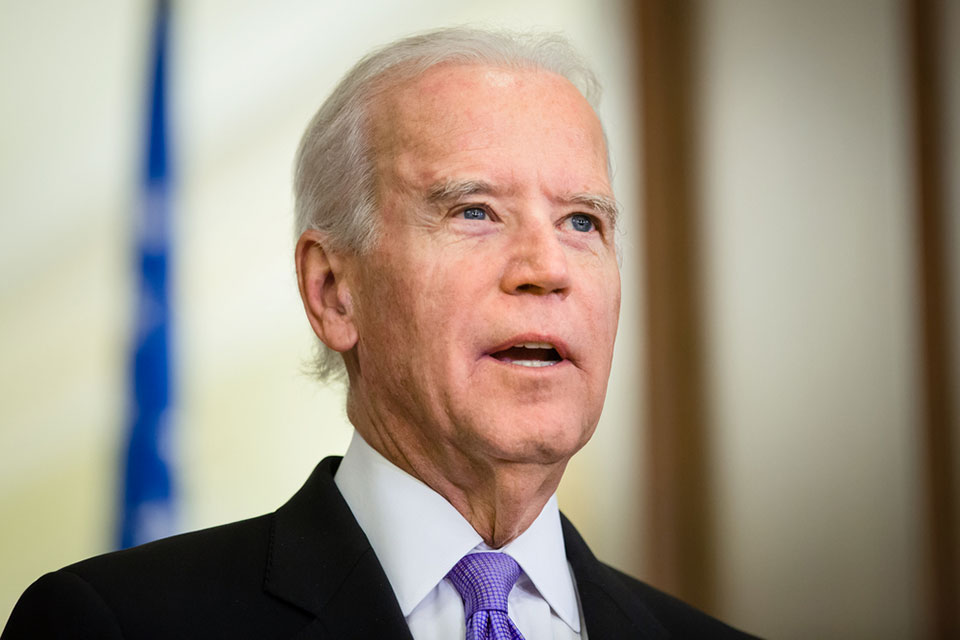

The 2020 elections could cause a landslide of reputational challenges for American corporations. Last August’s Business Roundtable pledge—with CEOs recognizing employees, communities, the environment and others as stakeholders of equal standing to actual shareholders—has given politicians license to subordinate investors. Even former Vice President Joe Biden, considered by most to be a moderate, said recently that the primacy of shareholders’ interests—profits—over all others is “an absolute farce.”

In this environment, not only do companies need to understand and meet the expectations of these disparate groups—their reputations depend on it. Reputation depends on actions aligning with expectations; disappointing new groups of already angry stakeholders risks reputational damage that can quickly become very expensive and litigious. In boardrooms, they call this peril “reputation risk.”

Former Hillary Clinton aides Nick Merrill and Dan Schwerin of Evergreen Strategy Group write that: “A glossy ad campaign or generous philanthropic commitment won’t be enough. Getting your own house in order—which many companies still fail to do—will be necessary, but not sufficient. Without the foil of President Trump and his antics, CEOs will have to back specific policy proposals, build coalitions, and put real political muscle behind their principles.” It is not something a marketing genie can magically fix.

Whoever gets elected in November, a clear trend has taken hold. CEOs and Boards of Directors need to take it seriously. Gone are the days when lofty marketing claims were accepted as aspirational in nature and not necessarily to be taken literally. When companies make claims that set high stakeholder expectations in areas that are fundamental to their reputations, they put their reputations at risk in both the courts of public opinion and law if their execution falls short.

When they make “commitments” to corporate social responsibility, tout their ESG scores, seek inclusion in ESG funds, and sign onto Business Roundtable pledges, the world is listening. Elected officials and regulators are going to hold them accountable, along with credit rating agencies, institutional investors, business partners, employees and customers.

When a Congressional hearing about a company’s failure to meet its sustainability goals – something that is bound to happen – is followed by a drop in stock price, plaintiffs’ lawyers are going to have a field day. They’ll call the decline a “liar’s discount” and condemn overly optimistic corporate statements designed to enhance the company’s reputation. Historically, such claims would have been written off in the courts of law as mere “puffery,” but recent rulings have defined corporate reputation as “mission critical” and held companies accountable for the impacts of reputational failures.

Corporate executives and boards need to anticipate in advance the operational issues on which after the fact, the media, politicians, regulators and plaintiffs’ lawyers are going to focus. They can only do that if they have in place a proactive, integrated process that can delve into every aspect of the company’s operation, gather intelligence about stakeholder expectations, and identify areas where there is a risk of disappointment sufficient to jeopardize corporate reputation. That’s as different to the Enterprise Risk Management processes most companies have in place today as a software spreadsheet is to an adding machine.

The political and cultural landscape is constantly shifting and, recently, the shifts have been dramatic and rapid. No risk management system is going to be fail safe 100% of the time. But when an unanticipated crisis does occur, executives and board members need to be able, at the very least, to show they had done everything possible to anticipate and mitigate the risk.

How well companies and their leadership weather 21st century risks, including the rise of new stakeholders and new pockets of political power, depends on their ability to anticipate and mitigate those risks and show they are taking their own claims seriously.

Have you read?

World’s Best Countries To visit In Your Lifetime.

World’s Best Countries For Women.

World’s Best Countries To Retire.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz