Central banks, not inflation, is the risk

The global inflation has been fairly stable since long and the outlook remains the same right now, the increased risk is that the central banks could be challenged if the situation changes.

Currently, American investors have an increasing fear of rising inflation, or they are at least buying more bonds that include inflation protection, the so-called Treasury inflation-protected securities, or simply Tips to make life easier. In this context, there is some speculation that the US central bank (Fed) will allow higher inflation when they announce their review of their own monetary policy tools, a report that is done every 10 years, so it’s pretty exciting.

Globally, low inflation has now and then caused some concerns, though, on the other hand, it has been a part of the sweet spot for all kinds of securities, to the pleasure of investors. Low global inflation also continues to be one of the megatrends that I expect to continue. Despite a consideration to change the outlook, I keep my primary scenario, which is a continued fairly low inflation around the globe. The arguments remain the same with the surplus of labor force globally, an energy surplus, excess production capacity, and further does globalization lead to ongoing price competition.

Though sudden unexpected changes are equal to real risks in the financial markets, as threatening risks are always the unforeseen changes– but are the central banks ready to deal with sudden changes in inflation based on the current monetary policy?

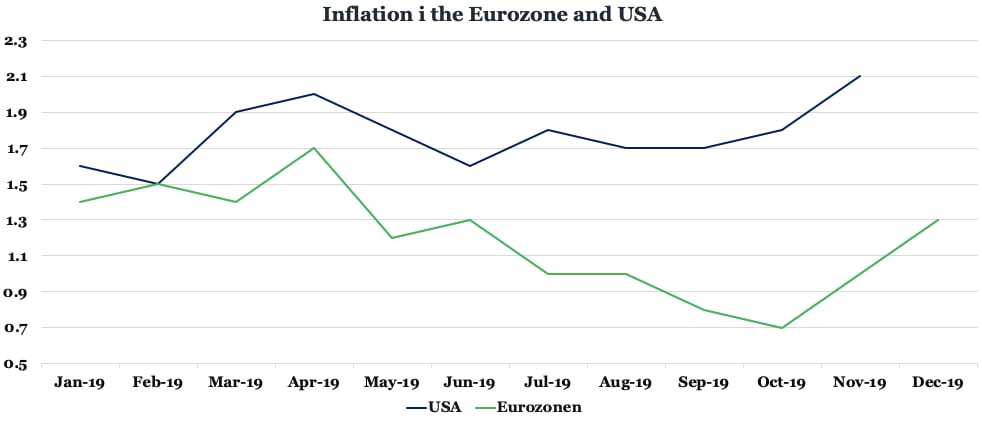

So far, there are no strong indications to change the inflation outlook, so I think the central banks can sleep comfortably at night (graphic one). But the global economy might start to be on the move again, at least for a period. The American economy is not heading towards any recession, which has been a fear among some economists for years now but I expect the fear to fade out. Furthermore, a range of countries around the world will even increase their fiscal spending this year.

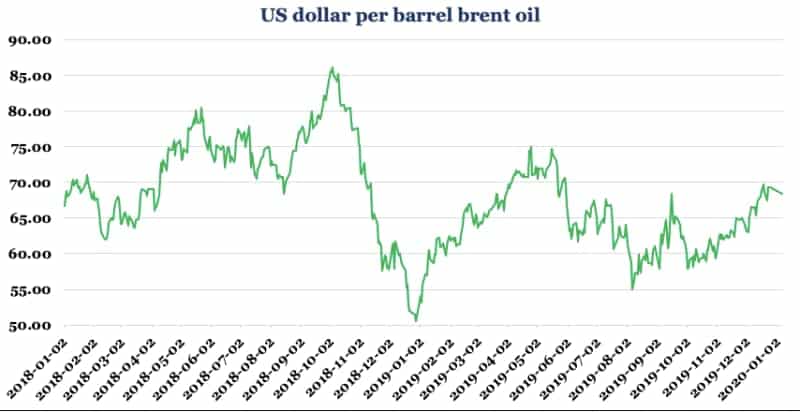

These days, the tension in the Middle East is rising, though it does not necessarily mean that the oil price will spike higher, the risk is, of course, currently rising. As the price of crude oil during 2019 moved in a pretty narrow range (graphic two), then just a minor increase in the oil price this year can generate measurable changes in inflation, which is a rising possibility, or risk. A jump in inflation cannot be excluded, but it’s another risk linked to inflation that I argue is rising.

It is the question about whether the leading central banks are ready to deal with a sudden change in inflation. The view is not about a decreasing or rising inflation, but whether the American and Eurozone central banks risk being left behind if the global growth and inflation surprise the whole market by moving higher.

As both the Fed and The European Central Bank (ECB) have cut their interest rates in 2019 without any reason, they moved further away from being in a position where they can smoothly tighten the monetary policy if inflation jumps unexpectedly. Currently, almost everybody in the financial markets, including the central banks, is relaxed about the inflation risk. I also keep my main scenario that inflation will remain stable, and so far, I do not upgrade towards higher inflation.

But I change my view towards a bigger risk- that the leading central banks might be behind the curve when it comes to having the inflation under control. I have noticed that US investors are buying more protection against inflation, which happens every now and then. I assess the investor behavior to confirm if any risk will hurt the financial markets this year, then it’s the bond markets, and that outcome or risk, I upgrade. The downgraded trust in leading central banks being able to handle a jump in inflation plays a higher role in this assessment– it’s not that the financial markets are derailing or that economies will explode, but it represents another nudge up in the risk that leading central bank will be left behind the curve if inflation surprises and central banks being left behind the curve can scare investors.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz