The investor’s dream- an AI profit machine

For a couple of days, I have had the pleasure of being in sunny Barcelona in Spain. Though it wasn’t the palms on the beach that was the attraction, but rather, a 1,000-person fixed income convention, where I was invited to share some thoughts on the podium. This convention always includes quite a lot of trading technology and risk management systems. One could ask, does this hold any relevance for normal investors?

In my opinion, the answer is quite clear- yes, as some of the systems that are promoted will help increase the volatility in many financial markets, which can hit any investor. The very big theme is, of course, whether artificial intelligence (AI) can create new and bigger profits for the investors– the dream of any investor is to buy a machine that is smarter than others and generate even more money every day.

The financial markets are already dominated by machine trading, where AI is a growing part of the programming of the trading software. In my view, it’s still predominantly to enhance the speed of the trading executions and to analyse for investment opportunities in a broader part of the financial markets. The hedge funds and asset managers with the fastest systems have the best chances to profit from all kind of arbitrages, simply by utilising inaccuracies in the pricing of assets in different markets. I expect that this kind of trading will remain at some large market participants, though machine trading, in an increasing manner, will influence the life of private investors in another way.

Constantly, we all try to predict if the markets are facing an immediate big move, either up or down. Or at least any investor would like to know this before all other investors, and here, the machines play an increasing role. For a human being to able to detect these potential big moves requires decades of experience and an ongoing attention to the financial markets. It’s natural to try to develop software that can take over this role, which a growing number of vendors are offering.

It has already gone so far, that machines try to protect so-called “low risk” pension saving schemes in the U.S. to manage this additional risk machine/trading programs and monitor the stock market very precisely, filtering factors that could indicate a burgeoning uncertainty. The risk monitoring is so finetuned that the related hedging even takes place during the day, which increases the volatility in the American stock markets.

The increasing volatility might be annoying for an individual investor, though it should not abstain anybody from using securities in their savings. But the swings will be bigger, and I expect the number of “flash-crashes” to be more frequent. A “flash-crash” is a crash in a financial market, where the market recovers right away, and nobody intended to sell-down the market.

Though what I fear is that one day, it converts a “flash-crash” into a real crash, and investors wake up one morning to a stock market that is 15 pct. lower. It’s still a very low probability, but the risk is growing, and I can’t see anybody prepared to handle this situation. Again, it should not scare investors away from the financial markets, but the risk is there.

The good news is, in my opinion, larger than the concerns. The current system developments allow professional investors to include more data and an extended number of investment opportunities in their decision-making. The data increasingly includes a lot of trade flow data from the banks’ own trading floors, which all-in-all makes the total information and data package more interesting. So far, this enhanced insight is kept inhouse or primarily shared with large institutional clients.

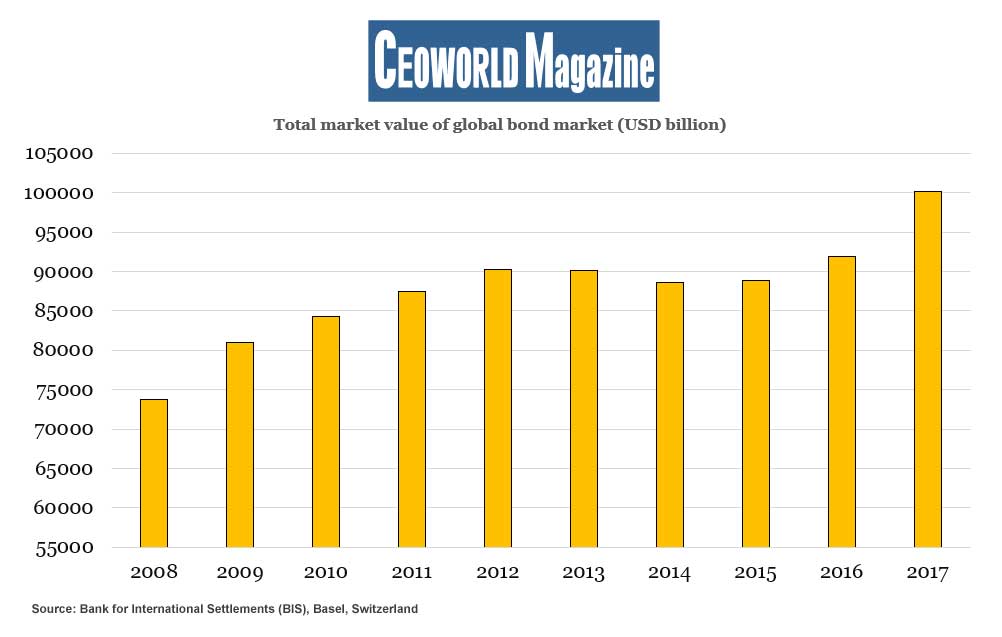

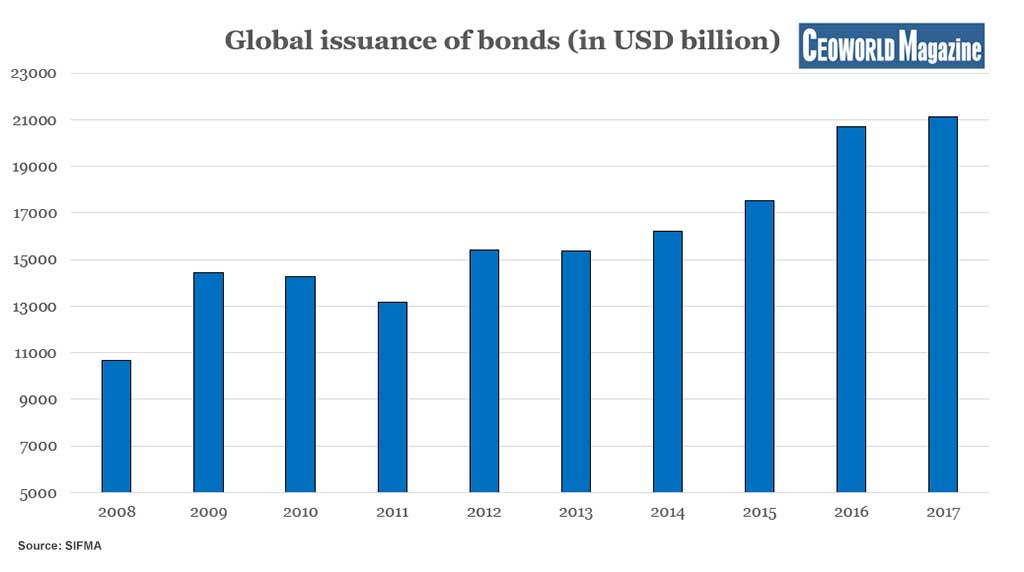

However, it should also be said that there will be a fewer number of employees on the trading floors at the banks to handle a growing market volume. Graphic 1 shows that global bond issuance is growing every year, and the same is the case for the total outstanding volume (graphic two). It makes good sense to develop more sophisticated and robust trading programs that can help in handling the larger trading volume. It is the development of new sophisticated trading programmes or machines, combined with artificial intelligence, that represents the exciting initiatives in the industry.

I expect that it wouldn’t last long before private investors can gain access to the same information as some institutions. It might be via new smart trading platforms, or smart banks, that also offer low trading fees and will give access to an extended number of exchanges. These are good news for the coming years, but to the question as to whether AI can also secure a daily trading income, then the realistic answer is that this part is still up to the investors to generate. For the simple reason, AI programmed machines do not make the global GDP growth higher, nor lead to higher company earnings, i.e. it’s still the same value creation that all investors will have to fight about.

But AI will pretty soon help investors in handling even more data to help better understand the indirect links between economic developments and individual companies’ earnings, as well as, for example, to spot new investment opportunities that one may not even consider, which is very exciting.

Graphic 1: Global issuance of bonds (in USD billion)

- 2008: 10681

- 2009: 14415

- 2010: 14264

- 2011: 13145

- 2012: 15406

- 2013: 15369

- 2014: 16198

- 2015: 17529

- 2016: 20696

- 2017: 21100

Graphic 2: Total market value of global bond market (in USD billion)

- 2008: 73814

- 2009: 80962

- 2010: 84334

- 2011: 87471

- 2012: 90300

- 2013: 90167

- 2014: 88638

- 2015: 88816

- 2016: 91918

- 2017: 100134

Have you read?

Top MBA Colleges In Europe For Marketing, 2019,

Revealed: The 50 Best Road Trip Songs Of All Time.

Ranked: Trendiest Countries In The World, 2019.

These Are The World’s Richest Royals, 2019.

Best Countries For Investment In Travel And Tourism Sector, 2019.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz