Even China Needs More Reforms To Stay Fit

Teaser: In China, a reform on state-controlled enterprises is once again on the agenda, but more is needed to satisfy the financial markets.

When China’s Communist Party held the yearly Congress in March, there was good optimism about China’s economic outlook. The trade conflict with the United States seemed like something that could be solved, despite the continued harsh rhetoric.

When the 25-person Politburo, chaired by President Xi Jinping, gave the more official assessment of the economic outlook last April 19th, the optimism was clearly still intact. Surely, when the economy is backed by tailwind, it is a good timing for reforms, though it is exciting to see if Beijing remains optimistic and will continue to follow that path.

When studying the communication from the highest political level in China, the phrases used are the interesting parts of the content, along with which words were avoided when communicating. Back in March, words like “reforms”, “opening up”, and “restructuring” were used. On the other hand, phrases like “stable labour market”, “trade”, “investment” etc. were avoided.

I assessed this as an official relief of the trade war that did not hit China seriously, and that the GDP growth in the first quarter was even slightly higher than expected.

The phrases in the rhetoric indicated a shift in focus- away from typical crisis communication and more towards reform thinking.

One of the reforms that once again seems to be on the agenda concerns the state-owned enterprises (SOEs). Since minimum 10 years, the central government in Beijing has repeatedly tried to reform this significant block in China’s economy. This time, the reform is attempting to shift the state role towards being

the capital owner, thus moving away from an operational or managerial influence on companies.

This time, the reform of the SOEs must be completed in 2022, but as mentioned, the government has repeatedly tried to reform the sector in the past decade.

The initiatives have included everything; from streamlining the individual companies, to the attempt to sell some of them. So far, the central government has not really succeeded, and whether it will be the same case this time remains an open question in my view.

A reform of the state-controlled companies is certainly a good initiative and a welcomed thought, but it is hardly a surprise that more is needed. When I observe the internal Chinese discussions about reforms, my assessment of the toolbox is that it contains fairly classical tools, and not much economic innovation.

In addition, optimism tends to be short-lived in the global economy nowadays, which doesn’t seem to be different in China.

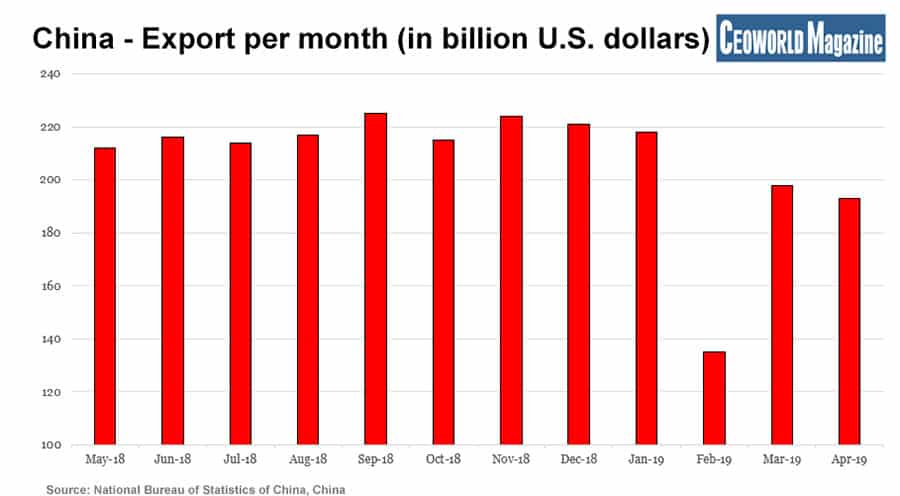

China – Export per month (in billion U.S. dollars)

- May-18: 212

- Jun-18: 216

- Jul-18: 214

- Aug-18: 217

- Sep-18: 225

- Oct-18: 215

- Nov-18: 224

- Dec-18: 221

- Jan-19: 218

- Feb-19: 135

- Mar-19: 198

- Apr-19: 193

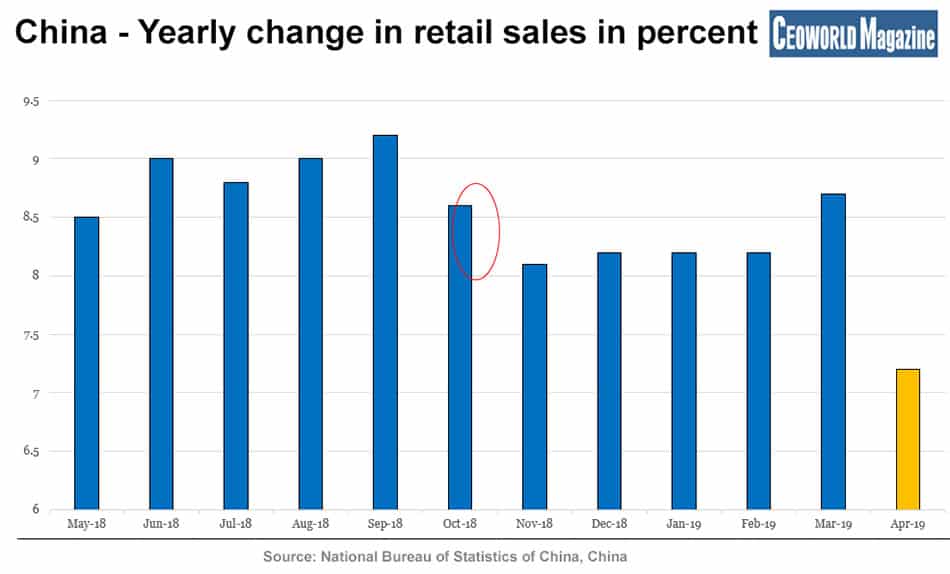

China – Yearly change in retail sales in percent

- May-18: 8.5

- Jun-18: 9

- Jul-18: 8.8

- Aug-18: 9

- Sep-18: 9.2

- Oct-18: 8.6

- Nov-18: 8.1

- Dec-18: 8.2

- Jan-19: 8.2

- Feb-19: 8.2

- Mar-19: 8.7

- Apr-19: 7.2

Graphic above shows China’s exports per month, where March and April altogether were on the soft side. Partly due to the trade battle with President Trump, though the global economy continues to face difficulties, which not only hit China, but all countries.

The retail sales in April with an annual increase of only 7.2 pct. is a true concern. The uncertainty among households concerning the labour market may have played a role – this makes the development in May particularly interesting follow.

As mentioned, reforms are easier to implement during times with economic tailwind, as there will always be winners and losers from a reform. But it is quite exciting to see if the optimism continues to be intact at the highest government level after the recent economic data, a resurgence of trade dispute

with the US, and the prospect of a second quarter with modest economic growth. Naturally, this reform momentum in China is of interest for the financial markets.

My long-term view remains that the most interesting Emerging Market countries over the next 10 years are the economies with strong domestic growth. Interesting countries keep themselves fit via economic reforms, though these countries are rare.

During China’s 40-year transition from a poor closed-economy to an advanced emerging- economy, it is natural that new legislations have been introduced on an ongoing basis. One could even argue that opening-up the economy was a reform. In terms of real reforms, many have surely made a parallel to the economic journey that China is still undertaking.

It is therefore easy to link reforms and economic prosperity together, so the reforms become the primary explanation for the economic progress in China.

It was brilliant strategic thinking behind opening-up China’s economy that once again created economic prosperity. Though I will allow myself to add a dash of wormwood in the beaker. The access to China originally meant that western companies got access to cheap labour, energy, and land. This generated a transformation of jobs from all western countries, and as a consequence, also shifted economic wealth towards China. The wormwood is that progress was not primarily based on extraordinary creative reform work.

I include this 40-year review because a fit and well-reformed economy is becoming particularly important when entering the next decade with lower global economic growth. The countries that either regularly adjust the economy with reforms, or have a tradition of major reforms, have the best conditions for

become the winners in a low-growth period, and are therefore the most attractive destinations for investors.

In China’s case, I argue that there is not necessarily a very strong tradition of forward-looking and creative economic reforms. This is one of the many reasons why I follow a possible current reform process with great interest.

I argue that the attractiveness about China as an investment destination is the dominant domestic growth, combined with the fact that many foreign investors remain underweighted in Chinese securities. To make China particularly attractive for global investors, then the reform optimism from March and April must be brought forward- this I will give extra attention to in the coming months.

Have you read?

# Top 20 Richest Sports Team Owners In The World, 2018.

# The 100 Most Influential People In History.

# Top CEOs And Business Leaders On Twitter: You Should Be Following.

# Must Read Books Recommended By Billionaires.

# The World’s Top 20 Most Charitable Billionaires.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz