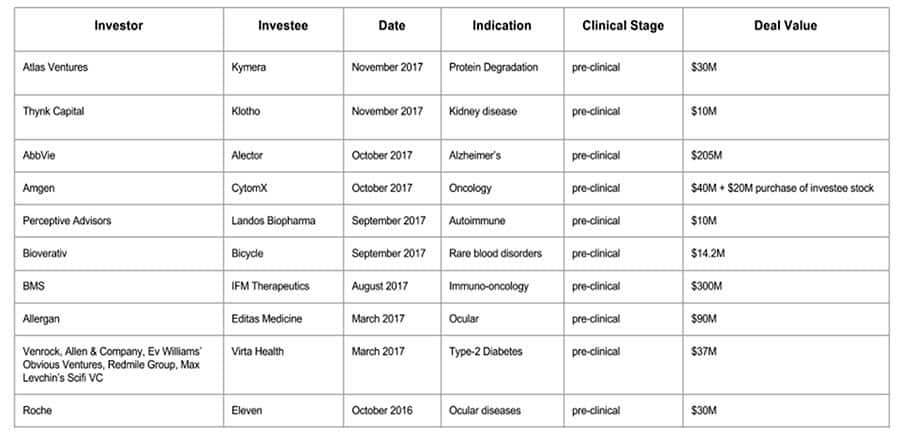

A Review of Preclinical Deals in 2017

Change must start somewhere. Deals both in preclinical and later stage women’s health applications are an important element we use when valuing my Company. Preclinical deals are the most fascinating for me to unpack. With great risk comes great reward and I applaud the visionaries at the helm of these early-stage agreements. I believe the life blood of biotech is wrapped around patience, solid science and persistence. And often times, the greatest discoveries are the simplest.

The most common element to these early stage deals is upfront Research and Development (R&D) capital to the investee. Many biotech/pharma companies will go years without profits. Growth models look more like stairs than a neat line. The true cost of drug development is hotly debated, but it is safe to assume that anywhere between $400 Million and $2.6 Billion depending on the drug application. The staggering cost of drug development is serious business and these early-stage companies will use this upfront capital to further mitigate risk and nominate their lead candidate(s) for clinical trials.

Another company profile garnering support from investors is a novel mechanism offering compelling preclinical evidence. A well differentiated potential solution to an unmet need helps pave the way for a favorable FDA regulatory environment. Areas of major unmet medical needs can lead to shortened clinical trials which means faster clinical development. Quicker development can lead to long-term intellectual property (IP) protection. Oncology, orphan disease and speciality products are good examples fitting in this category.

Strong biological rationale is complimented by another investment strategy that seems to be exercised in these deals. Investors tend to gravitate towards investment into companies with strong leadership teams. Early stage companies allow for firsthand insight into management capabilities in which investors can use to validate prior work and experience and demand the impeccable execution needed for success.

Saving the best for last, these potential solutions would be transformative for patients. We are in this business to provide better patient outcomes; this is the real value of these early stage investments. As the Holidays come upon us and we reflect on what we are grateful for, I would like to say thank you to the people that invest in visionaries helping accelerate life science technology development and a special thank you to the visionaries.

(Written by: Founder and CEO of LifeStory Health Inc., Anna Villarreal, recaps some of the year’s preclinical deals.0

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz