World’s 27 Biggest And Most Attractive Countries/Regions With Proven Petroleum Reserve For Investment

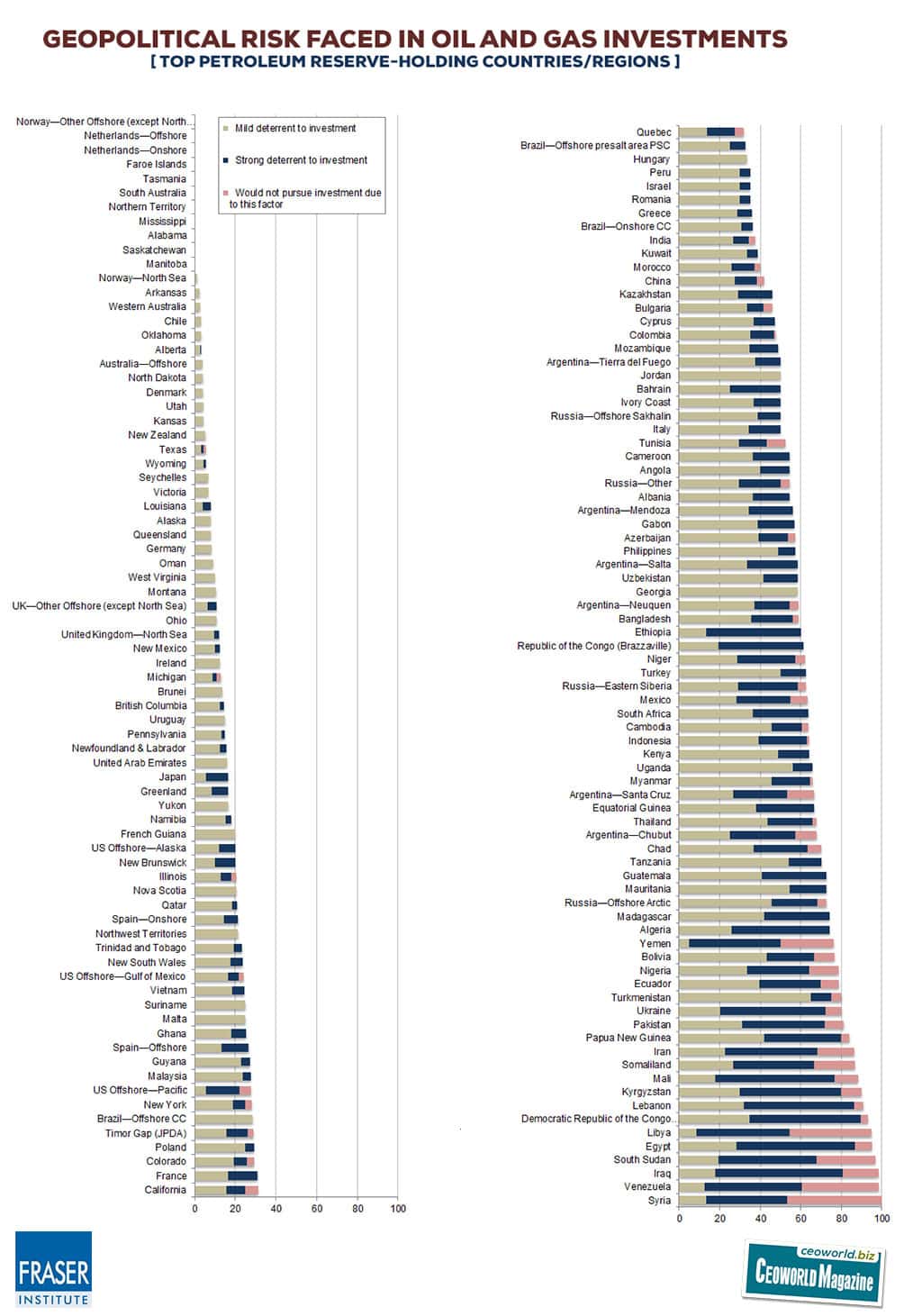

OPEC member countries continue to overshadow the world in terms of proven petroleum reserves, but interestingly Texas, Alberta, and Norway—North Sea ranked as the most attractive energy-producing regions for oil and gas investment in the world in a survey by the Vancouver-based Fraser Institute.

Additionally, United Arab Emirates and Qatar also ranked among the top 5 biggest petroleum reserve-holding countries/regions for investment, the research organization said in its Global Petroleum Survey 2014. Among jurisdictions with the largest proven reserves, Venezuela, Iran, four Russian regions, Iraq, Turkmenistan, Indonesia, and Egypt are the least attractive to investment.

Based on responses from petroleum executives and managers, this year’s survey ranks 156 jurisdictions worldwide on their relative attractiveness for investment. Barriers to investment include high taxes, costly regulatory obligations and uncertainty over environmental regulations.

Here Are The World’s 27 Biggest And Most Attractive Countries/Regions With Proven Oil And/OR Gas Reserves For Investment:

1. Texas

Policy Perception Index value: 13.19

Proved reserves: 28.571 billion barrels of oil equivalent (Bboe)

2. Alberta

Policy Perception Index value: 26.57

Proved reserves: 174.835 billion barrels of oil equivalent (Bboe)

3 Norway—North Sea

Policy Perception Index value: 29.70

Proved reserves: 13.576 billion barrels of oil equivalent (Bboe)

4. United Arab Emirates

Policy Perception Index value: 31.83

Proved reserves: 137.990 billion barrels of oil equivalent (Bboe)

5. Qatar

Policy Perception Index value: 34.90

Proved reserves: 190.700 billion barrels of oil equivalent (Bboe)

6. Malaysia

Policy Perception Index value: 53.10

Proved reserves: 19.513 billion barrels of oil equivalent (Bboe)

7. Brazil—Offshore CC

Policy Perception Index value: 55.18

Proved reserves: 14.589 billion barrels of oil equivalent (Bboe)

8. Mozambique

Policy Perception Index value: 66.13

Proved reserves: 18.690 billion barrels of oil equivalent (Bboe)

9. Kuwait

Policy Perception Index value: 66.58

Proved reserves: 115.868 billion barrels of oil equivalent (Bboe)

10. Azerbaijan

Policy Perception Index value: 68.29

Proved reserves: 13.542 billion barrels of oil equivalent (Bboe)

11. India

Policy Perception Index value: 70.63 14.432 billion barrels of oil equivalent (Bboe)

12. Nigeria

Policy Perception Index value: 72.04

Proved reserves: 70.920 billion barrels of oil equivalent (Bboe)

13. China

Policy Perception Index value: 72.37

Proved reserves: 53.413 billion barrels of oil equivalent (Bboe)

14. Algeria

Policy Perception Index value: 75.74

Proved reserves: 41.936 billion barrels of oil equivalent (Bboe)

15. Mexico

Policy Perception Index value: 75.79

Proved reserves: 13.264 billion barrels of oil equivalent (Bboe)

16. Kazakhstan

Policy Perception Index value: 75.93

Proved reserves: 45.887 billion barrels of oil equivalent (Bboe)

17. Russia—Other

Policy Perception Index value: 82.11

Proved reserves: 189.848 billion barrels of oil equivalent (Bboe)

18. Egypt

Policy Perception Index value: 83.08

Proved reserves: 18.829 billion barrels of oil equivalent (Bboe)

19. Russia—Offshore Sakhalin

Policy Perception Index value: 84.33

Proved reserves: 22.442 billion barrels of oil equivalent (Bboe)

20. Libya

Policy Perception Index value: 85.43

Proved reserves: 58.694 billion barrels of oil equivalent (Bboe)

21. Indonesia

Policy Perception Index value: 85.89

Proved reserves: 23.098 billion barrels of oil equivalent (Bboe)

22. Turkmenistan

Policy Perception Index value: 87.01

Proved reserves: 50.129 billion barrels of oil equivalent (Bboe)

23. Iraq

Policy Perception Index value: 88.59

Proved reserves: 161.143 billion barrels of oil equivalent (Bboe)

24. Russia—Offshore Arctic

Policy Perception Index value: 90.90

Proved reserves: 160.238 billion barrels of oil equivalent (Bboe)

25. Russia—Eastern Siberia

Policy Perception Index value: 92.66

Proved reserves: 22.959 billion barrels of oil equivalent (Bboe)

26. Iran

Policy Perception Index value: 93.78

Proved reserves: 380.272 billion barrels of oil equivalent (Bboe)

27. Venezuela

Policy Perception Index value: 100.00

Proved reserves: 334.449 billion barrels of oil equivalent (Bboe)

The 10 countries/regions with the highest percentage of negative responses, indicat ing the greatest barriers to investment, with the least attractive last, are:

1. Turkmenistan

2. Democratic Republic of the Congo (Kinshasa)

3. Uzbekistan

4. Iraq

5. Russia—Off shore Arc tic

6. Russia—Eastern Siberia

7. Iran

8. Ecuador

9. Bolivia

10. Venezuela

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz