Italy’s election doesn’t tilt anything, but….

The election results in Italy on Sunday 4th March resulted in the biggest voter move in a national election in Europe since the Brexit vote – some in the financial market even claimed it was a surprising result.

Although polls are not what they have been, it has since long been in the cards that the party “Five Star Movement” would become the biggest party in the parliament and that the parties on the right would gain in size. The surprise is perhaps the significance of the result, as before the election it was expected the ballot would result in three equal fractions in the lower house split on the right wing, the Five Star party, and the left wing, including the outgoing government party Democratic Party. On the right wing, the party “League” got the largest number of votes and “Five Star” got a result in the upper end of the expectations. Thus, the left is reduced to a smaller fraction than expected, however, the Democratic Party may end up being the parliamentary base for a Five Star government. But does this result really matter for the financial market?

The simple answer is no- at least in the short term. However, if one considers the long-term, or strategic effects, this political development adds important pieces to the big picture of the Eurozone. Italy’s future relationship with the EU, especially the other members of the Eurozone, will be extremely interesting. It is particularly important now where President Macron, on behalf of more Eurozone members, is trying to get his fingers in the German public finances.

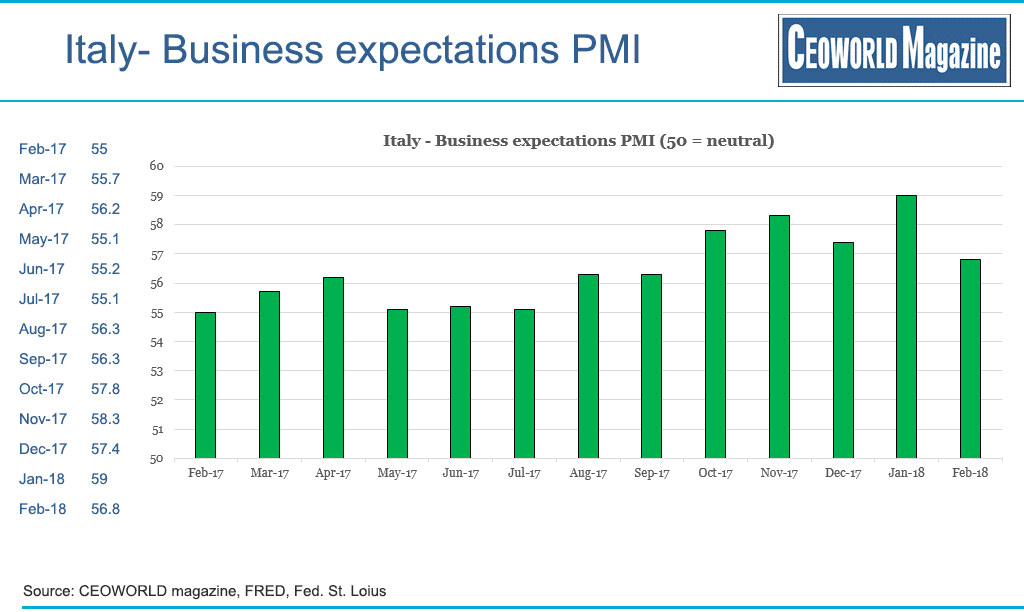

But there are also a few other developments, or lack of the same, that are worth noting. Italy is known for corruption, and there is no doubt that Five Star attracts voters due to the clear distance from corruption. But large electoral movements are very often caused by the economic condition of a country. If one looks at the two graphics, Italy should not have had the great election movement that actually happened.

That statistic that the PMI (Purchasing Managers Index) is so much above the neutral level of 50 should express a “strong expansion” among the companies surveyed. The consumer confidence points to the same as the reading is in the upper end of historical results where the highest level was 120.86 for 30 years ago back in 1988. The crux is that if these expectations really speak the truth, then Italy’s economy should hum of activity, and any government would almost certainly be re-elected. But the reality is quite different – the country has now achieved a GDP growth of 1.5 pct. which is the highest during the past 10 years since the financial crisis.

It is possible that the various surveys by coincidence only asked the most optimistic respondents, but this statistical extreme I do not believe. My assessment is that few and small progresses in the Italian economy are seen as big steps, because 10 years with lack of growth has been like walking in an economic desert where even the smallest drop is welcome.

This picture fits well with the big electoral movement because a GDP growth of 1.5 pct. by no way can be felt in the wide population. This would be a well-known reason for voters to move towards another economic policy.

However, my assessment of the Five Stars’ party is that it practically has no policy for this central area (i.e. the party cannot offer new suggestions that really can bring momentum in the country’s economy). The other parties who also received strong voter support haven’t shown any profound economic reform thinking either.

My best bet is that Italy simply continues on the same track as usual, with low economic growth, and thus remains uninteresting for most investors. The consequence for the wide Italian population is that it will continue to experience an annual decline in their national and international purchasing power.

In relation to the other members of the Eurozone, the Italian government negotiations are, as mentioned, extremely exciting. I expect that some bond investors will give this attention.

It would fit the French President Macron’s plan to take over the leadership of the Eurozone / EU very well if a Five Star government is formed based on the support on the outgoing government party and pro EU Democratic Party.

For years back, the Five Star movement had the view that Italy should hold a ballot about a continued membership in the euro. This standing has changed, and now the party has a significantly more neutral attitude towards the EU including the euro. Therefore, I do not doubt that Italy will support the French proposal about a partial joint fiscal budget for the Eurozone. On top the German government coalition partner, SPD also supports this idea, and they now take over the Ministry of Finance in the new German government.

If the plan succeeds for President Macron, it probably has a long-term impact on the credit quality of the respective countries’ bond markets. Of course, German government bonds will carefully be examined if the German Ministry of Finance partly sponsor the French and Italian budget deficits in the future. This could very well be the price that Germany will have to pay to take over the presidency of the European Central Bank (ECB), that soon is vacant.

But so far, nothing is decided, as it probably will take its time with the government talks in Italy. The outcome may also be that the right wing party League becomes the Five Star government’s parliamentary base. In this case, a completely different EU critical attitude will emerge from Italy, which surely will affect the financial markets – how the outcome will be, we most likely get a hint about on the 23rd March when the President of the Senate in the Italian parliament is elected.

Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2024 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz