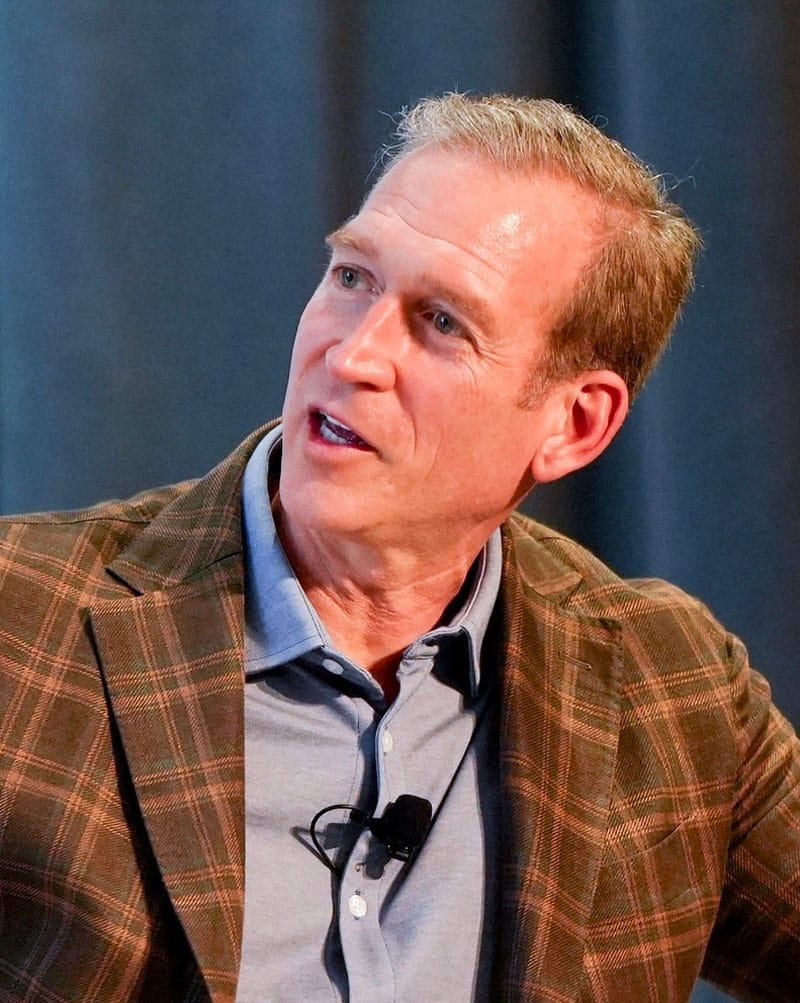

Thomas Priore Explains How Priority’s Unified Commerce Solution Helps Businesses Succeed

Businesses of all sizes face the challenge of managing payment processing, accounts payables, and banking operations while keeping pace with customer expectations. However, juggling multiple systems to manage these different areas can lead to inefficiencies, lost revenue, and missed opportunities. This is where a unified commerce solution available in a single platform, like those offered by Priority, can make a difference.

The fintech company provides an example of how payments companies can leverage technology to help businesses improve their operations beyond acquiring. The key to what Priority offers is like a one-stop shop: The technology drives a single platform through which businesses can manage a variety of complex finance-related operations, from paying vendors and contractors to improving the customer experience.

Priority CEO Thomas Priore says the ability to manage financial operations through one source allows business leaders to put their focus on more important areas such as long-term planning and expanding market reach.

“We are now a payments and banking fintech that has a very elegant set of financial tools that we are able to bring to businesses of all sizes,” Thomas Priore said of Priority’s unified commerce platform. He adds that these include treasury and banking solutions, vendor management, and large enterprise software that allows businesses to manage their “ecosystem of commerce.”

Priority’s unified commerce platform is designed to simplify financial operations, helping businesses achieve greater efficiency and scalability. By consolidating payment processing, accounts payable, and banking functions into a single system, Priority eliminates the need for fragmented tools.

“Our core focus across that financial tool set is a single platform,” said Thomas Priore. “We excel at collecting, storing, lending, and sending money.”

What Is Priority’s Unified Commerce Solution?

The Priority Commerce Engine serves as the core of the technology platform. It’s designed to streamline revenue management and help businesses accelerate growth.

The payables automation feature of the Commerce Engine optimizes working capital by automating payments and maximizing rewards. It ensures timely supplier and vendor payments, strengthening relationships and improving cash flow management.

The banking and treasury solutions offered through Priority’s platform automate banking processes, allow users to put idle cash to work in interest-earning accounts and other investments, and provide real-time visibility into cash flow.

Merchant services enable businesses to receive payments faster and with greater flexibility, contributing to improved cash flow and customer satisfaction.

These features “help us work with businesses of all sizes to accelerate cash flow and optimize working capital,” said Thomas Priore. “With that full menu, we are a single relationship that folks can go to for a financial tool set to manage their business that complements the other tools they have in place.”

Thomas Priore: Priority Built With ‘Foresight and Planning’

Thomas Priore points out that everything Priority has done is intentionally planned to support the fintech company in becoming more useful to clients, rather than simply building on one service. “Priority has been built with foresight and planning,” Thomas Priore said. “If you were to encapsulate it in one word, it would be ‘intention.’ We relentlessly pursue knowledge that can help us see around corners and operate with a singular focus on creating reliable, consistent, long-term value for stakeholders.”

One of the biggest benefits for Priority clients is operational efficiency. By unifying various financial functions, businesses can eliminate redundancies and streamline workflows, leading to increased productivity.

They also can enhance cash flow. Automated payables and expedited payment processing ensure that funds are managed effectively, allowing for better financial planning and investment opportunities. Priority’s services also improve financial transparency, providing real-time insights into financial operations and supporting informed decision-making.

The unified commerce platform from Priority is also designed to allow businesses to scale operations seamlessly, adapting to growth and market changes without overhauling existing systems.

Thomas Priore said all these benefits flow from Priority’s commitment to “meet the customer where they are. If I’m a small-to-midsize-business owner, I don’t have time to chase down self-service for technology. I want a consultant, an expert to help me.” Priority’s customer service is second to none, he added, and the company works with knowledgeable independent agents whose business relies on customer service.

Thomas Priore expects Priority to continue evolving its offerings. He mentioned artificial intelligence as a factor in potential new services that the company will offer clients.

“The thing I’m most excited about as it relates to AI is its predictive insights, and that can help drive efficiency in a business,” he said. AI could be used to “accelerate underwriting, get customers set up fast, that’s an awesome experience. [With AI,] I can see patterns and get smarter on risk management to protect not just Priority’s business, but our customers’ businesses.”

He added that he also thinks AI can make improvements in cash flow optimization in a company’s supply chain and vendor management. “These are things that can be really powerful,” said Thomas Priore. “But it all comes down to the fact that AI is a predictive tool that will help accelerate and improve our own decision-making.”

Have you read?

Longest and Shortest Life Expectancies in the World.

World’s Most And Least Stressed Countries.

Best cities in the world.

Largest Economies in the World by GDP (PPP).

Largest Asset Owners In The World.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz