Financing Egypt’s Tomorrow

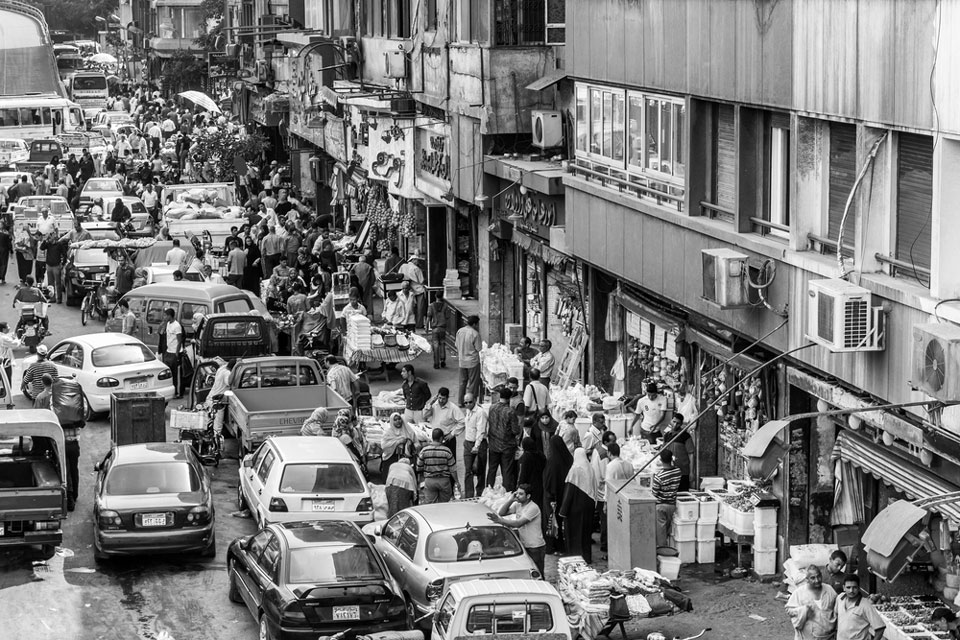

Busy street near Khan el-Khalili bazaar, CAIRO, EGYPT

Gap Analysis: Most of us are used to business leaders and government officials alike speaking of the long-term, working together towards a juster, freer and more equitable future, be it in the context of elections, mushrooming global summits or yet another entrepreneur that seems to sincerely change our world by moving to a different planet.

What is left out of the myriad proposals is usually financing and this gap between the vision of a better tomorrow and the resourcing of that vision has widened considerably of late. While over USD 100 trillion is being held by pension funds, mutual funds and investment funds, the infrastructure gap requires trillions invested each year. According to the World Bank, “675 million individuals are without electricity, 2.3 billion lack drinking water, 3.6 billion lack safe sanitation, 1 billion live more than 2 kilometres from an all-season road, and 450 million live beyond the range of a broadband signal”, a quote worth every letter.

The answer is somewhat self-evident when considering the economic return, but there is no particular reason why the world’s pensioners should be signed-up to meet any particular summit’s vision, nor is it wrong to expect a decent return.

The Case of Egypt

Which is why I’m quite happy to work with and witness first-hand the progress achieved by the likes of Rania Al-Mashat in Egypt in terms of concessional finance and climate finance, with the World Bank having just approved over USD 700 billion in concessional finance for Egypt.

These two tools are central tools for facilitating what could be one of the world’s most important financial exchanges, paring the aforementioned hundreds of trillions with the billions who acutely need them in a manner that respects the rights of investors, private individuals and governments alike.

In the strictest terms, concessional finance refers to loans and financial assistance provided on terms significantly more favourable than market rates. This type of finance is traditionally associated with international financial institutions as well as governments with the aim of supporting high economic yield projects in developing countries. The concessional part is generally understood as lower interest rates, longer repayment periods and more often than not more lenient terms than typical commercial loans. Concessional finance typically also comes with a grace period, during which repayments are not asked for, which can be a crucial differentiating factor when dealing with the sort of large-scale infrastructure projects that may take years to complete and start generating economic benefits, which is precisely where the infrastructure gap tends to be most prominent.

The problems stand self-evident: strings attached that risk filling the pockets of consultancies instead of the meeting needs, the scope for misuses of funds without those strings, all on top of the myriad problems that naturally come with multi-million USD projects.

Bridging the Gap

As such, you might very well wish Ms. Al-Mashat the best of luck, either as an investor, businessperson or citizen, because success would act as a blueprint for not only expanding concessional finance but expanding its definition beyond the strictest terms so as to include blended concessional finance.

Blended concessional finance simply combines concessional finance with commercial finance to support projects in developing countries. This approach seeks to leverage limited public funds to attract private investment, thereby enhancing the scale and impact of development initiatives. The goal of blended concessional finance is to bridge the gap between the funding needs of high-impact projects and the risk exposure private investors would be willing to have, facilitating investments that might otherwise be deemed too risky but which have a significant economic impact.

As it stands, it the closest way forward in an area of increasing urgency, namely letting business and social enterprise flourish in an environment where neither roads nor drinking water are considered hazardous. The market has a long-standing habit of solving the rest – but sometimes the road there needs to be financed.

—————–

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz