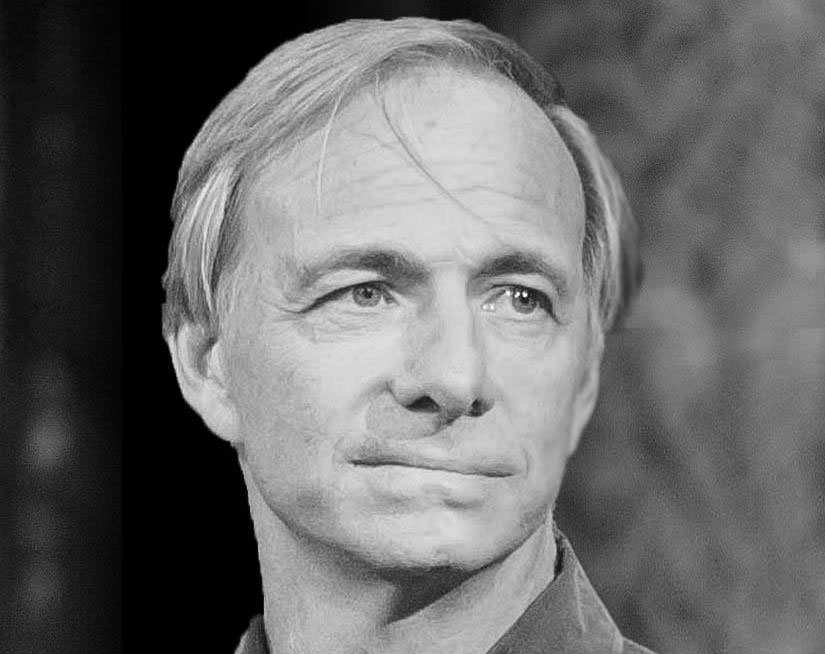

Billionaire Ray Dalio Loves These 10 Stocks

According to recent CEOWORLD magazine reports, Ray Dalio’s hedge fund, Bridgewater Associates, has invested in several stocks. As of the end of the fourth quarter of 2023, the company reported owning 214,126 shares of Exxon Mobil Corp (NYSE: XOM), worth $21,4 million. Another company on the list is Aon PLC (NYSE: AON), in which Bridgewater Associates has invested $16.3 million. Enstar Group Ltd (NASDAQ: ESGR) is also among the companies in which Ray Dalio has invested.

During the last quarter of 2023, Bridgewater Associates purchased 335,126 shares of media giant Warner Bros Discovery, worth $3.8 million. However, the company cut its stake in Enphase Energy Inc (NASDAQ: ENPH) by 76% in the same period, concluding the quarter with a $3 million stake. Ray Dalio’s Bridgewater decreased its stake in Sarepta Therapeutics Inc (NASDAQ: SRPT) by 48% in the fourth quarter of 2023, concluding the year with a $2.5 million stake in the Massachusetts-based medical research and drug development company. These are the 10 stocks in which billionaire Ray Dalio’s Bridgewater Associates has stakes, based on the fund’s Q4’2023 portfolio. The idea was to find stocks that both Ray Dalio love.

- Exxon Mobil Corp (NYSE: XOM)

Bridgewater Associates’ Stake: $21,408,317 - Aon PLC (NYSE: AON)

Bridgewater Associates’ Stake: $16,291,009 - Enstar Group Ltd (NASDAQ:ESGR)

Bridgewater Associates’ Stake: $7,341,089 - Warner Bros. Discovery Inc (NASDAQ: WBD)

Bridgewater Associates’ Stake: $3,813,734 - Enphase Energy Inc (NASDAQ:ENPH)

Bridgewater Associates’ Stake: $2,969,582 - Sarepta Therapeutics Inc (NASDAQ: SRPT)

Bridgewater Associates’ Stake: $2,544,595 - Keurig Dr Pepper Inc. (NASDAQ:KDP)

Bridgewater Associates’ Stake: $1,907,004 - Transocean LTD (NYSE: RIG)

Bridgewater Associates’ Stake: $1,741,132 - Block Inc (NYSE: SQ)

Bridgewater Associates’ Stake: $1,356,719 - CNX Resources Corp (NYSE: CNX)

Bridgewater Associates’ Stake: $1,084,440

Have you read?

The 21st Century’s Biggest Financial Frauds and Controversies.

The World’s Most Valuable Unicorns, 2023.

The World’s Top 10 Highest-Paid Wealth Management Executives.

Highest paid chief executive officers in the United States in 2022.

Highly-Paid Entertainment Chief Executives.

Highest paid health insurance CEOs.

Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

This report/news/ranking/statistics has been prepared only for general guidance on matters of interest and does not constitute professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this publication, and, to the extent permitted by law, CEOWORLD magazine does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.

Copyright 2024 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz

SUBSCRIBE NEWSLETTER