It’s a Tale of Two Markets; The Solution to Sourcing from Asia

“It was the best of times; it was the worst of times.” But no matter where in the Dickens your business profits fall on that spectrum these days, we can all agree we indeed live in challenging times, especially if you’re an off-shore manufacturer.

For the last few decades or more U.S.-based manufacturers have looked to Asia as a low cost of labor and material magnet to set up shop, off-shore. Until recently low-cost labor, materials, and shipping to the U.S. were cheaper than producing goods in the United States. And over time, much to the delight of Asian countries, this strategy became embedded in most international manufacturing business models. It was even said that Asia, notably China, Japan, South Korea, Taiwan, India, and Vietnam were collectively the World’s Manufacturers.

But oh, how times change.

Given the increasing costs and geopolitical risks created by Covid-19 and Russia’s invasion of Ukraine and the conspicuously complicit fence-sitting nature of China and India, the time may have come to pop the Asian balloon with a sharp pin.

A couple of years ago in July 2020, the U.S., Mexico, and Canada signed the new USMCA trade pact. This ground-breaking trade treaty eliminated tariffs, standardized labor rules, and synchronized supply chain logistics between the trade partners. The biggest push back against the USMCA was what 1992 Presidential candidate Ross Perot once called NAFTA, the predecessor to USMCA, “a giant sucking sound,” as jobs funneled south and down the drain by the thousands. He was right. But that was then. And now 30 years later all things considered Perot’s deepest NAFTA concerns are barely an echo to USMCA. And there’s a good reason for that.

As if globalization wasn’t already on the rocks, the growing political and economic issues in Asia and Russia along with Covid have consequently rung the alarm bell. Nearly every U.S. importer of finished goods or parts now find themselves suddenly vulnerable to the risk vs. resiliency of their formerly reliable global supply chains.

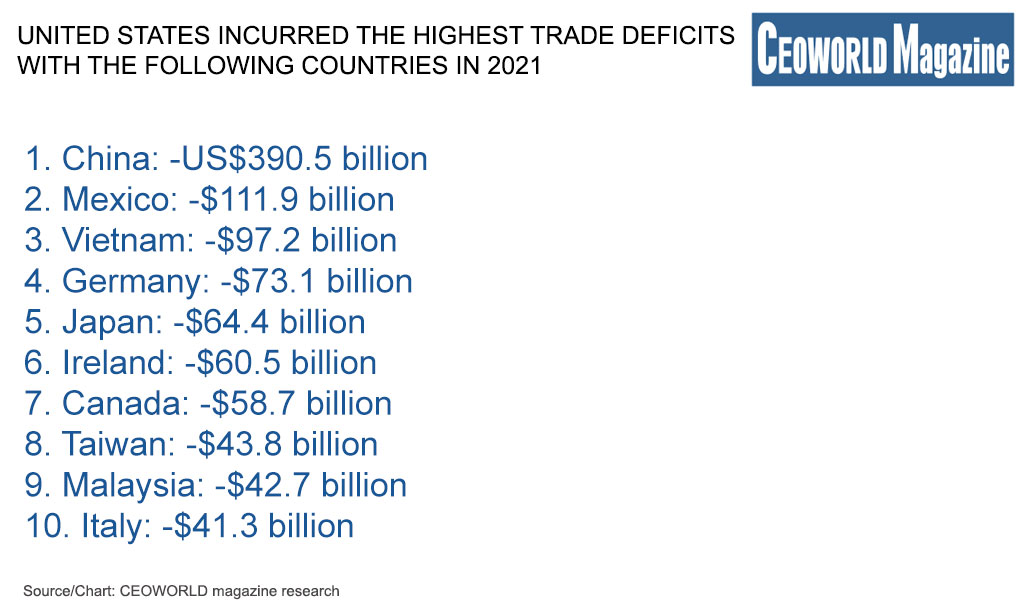

At the same time, in 2021 the U.S. imported $2.8 trillion in valued goods from other countries. The top 3 trading partners China, Mexico, and Canada together topped 40% of the total. But it’s China, clearly the leading exporter to the U.S. that creates the huge trade deficit. And it’s a monster-sized addiction.

Key imports from China include $100 billion in TVs, cameras, electronic gadgets, $100 billion in computers and appliances, and $100 billion in commodities, furniture, and textiles. It’s a never-ending conveyor belt of stuff packed into multi-colored rectangular steel boxes stacked 10 stories high on ships chugging their way to America and going back empty. Which begged the big question; Is now the time to seriously put globalization on hold… Maybe re-think some things?

The big reveal came before last Christmas 2021 as Covid ravaged the ranks of Asian factory workers and shut off the steady flow of ocean freight bound for U.S. shores. Here at home worker shortages, trucking shortages, warehousing shortages all combined to showcase the massive inefficiencies and clumsy inability to manage bottlenecks at U.S. ports.

Only because I live here, need I to mention why Christmas was late. At the Port of Los Angeles, the world’s largest, dozens of ocean-faring container ships packed with cars, and toys, and clothes and candy from Asia all piled up. Like a clogged river. In a normal pre-Covid year it’s clear sailing. There is no waiting to dock at Los Angeles. But for CEOs still far from normal the sight of millions of helpless containers sitting atop more than 100 “floating anchors“ offshore was an early winter storm’s wake-up call. It was time to reduce the unforgiving dependency on Asia, and bring production back home, a process popularly known as “Re-shoring,” and it’s frontpage news these days.

So, what is Re-shoring, and how is it different from On-shoring?

Re-shoring is the same as On-shoring, it’s the act of bringing back home the manufacturing of products previously made off-shore, essentially a full round trip. And it’s more popular than ever. The mounting pressures to consider re-shoring include increasing host country labor costs, shipping & logistics costs, new regulations, taxes, better communications, and the biggie: the dyer risks inherent in future geopolitical outcomes.

But while the visceral voices of value cry out for the satisfying sound of returning manufacturing to the wholesome heart of America, what if re-shoring back on home soil is still prohibitively too expensive?

In other words, according to The Nearshoring Company, what if Made in America doesn’t add up? The U.S. has among the highest-paid skilled-labor work force in the world. The average hourly wage for U.S. manufacturing jobs is about $30/hour, while in China it’s $7/hour. The U.S. also suffers from an aging manufacturing work force, a large capital investment hurdle, more regulations and higher taxes. And although Made in America is the safest and most reliable way to control cost, product quality and supply chain logistics it may also be time to skip past re-shoring, and go for the next best thing: “Near-shoring.”

Near-shoring is the act of transferring your business operations from far away to closer to home, closer to your customer channel, but not in the U.S.

The best argument post pandemic for “near-shoring” is evident in the daily geo-political and logistical troubles that sourcing from Asia has starkly revealed. Saving money and staying competitive is one thing, but not getting your products on time, or ever, is not a healthy business practice long term. With near-shoring all that goes away.

Under the current USMCA trade agreement between the U.S., Mexico and Canada depending on the product you’re making near-shoring to Mexico or Canada may be the perfect alternative.

For companies looking to sell into American markets having a more reliable supply chain is the elephant in the board room these days. Needless to say, before Covid-19 container ships from Asia took on average 3-4 weeks to make the trip to a western U.S. port, only to get stopped dead in the water, and wait. But with near-shoring that time drops from weeks to just days by truck or rail from most manufacturing facilities in Mexico and Canada.

So, then which is better – Mexico or Canada?

It depends on what you make. Enter Mexico, where 70% of its Foreign Direct Investment (aka investment by foreign companies) comes from a handful of countries with major manufacturing facilities and operations there. The top 5 Mexico FDIs include substantial interests from:

47% of Mexico’s GDP comes from manufacturing goods mostly sold and shipped to the U.S. through any one of the 48 U.S. Ports of Entry along the shared 2000 mile-long border.

Moreover, the average manufacturing wage in Mexico is just $5/hour compared to $30/hour in the U.S. and $17/hour in Canada. And despite Mexico’s evolving political scene, the labor pool there is young and robust and eager.

Currently Mexico’s top 10 exports include a diverse list of international mature industry sectors to choose from. Which is why a growing number of international players consider Mexico a safer bet than Asia to set up shop.

- Vehicles: US$100.7 billion (24.1% of total exports)

- Machinery including computers: $75.5 billion (18.1%)

- Electrical machinery, equipment: $75 billion (17.9%)

- Optical, technical, medical apparatus: $18.6 billion (4.4%)

- Mineral fuels including oil: $16.8 billion (4%)

- Plastics, plastic articles: $9.1 billion (2.2%)

- Furniture, bedding, lighting, signs, prefab buildings: $9.1 billion (2.2%)

- Vegetables: $8.5 billion (2%)

- Gems, precious metals: $8.15 billion (1.9%)

- Beverages, spirits, vinegar: $8.11 billion (1.9%)

It naturally follows for Mexican business authorities to hoist up the Open for Business sign and lay down the Welcome Home mat to attract more global companies looking to sell these goods to U.S. consumers.

And then there’s “Oh Canada”

The U.S. and Canada share a 5,500-mile-long border with more than 100 Ports of Entry into the U.S.. 74% of Canadian exports head south to the USA, mostly oil and cars. According to World’s Top Exports.com the top 10 exports into the U.S. from Canada include:

- Mineral fuels including oil: US$69.1 billion (17.7% of total exports)

- Vehicles: $46.5 billion (11.9%)

- Machinery including computers: $28.9 billion (7.4%)

- Gems, precious metals: $23 billion (5.9%)

- Wood: $13.5 billion (3.4%)

- Plastics, plastic articles: $12.4 billion (3.2%)

- Electrical machinery, equipment: $11 billion (2.8%)

- Ores, slag, ash: $9.9 billion (2.5%)

- Aircraft, spacecraft: $9.7 billion (2.5%)

- Pharmaceuticals: $8.5 billion (2.2%)

In fact, Canada recently snapped back from a sharp pandemic-related decline in Foreign Direct Investment with a whopping $75Bil run in 2021, the highest since 2007, 50% higher than in pre-Covid 2019 and 140% higher than in 2020. By country the U.S. invested 50% of Canada’s FDI in 2021 followed by Germany, UK, France and Japan. Each country sees investment in Canada as both a safe harbor and a global launch pad for future development. InvestCanada.ca says it’s the only country in the western hemisphere that can produce electric batteries and electric vehicles entirely from top to bottom. Very cool.

Canada also has the added advantage of its close proximity to the U.S. auto industry in the northern mid-western states including MI, IN, Il, and OH. The USMCA requires that 75% of all automotive components be manufactured in Canada, Mexico, or the United States, which deliberately adds significant depth to the supply chain networks in each country.

Nonetheless, despite the growing list of near-shore capabilities in Canada it’s more the home for sophisticated production and engineering, such as auto manufacturing. Near-shoring to Canada or Mexico from Asia for labor intensive industries such as clothing, commodity electronics and toys is still prohibitively more expensive in Canada. Consequently, if your product line requires a lot of hands-on labor, Asia is still the only game in town, sorry.

So, here’s the Bottom line

Given the recent fallout from Covid and now the growing geo-political tensions with countries in Asia and Europe, there’s little doubt that both Canada and Mexico will continue to see more Foreign Direct Investments with more countries building more plants, and hiring more workers.

It therefore makes perfect economic sense to consider moving your supply chain and manufacturing facilities away from Asia and back to the U.S., Mexico or Canada. And you may be glad you did. The move not only helps reduce the trade deficit but also adds peace-of-mind.

So, first thing Monday morning let’s grab your CFO and crunch some numbers. Because now is the time to wrestle the worst of times back into the best of times, before it’s too late.

For a closer look at the pros and cons of near-shoring check out The Nearshore Company advisory group. Or consider Sourcinghub, a guide to sourcing products made in Mexico. And for a closer look at Canada Re-shoring Canada and the Canadian manufacturing guide are good places to get started.

Make sense?

Written by Rick Andrade.

Have you read?

# Best CEOs In the World Of 2022.

# TOP Citizenship by Investment Programs, 2022.

# Top Residence by Investment Programs, 2022.

# Global Passport Ranking, 2022.

# The World’s Richest People (Top 100 Billionaires, 2022).

# Jamie Dimon: The World’s Most Powerful Banker.

Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

This report/news/ranking/statistics has been prepared only for general guidance on matters of interest and does not constitute professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this publication, and, to the extent permitted by law, CEOWORLD magazine does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.

Copyright 2024 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz

SUBSCRIBE NEWSLETTER