The Evolution of the CFO Role: Why Accounting and Financial Planning & Analysis Are No Longer Enough

Over the past decade, there has been an unmistakable evolution in the role of the CFO, a shift that has only intensified with the adoption of new data-centric business technologies and practices.

In the past, organizations searching for a new CFO typically had a choice to make. Did they want a traditional, accounting-focused CFO, or did they prefer one more skilled in Financial Planning & Analysis (FP&A)? If they were fortunate, they might find a “unicorn” who was experienced in both.

Regardless of which career path they traveled, the CFO was expected to perform several critical roles for the organization: Report on the company’s financial present and predict its financial future along with providing intelligence to leadership that would guide topline growth and bottom-line profitability.

In the past, that meant that the best CFOs analyzed the numbers and delivered reports to the business on what the numbers meant.

Today, that is no longer enough.

A new requirement has emerged for CFOs – data analytics. Today’s CFO must be facile with data, comfortable with powerful computing, and able to harness business intelligence to drive sound decision-making at their organization.

Technology Revolution = CFO Evolution

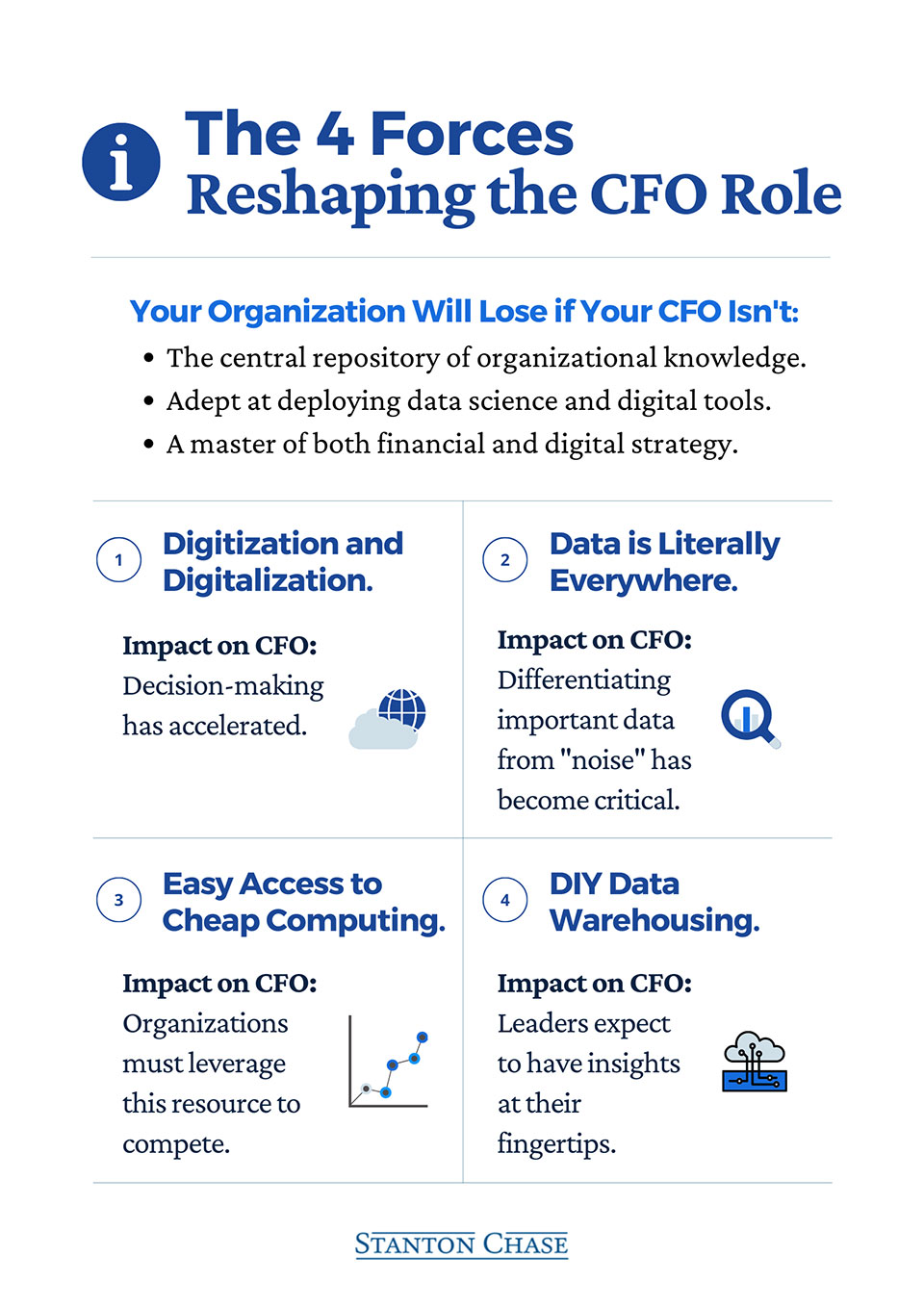

Four technology-driven factors have dramatically changed the role of the CFO.

- The role of digitization and digitalization in accelerating decision-making.

Until recently, most finance functions and processes were manually driven and physically stored on hard copies and filed. Now, business information is being digitized – converted from non-digital to a digital format. At the same time, business systems are being fully digitalized – converted from manual systems and processes to digital systems and processes.Couple that trend with the introduction of Big Data systems, AI, machine learning and other digital technologies into business and finance. The result is immediate access to information that was not readily available in the past.This has accelerated the speed with which business decisions are being made. Everything is happening faster – transactions, communications, and year-over-year growth. Today’s CFO must be creative, tech-savvy, and capable of acting swiftly on emerging business intelligence.

- The need to differentiate important data from the noise.

The CFO role has always been centered around understanding and reporting data. However, past limitations of non-digital data meant that there was less data available for analysis and reporting was more limited and dated.The digitization of data today means that data is literally everywhere. The question is no longer, “How do we get data?” Rather, it is, “Which data actually matters, and which is just noise?” In the end, all the data in the world won’t help without knowing where to look or which questions to ask.Today’s CFO must identify KPIs that matter most across all areas of the business and give true insight into how the business is tracking in achieving those Objectives and Key Results.

- Easy access to cheap computing power.

A decade ago, the most complex data queries could only be conceptualized and composed by the most senior and knowledgeable data scientists; they took months to compose, and weeks, or even months, to run. However, today, while the most complex data queries still require skilled data scientists to conceptualize, complex queries can occur in minutes rather than in months.This increased power, coupled with the low cost of computing, is an incredible tool for businesses that know how to wield it. It is essential that CFOs understand how to take advantage of this powerful resource and use the knowledge gained to shape the future of the enterprise. - The ability to store, aggregate and analyze data in a “self-service” platform.

Data warehousing isn’t new, but only recently has it migrated into the realm of “self- service.” While composing complex queries still requires an individual with knowledge of data analytics and business intelligence, queries once developed can largely exist within a self-service platform that business leadership can access.This democratizing of technology has driven an evolution in the FP&A role. Increasingly, that role focuses on creating self-service platforms that put insights into the state of the business at leaders’ fingertips. It often involves business intelligence, as well.Significantly, this enhanced FP&A group reports directly to the CFO. As a result, CFOs now play a central leadership role in shaping their company’s digital strategy.

Data Scientists Join Finance Teams

Together, these four forces have led to a dramatic shift in the makeup of corporate finance departments – the increasingly common expansion of the FP&A role to include Business Intelligence.

Today, FP&A teams are commonly populated with professionals who have a deep understanding of data science principles, tools and platforms. Savvy CFOs – many who arrived to their roles from a traditional accounting or FP&A path – know they need business intelligence tools and staff who are experienced in using them.

If an organization hopes to assume full ownership of the data, its finance function needs a team of data scientists along with a powerful self-service platform to enable that. The CFO role has the potential to become the single greatest resource of data and intelligence within a company.

The ideal profile for CFOs and their direct reports is evolving to include this new reality. Going forward, the successful CFO will use data, powerful computing, and business intelligence as the foundation for decision-making. To remain relevant and valuable, CFOs must be masters of both financial and digital strategy.

Written by Greg Selker.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz