Internationalization for Development in the Global South

Growth and Development: The emerging Global South, as heterogeneous a place as the term allows, has mostly been joined by the fact that it is primarily characterized by perceived underdevelopment coupled with rapid economic growth. That rapid economic growth has made some forecasters lump together quite different economic profiles where similarities primarily stem simply from experiencing sustained high rates of growth.

Usually, we associate such high rates of growth with the East Asian economic miracle, which remains the world’s great development story. In just a few decades, either in Japan, South Korea or China, where millions were once close to poverty, we saw the largest sustained increase in wealth in history. A critical part of that was internationalisation: the process by which firms acquire foreign technology, begin exporting to foreign markets aided by a comparative cost advantage, eventually begin moving towards the consumer market through foreign branches and, in its last stages, become sources of outward foreign direct investment as they outgrow their domestic market. This was the model that was followed quite successfully by what we consider the great East Asian business success stories.

Quite simply, these firms’ internationalisation has successfully translated into their home countries’ development. That is a critical distinction: development, through the acquisition of technology, export competitiveness, moving up value chains and finally investments in research. Conceptually, that allowed an agricultural worker’s son to become a factory worker and raise his son to become a research engineer. That differentiates it from economic growth, which could have been a function of commodity exports, or simply the usage of the same price-competitive supply of labour in low value-add activities until the demographic transition does away with that country’s advantage.

Globalisation and Internationalisation

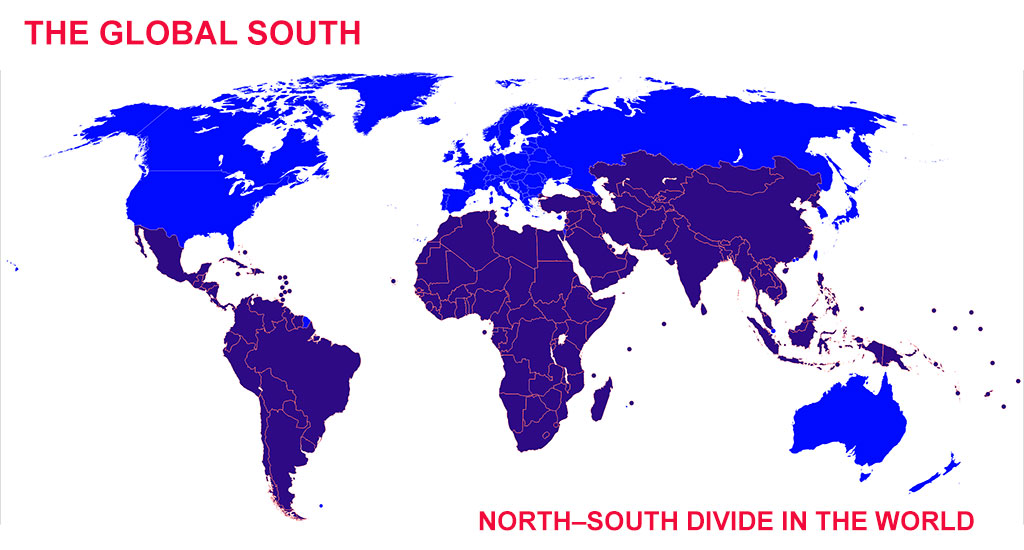

Seen from this perspective, the narrative of the actually heterogeneous ‘Global South’ converging with the ‘Global North’ hides two very different economic profiles. One is that of growth and globalisation but without the same internationalisation seen in East Asia. The other is of firm-level internationalisation and country-wide development, as the model suggests.

In some cases, such as for some South American or Sub-Saharan African countries, that growth is partially an effect of the previous, Chinese-driven, commodity super-cycle. For example, data from the World Bank suggests a near 0.8 correlation of Chinese economic growth with the rate of growth for many South American commodity exporters.

In other cases, such as Vietnam or significant parts of South East Asia, the rates of growth are partially driven by local firms’ integration into global value chains, either as a side effect of foreign companies reorganising part of their supply chain for a non-Chinese ‘exit node’ or due to East Asian companies’ regional expansion into what looks like one of the largest consumer markets to come.

In other words, the patterns observed in the Global South, while similar from afar, are actually quite different. In one group we see significant globalisation without firm internationalisation among commodity exporters. On the other, we see regional globalisation with high rates of firm-level internationalisation. While growth is welcome for its own sake as the clearest way to reduce poverty, these two divergent paths indicate two very different outcomes. South-East Asia is moving up value chains and reducing its long-run dependency on the price of labour or natural resources. Africa or parts of South America don’t seem to be following the same path at the same speed, leaving the countries exposed both to the other side of the demographic transition as well as the automation of the lowest value add activities where most firms start the process of internationalisation. Quite simply, while increasingly globalised and enjoying extraordinary rates of economic growth, this may not be sufficient for parts of the Global South.

The Time for Internationalisation

That is becoming a matter of urgency.

As countries such as Vietnam or Indonesia converge with their northern neighbours, the developmental gap with the rest is becoming ever more apparent. This is partially a matter of simple geographical scope. As Rugman and Verbeke (2004) note, most multinational enterprises are regional in scope, not actually global in the strictest sense of the word. About 84% of the largest companies worldwide are concentrated on a single region while a further 7% are bi-regional. Only about 9% can be genuinely considered global in scope. That means countries in South East Asia can more directly benefit from the expansion of East Asian economies and integrate into sometimes surprisingly regional value chains. In other words, firm-level internationalisation is somewhat better facilitated.

But those critical first stages of the internationalisation process depend on a price competitive labour supply having demand for low-value-add activities, which in turn depends on firms actively employing foreign technology. First, the demographic transition is running its course in most parts of South America while Africa’s booming population and rates of urbanisation make job creation almost a matter of national security. Secondly, technological complexity is increasing rapidly enough that, in the near future, it’s unclear to what extent poor patent laws may actually help firms catch up technologically. Even if given the full blueprints for the latest electric car, they would be quite useless without the software, semi-automated assembly line and data centres.

In other words, without business internationalisation beginning now, large parts of the Global South may find themselves having missed the clearest path to development.

Written by Radu Magdin. Have you read?

Best Hospitality And Hotel Management Schools In The World For 2021.

Best Fashion Schools In The World For 2021.

Best Business Schools In The World For 2021.

Best Medical Schools In The World For 2021.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz