Continuous Interest Rate to Rank Investments

The measuring-staff is i, the continuous interest rate. Function FV at t = PV at 0 · e^i.t and which Future Value do you demand or expect? Note: the outcome is a (new) measuring-staff, nothing more or less than a translation of the used rate i, the basic measuring-staff.

Given is i = 0.025/quarter of a year and that is identical to QPR 2.53151205…

Re ‘Accounting Real Interest‘ and to learn it from the beginning, see Chapter 2 in ISBN 9781086355635 available at Amazon.

Here the content of the book is given:

Maybe the reference in use is such a Period Percentage Rate, for instance this Quarterly Percentage Rate is the measuring-staff to judge investments.

Risk factor 1.00 means measuring-staff is QPR 2.53151205…

- Investment A: Present Value 1 billion, 2 week currency, risk factor 1.50

- Investment B1: Present Value 1 billion, 30 year currency, risk factor 1.20

- Investment B2: Present Value 1 billion, 30 year currency, risk factor 0.80

Which Future Values do you demand or expect in these cases? Starting from reference QPR 2.53151205… there are different roads leading to different results and most of the widely used roads do not lead to Rome. People become confused by using a PPR, any Period Percentage Rate. Starting from reference i, you will be lead directly to Rome.

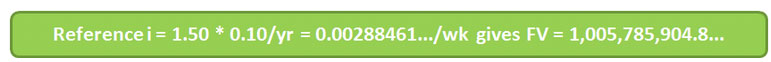

Investment A

QPR 2.53151205…* 1.50 = 3.79726807… identical to WPR 0.28709953…

this road gives FV = 1,005,750,233.3…

QPR 2.53151205… identical to WPR 0.19249272… next * 1.50

using WPR 0.28873908… gives FV = 1,005,783,118.6…

The second PPR-road turns out to be close but not on the button. Mostly PPR gives false signals. Suppose, we compare investment A with another investment C, in any detail exactly the same, except FV = 1,005,785,900… Then A wins. Positive! What is your conclusion when using PPR?

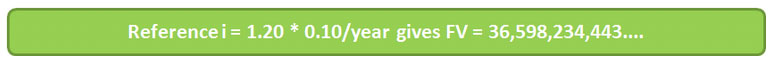

Investment B1

QPR 2.53151205…* 1.20 = 3.03781446… identical to APR 12.71625557…

this road gives FV = 36,274,095,641….

QPR 2.53151205… identical to APR 10,51709180… next * 1.20

using APR 12,62051016… gives FV = 35,361,014,020….

The first PPR-road seems to be the best one but FV is considerably too low.

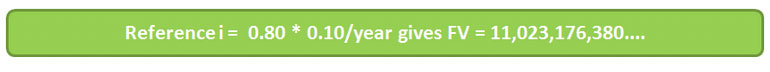

Investment B2

QPR 2.53151205…* 0.80 = 2.02520964… identical to APR 8.35026637…

this road gives FV = 11,089,181,722….

QPR 2.53151205… identical to APR 10,51709180… next * 0.80

using APR 8.41367344… gives FV = 11,285,525,953….

Also in this case the first PPR-road is the best one but now FV is too high. One time one PPR-calculation gives a too low outcome, another time another PPR-calculation gives a better answer but too high, still not good.

Better PPR-roads than shown above do exist but who is aware of them and capable to do the work that has to be done to walk down these roads? PPR is not user-friendly. Moreover, the continuous i is the reference and will stay the reference forever.

An ‘annual rate’ (discrete) that is arrived at by multiplying a periodic rate by the number of periods – as Microsoft Excel does, re free downloadable ‘Microsoft Excel, Financial Functions, Matter in Dispute‘ – is not an appropriate measure. Maybe ‘the man in the street’ an average person has enough trouble with grade school arithmetical concepts and the e-power is totally foreign to him, still he is able to push the e-key on the keyboard of any pocket-calculator. How many keys are we all pushing all the time? Not knowing what. Only be interested in the outcome. There is no reason NOT to use the continuous i. The e-key leads you right to Rome. The continuous i is a fraction. Grade school arithmetical concepts are enough to handle the continuous i, yes indeed, and not PPR.

Conclusion

Using PPR (Discrete Compound Interest) to rank investments is often deceptive. Financial tools like Microsoft Excel using PPR are dangerous.

Commentary by Jan Jacobs. Here’s what you’ve missed?

World’s Best Destinations For Business Travelers.

World’s Most Stressed-Out Cities For Employees.

The World’s Best Luxury Superyacht Charters And Builders.

Luxury Superyacht charter in Greece and the Greek Islands.

Crewed MegaYacht charter in Greece and the Greek Islands.

Bring the best of the CEOWORLD magazine's global journalism to audiences in the United States and around the world. - Add CEOWORLD magazine to your Google News feed.

Follow CEOWORLD magazine headlines on: Google News, LinkedIn, Twitter, and Facebook.

Copyright 2025 The CEOWORLD magazine. All rights reserved. This material (and any extract from it) must not be copied, redistributed or placed on any website, without CEOWORLD magazine' prior written consent. For media queries, please contact: info@ceoworld.biz